In early October 2025, a now-deleted social media post sent shockwaves through the cryptocurrency community. Josh Mandell, a former Wall Street trader, made a startling claim: quantum computers were already being used to siphon Bitcoin from long-dormant wallets, particularly those belonging to inactive or deceased owners. According to Mandell, a "large player" had found a way to extract Bitcoin directly from these wallets without going through the open market, leaving blockchain analysts as the only means of detection.

The allegation was explosive. If true, it would undermine the very foundation of Bitcoin's security model and challenge the principle that once funds are secured by a private key, only the holder can access them. Within hours, the claim sparked intense debate across crypto forums, social media, and industry publications. Some expressed alarm, others skepticism, and many simply confusion about whether the quantum threat they'd been hearing about for years had finally materialized.

The response from Bitcoin experts and the broader cryptocurrency community was swift and unequivocal: this isn't happening. Harry Beckwith, founder of Hot Pixel Group, stated flatly that there is "literally no chance this is currently happening." Matthew Pines of the Bitcoin Policy Institute called the theory "false" and criticized its lack of evidence. The consensus among technical experts was clear - while quantum computing poses a theoretical future risk to Bitcoin, current machines lack the qubit counts, error correction capabilities, and processing power needed for cryptographic attacks.

Yet Mandell's viral claim, despite being debunked, revealed something important: the quantum threat to Bitcoin has entered the mainstream consciousness, and the line between reasonable concern and unfounded panic has become dangerously blurred. With Google announcing its 105-qubit Willow chip in December 2024, IBM laying out a roadmap to fault-tolerant quantum computing by 2029, and asset manager BlackRock adding quantum computing warnings to its Bitcoin ETF filings in May 2025, the question is no longer whether quantum computers will pose a risk to cryptocurrency - but when, and what the industry should do about it.

This article examines the real relationship between quantum technology and Bitcoin, separating hype from reality. Rather than echoing simplistic narratives of quantum computers either "killing Bitcoin" or posing no threat whatsoever, we'll explore the actual timeline, technical barriers, economic stakes, ethical debates, and even potential benefits quantum computing might bring to the cryptocurrency ecosystem. The truth, as usual, lies somewhere between panic and complacency.

Quantum Computing 101 for Crypto Readers

To understand the quantum threat to Bitcoin, we first need to grasp what makes quantum computers fundamentally different from the classical computers that have powered the digital revolution for the past 70 years.

The Birth of Quantum Computing

The story of quantum computing begins not with computers, but with light. In 1905, Albert Einstein published his groundbreaking work on the photoelectric effect, demonstrating that light behaves not just as a wave but also as discrete packets of energy called photons. This discovery helped establish quantum mechanics as a new framework for understanding nature at its smallest scales - a framework where particles can exist in multiple states simultaneously, where observation changes reality, and where particles separated by vast distances can remain mysteriously connected.

For decades, quantum mechanics remained primarily a theoretical domain for physicists. But in 1994, mathematician Peter Shor developed an algorithm that would change everything. Shor's algorithm demonstrated that a sufficiently powerful quantum computer could factor large numbers exponentially faster than any classical computer - a discovery with profound implications for cryptography, since much of modern encryption relies on the mathematical difficulty of factoring large prime numbers or solving discrete logarithm problems.

Suddenly, quantum computing transformed from an academic curiosity into a matter of national security and economic importance. Governments and tech companies began pouring resources into building practical quantum computers, racing toward a future where today's cryptographic protections might become obsolete.

How Quantum Computers Work

At the heart of quantum computing is the qubit, or quantum bit. Unlike classical bits, which exist in a definite state of either 0 or 1, qubits can exist in a superposition - simultaneously representing both 0 and 1 until measured. This isn't just a metaphor or approximation; it's a fundamental feature of quantum mechanics.

When you combine multiple qubits, the possibilities multiply exponentially. Two classical bits can represent four possible states, but only one at a time. Two qubits can represent all four states simultaneously through superposition. Add more qubits, and the computational space explodes: 10 qubits can represent 1,024 states at once, 50 qubits can represent over a quadrillion states, and 300 qubits could theoretically represent more states than there are atoms in the observable universe.

This massive parallelism is complemented by two other quantum phenomena: entanglement and interference. Entanglement allows qubits to be correlated in ways that have no classical analog - measuring one instantly affects the others, regardless of distance. Interference allows quantum computers to amplify correct answers and cancel out wrong ones, guiding computation toward solutions.

These properties enable quantum computers to tackle certain problems in fundamentally new ways. For tasks like simulating molecular behavior, optimizing complex systems, or - crucially - breaking certain types of encryption, quantum computers could vastly outperform even the most powerful supercomputers.

The Current State of Quantum Hardware

The gap between quantum computing's theoretical promise and practical reality remains vast, however. The same quantum properties that make qubits powerful also make them extraordinarily fragile. Qubits are extremely sensitive to environmental disturbances - heat, electromagnetic radiation, vibrations - all of which cause errors and destroy the delicate quantum states needed for computation. This phenomenon, called decoherence, occurs on timescales measured in microseconds.

In December 2024, Google unveiled its Willow quantum chip, representing the current state of the art. Willow features 105 physical qubits with an average connectivity of 3.47 qubits. The chip demonstrated breakthrough improvements in quantum error correction, achieving an error rate of just 0.035 percent for single-qubit gates. Perhaps most impressively, Willow showed that adding more qubits could actually reduce errors - a critical milestone called "below threshold" error correction that had eluded researchers for nearly three decades.

Willow performed a computation in under five minutes that would take one of today's fastest supercomputers an estimated 10 septillion years - a number that vastly exceeds the age of the universe. While critics noted this was a specialized benchmark task (random circuit sampling) rather than a practical application, it demonstrated that quantum computers are achieving computational feats genuinely beyond classical reach.

IBM has outlined an even more ambitious roadmap. By 2025, the company plans to deliver the Nighthawk processor with 120 qubits capable of running circuits with 5,000 gates. By 2028, IBM aims to connect multiple modules to realize systems with over 1,000 qubits. The ultimate goal: IBM Quantum Starling, scheduled for 2029, will be a large-scale fault-tolerant quantum computer capable of running circuits comprising 100 million quantum gates on 200 logical qubits.

These are remarkable achievements, but they also highlight how far we remain from the machines that could threaten Bitcoin. Current systems operate with around 100 to 1,000 physical qubits. Breaking Bitcoin's cryptography would require something entirely different in scale.

Bitcoin's Cryptography and the Quantum Threat

To understand Bitcoin's vulnerability to quantum computers, we need to examine the cryptographic foundations that secure the network and keep users' funds safe.

The Dual Shield: ECDSA and SHA-256

Bitcoin employs two main cryptographic systems, each serving different security functions. The first is the Elliptic Curve Digital Signature Algorithm (ECDSA), specifically using the secp256k1 curve. ECDSA creates the relationship between a user's private key (which they must keep secret) and their public key (which they can safely share). When you spend Bitcoin, you use your private key to create a digital signature proving ownership. Anyone can verify this signature using your public key, but deriving the private key from the public key is considered computationally infeasible with classical computers.

The security of ECDSA relies on the elliptic curve discrete logarithm problem. Given a starting point on an elliptic curve and the result of multiplying that point by a secret number (the private key), finding that secret number is extraordinarily difficult. With 256 bits of security, there are approximately 2^256 possible private keys - a number so large that trying them all would take longer than the age of the universe, even for all the classical computers on Earth working together.

