The cryptocurrency market witnessed an explosive end to 2024, characterized by major political shifts, technological advancements, and record-breaking milestones. The U.S. presidential election, AI-driven projects, and institutional investments played pivotal roles in driving the market upward. Let's recap some of the key events from Q4 2024 and outline what to expect in 2025. We aim to offer insights into emerging trends and potential challenges for the coming quarter.

Q4 2024: The Bull Run Ignited

Political Influence on Crypto Markets

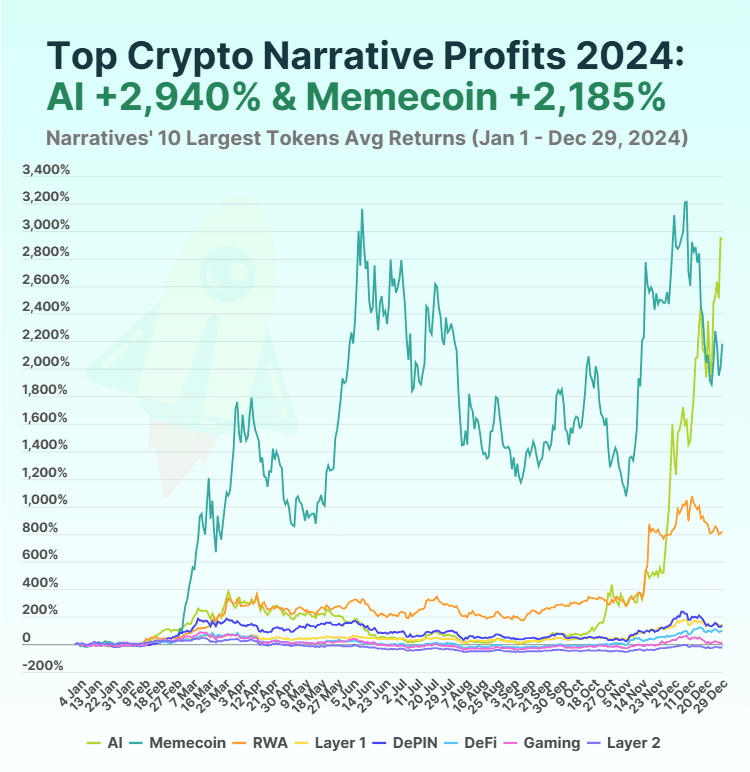

The U.S. presidential election in November 2024 emerged as a critical turning point for the crypto market. Donald Trump’s victory ushered in a wave of optimism, as his administration proposed crypto-friendly policies, including appointing Paul Atkins as SEC Chair and floating the idea of a "National Bitcoin Reserve." Elon Musk’s appointment to lead the Department of Government Efficiency (DOGE) further fueled enthusiasm, especially for memecoins like DOGE, PEPE, and Dogwifhat, which saw significant price surges.

