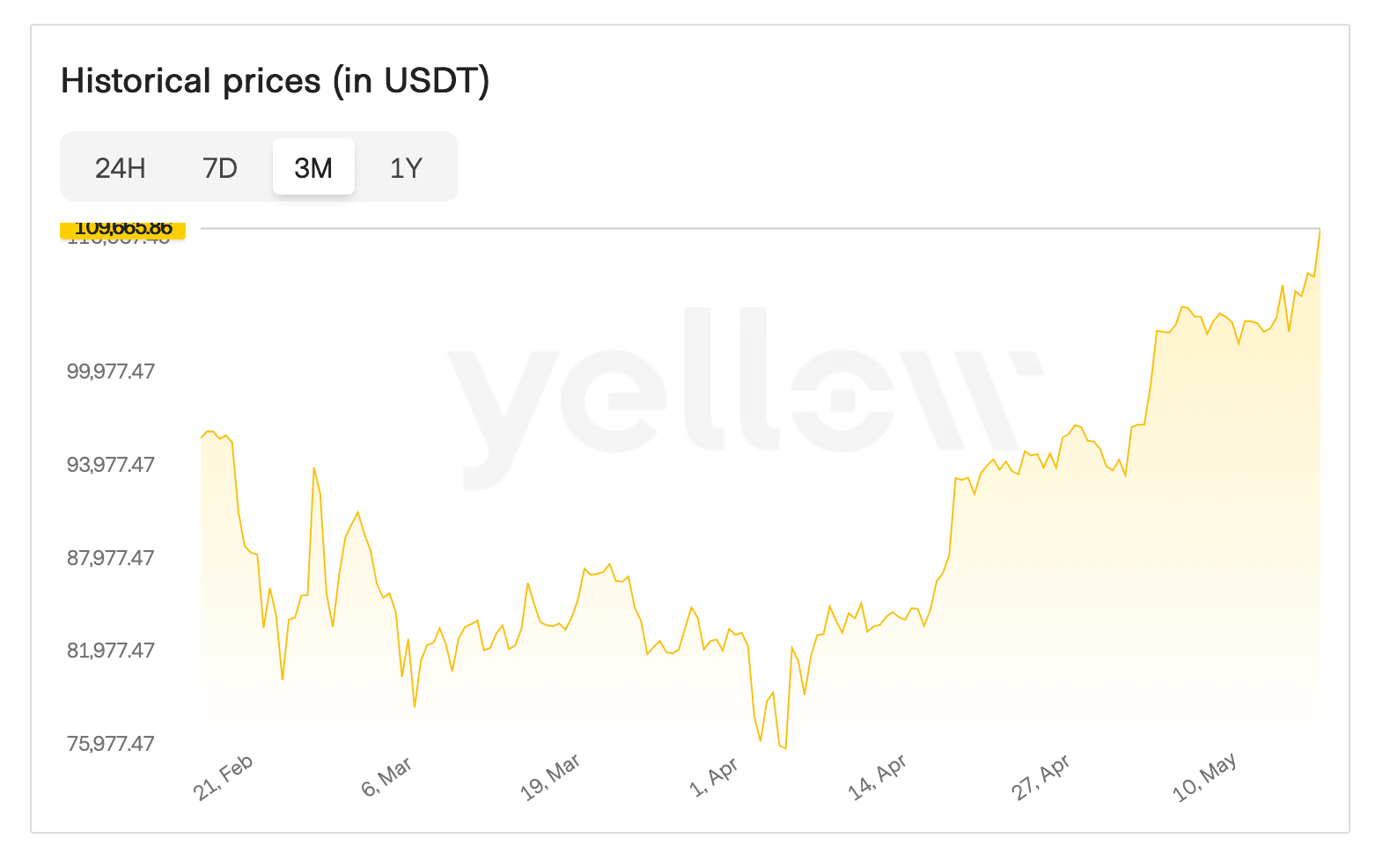

Short-term Bitcoin investors have realized $11.6 billion in profits over the past month as the cryptocurrency surged to a new all-time high of $109,400, according to blockchain analytics firm Glassnode. The massive profit-taking surge represents a nearly tenfold increase from the $1.2 billion realized in the previous 30-day period, highlighting dramatic shifts in investor behavior as Bitcoin continues its historic rally.

What to Know:

- Short-term Bitcoin holders generated $11.6 billion in profits during the past month, compared to just $1.2 billion in the previous period

- Daily profit realization peaked at $747 million as investors capitalized on Bitcoin's surge to new record highs

- The selling pressure from short-term investors remains below levels seen in late 2024 despite the substantial profit-taking activity

Profit-Taking Surge Reflects Market Psychology

The profit realization comes from investors classified as short-term holders who purchased their Bitcoin within the past 155 days. These investors typically represent the more volatile segment of the Bitcoin market, often reacting quickly to price movements and market developments.

Glassnode's analysis reveals that daily profit realization peaked at $747 million during this period. The firm tracks this data by examining the transfer history of each Bitcoin being sold, comparing the original purchase price to the current selling price to calculate realized gains.

The metric provides insight into market psychology during rallies. When Bitcoin prices climb significantly, short-term holders often choose to lock in profits rather than hold for potentially higher gains.

Historical Context and Market Dynamics

Despite the substantial $11.6 billion in realized profits, the current selling pressure remains below peaks observed in late 2024. This suggests that while profit-taking has been significant, it has not reached the extreme levels seen during previous market cycles.

The analytics firm noted the dramatic contrast between recent profit realization and earlier periods. "Over the previous 30d period, only $1.2B of profit was realized, underscoring how drastic the rebound in new investor sentiment and spending behavior has been," Glassnode stated in its weekly report.

Short-term holders are considered among the most reactive participants in the Bitcoin ecosystem. Their trading patterns often serve as indicators of broader market sentiment and can influence price movements, particularly during periods of significant volatility.

The elevated profit-taking levels have persisted throughout the month-long rally. This sustained activity indicates that the current price surge has created compelling profit opportunities for investors who entered positions during the previous 155-day window.

Market Outlook and Price Performance

Bitcoin's recent performance has established new benchmarks for the cryptocurrency market. The digital asset reached approximately $109,400, surpassing previous records and demonstrating continued institutional and retail interest.

The sustainability of the current rally depends partly on whether incoming demand can absorb the selling pressure from profit-taking activities. Market observers are monitoring whether realized profit levels will continue expanding or begin to moderate as the rally progresses.

Bitcoin's price trajectory reflects broader cryptocurrency market dynamics and evolving investor sentiment. The substantial profit realization by short-term holders indicates strong conviction among newer investors to capitalize on recent gains.

Technical Analysis and Market Indicators

The realized profit metric serves as a key indicator for understanding market behavior during price rallies. By tracking the difference between purchase prices and selling prices across all transactions, analysts can gauge the extent of profit-taking activity within specific investor cohorts.

Glassnode's methodology involves examining blockchain data to identify when coins change hands and at what profit margins. This analysis provides real-time insights into investor behavior that traditional financial markets cannot replicate.

The 155-day threshold for defining short-term holders reflects typical holding patterns observed in cryptocurrency markets. Investors who hold Bitcoin for longer periods are generally considered less likely to react to short-term price movements.

Conclusion

The $11.6 billion profit realization by Bitcoin short-term holders represents a significant market development as the cryptocurrency reaches new heights, though selling pressure remains manageable compared to previous peaks. Market dynamics continue evolving as Bitcoin establishes fresh records while investors balance profit-taking opportunities against potential future gains.