In a market teetering between meme-driven mania and institutional signals, today’s spotlight fell on five standout tokens: DEGEN, NEIRO, KAITO, SKYAI, and XRP. From Base chain breakouts to regulatory rebounds, the day reflected the twin forces of speculative retail interest and growing macro clarity.

DEGEN and NEIRO led the memecoin charge with explosive rallies fueled by pattern breakouts and buying pressure. Meanwhile, KAITO and SKYAI reflected the altcoin sector's shift back to AI narratives and chain incentives. XRP, bolstered by ETF speculation and legal resolution, showed that institutional themes are far from dormant—even as memecoins dominate volume.

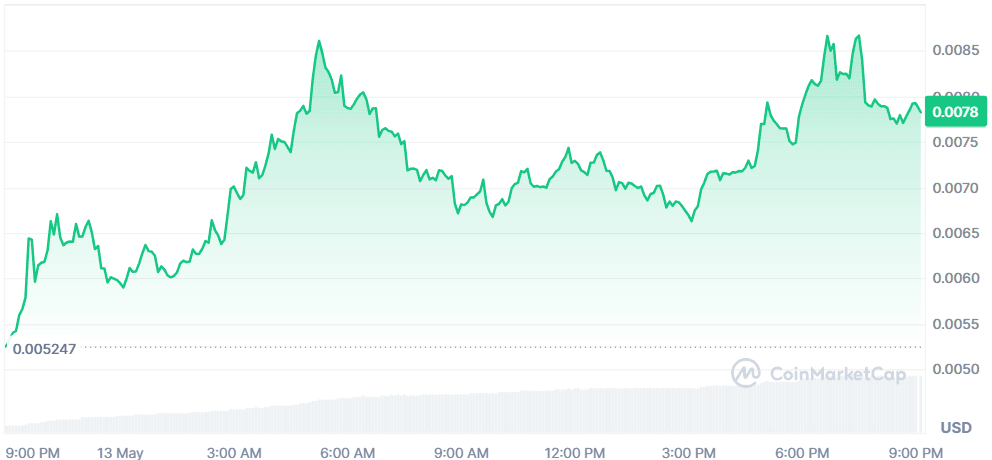

Degen (DEGEN)

Price Change (24H): +45.83% Current Price: $0.007866

What happened today

DEGEN exploded nearly 46% in the last 24 hours, reclaiming price levels last seen in February and now up 440% over 90 days. The memecoin broke out of a descending triangle pattern, with bullish MACD and EMA crossovers echoing its 2024 rally. The Money Flow Index (MFI) hit 93.46, signaling high buying pressure, while on-chain data shows strong support at $0.0079, with 14,920 addresses holding over 13B tokens in unrealized profits. Analysts eye $0.0093 as the next resistance and $0.015 if the bullish momentum persists.

Market Cap: $111.54M 24-Hour Trading Volume: $416.42M Circulating Supply: 14.17B DEGEN

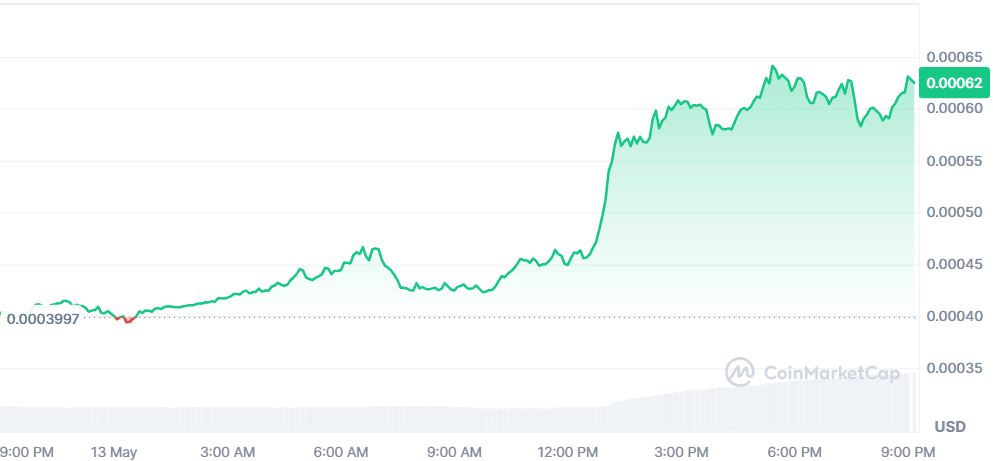

Neiro (NEIRO)

Price Change (24H): +55.69% Current Price: $0.0006245

What happened today

NEIRO rebounded nearly 200% this week, breaking out of a multi-month downtrend and reaching price levels last seen in January. A significant drop in Mean Dollar Invested Age (MDIA) from 60.55 to 16.04 suggests long-dormant wallets reactivated. Rather than dumping, most held firm, triggering a supply shock. The 20 EMA crossed above the 50 EMA and the token breached the Ichimoku Cloud resistance. If momentum holds, targets at $0.00073 and $0.00091 are in sight, though profit-taking could cause a pullback to $0.00043.

