As Bitcoin (BTC) surged above the $100,000 mark this year, its mainstream adoption also reached new heights, as seen in the massive spike in institutional interest, while the real challenge is scaling up the network. As we enter 2025 with a bull run prediction, several Bitcoin scaling solutions have emerged, specially Layer 2 solutions, which have the potential to address the many scalability concerns of the network.

This includes everyday transactions and micropayments. So, let’s explore how Bitcoin scaling solutions have evolved and what are the new Layer 2 ideas that will cook up a storm in 2025.

The Evolution of Bitcoin's Scaling Challenge

Bitcoin's fundamental design, while ensuring security and decentralization, has historically limited its transaction throughput. The traditional 10-minute block confirmation time poses significant challenges for widespread adoption, especially in daily transactions like purchasing coffee.

However, the cryptocurrency community has responded with increasingly sophisticated Layer 2 solutions that maintain Bitcoin's security while dramatically improving its scalability.

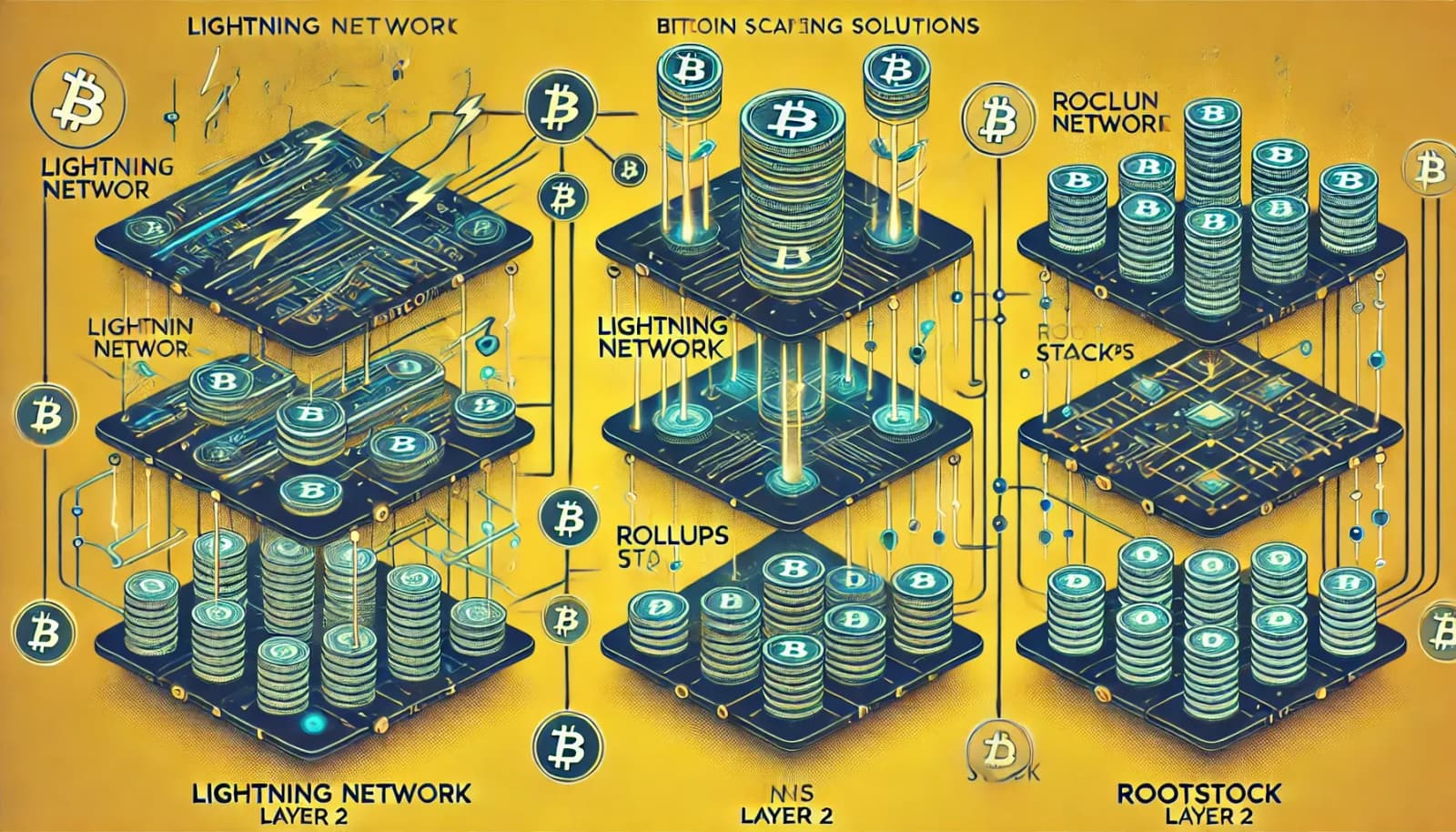

Leading Layer 2 Bitcoin Scaling Solutions

Rollup Technologies

The rollup ecosystem has matured significantly in 2025, offering various approaches to transaction compression and validation. Two distinct types have emerged as market leaders:

-

Zero-Knowledge (ZK) Rollups: Platforms like Citrea have revolutionized Bitcoin scaling by implementing advanced cryptographic proofs that validate transactions without compromising privacy. This technology has gained particular traction in financial institutions requiring both speed and confidentiality.

-

Optimistic Rollups: These solutions have found their niche in applications requiring lower fees and simpler implementation, with the Build on Bitcoin (BoB) platform leading the charge in this category.

The Lightning Network

Mature and Battle-tested The Lightning Network has maintained its position as the dominant Layer 2 solution, boasting a Total Value Locked (TVL) of $330 million. Its implementation of Hashed Time-Locked Contracts (HTLCs) and discreet log contracts (DLCs) has proven particularly effective for micropayments and instant transactions, making it the go-to solution for retail applications.

Stacks (STX)

