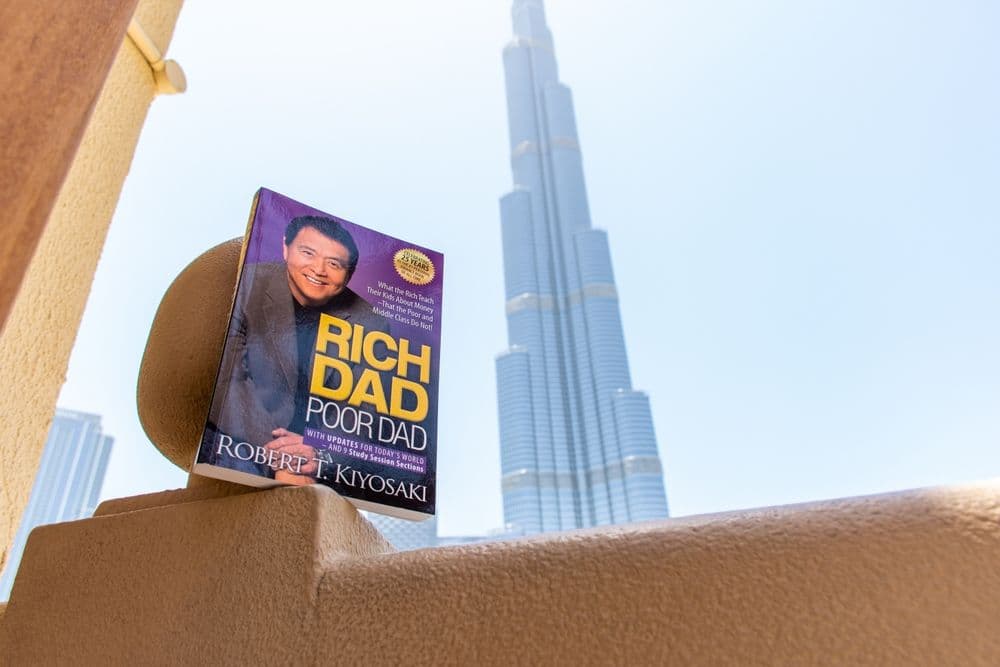

Robert Kiyosaki, author of the best-selling personal finance book "Rich Dad Poor Dad," dismissed concerns about Bitcoin (BTC) price volatility, declaring he does not care whether cryptocurrency values rise or fall because he views digital assets as a hedge against declining U.S. dollar purchasing power.

What Happened: Author Dismisses BTC Concerns

Kiyosaki posted on social media that he continues accumulating Bitcoin, gold, silver, and Ethereum (ETH) regardless of market conditions. He attributed his stance to what he described as incompetent monetary policy from those controlling the Federal Reserve, the Treasury, and the U.S. government.

"Do I care when the price of gold, silver, or Bitcoin go up or down? No. I do not care," Kiyosaki wrote. "Because I know the national debt of the US keeps going up and the purchasing power of the US dollar keeps going down."

His comments arrived as Bitcoin dropped to $84,300, extending losses beyond 5 percent and breaking through critical support at $86,000.

Major altcoins followed lower, with Ethereum falling slightly below $2,800, Solana (SOL) dropping to $116, and Cardano (ADA) declining to $0.33.

Also Read: Why Central Banks Are Stockpiling Gold Instead Of U.S. Debt For First Time Since 1996

Why It Matters: Dollar Weakness Thesis

The financial author's message reflects a longer-term investment thesis centered on national debt expansion. He argued that rising U.S. debt levels and eroding dollar purchasing power make precious metals and cryptocurrencies attractive stores of value.

Bitcoin has now fallen 33 percent from its October peak of $126,200, with total cryptocurrency market capitalization declining to $2.87 trillion. Derivatives data shows leveraged long positions absorbed substantial losses as price support levels failed, with Bitcoin experiencing multiple liquidation waves throughout January totaling nearly $1.8 billion.

As Yellow Media reported in January 2025, Kiyosaki predicted Bitcoin could reach $250,000 by the end of the year. The cryptocurrency was trading at $105,000 at the time of that forecast.