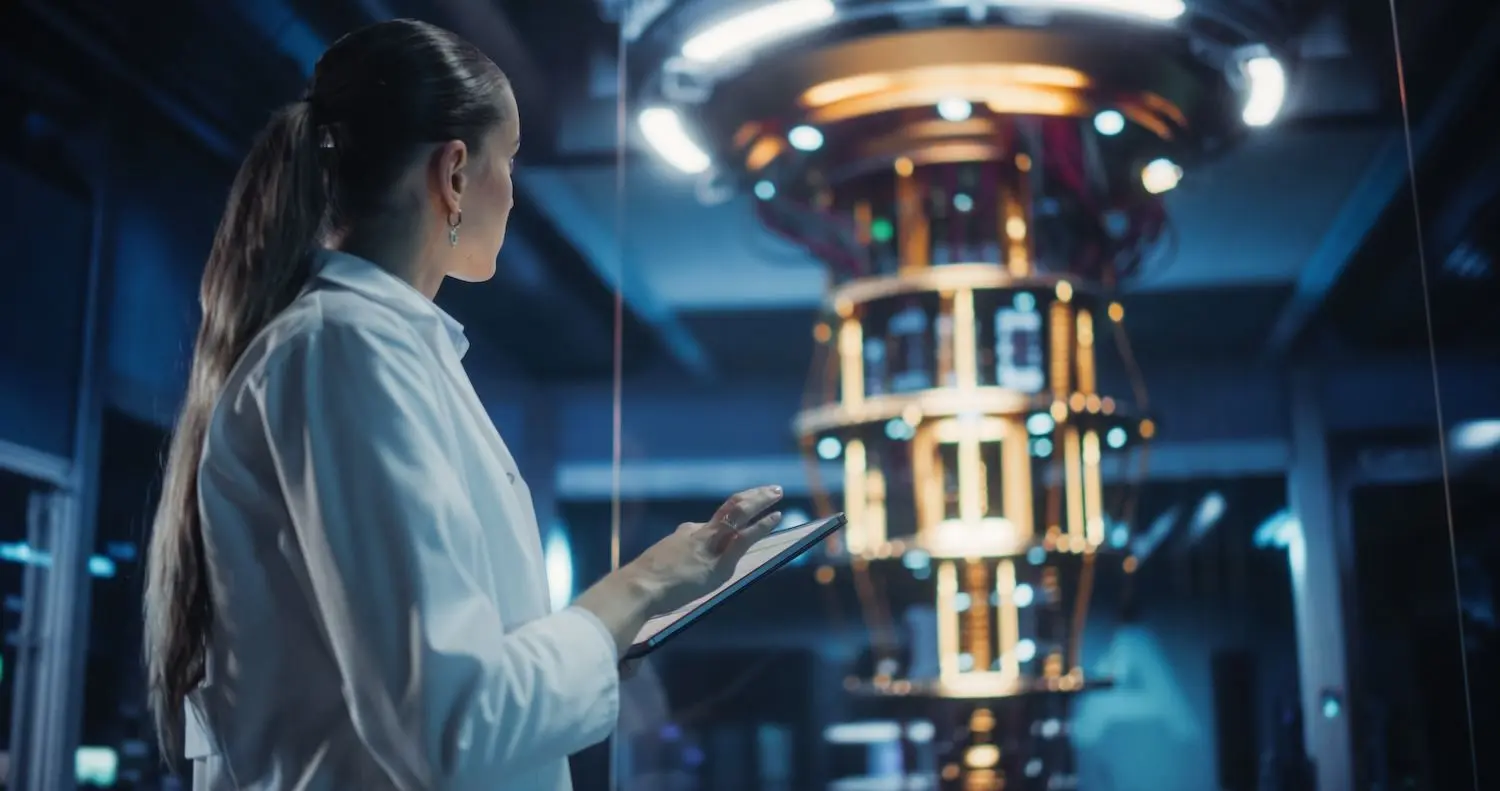

Bitcoin(BTC) faces growing scrutiny from institutional investors over quantum computing risks, with new research suggesting that between $650 billion and $750 billion worth of the cryptocurrency could be vulnerable to future attacks targeting its cryptographic security.

What Happened: Quantum Risk Reshapes Portfolio Strategy

Jefferies strategist Christopher Wood removed a 10% Bitcoin allocation from his flagship "Greed & Fear" model portfolio, reallocating to physical gold and mining equities.

Wood cited concerns that quantum computers could one day break Bitcoin's Elliptic Curve Digital Signature Algorithm keys, which secure transactions on the network.

A 2025 Chaincode Labs study estimated that 20% to 50% of circulating Bitcoin addresses remain vulnerable to future quantum attacks due to reused public keys.

That represents roughly 6.26 million BTC. Bitcoin has underperformed gold significantly this year, falling 6.5% in 2026 while gold surged 55%.

In the meantime, according to Grayscale's updated outlook on digital assets, Bitcoin faces no immediate price threat from quantum computing in 2026. The investment firm's latest research acknowledges the theoretical risk but dismisses its near-term market impact based on current technology timelines.

Also Read: The One Signal Everyone Missed Before Bitcoin Crashed And Wiped Out Nearly $1B

Why It Matters: Institutions Diverge on Risk

David Duong of Coinbase identified two major threats from quantum computing: breaking ECDSA keys and targeting SHA-256, which underpins Bitcoin's proof-of-work system.

Not all institutions are retreating.

Harvard increased its Bitcoin allocation by nearly 240%, raising its investment from $117 million to $443 million in the third quarter. Morgan Stanley began advising wealth management clients to allocate up to 4% of portfolios to digital assets.

Charles Hoskinson of Cardano warned that premature adoption of quantum-resistant cryptography could reduce network efficiency.

DARPA's Quantum Blockchain Initiative suggests meaningful threats may not emerge until the 2030s, though rapid advances in quantum hardware could accelerate that timeline.

Read Next: The Economist Who Sounded The Alarm Before 2008 Now Warns Of A Far Bigger Crisis