Bitcoin's second cryptographic layer is SHA-256, a cryptographic hash function used both in mining (where miners compete to find specific hash values) and in generating addresses (public keys are hashed to create shorter, more convenient addresses). Hash functions are one-way: it's easy to compute the hash of any input, but virtually impossible to reverse the process and find an input that produces a specific hash.

Shor's Algorithm: The Quantum Sword

Here's where quantum computers enter the picture. In 1994, Peter Shor demonstrated that a sufficiently powerful quantum computer running his algorithm could solve the discrete logarithm problem - and by extension, break elliptic curve cryptography - in polynomial time. Instead of needing exponential computational resources that would take eons, Shor's algorithm could potentially crack a 256-bit ECDSA key in hours or even minutes, given adequate quantum hardware.

The mechanism is elegant but complex. Shor's algorithm transforms the discrete logarithm problem into a period-finding problem, which quantum computers can solve efficiently using the quantum Fourier transform. By exploiting superposition and interference, the algorithm can simultaneously explore many potential solutions and extract the correct period, which then yields the private key.

This isn't theoretical handwaving - Shor's algorithm has been successfully implemented on small quantum computers to factor modest numbers. In 2019, researchers used a quantum computer to factor the number 35 (5 × 7). While this is trivially easy for classical computers, it demonstrated that the algorithm works in principle. The challenge lies in scaling up to cryptographically relevant sizes.

The Qubit Threshold Problem

How many qubits would actually be needed to break Bitcoin's ECDSA encryption? This question sits at the heart of timeline debates, and the answer is more nuanced than a single number suggests.

Research suggests that breaking a 256-bit elliptic curve key like Bitcoin's secp256k1 using Shor's algorithm would require approximately 2,000 to 3,000 logical qubits. One frequently cited estimate places the requirement at around 2,330 logical qubits, capable of performing roughly 126 billion quantum gates.

However, the crucial distinction lies between logical qubits and physical qubits. A logical qubit is an error-corrected computational unit - the stable, reliable qubit that Shor's algorithm requires. Each logical qubit must be constructed from many physical qubits working together to detect and correct errors. Current error correction schemes might require anywhere from hundreds to thousands of physical qubits to create a single logical qubit, depending on the error rates and the correction codes used.

When accounting for error correction overhead, estimates for breaking Bitcoin's ECDSA climb dramatically. Various studies suggest anywhere from 13 million to 317 million physical qubits might be necessary, depending on the desired attack timeframe and the quality of the quantum hardware. For context, Google's Willow chip has 105 physical qubits - meaning we would need systems roughly 100,000 to 3 million times larger than current cutting-edge hardware.

There's another critical factor: speed. Bitcoin addresses with funds in them only expose their public keys when transactions are broadcast to the network. In modern Bitcoin usage, those transactions typically get confirmed into a block within 10 to 60 minutes. An attacker using quantum computers to extract private keys from public keys would need to complete this computation within that narrow window - before the legitimate transaction gets confirmed and the funds are no longer accessible.

This time constraint dramatically increases the hardware requirements. To crack an ECDSA key within one hour rather than one day multiplies the qubit requirements further, potentially pushing the number well above 300 million physical qubits for any realistic attack scenario.

Which Wallets Are Most Vulnerable?

Not all Bitcoin addresses face equal quantum risk. The level of vulnerability depends primarily on one factor: whether the public key has been exposed.

The most vulnerable are Pay-to-Public-Key (P2PK) addresses, the original Bitcoin address format that Satoshi Nakamoto used extensively. These addresses contain the public key directly in the blockchain, visible to anyone. Approximately 1.9 million Bitcoin (about 9 percent of the total supply) sit in P2PK addresses, including an estimated 1 million Bitcoin attributed to Satoshi. These coins are immediately vulnerable to anyone with a quantum computer powerful enough to run Shor's algorithm.

Next are Pay-to-Public-Key-Hash (P2PKH) addresses where the public key has been revealed through spending transactions. Once you spend from a P2PKH address, the public key becomes visible on the blockchain. Best practice dictates using each address only once, but many users reuse addresses, leaving remaining funds vulnerable if quantum computers materialize. Industry analysis suggests as much as 25 percent of Bitcoin's circulating supply could be at risk due to exposed public keys - roughly 4 million Bitcoin worth tens of billions of dollars.

Modern address formats offer more protection. Segregated Witness (SegWit) and Taproot addresses provide better quantum resistance not through different cryptography, but through improved address reuse practices and, in Taproot's case, through alternative spending paths. However, even these addresses eventually expose public keys when funds are spent.

The safest Bitcoin addresses are those that have never been used - where the public key remains hidden behind a hash and no transaction has ever revealed it. For these addresses, a quantum attacker would need to break SHA-256, which is considerably more resistant to quantum attack than ECDSA.

SHA-256 and Grover's Algorithm

While Shor's algorithm threatens ECDSA, a different quantum algorithm called Grover's algorithm affects hash functions like SHA-256. Unlike Shor's exponential speedup, Grover's algorithm provides only a quadratic speedup for searching unstructured databases.

In practical terms, Grover's algorithm effectively halves the security level of SHA-256, reducing it from 256-bit security to 128-bit security. This sounds dramatic, but 128-bit security remains extraordinarily strong - far beyond what any classical or near-term quantum computer could break. Attacking SHA-256 even with Grover's algorithm would require astronomical computational resources, likely including billions of logical qubits.

The consensus among cryptographers is that SHA-256 is not the immediate concern. The real vulnerability lies in ECDSA and the exposed public keys that make quantum attacks feasible.

Mandell's Quantum Theft Allegation: Dissecting the Claim

Josh Mandell's October 2025 claim represented the latest - and perhaps most viral - entry in a long history of quantum FUD (fear, uncertainty, and doubt) targeting Bitcoin. Let's examine his specific allegations and the evidence against them.

The Allegation in Detail

According to multiple reports, Mandell alleged that:

- Old, inactive Bitcoin wallets were being quietly drained using quantum computing technology

- A major actor was accumulating Bitcoin off-market by accessing private keys of wallets whose owners were unlikely to notice or respond

- The targeted wallets were long-dormant accounts, often assumed abandoned or tied to deceased owners

- Coins were being extracted without creating market disruptions or large sell orders

- Only blockchain forensic analysis could reveal suspicious movement patterns

- Quantum technology had reached a point where it could crack Bitcoin's cryptographic defenses in ways classical computing cannot

Crucially, Mandell offered no hard evidence for these claims. His position was that the scenario was technically possible and might already be unfolding, but this remained unverified and speculative.

Why the Claim Resonated

Mandell's allegation gained traction because it tapped into several real concerns within the Bitcoin community. First, the timing coincided with legitimate advances in quantum computing. Google had just announced its Willow chip, and IBM was publicizing its roadmap to fault-tolerant quantum computing by 2029. The quantum threat suddenly felt more concrete and imminent than it had in previous years.

Second, Bitcoin's mystique around "lost coins" creates a narrative opening for such claims. Between 2.3 million and 3.7 million Bitcoin are estimated to be permanently lost due to forgotten private keys, deceased owners without proper estate planning, or wallets created in Bitcoin's early days and subsequently abandoned. That represents anywhere from 11 to 18 percent of Bitcoin's fixed 21 million supply - hundreds of billions of dollars in value, sitting dormant and potentially vulnerable.

