Regulatory advancements and security-driven innovations are shaping the week's biggest crypto trends. Alchemy Pay (ACH) is surging on the back of licensing approvals, while GoPlus Security (GPS) continues expanding its Web3 protection infrastructure.

Market participants are also closely watching infrastructure projects like Wormhole (W) and XYO (XYO), which are driving cross-chain adoption. Meanwhile, DeXe (DEXE) and Usual (USUAL) are proving that staking and governance remain strong narratives. With several tokens breaking key resistance levels, traders are looking for the next moves that could set the pace for the broader crypto market.

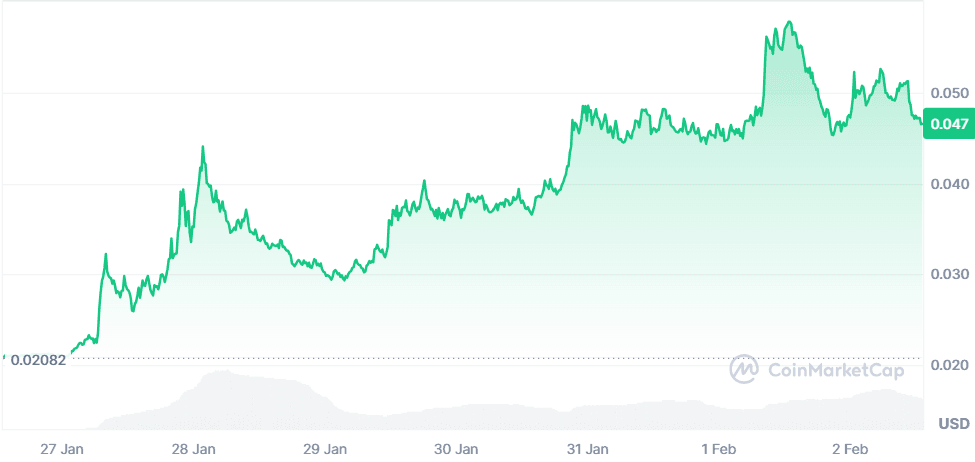

Alchemy Pay (ACH)

Price Change (7D): +126.66% Current Price: $0.04715

News

Alchemy Pay saw a sharp rise after securing a digital currency exchange provider license in Australia, expanding fiat-to-crypto services. It now holds 12 global licenses and is working towards obtaining more regulatory approvals. The company’s recent $10 million funding round valued it at $400 million, attracting institutional interest. A partnership with Movement strengthens its position by enabling seamless fiat onboarding for blockchain applications. The introduction of Alchemy Chain, a high-performance Layer 1 payment solution, further enhances its market presence, positioning it as a key player in bridging cryptocurrency and traditional finance.

Forecast

ACH broke resistance at $0.0515, confirming a bullish trend. The next target is $0.0930, aligning with the 50% Fibonacci retracement. If momentum sustains, further upside to $0.12 is possible. A rejection may lead to consolidation around $0.0425 before resuming upward. If volume declines, a breakdown to $0.0380 is likely, but the bullish structure remains intact above $0.0350. The RSI indicates strong buying pressure, while MACD suggests continued bullish divergence. Moving averages show support at $0.0440, making dips a potential accumulation opportunity before the next leg up.

GoPlus Security (GPS)

Price Change (7D): +38.31% Current Price: $0.1812

News

GoPlus Security continued its expansion as the first decentralized security layer in Web3, integrating AI-driven risk analysis for blockchain transactions. The token price surged following strategic partnerships, including UXLink and Virtuals, to enhance security intelligence across decentralized applications. CoinMarketCap now integrates GoPlus Security’s analysis, allowing users to cross-reference blockchain security risks with CertiK reports. The project’s growing adoption was further demonstrated by its airdrop campaign, which exceeded 500,000 wallet claims. The team continues improving its decentralized architecture, leveraging artificial intelligence to build a scalable, trustless security layer across all major blockchain ecosystems.

Forecast

GPS tested resistance at $0.20 but faced selling pressure. A breakout above this level could trigger an upward move to $0.225, with the next major target at $0.25 if market conditions remain bullish. If it fails to hold above $0.175, the price could pull back to $0.155, where buyers may re-enter. The MACD shows weakening momentum, and RSI suggests a potential short-term retracement. However, long-term bullish sentiment remains strong as trading volume remains elevated. The key support to watch is $0.165, where historical buying interest has been concentrated.

XYO (XYO)

Price Change (7D): +31.22% Current Price: $0.01825

News

XYO experienced significant gains after launching its Layer 1 blockchain, XYO Layer One, designed to facilitate AI-driven applications, real-world asset management, and decentralized data analytics. Market speculation surrounding a potential partnership with Tesla further fueled investor interest, driving a price surge of over 42%. The project benefits from its U.S. presence, where discussions around a 0% capital gains tax on domestic cryptocurrency projects could provide long-term advantages. XYO’s governance model ensures decentralized control over its infrastructure, making it a critical player in the emerging Decentralized Physical Infrastructure Networks (DePIN) sector.

