Coinbase announced Tuesday it has added Ethena's native token ENA to its official listing roadmap, triggering an immediate 8.6% price surge during early Asian trading hours. The move represents another step in the exchange's expansion of cryptocurrency offerings, though actual trading remains contingent on meeting specific technical and market-making requirements.

What to Know:

- Coinbase added ENA (contract address 0x57e114B691Db790C35207b2e685D4A43181e6061) to its listing roadmap alongside QCAD

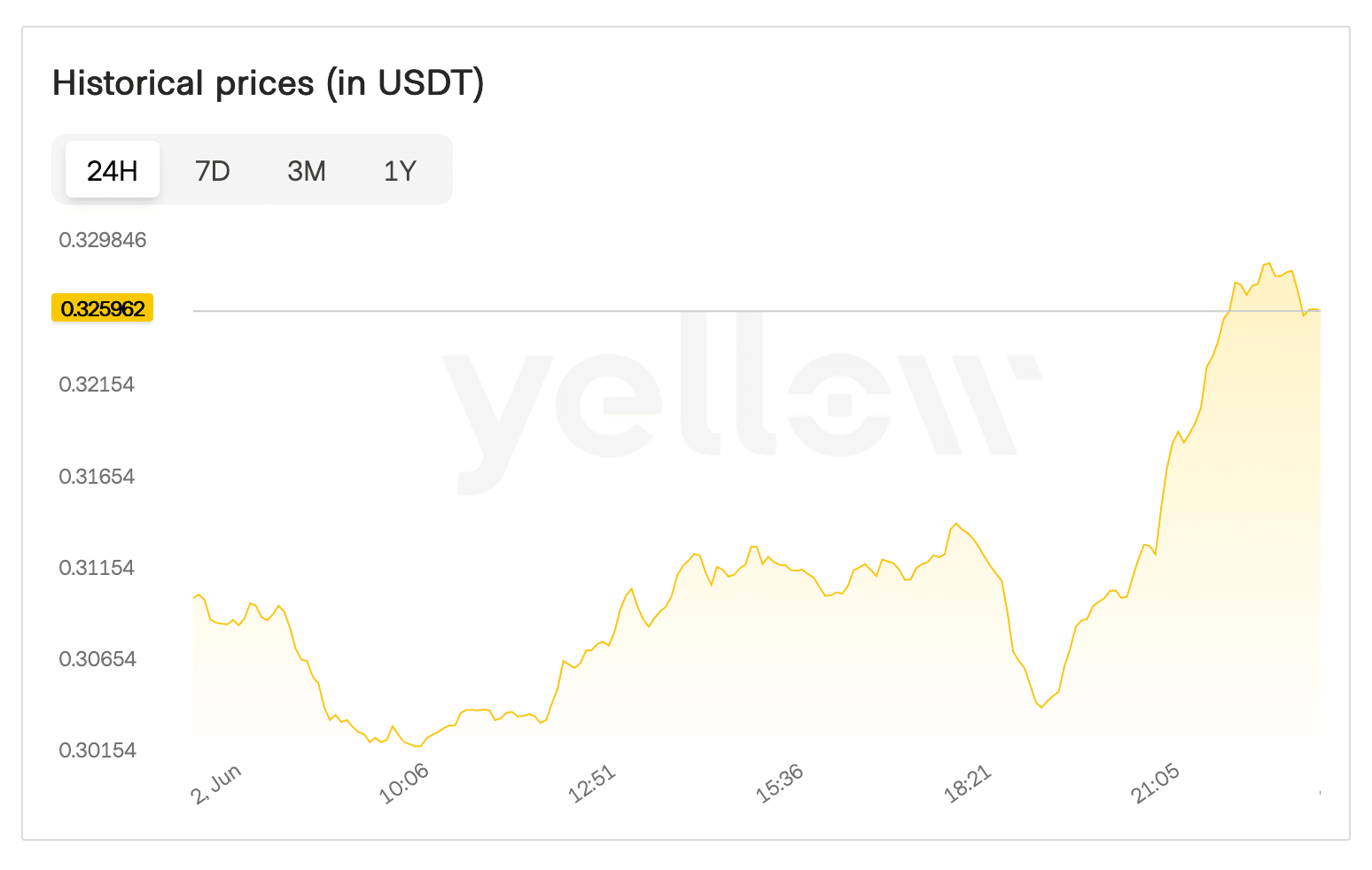

- ENA price jumped from $0.312 to $0.338 before settling at $0.329, with trading volume surging 91.7% to $254 million