The idea that someone with advanced quantum technology could recover these lost coins before their rightful owners (if they still exist) carries a certain plausibility to those unfamiliar with the technical requirements. It also plays into narratives about secretive state actors, well-funded corporations, or shadowy entities with access to classified technology far beyond what's publicly known.

The Technical Rebuttals

Experts quickly identified numerous problems with Mandell's claim. The most fundamental issue is hardware capability. As we've established, breaking Bitcoin's ECDSA encryption would require anywhere from 13 million to 300 million physical qubits, depending on various factors. Current systems have around 100 to 1,000 qubits - a gap of five to six orders of magnitude.

Google's Willow chip, impressive as it is, operates at 105 physical qubits. Even if we assume extraordinary progress in qubit quality and error correction, the jump to millions of qubits represents not an incremental advance but a transformational breakthrough that would revolutionize not just quantum computing but manufacturing, cooling systems, control electronics, and fundamental physics research. Such a breakthrough happening secretly, without any public indication, strains credibility.

There's also the error correction problem. Current quantum computers have error rates that make extended computations impossible without sophisticated error correction. Google's achievement with Willow was demonstrating "below threshold" error correction for the first time - showing that errors can decrease as you add more qubits. But the logical error rates achieved (around 0.14 percent per cycle) remain orders of magnitude above the 0.0001 percent or better believed necessary for running large-scale quantum algorithms like Shor's.

Industry experts note that transitioning from laboratory demonstrations of quantum error correction to fault-tolerant machines capable of running Shor's algorithm at cryptographically relevant scales remains a monumental engineering challenge, likely requiring at least another decade of intensive development.

The Blockchain Evidence (or Lack Thereof)

Perhaps most damning to Mandell's claim is the absence of supporting evidence on the blockchain itself. Bitcoin's transparency means all transactions are publicly visible and extensively monitored by blockchain analytics firms, academic researchers, and curious individuals with the technical skills to analyze movement patterns.

If quantum computers were systematically draining dormant wallets, we should see specific signatures:

- Sudden, simultaneous movements from multiple old P2PK addresses that had been inactive for years

- Funds moving in coordinated patterns suggesting a single actor with privileged access to multiple wallets

- A statistical anomaly in the rate of "reawakening" wallets that can't be explained by normal factors

What blockchain analysts actually observe is quite different. Old wallets do occasionally become active again, but these movements align with expected patterns: estate settlements after owners' deaths, long-term holders finally deciding to sell, users recovering old hardware wallets, or security-conscious users migrating funds to new address types.

Importantly, these reactivations typically involve wallets with known histories and plausible explanations. There's no wave of mysterious, coordinated movements from the oldest, most vulnerable addresses that would indicate quantum-powered theft.

Blockchain analytics firm Chainalysis and others have examined movement patterns from early Bitcoin addresses and found no evidence of anomalous activity that would suggest quantum attacks. The dormant coins remain dormant.

The Economic Logic Problem

There's also an economic argument against current quantum theft. If a state actor or well-funded organization had successfully developed quantum computers capable of breaking Bitcoin's cryptography, would they really deploy this capability in a manner that might be detected?

Such technology would be one of the most valuable secrets in the world, with applications far beyond cryptocurrency. It could break government communications, compromise military systems, undermine financial infrastructure, and render trillions of dollars worth of encrypted data vulnerable. Using it to steal Bitcoin - and risking detection that would alert the world to this capability - makes little strategic sense.

A rational actor with quantum capability would more likely wait, accumulate as much intelligence and economic advantage as possible under the radar, and only reveal the technology when absolutely necessary or when doing so advances a larger strategic objective. Stealing Bitcoin from dormant wallets, while potentially profitable, would risk exposing the quantum capability for relatively modest gains compared to the technology's full potential.

Economic and Ethical Dimensions: The Lost Bitcoin Problem

While Mandell's specific claim of current quantum theft lacks evidence, his allegation raises profound questions about Bitcoin's future in a post-quantum world. What happens if - or when - quantum computers become powerful enough to recover "lost" Bitcoin? The economic and ethical implications deserve serious consideration.

The Magnitude of Lost Bitcoin

Current estimates suggest between 2.3 million and 3.7 million Bitcoin are permanently lost. This includes:

- Coins in wallets where private keys were lost or never properly backed up

- Bitcoin sent to wallets of deceased individuals whose heirs lack access

- Coins in early P2PK addresses from Bitcoin's first years, when the cryptocurrency had little value and security practices were lax

- Bitcoin in addresses that have shown no activity for over a decade, suggesting abandonment

The most famous potentially lost Bitcoin belongs to Satoshi Nakamoto. The Bitcoin creator is estimated to have mined around 1 million Bitcoin in the network's first year, all stored in early P2PK addresses. Satoshi has never moved any of these coins, and the creator's identity remains unknown. Whether Satoshi still has access to these wallets, chose to permanently lock them away, or lost the keys entirely is one of Bitcoin's greatest mysteries.

Then there's the Mt. Gox hack. In 2014, the then-largest Bitcoin exchange collapsed after losing approximately 850,000 Bitcoin to theft. While some coins were recovered, a wallet associated with the hack still holds nearly 80,000 Bitcoin - about 0.4 percent of Bitcoin's total supply - sitting dormant on the blockchain.

These lost coins have become, in effect, deflationary forces. They reduce Bitcoin's practical circulating supply, making each remaining coin slightly more valuable. Many Bitcoiners view this as a feature rather than a bug - a natural consequence of a truly decentralized system where no authority can recover lost funds.

The Quantum Recovery Scenario

Now imagine quantum computers advance to the point where they can efficiently crack ECDSA encryption. Suddenly, those millions of lost Bitcoin become accessible - not to their original owners (who lack the private keys) but to whoever has the quantum capability to derive private keys from the exposed public keys.

This creates an unprecedented situation. Bitcoin that markets have essentially written off as permanently lost could flood back into circulation. The price impact would be severe. Even the possibility of such a recovery could trigger panic selling as investors try to front-run the hypothetical flood of supply.

In May 2025, BlackRock added explicit warnings about quantum computing to its iShares Bitcoin Trust (IBIT) filing, one of the most popular Bitcoin ETFs. The filing warned that advances in quantum computing could threaten Bitcoin's cryptographic security and undermine the integrity of the network itself. This represents a significant moment - traditional financial institutions now view quantum risk as material enough to disclose to investors.

The economic disruption wouldn't be limited to price volatility. Bitcoin's value proposition depends heavily on its perceived scarcity and security. If millions of previously inaccessible coins suddenly become accessible to quantum attackers, it raises questions about whether any Bitcoin is truly secure. Trust in the network could erode rapidly, potentially creating a cascade of selling pressure that goes beyond the immediate impact of the recovered coins themselves.

The Ethical Dilemmas

The quantum recovery scenario creates thorny ethical questions without clear answers. If quantum computers can access lost Bitcoin, what should happen to those coins?

One camp, led by prominent voices like Bitcoin developer Jameson Lopp, argues these coins should be burned - deliberately destroyed to prevent anyone from claiming them. Lopp contends that allowing quantum adversaries to claim funds that rightfully belong to other users represents a failure to protect property rights. In a February 2025 essay, Lopp wrote: "If the entire Bitcoin ecosystem just stands around and allows quantum adversaries to claim funds that rightfully belong to other users, is that really a 'win' in the 'protecting property rights' category? It feels more like apathy to me."

