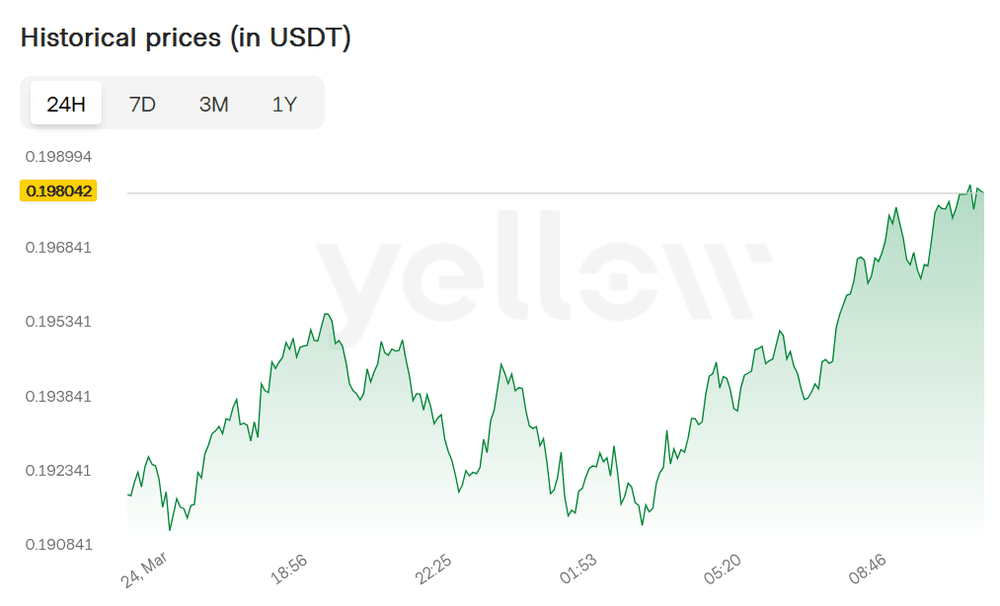

Hedera's cryptocurrency HBAR has gained 4% over the past week, reaching $0.19 as broader market activity strengthens. The digital token's technical indicators suggest a potential bullish trend emerging, though analysts remain cautious about sustainability.

What to Know:

- Hedera's HBAR token has gained 4% over the past week, trading at $0.19 amid increasing market strength.

- Technical indicators, including a golden cross formation and movement above the 20-day EMA, suggest growing bullish momentum.

- Analysts project a potential price target of $0.24 (26% upside) if bullish trends continue, but warn of possible reversal to $0.16 if profit-taking accelerates.

What is Happening with Hedera

Growing investor confidence has increased demand for the altcoin, positioning it for possible further appreciation. Market data shows HBAR's recent price performance has outpaced several competing cryptocurrencies in its market segment during the same period.

"The current market conditions appear favorable for alternative cryptocurrencies like HBAR," said one market analyst who requested anonymity because they weren't authorized to speak publicly. "We're seeing renewed interest from both retail and institutional investors."

The token's movement above key technical thresholds has caught traders' attention.

HBAR's attempt to break above its 20-day exponential moving average signals growing bullish sentiment among market participants. This technical indicator measures average price over 20 trading days with higher weighting for recent price action.

When cryptocurrencies move above their 20-day EMA, it typically indicates a transition from bearish to bullish momentum. For HBAR, sustaining this breakout could shift overall market sentiment positive and drive additional price gains in coming sessions.

Technical analysts point to additional supporting evidence. A golden cross formation on HBAR's Moving Average Convergence Divergence (MACD) chart confirms the building bullish momentum. Currently, the token's MACD line remains positioned above its signal line, considered a positive indicator by market technicians.

The MACD serves as a momentum indicator helping traders identify trend direction and potential market reversals. The golden cross pattern suggests increasing buying pressure could sustain HBAR's upward price trajectory, provided broader economic conditions remain supportive.

HBAR Critical Price Level and Further Outlook

HBAR faces a crucial test as it approaches higher resistance levels. Successfully breaking above its 20-day EMA could strengthen bullish market pressure and potentially trigger an extended rally.

Under optimistic scenarios, analysts project the token's price could reach $0.24, representing a significant 26% increase from current trading levels. This target aligns with previous resistance points established during earlier market cycles.

However, market observers note substantial risks remain. If profit-taking accelerates among current HBAR holders, the bullish outlook would likely be invalidated. Under this scenario, the cryptocurrency could reverse its upward trajectory and potentially fall to support levels around $0.16.

Trading volumes will be a key metric to watch in coming days. Increasing volumes would lend credibility to any sustained price movement, while declining participation could signal waning momentum.

Closing Thoughts

Hedera's HBAR shows promising technical indicators amid broader cryptocurrency market strength, with potential for significant price appreciation if current trends continue. However, the volatile nature of cryptocurrency markets means traders should monitor key resistance levels and prepare for possible reversals.