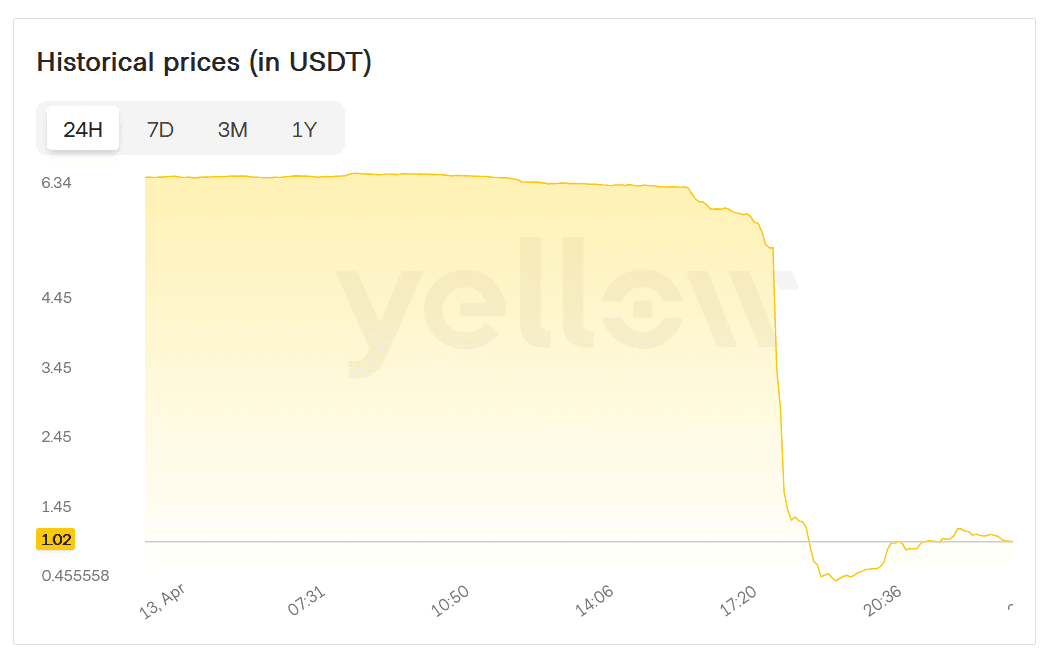

The Mantra token (OM), the native cryptocurrency of the Mantra real-world tokenized asset blockchain, experienced a catastrophic collapse exceeding 90% in value over a 24-hour period ending April 13, dropping from approximately $6.30 to below $0.50 and wiping out most of its $6 billion market capitalization.

What to Know:

- Mantra's token (OM) lost over 90% of its value in 24 hours, erasing billions in market capitalization

- The team has denied responsibility, blaming "reckless liquidations" while assuring investors they "are not going anywhere"

- The collapse follows Mantra's recent $1 billion tokenization deal with DAMAC and receiving regulatory approval in Dubai

The dramatic price implosion triggered immediate speculation across cryptocurrency markets, with some traders characterizing the event as a potential "rug pull" - a term describing when developers abandon a project and abscond with investor funds. Market investor Gordon wrote on social media: "[The] team needs to address this or OM looks like it could head to zero, biggest rug pull since LUNA/FTX?"

This incident adds to a growing list of significant cryptocurrency market disruptions in early 2025, following the Libra memecoin collapse and the $1.4 billion Bybit hack. These events have collectively resulted in billions of dollars in investor losses during the first quarter of the year.

The precise cause of the Mantra token's sudden devaluation remains unclear at publication time. Requests for comment from the Mantra team regarding the collapse were not immediately returned.

Team Response and Assertions

Mantra co-founder JP Mullin addressed the situation on social media platform X, attempting to reassure the community that the project remains operational. "We are here and not going anywhere," Mullin wrote, while providing a verification address purportedly showing that the team's tokens remain in their custody.

According to Mullin, the project's communication channels, including their Telegram group, continue to function normally despite the market turmoil.

The Mantra team separately issued a statement attributing the price crash to "reckless liquidations" rather than any actions taken by the development team or leadership.

The team's response comes amid growing concern from investors who witnessed the token's value evaporate in less than a day. Market observers note that such rapid devaluations typically trigger chain reactions of forced liquidations and panic selling, potentially accelerating price declines beyond their initial triggers.

Mantra's Middle East Expansion and Recent Developments

The price collapse comes just months after Mantra announced significant business developments in the Middle East. In January 2025, the project signed a $1 billion deal with investment conglomerate DAMAC to tokenize various assets including real estate, data centers, and other physical properties on the Mantra blockchain.

This partnership represented one of the largest real-world asset tokenization initiatives in the cryptocurrency sector to date. The following month, Mantra obtained a virtual asset service provider license from Dubai's Virtual Assets Regulatory Authority (VARA), granting the company permission to operate comprehensive digital asset services within the United Arab Emirates.

These regulatory achievements and business developments had positioned Mantra as a potentially significant player in the growing intersection between traditional finance and blockchain technology.

The company's expansion in the UAE was reportedly driven by increasing demand for tokenized investment products from real estate developers and investors seeking alternative funding mechanisms.

Proponents of blockchain-based real-world asset tokenization frequently cite benefits including near-instant settlement finality, reduced transaction costs, and improved cross-border functionality. These advantages have attracted increasing interest from traditional investment sectors looking to modernize capital formation processes.

The contrast between Mantra's recent business achievements and its token's sudden market collapse underscores the volatile nature of cryptocurrency markets, even for projects with apparent institutional backing and regulatory approval.

Market Impact and Outlook

The Mantra token collapse represents one of the most significant single-day cryptocurrency devaluations in recent months, both in percentage terms and total market value erased. The incident has heightened calls for greater transparency in tokenization projects that bridge traditional finance with cryptocurrency markets.

In conclusion, while the Mantra team maintains the price collapse resulted from market dynamics rather than project failure, the incident highlights persistent risks in cryptocurrency investments even as the sector continues pursuing mainstream financial integration.