From this perspective, burning vulnerable coins is the lesser evil. It prevents ill-gotten gains, protects Bitcoin's scarcity, and demonstrates the network's commitment to security over short-term convenience. The counterargument is that burning coins represents a form of confiscation - punishing users whose only "crime" was adopting Bitcoin early, before quantum-resistant best practices existed.

Another camp suggests attempting to return recovered Bitcoin to their rightful owners. This sounds noble but creates enormous practical problems. How do you prove ownership of Bitcoin when the defining characteristic of being lost is that you no longer have the private keys? Estate settlements already face legal challenges when cryptocurrency is involved. Now imagine trying to adjudicate ownership claims for coins that haven't moved in a decade, where the original owner might be deceased, unknown, or impossible to verify.

Any recovery system would necessarily involve trusted third parties to verify claims - exchanges, government agencies, or newly created institutions. This runs counter to Bitcoin's ethos of trustlessness and censorship resistance. It would also create intense pressure for fraud, as bad actors impersonate rightful owners or manufacture false claims to valuable Bitcoin addresses.

A third option is to redistribute recovered coins. Some have proposed using recovered Bitcoin to fund network development, reward miners, or even distribute equally among all current Bitcoin holders. This transforms lost coins into a kind of communal asset. However, it amounts to changing Bitcoin's social contract after the fact - altering the rules for coins that were secured under a different set of assumptions.

Perhaps the starkest ethical question involves Satoshi's million Bitcoin. If these coins could be recovered via quantum computing, should they be? Satoshi's anonymity means we can't ask the creator's wishes. Many in the community consider these coins sacred - a permanent part of Bitcoin's mythology that should remain untouched regardless of technical capability. Others argue that leaving such a massive supply sitting vulnerable to quantum attack poses systemic risk to the network.

The Institutional Response

BlackRock's decision to add quantum warnings to its Bitcoin ETF filing signals that institutional finance is taking these questions seriously. The filing states explicitly that quantum computing advances could "threaten the security of the network" and potentially lead to "significant losses" for investors.

This reflects a broader pattern of institutional adoption bringing increased scrutiny of risks that the crypto community might have previously dismissed or downplayed. Pension funds, endowments, and financial advisors considering Bitcoin exposure want clarity on tail risks, including quantum computing. The fact that quantum risk now appears in regulated financial products' disclosure documents transforms it from a theoretical concern to a quantifiable investment consideration.

Other major institutions are watching. If quantum capabilities advance faster than expected, we could see institutional capital flee cryptocurrency markets unless clear mitigation strategies exist. This creates pressure on Bitcoin developers and the broader community to implement quantum-resistant solutions before the threat materializes, rather than waiting for a crisis.

Security Roadmap: How Bitcoin Can Evolve

The encouraging news is that Bitcoin's quantum vulnerability is neither surprising nor unaddressed. Cryptographers have known about Shor's algorithm since 1994, and the Bitcoin development community has been discussing quantum resistance for years. Multiple research directions and practical strategies exist for hardening Bitcoin against quantum attack.

Current Best Practices for Users

Even before any protocol-level changes, individual Bitcoin users can take steps to minimize their quantum exposure. The most important practice is avoiding address reuse. When you spend from a Bitcoin address, the public key becomes visible on the blockchain. Best practice is to treat each address as single-use - after spending from it, move any remaining funds to a new address, ensuring the old public key is no longer associated with unspent coins.

Modern wallet software has increasingly adopted this practice automatically. Hardware wallets and full-node wallets typically generate new change addresses for each transaction, implementing single-use addresses without requiring users to understand the underlying security logic. Users with older wallet software or those who manually manage addresses should audit their practices and upgrade to quantum-safer habits.

Another protective step is migrating funds to more modern address formats. Segregated Witness (SegWit) and especially Taproot addresses provide marginally better quantum resistance through improved address hygiene and, in Taproot's case, alternative script paths that might enable quantum-resistant signatures in future soft forks. While these formats use the same underlying elliptic curve cryptography, they reflect more quantum-conscious design philosophy.

For long-term holders, the advice is simple: use new addresses for each receive transaction, never reuse addresses after spending, and keep funds in addresses whose public keys have never been exposed. This doesn't eliminate quantum risk entirely but significantly reduces the attack surface.

