Bitcoin mining difficulty dropped to approximately 146.4 trillion in the network's first recalibration of 2026, providing a short-term reduction in computational hurdles for miners as average block times settled near 9.88 minutes.

What Happened; Difficulty Drops

The adjustment, completed in early January, marked the first difficulty change of the year for the Bitcoin network. Block times were running slightly faster than the protocol's 10-minute target at the time of the recalibration.

That quicker pace triggered the automatic reduction.

Multiple reports noted the metric fell from levels recorded at the end of 2025.

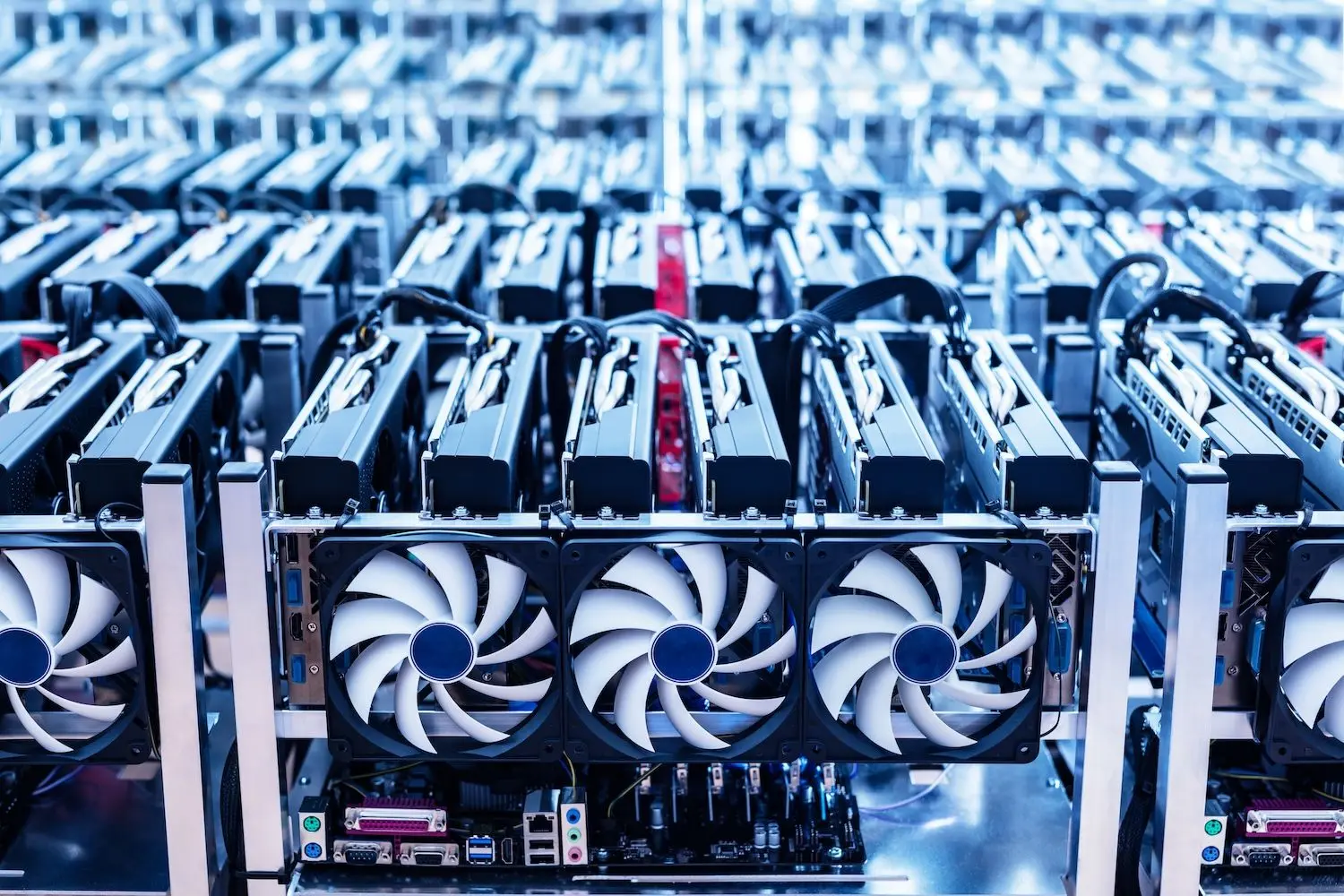

Despite the decrease, difficulty remains elevated compared with earlier years, and miners continue to face margin pressure following the 2024 halving and substantial hardware investments made throughout 2025.

Hash price softened while energy and equipment costs stayed high.

The next recalculation is projected for Jan. 22, with trackers estimating difficulty could rise toward 148 trillion as block times slow toward the 10-minute mark.

Also Read: Cardano Long-Term Holders Sell While Short-Term Traders Buy The Dip — What's Next For ADA?

Why It Matters; Miner Relief Window

Difficulty serves as the protocol's mechanism for maintaining steady block production, adjusting every 2,016 blocks — roughly two weeks — to match total network computing power. When hash rate increases, difficulty rises; when blocks arrive too quickly, it eases.

These shifts directly affect how much work miners must perform to earn rewards.

Analysts say the current adjustment offers temporary breathing room but does not eliminate the financial pressures many operators faced through 2025.

Miners will monitor hash rate trends, power costs, and Bitcoin's price in the coming days because those factors determine profitability between adjustments.

If conditions shift as expected, competition among miners may intensify again later this month.

Read Next: What Does Bitcoin's Move From Power Law To S-Curve Mean For Investors?