Ripple announced Monday it will sunset its current quarterly XRP markets report format after Q2 2025, planning to expand future versions with deeper insights as institutional demand for the cryptocurrency grows. The company cited concerns that its transparency efforts have been "used against the company, most notably by former SEC leadership," according to its Q1 2025 report.

What to Know:

- XRP outperformed major cryptocurrencies with a 50% surge in early February while Bitcoin remained range-bound

- XRP-based investment products recorded $37.7 million in net inflows, with year-to-date total reaching $214 million

- Ripple plans to enhance its quarterly reports with more institutional perspectives as XRP adoption increases

The announcement comes amid increased institutional engagement with XRP, evidenced by a flurry of XRP-based ETF filings in the United States and Brazil. A leveraged XRP ETF has already been available to investors since April, reflecting growing mainstream interest in the digital asset.

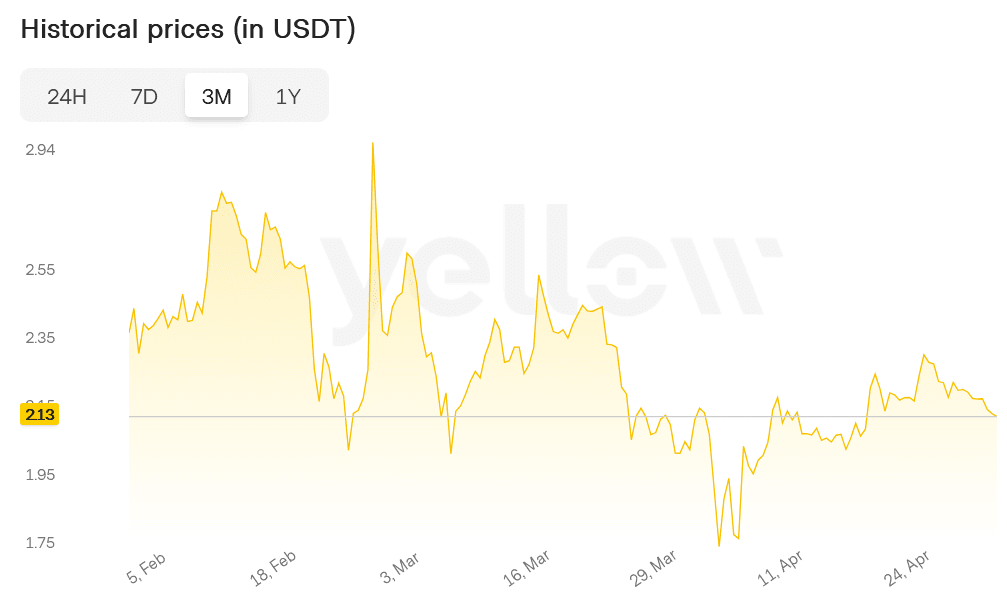

XRP delivered one of the strongest performances among major cryptocurrencies in the first quarter of 2025, surging nearly 50% in early February.

This remarkable growth outpaced both Bitcoin and Ether during a period characterized by market turbulence and rising macroeconomic uncertainty. While Bitcoin remained range-bound and Ether trended lower, XRP demonstrated notable relative strength.

The XRP/BTC ratio rose more than 10% during the quarter, according to the report. This strength coincided with growing institutional appetite for XRP exposure through regulated investment products. XRP-based investment vehicles recorded $37.7 million in net inflows during the quarter, pushing the year-to-date total to $214 million – just $1 million short of surpassing Ethereum-focused funds.

"As more institutions engage with XRP, additional perspectives and insights are expected to follow, pushing the market conversation forward," Ripple stated in its report. This institutional momentum represents a significant shift for a cryptocurrency that has faced regulatory challenges in recent years.

Trading Activity and On-Chain Metrics Show Mixed Results

XRP spot market activity remained robust throughout the quarter with average daily volumes hovering around $3.2 billion. Binance maintained a dominant market share at 40%, followed by exchanges Upbit and Coinbase. Price volatility spiked significantly in February, pushing realized volatility to approximately 130% as XRP touched price levels not seen since early 2018.

The quarterly XRP Markets Report, which provides transparency into Ripple's XRP holdings and updates on the state of cryptocurrency markets, has been a fixture of the XRP ecosystem. "However, the reality is that the report has not had the intended effect," Ripple acknowledged in Monday's release.

On-chain activity on the XRP Ledger moderated after a period of expansion in late 2024. Wallet creation and transaction volume dropped by 30-40%, aligning with broader slowdowns observed across Layer 1 blockchain networks.

The cooling of on-chain metrics follows a common pattern in cryptocurrency markets, where network usage often correlates with price action.

Despite the general slowdown in on-chain activity, XRP's decentralized finance (DeFi) ecosystem showed resilience. Decentralized exchange volume decreased by only 16% quarter-over-quarter, a relatively modest decline compared to other metrics. RLUSD emerged as a key driver of DeFi activity within the XRP ecosystem, with its market capitalization surpassing $90 million and cumulative DEX trading volume crossing the $300 million threshold.

The contrast between moderating on-chain activity and resilient DeFi usage suggests evolving utilization patterns within the XRP ecosystem. As institutional adoption increases, the nature of XRP usage appears to be shifting from retail-dominated speculation toward more sophisticated financial applications.

Closing Thoughts

As Ripple prepares to transform its quarterly reporting approach, XRP continues to demonstrate significant institutional appeal and market resilience. The cryptocurrency's strong performance amid market volatility, coupled with growing investment inflows and evolving ecosystem metrics, points to a maturing asset class increasingly integrated into mainstream financial infrastructure.