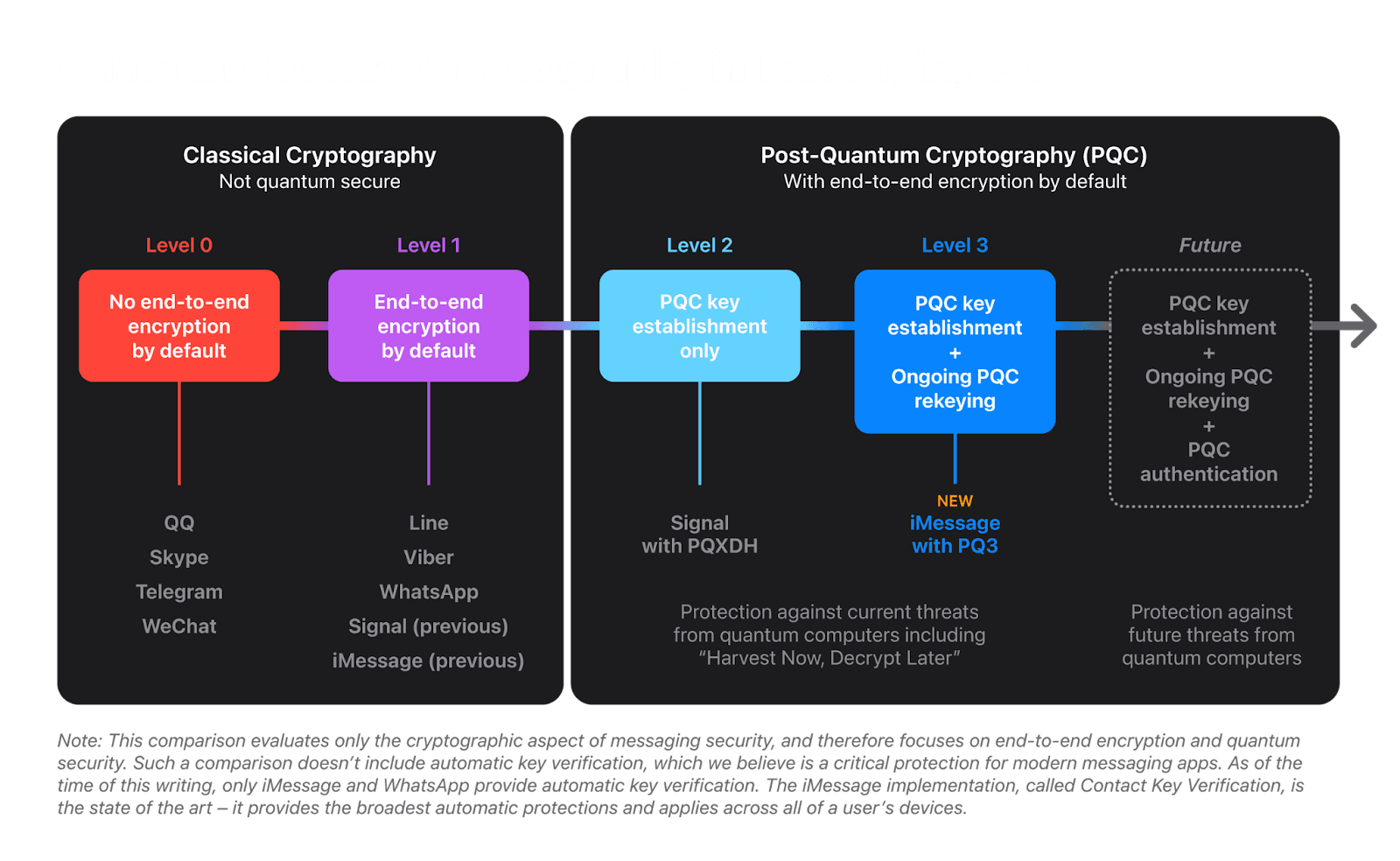

Post-Quantum Cryptography Standards

The broader cryptographic community has been working toward quantum-resistant alternatives for over a decade. In 2016, the U.S. National Institute of Standards and Technology (NIST) launched a project to standardize post-quantum cryptography (PQC) - cryptographic algorithms believed to be secure against both classical and quantum computers.

After years of analysis and competition, NIST announced its first set of PQC standards in 2024. The selected algorithms include:

- CRYSTALS-Kyber for key encapsulation (replacing systems like RSA for securely exchanging keys)

- CRYSTALS-Dilithium, FALCON, and SPHINCS+ for digital signatures (replacing systems like ECDSA and RSA signatures)

These algorithms rely on different mathematical problems than current cryptography. Lattice-based schemes like Dilithium are based on the difficulty of finding short vectors in high-dimensional lattices. Hash-based schemes like SPHINCS+ are built on the security of cryptographic hash functions, which are already believed to be relatively quantum-resistant. Multivariate cryptography uses systems of quadratic equations over finite fields.

The crucial insight is that while Shor's algorithm efficiently solves discrete logarithm and factoring problems, it doesn't provide similar advantages against these new mathematical structures. As far as current knowledge extends, quantum computers offer no practical shortcut to breaking properly implemented lattice-based or hash-based cryptography.

Bitcoin-Specific Research: QRAMP

In early 2025, Bitcoin developer Agustin Cruz proposed a radical framework called QRAMP (Quantum-Resistant Asset Mapping Protocol). QRAMP represents one of the most comprehensive approaches to Bitcoin's quantum problem, though it remains controversial and far from consensus.

QRAMP proposes a mandatory migration period where all funds in legacy quantum-vulnerable addresses must be moved to quantum-resistant addresses by a specific block height deadline. After that deadline, transactions from old ECDSA addresses would be rejected by the network, effectively burning any coins that weren't migrated.

The protocol would work through several mechanisms:

- Identifying vulnerable addresses: QRAMP would scan for Bitcoin addresses with exposed public keys, particularly older P2PK formats

- Burn and replace: Users send coins from vulnerable addresses to a special "quantum burn" address, permanently removing them from circulation

- Post-quantum security: In return, equivalent amounts of Bitcoin secured by quantum-resistant cryptography (like hash-based or lattice-based signatures) would be issued

- Proof-based verification: Only verified burns result in new quantum-resistant coins, maintaining a strict 1:1 ratio to prevent inflation

QRAMP also aims to enable cross-chain Bitcoin functionality. Rather than relying on custodians (like wrapped Bitcoin solutions), QRAMP would use cryptographic attestations - mathematical proofs derived from Bitcoin's blockchain that other networks can verify. This would allow Bitcoin balances to be reflected on other blockchains without actually moving the underlying Bitcoin, maintaining both security and Bitcoin's 21 million supply cap.

The proposal has sparked intense debate. Proponents argue it provides a clear, systematic path to quantum resistance with unambiguous deadlines that force timely migration rather than dangerous complacency. Critics contend that mandatory burns represent a form of confiscation, punishing early adopters and potentially destroying millions of Bitcoin including Satoshi's coins.

The timeline concerns are also significant. QRAMP would require a hard fork - a non-backward-compatible protocol change requiring consensus from miners, node operators, and the broader community. Bitcoin's history shows that controversial hard forks are difficult to achieve and risk chain splits. Implementing QRAMP would require convincing the ecosystem that quantum threats are imminent enough to justify such drastic action while also being early enough that users have time to migrate.

As of October 2025, QRAMP remains a draft proposal without a formal BIP (Bitcoin Improvement Proposal) number and lacking community consensus to move forward.

Alternative Approaches

Not all quantum-resistant proposals are as radical as QRAMP. Other researchers are exploring gradual migration strategies that would introduce quantum-resistant signature schemes alongside existing ECDSA, allowing users to voluntarily upgrade over time.

Adam Back, CEO of Blockstream and a respected cryptographer, has suggested incorporating quantum-resistant cryptography into Bitcoin's existing address and script system. One approach would use Schnorr signatures (already implemented in Taproot) combined with SLH-DSA (SPHINCS+) tapleafs. This would allow users to gradually move funds to quantum-safe addresses without requiring a contentious hard fork or burning vulnerable coins.

The advantage of gradual migration is flexibility. Users who are confident in their address security could continue using existing wallets while more cautious users migrate to quantum-resistant formats. As quantum capabilities advance, social pressure and market forces would naturally encourage migration without requiring protocol enforcement.

The disadvantage is that voluntary migration might happen too slowly. If quantum computers advance faster than expected, vulnerable coins could be attacked before users migrate, defeating the purpose. There's also the problem of lost or abandoned wallets - coins whose owners no longer have access would remain perpetually vulnerable.

Other research directions include:

- Quantum-safe multi-signature schemes that combine multiple post-quantum algorithms, providing redundant security even if one algorithm is broken

- Hybrid systems that use both classical ECDSA and quantum-resistant signatures, requiring attackers to break both

- Zero-knowledge proofs that could enable quantum-resistant verification without exposing public keys

The Ethereum community has been researching post-quantum cryptography through account abstraction and STARKs (Scalable Transparent Arguments of Knowledge), which use hash functions and are inherently quantum-resistant. Some of these innovations might eventually inform Bitcoin's approach.

The Challenge of Quantum-Resistant Signatures

One challenge with post-quantum cryptography is that signatures are typically much larger than ECDSA signatures. A CRYSTALS-Dilithium signature can be 2-3 kilobytes, compared to 64-71 bytes for an ECDSA signature. This has implications for blockchain efficiency, transaction costs, and scalability.

Hash-based signatures like SPHINCS+ are even larger - potentially tens of kilobytes per signature. While these sizes aren't prohibitive, they represent a meaningful increase in data that must be stored and transmitted by every node on the network. In a blockchain where efficiency and scalability are already concerns, adding larger signatures could exacerbate existing challenges.

Various optimizations are being researched to minimize signature sizes while maintaining security. Some schemes use Merkle trees to amortize signature size across multiple transactions. Others explore threshold signatures where multiple parties collaboratively sign, reducing the per-transaction overhead.

The Bitcoin community will need to balance security, efficiency, and backward compatibility when ultimately selecting which post-quantum algorithms to implement.