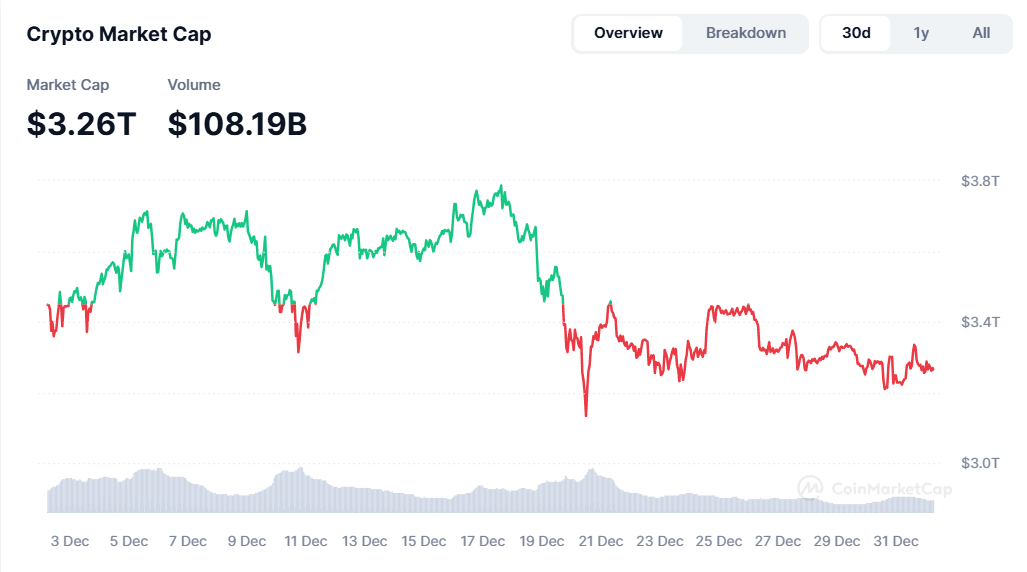

Bitcoin’s price climbed 59% during the quarter, reaching a record high of over $100,000, while the total crypto market cap surged to $3.66 trillion, reflecting a 75% increase in Q4. These developments highlighted the growing impact of global political shifts on the crypto ecosystem.

Institutional Investment Surges

Institutional investors played a pivotal role in driving the market rally. MicroStrategy expanded its Bitcoin holdings to over $42 billion, cementing its position as the largest corporate holder of BTC.

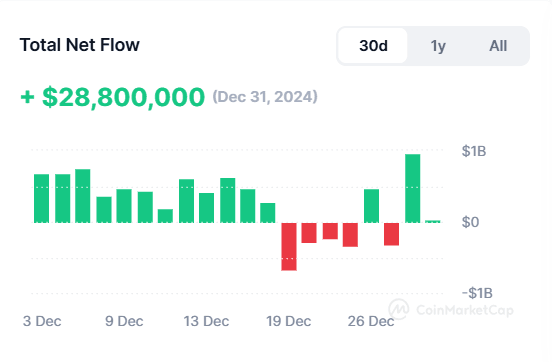

Bitcoin ETFs continued to attract record inflows, with over $35 billion in investments by the year’s end. This institutional adoption underscored the growing recognition of Bitcoin as a legitimate asset class, akin to digital gold.

The SEC’s approval of Bitcoin futures and spot ETFs marked a regulatory milestone, further boosting investor confidence. However, some traditional players, like Microsoft, refrained from adding Bitcoin to their portfolios, signaling ongoing caution among corporate giants.

Global Regulatory Shifts

On the international front, countries like China and Russia eased restrictions on cryptocurrency, allowing it to be purchased as an asset. This policy shift marked a significant departure from their earlier bans and created a more favorable global environment for crypto adoption.

These regulatory changes coincided with a surge in activity within decentralized finance (DeFi) and smart contract platforms, reflecting a maturing ecosystem supported by institutional and retail interest alike.

AI-Driven Crypto Projects Shine

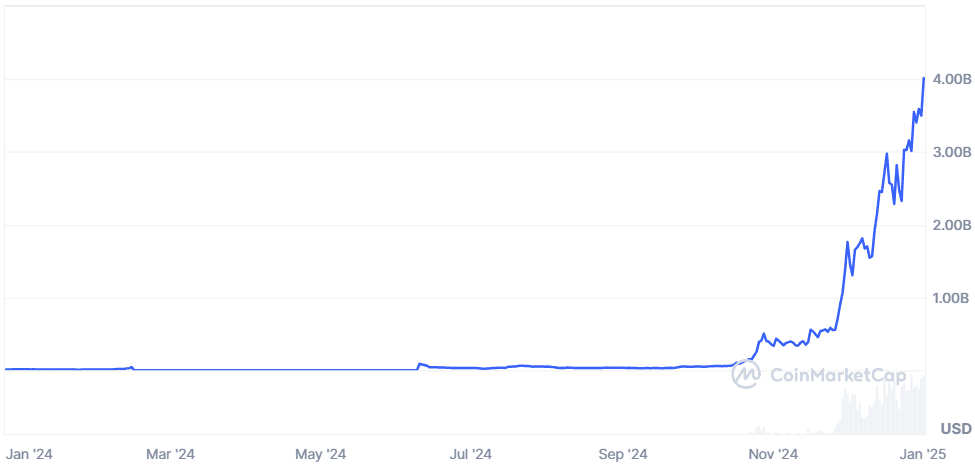

The convergence of AI and blockchain gained momentum in Q4 2024, with projects like Virtual and AI16Z leading the charge. These platforms showcased how decentralized infrastructure can support AI applications, from autonomous agents to decentralized data networks. Virtual’s meteoric rise, with a market cap of $445 million within two months, demonstrated the potential of this emerging sector.