Market Cap: $262.74M 24-Hour Trading Volume: $567.29M Circulating Supply: 420.68B NEIRO

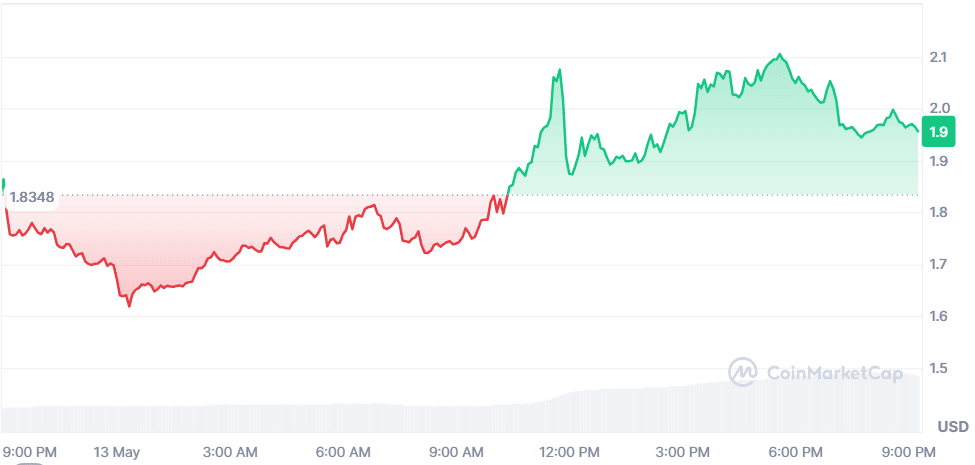

Kaito (KAITO)

Price Change (24H): +11.65% Current Price: $1.95

What happened today

KAITO continues its climb after a 200% rally off its April low of $0.67. A golden cross between the 20 EMA and 50 EMA, along with a breakout from a falling wedge, confirmed bullish sentiment. Strong support lies between $1.76–$1.82, where 3.31M tokens were accumulated. If momentum sustains, KAITO could break $2.45 and target $3. However, if selling pressure returns, a fallback to $1.57 remains possible.

Market Cap: $472.36M 24-Hour Trading Volume: $659.35M Circulating Supply: 241.38M KAITO

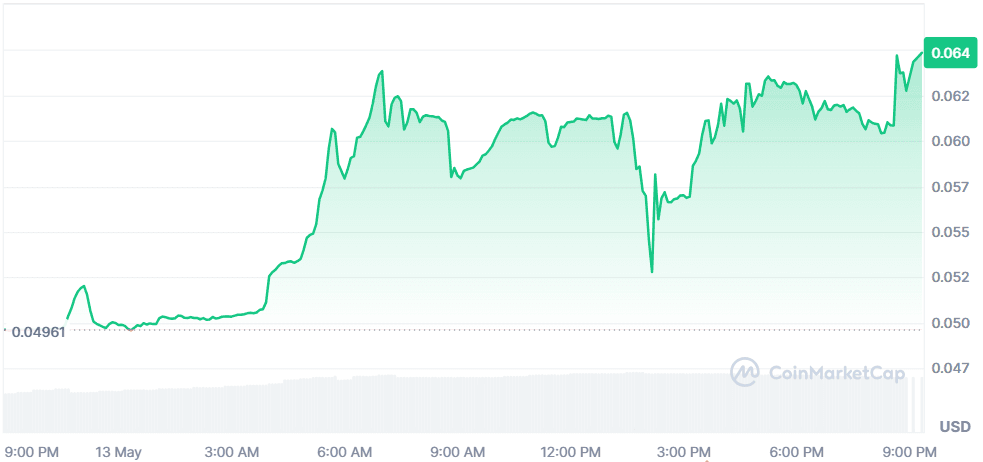

SKYAI (SKYAI)

Price Change (24H): +30.32% Current Price: $0.06465

What happened today

SKYAI surged following major announcements: Binance Futures listing, Bitget USDT trading launch, and being the first project to secure 100K USDT from the BNB Chain Incentive Program. BNB Chain Foundation’s direct purchases of SKYAI ($100K across four txs) added fuel. Now trending #1 on BSC by volume, the token rides institutional momentum, with Bitget offering 50x leverage and incentives, creating FOMO among retail and institutional traders.