Beyond Threats: Quantum Opportunities for Crypto

Discussions about quantum computing and cryptocurrency overwhelmingly focus on threats - the looming danger of quantum computers breaking cryptography. But this framing misses a crucial aspect of the story. Quantum computing isn't merely a weapon pointed at blockchain technology; it's also a tool that could enhance, strengthen, and advance the entire cryptocurrency ecosystem in unexpected ways.

Quantum-Enhanced Cryptography

The arms race between quantum attackers and quantum defenders will eventually produce cryptography that is stronger than anything possible with classical computation. Quantum key distribution (QKD) already enables provably secure communication channels, protected by the laws of physics rather than computational assumptions. While implementing QKD in decentralized blockchain systems faces significant technical challenges, research continues into adapting quantum communication protocols for cryptocurrency applications.

Post-quantum cryptography developed in response to quantum threats will create the foundation for a new generation of cryptographic systems. These algorithms aren't just quantum-resistant; many offer additional security properties like forward secrecy, smaller keys for equivalent security levels, and resistance to side-channel attacks that plague some current implementations.

Lattice-based cryptography, in particular, enables powerful new capabilities like fully homomorphic encryption - the ability to perform arbitrary computations on encrypted data without decrypting it. While computationally expensive today, quantum computers might eventually make homomorphic encryption practical at scale, enabling privacy-preserving smart contracts and confidential transactions without sacrificing auditability.

Improved Scalability Solutions

Quantum computers excel at certain optimization problems that currently limit blockchain scalability. Route finding in payment channel networks like Bitcoin's Lightning Network involves searching through a vast space of possible paths to find optimal routes for payments. Quantum algorithms could potentially find better routes faster, improving payment success rates and reducing channel capital requirements.

Zero-knowledge proof systems, which enable privacy and scalability solutions like ZK-Rollups, require extensive cryptographic computations. Quantum computers might accelerate proof generation while maintaining security, enabling more sophisticated privacy-preserving applications without the computational overhead that currently limits their adoption.

Even mining could eventually benefit from quantum computation. While quantum computers using Grover's algorithm could theoretically search for proof-of-work solutions more efficiently than classical miners, the same technology would be available to all participants, creating a new equilibrium rather than an attack vector. Some researchers have proposed quantum-secured consensus mechanisms that leverage quantum properties for Byzantine fault tolerance.

Quantum-Secured Smart Contracts

The combination of quantum computing and cryptocurrency could enable entirely new classes of smart contracts and decentralized applications. Quantum random number generation provides truly unpredictable randomness - crucial for gambling applications, cryptographic protocols, and fair leader election in consensus mechanisms. Current blockchain-based randomness must rely on complicated protocols to prevent manipulation; quantum randomness would be provably fair.

Quantum sensing and quantum communication could enable new types of oracle systems - the bridges between smart contracts and real-world data. Quantum sensors can measure physical phenomena with unprecedented precision, potentially creating more reliable data feeds for decentralized finance applications that depend on accurate price feeds, weather data, or supply chain verification.

Post-quantum cryptographic protocols could enable more sophisticated multi-party computation, allowing multiple parties to jointly compute functions over their private data without revealing that data to each other. This opens possibilities for decentralized financial products, privacy-preserving auctions, and confidential voting systems that are currently impractical.

Academic and Industry Collaboration

The quantum threat has catalyzed unprecedented collaboration between the cryptocurrency community and mainstream computer science research. NIST's post-quantum cryptography standardization effort included input from blockchain researchers and cryptocurrency companies. Academic conferences increasingly feature sessions on quantum-safe blockchain design.

This collaboration benefits both sides. Cryptocurrency's real-world deployment provides testing grounds for post-quantum algorithms under adversarial conditions with actual economic value at stake. Meanwhile, blockchain systems benefit from cutting-edge cryptographic research that might otherwise take years to filter into production systems.

Major technology companies including Google, IBM, Microsoft, and Amazon are investing billions in quantum computing research while simultaneously developing quantum-safe cryptography and consulting with blockchain projects. This creates a rare alignment of interests where the same companies advancing quantum capabilities also contribute to defending against quantum threats.

Reframing the Narrative

Perhaps most importantly, viewing quantum computing purely as a threat misses the opportunity to reshape cryptocurrency's security model for the better. Every cryptographic transition - from DES to AES, from SHA-1 to SHA-256, from RSA to elliptic curves - has ultimately strengthened systems by forcing migrations to better algorithms.

Bitcoin's eventual adoption of post-quantum cryptography will create an opportunity to address other protocol limitations simultaneously. A coordinated upgrade could implement not just quantum resistance but also signature aggregation, better privacy features, improved scripting capabilities, and efficiency improvements that have been long desired but difficult to deploy through isolated soft forks.

The quantum transition might also resolve ongoing debates about Bitcoin's rigid conservatism versus pragmatic evolution. When quantum computers demonstrably threaten ECDSA, even the most conservative community members will recognize the need for substantial protocol changes. This creates political cover for upgrades that might be desirable for other reasons but lack consensus under normal circumstances.

Expert Forecasts and Diverging Views

The quantum computing timeline remains one of the most contentious aspects of the Bitcoin security debate, with expert opinions ranging from "decades away" to "possibly within 10 years." Understanding these divergent perspectives provides crucial context for evaluating how urgently Bitcoin needs quantum-resistant upgrades.

The Optimists: Decades of Safety

Adam Back, CEO of Blockstream and a highly respected cryptographer, represents the conservative view on quantum timelines. Back has consistently argued that quantum computers capable of threatening Bitcoin remain decades away, not years. In a June 2025 interview, Back acknowledged that quantum computing could eventually become relevant but emphasized that the timeline spans "decades, not years" and that proactive but gradual measures provide adequate protection.

Back's perspective is informed by deep understanding of both the theoretical requirements and practical engineering challenges. He notes that quantum computers must not only achieve the raw qubit count necessary for Shor's algorithm but also maintain error rates low enough for fault-tolerant computation throughout the extended calculation period. Current systems are orders of magnitude away from meeting these requirements simultaneously.

Michael Saylor, executive chairman of Strategy (formerly MicroStrategy) and one of Bitcoin's most prominent institutional advocates, has been even more dismissive of near-term quantum threats. In multiple interviews throughout 2025, Saylor characterized quantum concerns as "mainly marketing from people that want to sell you the next quantum yo-yo token."

Saylor's argument rests on institutional alignment. He points out that major tech companies like Google and Microsoft have more to lose than gain from quantum computers that can break encryption. These companies rely on the same cryptographic systems that secure Bitcoin. If quantum computers threaten ECDSA and RSA, they threaten cloud services, email, e-commerce, and every other encrypted communication on the internet.

"Google and Microsoft aren't going to sell you a computer that cracks modern cryptography because it would destroy Google and Microsoft - and the U.S. government and the banking system," Saylor said in a June 2025 CNBC interview. His view is that when quantum threats do materialize, Bitcoin will upgrade its cryptography just like every other major software system, without catastrophic disruption.

Saylor also argues that quantum-resistant tokens being marketed as "Bitcoin killers" are mostly opportunistic projects capitalizing on fear rather than offering genuine solutions. From his perspective, quantum threats to Bitcoin are not immediate, and when they do arrive, Bitcoin's robust development community and strong incentives for maintaining security will enable effective responses.