As the lines between AI and blockchain continue to blur, the demand for such projects is expected to grow, unlocking new possibilities for innovation and collaboration.

Trends to Watch in 2025

Bitcoin’s Path Forward

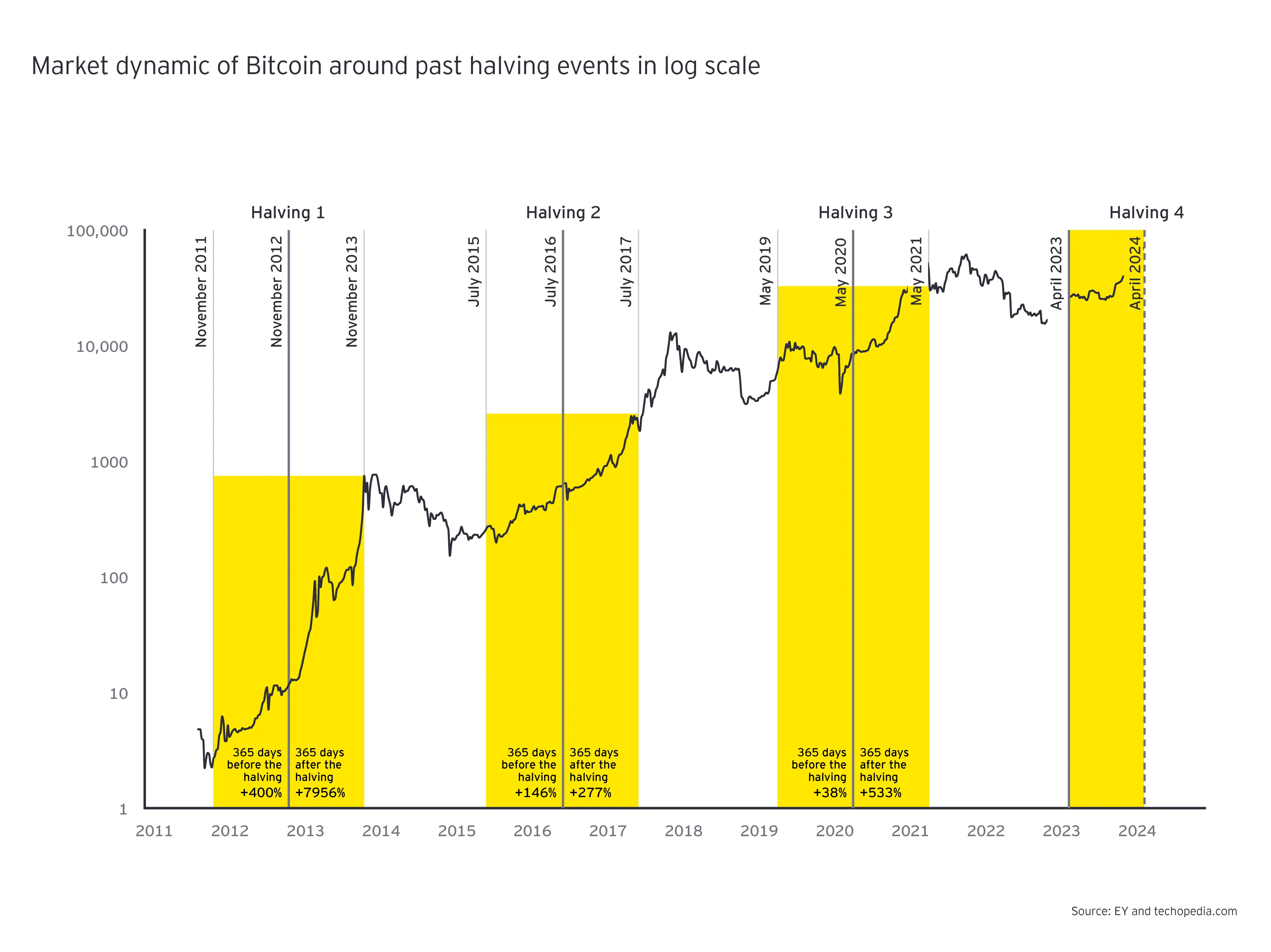

Bitcoin’s bullish momentum is expected to continue in 2025, with analysts projecting prices between $180,000 and $200,000 by year-end. The April 2024 halving has reduced Bitcoin’s supply inflation to less than 1% annually, increasing scarcity and supporting higher valuations.