Forecast

XYO is trading above its falling wedge breakout level, signaling a potential move towards $0.0245. If bullish momentum continues, the next resistance at $0.0270 could be tested. A failure to sustain above $0.0175 may lead to a retracement toward $0.0150, where support has historically held. The MACD remains in bullish territory, but RSI is approaching overbought levels, suggesting a short-term pullback could precede further gains. If XYO consolidates above $0.0180, it could enter an accumulation phase before another leg upward, with $0.0300 as the next major target.

Neon EVM (NEON)

Price Change (7D): +30.44% Current Price: $0.3004

News

Neon EVM gained traction after integrating EIP-1559 , bringing Ethereum’s dynamic fee structure to the Solana ecosystem. This upgrade improves transaction cost predictability, making it easier for developers to migrate Ethereum-based decentralized applications to Solana. The project’s strong fundamentals, including over 200 projects preparing for deployment, position it as a critical bridge between Ethereum and Solana. Recent discussions surrounding the upcoming token unlock on February 7 have also fueled speculation, increasing trading volume. Neon’s infrastructure allows developers to access Solana’s high-speed transactions without modifying Ethereum smart contracts, increasing adoption potential.

Forecast

NEON is facing resistance at $0.315. A breakout above this level could push the price toward $0.38, aligning with previous rejection points. Sustained bullish momentum could see it retest $0.42, but failure to maintain current levels may lead to a drop to $0.265 before consolidation. The RSI is near overbought levels, suggesting a short-term correction is possible. The 50-day moving average provides support at $0.275, making it a key level to watch. A bounce from this support zone could signal renewed buying interest, with $0.35 as the next psychological resistance.

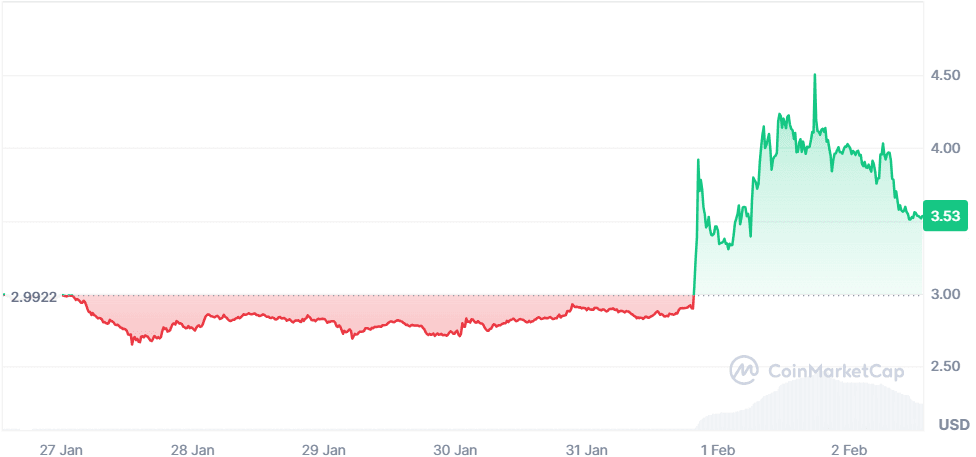

Qtum (QTUM)

Price Change (7D): +18.18% Current Price: $3.53

News

Qtum saw a price surge following a significant rally in quantum computing stocks, highlighting renewed interest in blockchain scalability solutions. The project combines Bitcoin’s UTXO model with Ethereum’s smart contract functionality, enabling secure and efficient decentralized applications. Recent advancements in quantum-resistant cryptographic implementations have improved security and long-term viability. Institutional investors have shown increased interest in Qtum’s hybrid consensus model, which utilizes proof-of-stake to enhance efficiency. The project continues integrating cutting-edge blockchain upgrades, positioning itself as a leading contender in high-performance smart contract platforms.

Forecast QTUM faces resistance at $3.80, a level that has previously triggered sell-offs. A breakout above this point could push the price to $4.45, with $5 as the next major resistance. If bearish pressure increases, the price could retrace to $3.25, where buyers may look to accumulate. The MACD remains in positive territory, but the RSI suggests slight overbought conditions. If QTUM sustains momentum above $3.50, it could enter a consolidation phase before another leg upward. Key support to watch is at $3.30, which has historically served as a re-entry point for bullish traders.