The Pragmatists: Start Preparing Now

Not all experts share this sanguine view. Jameson Lopp, chief technology officer at Casa and a prominent Bitcoin security researcher, occupies a middle position. In his February 2025 essay "Against Allowing Quantum Recovery of Bitcoin," Lopp argues that while quantum computers aren't an immediate crisis, the Bitcoin community has less than a decade to implement contingency plans.

Lopp's concern focuses less on the precise quantum timeline and more on Bitcoin's slow governance and the difficulty of achieving consensus on controversial changes. Even if quantum computers capable of breaking ECDSA don't arrive until 2035, Bitcoin needs to start implementing changes now because:

- Reaching consensus on quantum-resistant schemes requires years of debate and testing

- Users need time to migrate funds to new address types

- Lost or abandoned wallets represent a systemic risk if left vulnerable

- Waiting until quantum computers are demonstrably threatening ECDSA might be too late

Lopp advocates for burning coins in vulnerable addresses rather than attempting recovery - a position that has generated significant controversy. He argues this approach best protects property rights by preventing quantum adversaries from claiming funds while also addressing the lost coin problem decisively.

BlackRock's May 2025 IBIT filing warning represents another pragmatic voice. By including quantum computing as a material risk factor in a regulated financial product, BlackRock signals that institutional investors should consider quantum threats as part of their risk assessment, even if the timeline remains uncertain. This reflects a precautionary principle: the potential consequences are severe enough that waiting for certainty might be imprudent.

The Concerned: Sooner Than We Think

Some researchers and organizations believe quantum threats could materialize faster than the consensus estimates suggest. NIST experts have stated that quantum computers capable of breaking current cryptographic standards could arrive within 10 to 20 years, with some private forecasts suggesting it could happen even sooner.

In 2025, researchers from Project Eleven launched a quantum challenge offering one Bitcoin to anyone who can break elliptic curve cryptography using a quantum computer. Their assessment is that around 2,000 logical (error-corrected) qubits may be enough to break a 256-bit ECC key - something they believe is achievable within the next decade.

Google researcher Craig Gidney published work in May 2025 suggesting that RSA-2048 could be factored with fewer than 1 million qubits in under a week - a 20-fold decrease from previous estimates. While RSA and ECC aren't identical, the algorithmic improvements demonstrated for one problem often apply to the other. If quantum algorithms continue improving while hardware scales up, the timeline could compress significantly.

IBM's concrete roadmap to fault-tolerant quantum computing by 2029 with 200 logical qubits represents another data point suggesting quantum threats might materialize in the early 2030s rather than the 2040s or 2050s. IBM Quantum Starling, scheduled for 2029, won't have enough logical qubits to threaten Bitcoin immediately. But if IBM successfully demonstrates fault-tolerant quantum computing at that scale, scaling to the 2,000+ logical qubits needed for cryptanalysis might happen relatively quickly - perhaps within another 5-10 years.

At CES 2025, Nvidia CEO Jensen Huang stated that a major breakthrough in quantum computing is likely 15 to 30 years away, with 20 years being the most realistic estimate. This puts quantum threats to cryptography somewhere between 2040 and 2055 - a timeframe that seems comfortable but could arrive faster if Huang's estimate proves conservative.

Interpreting the Divergence

Why do expert opinions diverge so widely? Several factors contribute to the uncertainty:

Defining the Threat Threshold: Different experts use different metrics for when quantum computers become "threatening." Some focus on demonstrating Shor's algorithm on any cryptographically relevant problem. Others require quantum computers that can break Bitcoin's specific ECDSA implementation within the narrow time window of unconfirmed transactions. These represent vastly different capability levels.

Secret vs. Public Development: Public quantum computing efforts through companies like IBM, Google, and academic institutions are transparent, allowing detailed assessment. But classified government programs at agencies like NSA, GCHQ, or their Chinese and Russian equivalents operate in secret. Some experts suspect classified programs might be years ahead of publicly known capabilities, though evidence for this remains speculative.

Algorithmic Unknowns: Current estimates assume Shor's algorithm and existing error correction schemes. A breakthrough in quantum algorithms that further reduces qubit requirements could dramatically accelerate timelines. Conversely, fundamental barriers to scaling quantum computers might emerge that push timelines back.

Engineering vs. Theory: Computer science theory and practical engineering often diverge. Theoretically, we understand how to build quantum computers with millions of qubits. Engineering systems that actually work at that scale - maintaining coherence, implementing error correction, and integrating with classical control systems - presents challenges that might prove much harder or easier than current extrapolations suggest.

The prudent interpretation is that quantum threats to Bitcoin are not immediate but also not safely distant. A realistic timeline suggests the late 2020s to mid-2030s as the period when quantum computers might begin posing credible threats to elliptic curve cryptography, with significant uncertainty in both directions.

The Road Ahead: Preparing for a Post-Quantum Bitcoin

As quantum computing advances and timelines compress, the cryptocurrency community faces crucial decisions about when and how to implement quantum-resistant upgrades. The path forward requires technical preparation, community consensus, and vigilant monitoring of both quantum computing progress and on-chain activity.

Signals to Watch For

Several indicators would signal that quantum threats are transitioning from theoretical to practical:

Large Movements from Vulnerable Addresses: The clearest warning sign would be sudden, coordinated movements from multiple old P2PK addresses, particularly those dormant for many years. While individual reactivations have innocent explanations, a pattern of simultaneous movements from addresses with no prior relationship would suggest a quantum attacker systematically targeting vulnerable coins.

Real-Time Key Extraction: If funds move from an address immediately after its public key is revealed during transaction broadcasting - faster than blockchain confirmation times - this would indicate an attacker can extract private keys in real-time. This represents the nightmare scenario for Bitcoin security and would demand immediate emergency protocol changes.

Quantum Computing Milestones: Announcements of quantum computers achieving certain capability thresholds should trigger heightened concern:

- Quantum computers demonstrating 1,000+ logical qubits with low error rates

- Successful implementation of Shor's algorithm on problems approaching cryptographic scales

- Demonstrations of quantum systems maintaining coherence through calculations requiring billions of gates

Academic Breakthroughs: Papers demonstrating significant reductions in the qubit requirements for breaking ECDSA, improvements in quantum error correction, or novel algorithms that accelerate cryptanalysis would all warrant attention. The quantum computing literature should be monitored for results that compress timelines.

Technical Preparations

The Bitcoin development community should continue several preparatory efforts even before quantum threats become immediate:

Standardization and Testing: Selecting which post-quantum algorithms Bitcoin should adopt requires extensive analysis, testing, and community review. NIST's standardized algorithms provide a starting point, but Bitcoin's specific requirements - decentralization, open-source auditability, signature size constraints, and computational efficiency for node operators - might favor different choices than traditional cryptographic applications.

Wallet Infrastructure: Wallet software needs to implement support for quantum-resistant signature schemes before they're required at the protocol level. This allows early adopters to begin using quantum-safe addresses voluntarily, creating a template for eventual mandatory migration. Hardware wallet manufacturers must update firmware to support new algorithms.

Transaction Format Design: Quantum-resistant transactions will likely require different data structures than current Bitcoin transactions. Designing these formats with consideration for efficiency, privacy, and potential future upgrades will prevent technical debt. Script opcodes for post-quantum signature verification must be carefully designed.