- The announcement came one day after 40 million ENA tokens worth $12 million were unlocked without triggering major selloffs

Exchange Sets Conditions for Trading Launch

Coinbase Assets confirmed the roadmap addition through its official X account, specifying the token's ERC-20 contract address as 0x57e114B691Db790C35207b2e685D4A43181e6061. The exchange emphasized that roadmap inclusion does not guarantee immediate trading availability.

"Transfers and trading are not supported for these or any other assets until a listing is officially announced," Coinbase stated in its disclosure. The company warned that depositing unlisted assets could result in permanent fund loss.

Trading activation depends on increased market-making support and adequate technical infrastructure development. Coinbase indicated it will issue separate announcements once these conditions are satisfied. The exchange maintains that its roadmap list is not exhaustive, suggesting additional tokens may be added without prior notice.

ENA joins QCAD in the current roadmap, representing Coinbase's measured approach to new listings. This strategy contrasts with smaller exchanges that often list tokens with minimal preparation.

Market Responds with Measured Enthusiasm

The price reaction followed typical patterns seen with previous Coinbase roadmap announcements. ENA climbed from $0.312 to a peak of $0.338 before retreating to $0.329 at press time. The 8.6% gain, while notable, proved more modest than other recent roadmap additions.

Trading volume told a different story, surging 91.7% to reach $254 million over 24 hours. This spike indicated heightened investor interest despite the relatively controlled price movement. The volume surge suggests traders are positioning for potential future listings while remaining cautious about immediate prospects.

Market analysts noted that ENA's gains appeared restrained compared to tokens like TokenBot (CLANKER), doginme (DOGINME), and Freysa AI (FAI), which experienced more dramatic surges following similar announcements. This difference may reflect varying market conditions or investor sentiment toward synthetic dollar protocols like Ethena.

The measured response also coincided with broader cryptocurrency market uncertainty. Bitcoin and Ethereum have faced pressure in recent weeks, potentially dampening enthusiasm for altcoin announcements.

Strategic Timing Amid Token Unlock Event

Coinbase's announcement arrived one day after a significant token unlock event that had raised investor concerns. More than 40 million ENA tokens valued at approximately $12 million entered circulation Monday, creating potential selling pressure.

Market observers had anticipated a possible price decline following the unlock. Instead, ENA demonstrated resilience, dropping only 1% in the immediate aftermath. This stability may have influenced Coinbase's decision to proceed with the roadmap announcement.

The timing suggests careful coordination between the exchange and market conditions. Coinbase typically monitors token performance and market stability before making listing decisions. The fact that ENA weathered the unlock event without significant volatility likely reinforced confidence in the token's market dynamics.

Token unlocks often create uncertainty as investors speculate about selling pressure from newly liquid holdings. ENA's ability to maintain price stability during this period demonstrated market maturity that exchanges value when evaluating listing candidates.

Technical Infrastructure Requirements

Coinbase's emphasis on technical infrastructure development reflects the exchange's rigorous listing standards. The company has faced regulatory scrutiny over asset selection and must ensure proper technical integration before launching new trading pairs.

Market-making support represents another critical requirement. Adequate liquidity provision ensures smooth trading experiences and reduces price volatility during initial trading periods. Coinbase works with institutional market makers to provide this service.

The exchange's cautious approach stems from both regulatory considerations and user experience priorities. Previous listing failures at other exchanges have demonstrated the importance of proper preparation before launch.

Closing Thoughts

Coinbase's addition of ENA to its listing roadmap signals growing institutional recognition for Ethena's synthetic dollar protocol, though actual trading availability remains dependent on meeting specific technical and market requirements. The measured market response, combined with ENA's resilience during recent token unlocks, suggests a maturing ecosystem around the project.