The Bitcoin Sidechain Pioneer Despite maintaining a lower TVL of $125 million, Stacks has emerged as a crucial player in the Bitcoin Layer 2 ecosystem. Its innovative Proof-of-Transfer consensus mechanism and deep integration with Bitcoin's security model have attracted developers and users alike. The platform now hosts a thriving ecosystem of DeFi protocols, demonstrating the potential for sophisticated financial applications on Bitcoin.

Rootstock (RSK)

The Smart Contract Enabler Rootstock has solidified its position as Bitcoin's premier smart contract platform, with a TVL of $185 million. Its compatibility with Ethereum's development tools and the successful implementation of merged mining has created a unique value proposition. The platform has become particularly notable for hosting established DeFi protocols like Money On Chain and Sovryn, bridging the gap between Bitcoin's security and Ethereum's programmability.

Bitcoin scaling leading to greater adoption?

The diversification of Bitcoin scaling solutions has created a robust ecosystem that caters to different use cases and requirements. Financial institutions have gravitated toward ZK-rollups for their privacy features, while retail users have embraced the Lightning Network for everyday transactions.

This segmentation has contributed to Bitcoin's increased utility across various sectors. The emergence of these scaling solutions has also sparked a new wave of innovation in the Bitcoin ecosystem. Developers are increasingly building applications that leverage these Layer 2 networks, creating new use cases for Bitcoin beyond its traditional role as a store of value. This has led to a surge in Bitcoin's adoption in everyday transactions and decentralized finance applications.

Addressing limitations to become a global financial infrastructure

The way the Bitcoin scaling landscape is going to develop in 2025 mirrors how the crypto ecosystem is maturing successfully, addressing key issues and historical limitations. The Bitcoin network is slated to become more efficient and versatile as a result of the coexistence of many Layer-2 solutions mentioned in this article. Each of them serves a specific use case and eliminates certain problem areas. As these technologies continue to evolve, BTC is well-positioned to fulfil its potential as both a store of value and a practical medium of exchange for the digital age.

Analysts think that this development and integration of Bitcoin scaling solutions will help in making the digital asset a global financial infrastructure, as the success of these layer 2 solutions showcases that the network’s scalability issues could be eradicated without compromising its decentralization and security.