Testing on Testnets: Before deploying any quantum-resistant changes to Bitcoin's mainnet, extensive testing on testnets and signet networks will verify that implementations work correctly, nodes can efficiently validate the new transaction types, and no unexpected interactions with existing protocol rules create vulnerabilities.

Building Community Consensus

Perhaps the most challenging aspect of Bitcoin's quantum transition will be achieving consensus on controversial questions:

Hard Fork vs. Soft Fork: Some quantum-resistant changes might be implementable through soft forks (backward-compatible upgrades), while others might require hard forks (non-backward-compatible changes). The Bitcoin community has historically preferred soft forks to maintain network cohesion, but quantum resistance might necessitate more disruptive changes.

Mandatory vs. Voluntary Migration: Should Bitcoin enforce deadlines for migrating to quantum-resistant addresses (like QRAMP proposes), or should migration be voluntary and gradual? Mandatory migration provides clear security but risks burning lost coins and faces political opposition. Voluntary migration is gentler but might leave the network vulnerable if adoption is too slow.

What to Do About Lost Coins: The debate over whether to burn, recover, or redistribute coins in quantum-vulnerable addresses lacks consensus. This question touches on fundamental issues of property rights, Bitcoin's philosophy, and practical risk management. Resolving it will require extensive community discussion and likely compromise.

Timeline for Action: When should Bitcoin implement quantum-resistant upgrades? Acting too early risks adopting immature algorithms or wasting developer resources on premature solutions. Acting too late risks catastrophic attacks. Finding the optimal timing requires continuous risk assessment and flexibility to accelerate plans if quantum computing advances faster than expected.

Broader Industry Implications

Bitcoin's quantum challenges extend to the entire cryptocurrency ecosystem. Ethereum, with its more flexible governance and active research into account abstraction and STARKs, might implement quantum resistance earlier than Bitcoin. This could create interesting dynamics where Ethereum markets itself as quantum-safe while Bitcoin faces lingering vulnerabilities.

Stablecoins, which often depend on multi-signature setups and smart contracts, face quantum vulnerabilities in their underlying blockchains. Tether and USDC issuers must consider quantum risks to the networks they operate on, potentially driving demand for quantum-resistant blockchain infrastructure.

Central bank digital currencies (CBDCs) being developed by governments worldwide are incorporating post-quantum cryptography from the start, learning from the challenges facing existing cryptocurrencies. This gives CBDCs a potential security advantage over legacy blockchain systems, which governments might leverage in arguments for CBDC adoption over decentralized cryptocurrencies.

Privacy coins like Monero and Zcash face unique quantum challenges. Monero's ring signatures and stealth addresses could be compromised by quantum computers, while Zcash's zkSNARKs might need replacement with STARKs or other quantum-resistant zero-knowledge proof systems. The privacy-preserving cryptocurrency sector must evolve alongside quantum threats.

The Role of Education

One often-overlooked aspect of quantum preparation is education. The Bitcoin community, cryptocurrency users, and the general public need better understanding of quantum computing - what it is, what it isn't, what threats are real, and what timeline is realistic.

Misinformation and FUD, exemplified by claims like Mandell's, spread because many cryptocurrency users lack the technical background to evaluate quantum claims critically. Education efforts could include:

- Clear, accessible explainers about quantum computing basics

- Regular updates on quantum computing progress from credible sources

- Guidance for users on quantum-safe practices they can adopt now

- Transparent communication from Bitcoin developers about plans and timelines

A well-informed community will make better decisions about quantum resistance, resisting both unfounded panic and dangerous complacency.

Final thoughts

The relationship between quantum computing and Bitcoin is more nuanced than either alarmists or dismissive voices suggest. Quantum computers will not "kill Bitcoin overnight," as some headlines breathlessly claim. But neither is quantum computing harmless background noise that Bitcoin can safely ignore.

Josh Mandell's October 2025 allegation that quantum computers are already stealing Bitcoin was false - lacking evidence, implausible given current hardware capabilities, and contradicted by blockchain data. Yet the claim's viral spread reveals real anxiety about quantum threats that the crypto community must address with facts, preparation, and reasoned action.

The technical reality is that breaking Bitcoin's ECDSA encryption requires quantum computers far more powerful than anything that currently exists. We would need systems with millions of physical qubits, fault-tolerant error correction, and the ability to execute billions of quantum gates - capabilities that remain at least a decade away by most expert estimates, possibly longer.

But quantum computing is advancing. Google's Willow chip demonstrated below-threshold error correction. IBM's roadmap to 200 logical qubits by 2029 is concrete and funded. Academic research continues improving quantum algorithms and reducing qubit requirements. The window between "quantum computers can't threaten Bitcoin" and "quantum computers are actively attacking Bitcoin" might be surprisingly narrow.

Bitcoin's vulnerability is real but manageable. The cryptocurrency community has known about Shor's algorithm since 1994. Research into post-quantum cryptography has produced viable alternatives like lattice-based and hash-based signatures that could replace ECDSA. Projects like QRAMP propose systematic migration paths, though they remain controversial.

The economic and ethical dimensions add complexity beyond pure technical concerns. Millions of Bitcoin sit in potentially quantum-vulnerable addresses, including Satoshi's legendary million-coin stash. What happens if these coins become accessible poses questions without easy answers - questions about property rights, network security, market stability, and Bitcoin's fundamental values.

Yet there's room for optimism. The same quantum revolution that threatens current cryptography will also enable stronger security, more sophisticated protocols, and capabilities impossible with classical computation. Post-quantum cryptography represents not just defense against quantum attacks but an evolution toward more robust security overall.

The crypto industry has a window to prepare, adapt, and even benefit from the quantum transition - but only if it acts with appropriate urgency. The real challenge is not quantum versus Bitcoin, but whether the cryptocurrency ecosystem can evolve faster than the technology designed to crack it.

This requires several things: continued monitoring of quantum computing progress; ongoing research into quantum-resistant protocols; education to combat misinformation; community consensus-building on difficult questions about migration timelines and lost coins; and the wisdom to distinguish between genuine threats requiring action and hype serving other agendas.

Bitcoin has weathered many crises since Satoshi mined the genesis block in 2009. It survived exchange hacks, regulatory crackdowns, scaling wars, and countless pronouncements of its imminent demise. The quantum challenge differs in that it represents a fundamental threat to Bitcoin's cryptographic foundations - not an external attack or governance dispute, but a transformation in what's computationally possible.

Yet Bitcoin's history also demonstrates remarkable adaptability. The network has implemented significant upgrades like SegWit and Taproot despite Bitcoin's conservative culture. When threats are clear and solutions are ready, the community has consistently risen to the challenge. There's no reason to believe the quantum transition will be different, provided preparation begins before a crisis forces desperate measures.

The quantum era will arrive - not today, not tomorrow, but sooner than many assume. When it does, Bitcoin will need to evolve. The cryptocurrency that emerges will be more secure, more sophisticated, and better tested than the Bitcoin of today. The quantum threat, managed properly, becomes an opportunity to strengthen Bitcoin's foundations for another decade of growth and adoption.

The choice facing the Bitcoin community is not whether to prepare for quantum computing, but how urgently and comprehensively to act. Somewhere between the panic of those seeing immediate threats in every quantum announcement and the complacency of those dismissing quantum risks as decades away lies the path forward - informed by evidence, guided by expertise, and driven by Bitcoin's ultimate imperative: securing the hardest money humanity has ever created, regardless of what computational paradigms the future brings.