However, macroeconomic factors, such as potential interest rate hikes and shifts in monetary policy, could pose challenges. If global central banks adopt a more hawkish stance, it may dampen the institutional enthusiasm that drove 2024’s rally.

The Evolution of Altcoins

While Bitcoin dominated headlines in 2024, Ethereum is poised to outshine it in 2025. The growing adoption of decentralized finance (DeFi), scaling solutions like Layer 2 networks, and the approval of Ethereum ETFs are all contributing to its rising prominence.

Grayscale’s analysis highlights the continued competitiveness within the Smart Contract Platforms sector, where Ethereum remains the category leader despite facing strong challenges from alternatives like Solana and Sui. While Ethereum leads in terms of developer activity, total value locked (TVL), and fee revenue, the rise of high-performance blockchains such as Solana - offering faster transactions and lower fees - indicates increasing competition.

Decentralized Infrastructure Growth

The decentralized infrastructure sector is poised for significant growth, supported by advancements in Layer 2 networks and decentralized physical infrastructure projects. Grayscale’s Top 20 assets for 2025 emphasize this trend, including projects like Helium and Optimism. Helium’s decentralized wireless network has expanded to over one million hotspots, while Optimism continues to lead Ethereum scaling with its Superchain framework, enabling faster and cheaper transactions.

These infrastructure improvements are unlocking new applications, including prediction markets, stablecoin innovations, and gaming, paving the way for broader adoption and innovation in 2025.

AI and Decentralized Applications

AI-powered blockchain applications will likely gain significant traction in 2025. Projects like Gensyn and Virtual are already demonstrating how decentralized systems can address challenges in AI, such as democratizing access to computing resources and tracking intellectual property.

These advancements are expected to unlock a new wave of decentralized applications, ranging from AI-driven prediction markets to tokenized autonomous agents, further bridging the gap between blockchain and artificial intelligence.

Grayscale Research emphasizes the role of decentralized AI platforms like Bittensor in democratizing access to AI capabilities. By leveraging blockchain technology to create open AI systems, projects like Bittensor represent the intersection of AI and blockchain, addressing challenges of centralization and enabling more equitable access to computational resources

Geopolitical and Economic Impacts

One of the most striking trends in Q4 2024 was the crypto market’s heightened sensitivity to global political and economic events. From the Trump administration’s pro-crypto stance to South Korea’s military law announcement and U.S. interest rate cuts, crypto prices reacted strongly to traditional market drivers.

This dynamic raises questions about whether cryptocurrencies are evolving into tools of centralized geopolitical influence, contradicting their foundational ethos of decentralization (Food for thought, maybe?).

Challenges for 2025

Regulatory Clarity

While the Trump administration promises regulatory reforms, the timeline for implementation remains uncertain. Key areas of focus will include stablecoin legislation and defining the regulatory framework for DeFi and other crypto sectors. The industry’s ability to navigate these changes will be critical to its growth (Statista).

Market Corrections

Despite the optimism surrounding 2025, historical patterns suggest the potential for market corrections.

The cyclical nature of Bitcoin’s halving events often leads to significant pullbacks following major rallies. However, the increasing presence of institutional investors may help cushion the impact of such corrections.

Scalability and Infrastructure Bottlenecks

As crypto adoption accelerates, scalability challenges could hinder growth. Networks like Ethereum must continue to innovate through solutions like Layer 2 scaling and zero-knowledge rollups to meet rising demand. Infrastructure improvements will be essential to supporting new use cases and maintaining user engagement.

Conclusion

The cryptocurrency market is entering 2025 with unparalleled momentum, driven by institutional adoption, regulatory advancements, and technological innovations. While challenges remain, from scalability to market corrections, the industry’s resilience and adaptability offer reasons for optimism.

As crypto continues to integrate with global financial systems and expand its use cases, it is poised to remain a focal point for innovation, investment, and geopolitical discourse in the coming year.