Market Cap: $64.65M 24-Hour Trading Volume: $437.88M Circulating Supply: 1B SKYAI

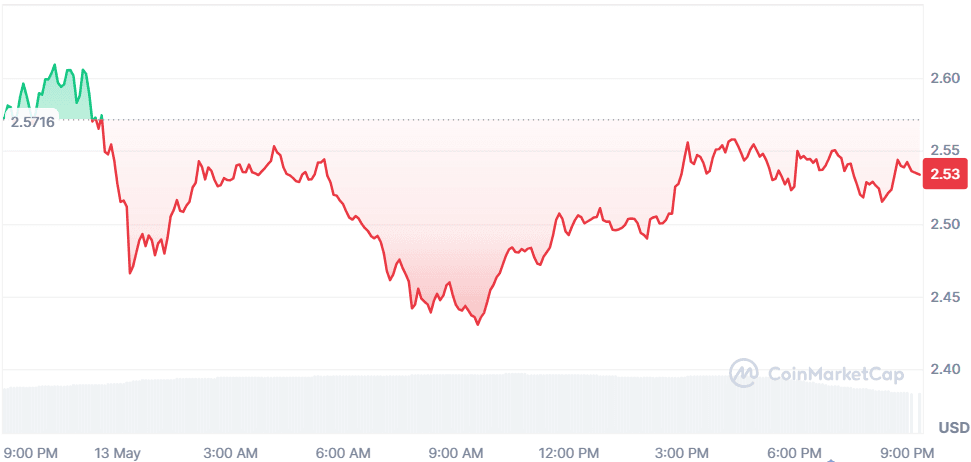

XRP (XRP)

Price Change (24H): –1.81% Current Price: $2.53

What happened today

XRP is buzzing after hitting a 2-month high of $2.61. The recent $50M SEC settlement removed regulatory overhang, boosting confidence around an XRP ETF. Technically, XRP broke a symmetrical triangle, trades above 200- and 50-day EMAs, and analysts target $3 short term. Today’s SEC roundtable on DeFi-TradFi integration, featuring BlackRock and Fidelity, adds macro buzz. If XRP sustains above $2.60, the $3 mark could be next. Broader support from adoption, including Travala and Southeast Asian remittances, reinforces the bullish tone.

Market Cap: $148.38B 24-Hour Trading Volume: $7.49B Circulating Supply: 58.55B XRP

Global Market Snapshot

Markets are cautiously optimistic following a temporary truce in the U.S.–China trade war, which has eased tariff pressure but not fully restored investor confidence.

The GEP Global Supply Chain Volatility Index signals a sharp drop in manufacturing demand, with U.S. firms aggressively stockpiling and Asian producers facing underutilization. Freight volatility persists, though European manufacturing, especially in Germany and France, shows signs of recovery.

U.S. inflation cooled to 2.3% in April, under expectations, prompting hopes for Fed rate cuts. The VIX fell below 18 for the first time since March, signaling reduced market fear. Meanwhile, a $600B Saudi investment into U.S. sectors, and Coinbase’s inclusion in the S&P 500, spotlight crypto’s institutional integration. Still, concerns around the sustainability of recovery remain as global investors digest mixed earnings, macro data, and geopolitical uncertainty.

Closing Thoughts

Investor sentiment today is split between high-risk speculation and cautious optimism. The strongest momentum clearly rests with memecoins and low-cap AI tokens: DEGEN, NEIRO, and SKYAI all surged with retail engagement, token support zones, and bullish technicals driving FOMO.

Their charts reflect breakout patterns and fresh liquidity, often supported by listings, community pushes, or base-chain trends. It’s a reminder that even amid macro noise, pockets of the market are ready to explode when the setup aligns. Meanwhile, KAITO’s continued strength and XRP’s legal clarity indicate that capital is also rotating into tokens with structural or regulatory narratives, signaling broader investor readiness to take calculated bets.

Zooming out, the macro backdrop is cautiously constructive. The U.S.-China tariff pause and CPI cooling to 2.3% offer some economic breathing room. The GEP supply chain index suggests fragility remains, but institutional moves—like Coinbase joining the S&P 500 and XRP ETF whispers, hint at deeper crypto-tradfi integration. The action today reinforces that the market is not in full risk-on mode yet, but selective sectors like memes, AI, and regulated tokens are already drawing crowds.