Hedera's native token HBAR posted a 3.3% gain over the past 24 hours, pushing the cryptocurrency's market capitalization to $8.06 billion while generating nearly $127 million in trading volume. The modest price increase comes amid conflicting technical signals that suggest market participants remain divided on the token's near-term direction.

What to Know:

- Hedera's BBTrend indicator has turned sharply negative to -3.67, signaling renewed bearish pressure after brief recovery

- The cryptocurrency's RSI rebounded to neutral territory at 49.25 following volatile swings between oversold and overbought levels

- HBAR continues trading within a tight consolidation range between $0.183 support and $0.193 resistance

Bearish Momentum Returns as BBTrend Plunges

The cryptocurrency's Bollinger Band Trend indicator has reversed course dramatically, falling to -3.67 from a positive 1.84 reading just one day earlier. This sharp decline reflects renewed selling pressure and suggests that bears have regained control of short-term price action. The BBTrend measures price movement strength relative to Bollinger Bands, with readings below -2 typically indicating strong bearish trends.

Market analysts interpret the current -3.67 reading as evidence that HBAR's price is gravitating toward the lower Bollinger Band. This technical pattern often precedes continued downside momentum. The rapid reversal from positive to deeply negative territory highlights the instability in market sentiment surrounding the token.

If bearish pressure persists, traders expect potential retests of recent support levels. The volatility in the BBTrend indicator suggests quick shifts in trader positioning, reflecting broader uncertainty about HBAR's price direction in coming sessions.

RSI Recovery Provides Limited Relief

Hedera's Relative Strength Index has climbed to 49.25, marking a significant recovery from oversold conditions at 30.46 recorded just 24 hours ago. The rebound places the momentum oscillator in neutral territory after experiencing extreme volatility over recent trading sessions. Four days prior, the RSI had reached overbought levels at 69.91 before beginning its descent.

The current neutral RSI reading indicates neither strong bullish nor bearish momentum dominates the market. Technical analysts view readings between 30 and 70 as balanced conditions where price direction depends on external catalysts rather than internal momentum. The recovery from near-oversold levels suggests immediate selling pressure has eased.

However, the limited conviction among buyers remains evident. The RSI's position at 49.25 leaves room for movement in either direction, making broader market conditions and upcoming developments crucial for determining HBAR's next significant move.

Price Consolidation Tests Key Levels

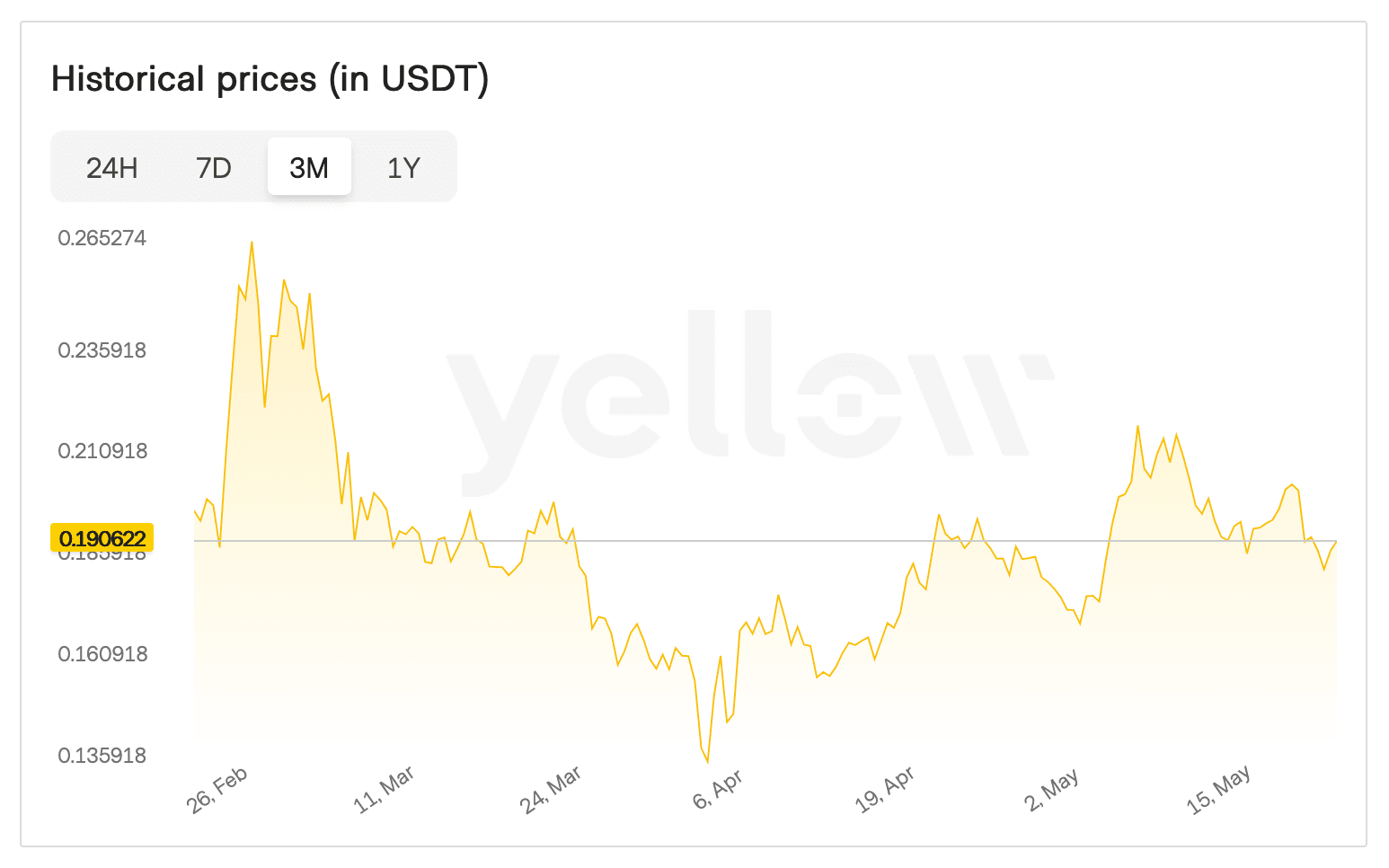

HBAR has maintained a narrow trading range between $0.183 and $0.193 over recent sessions, creating a consolidation pattern that technical analysts view as a potential precursor to significant price movement. The tight range reflects balanced buying and selling pressure, with neither bulls nor bears achieving decisive control.

A breakout above the $0.193 resistance level could open the path toward the psychologically important $0.20 threshold. Sustained bullish momentum might push prices to $0.209 and potentially $0.228, levels that have previously served as resistance zones during past rallies.

The cryptocurrency's exponential moving averages currently provide little directional guidance, reflecting the prevailing market indecision. This technical setup suggests traders are waiting for clearer signals before committing to larger positions.

Conversely, failure to maintain support at $0.184 could trigger a deeper retracement toward $0.169. Such a decline would represent a more significant pullback and potentially attract additional selling pressure from technical traders monitoring these key levels.

Final Thoughts

Current technical conditions suggest HBAR will likely continue range-bound trading until a clear catalyst emerges to drive directional movement. The conflicting signals between the bearish BBTrend reading and neutral RSI create uncertainty about immediate price prospects.

Traders are closely monitoring the $0.193 resistance and $0.184 support levels for potential breakout or breakdown signals. The combination of modest trading volume and tight price consolidation indicates market participants remain cautious about making significant directional bets on the cryptocurrency at current levels.