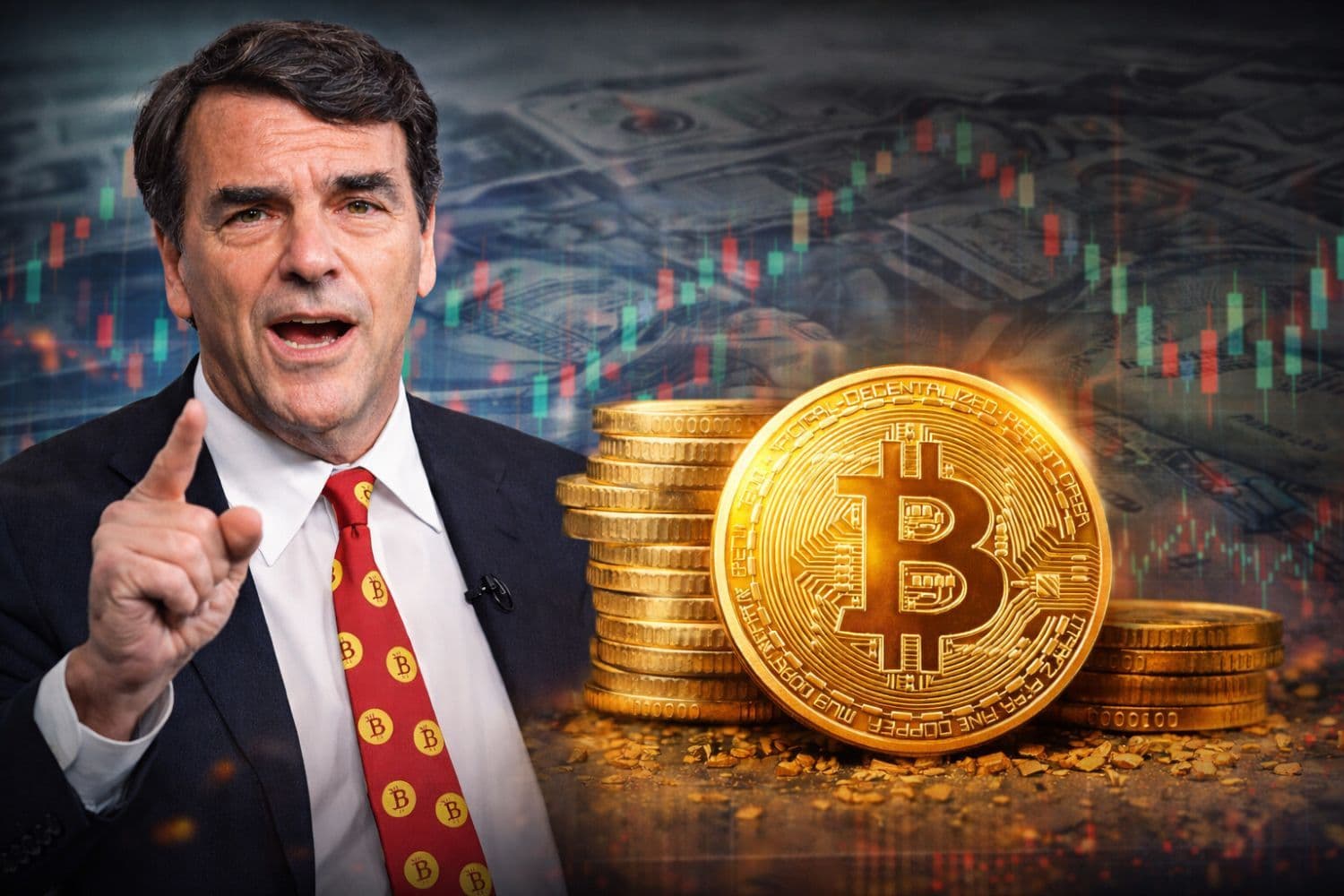

Venture capitalist Tim Draper has once again returned to one of his most closely watched predictions, asserting that the long-term trajectory of Bitcoin (BTC) and the future of the U.S. dollar.

What Happened

Speaking on a podcast on Monday, Draper argued that Bitcoin remains one of the strongest asymmetric bets against fiat currency.

He outlined a price path that begins with a move to $250,000, extends to $1 million, and ultimately reaches $10 million per Bitcoin.

At that point, Draper suggested, the dollar would no longer serve as a practical medium of exchange.

Shortly after the podcast aired, Draper reiterated his conviction on X, revisiting his early involvement with Bitcoin and reaffirming his near-term forecast.

He told followers he expects Bitcoin to reach $250,000 within six months, pointing to the network’s continued expansion while, in his view, confidence in traditional currencies erodes.

He framed those experiences as proof that conviction, rather than timing, has defined his approach to the asset.

He also reflected on earlier predictions that were widely dismissed.

Also Read: Bermuda Moves Toward Onchain Economy, Sidesteps Traditional Banking Rails

Draper recalled forecasting a $10,000 Bitcoin price in 2014, when the asset was trading below $200. Three years later, Bitcoin reached that level.

While he acknowledged that regulatory pressure and policy decisions temporarily slowed adoption, he argued that momentum has since resumed.

Why It Matters

Draper’s comments align with themes he has repeatedly emphasized in past remarks, that Bitcoin as a growing global network and fiat currencies as systems under strain.

In previous interviews, Draper has argued that Bitcoin’s borderless nature and predictable monetary policy position it as a hedge against government overreach, inflation, and financial fragmentation, arguments he returned to again in his most recent remarks.

Draper has issued versions of the $250,000 target for years, pushing back timelines as market conditions and industry setbacks changed.

In late 2022, for example, he said he remained “100% sure” Bitcoin would reach $250,000, while extending the timeframe after the collapse of FTX.

Read Next: Study Shows Americans Pay 96% Of US Tariff Costs Not Exporters