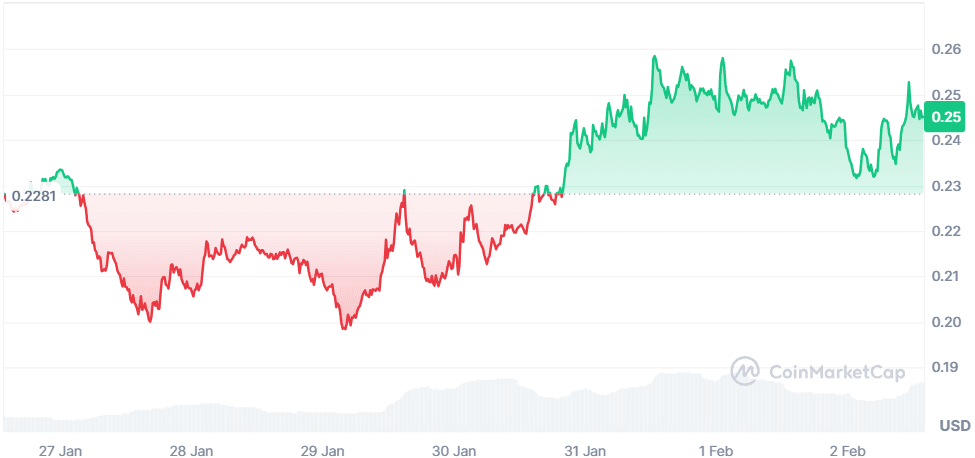

Wormhole (W)

Price Change (7D): +7.38% Current Price: $0.2451

News

Wormhole continues expanding its interoperability capabilities with major integrations. Securitize announced Wormhole as its primary interoperability solution, enhancing cross-chain liquidity for institutional investors, including those holding tokenized assets from BlackRock and Hamilton Lane. Additionally, Cronos integrated LayerZero, connecting to over 115 blockchain networks, indirectly benefiting Wormhole's ecosystem. The protocol has now facilitated over $55 billion in cross-chain volume, with multiple DeFi platforms leveraging its infrastructure.

Forecast

Wormhole is currently consolidating above the $0.24 support level, attempting to establish a stronger position before another move upward. The immediate resistance at $0.26 has acted as a rejection point, and a decisive breakout above this level could push the price toward $0.30, which aligns with previous liquidity zones. If momentum continues, the next target sits at $0.34, a level not seen since early January. However, if the price fails to hold above $0.235, a retest of $0.22 is likely, which has served as a strong accumulation zone. A breakdown below $0.22 would weaken the bullish case, potentially leading to a decline toward $0.20 before any meaningful recovery. The RSI remains neutral, indicating that a breakout or breakdown will depend on broader market sentiment and trading volume in the coming days.

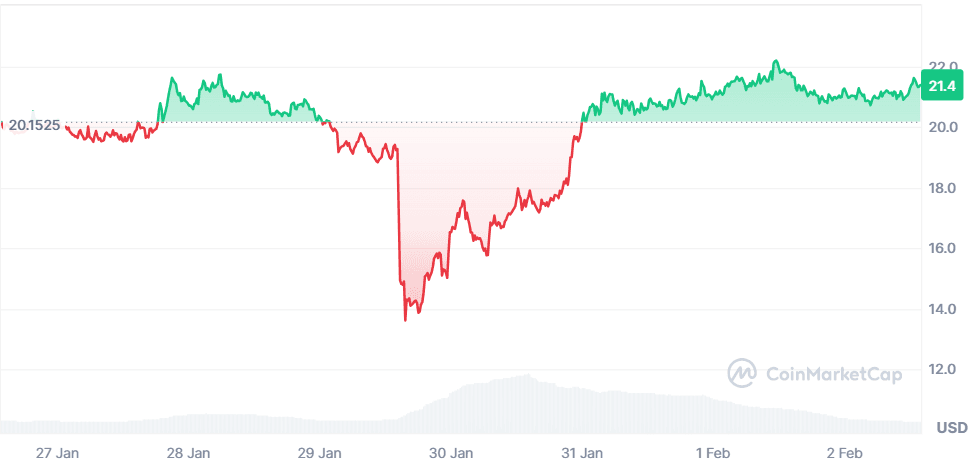

DeXe (DEXE)

Price Change (7D): +5.83% Current Price: $21.33

News

DeXe Protocol saw increased activity as staking participation surged, with over 16.3 million DEXE staked, locking nearly 20% of circulating supply. The token also benefits from strong whale accumulation, with 99.22% held by large addresses. DeXe’s recent collaboration with GraFun added enhanced anti-sniping protection to token launches, increasing demand for its governance features. The project remains a leader in DAO governance and staking mechanisms, attracting institutional and long-term holders.

Forecast

DeXe is facing resistance at $22, which has acted as a local high in previous trading sessions. A confirmed breakout above this level could see the price climb to $24, where the next resistance zone is located. If strong buy pressure sustains, the next key target would be $27, aligning with a prior liquidity area. The MACD indicates continued bullish momentum, but RSI nearing overbought territory suggests some potential for short-term retracement. If DEXE fails to break $22, a pullback toward $19.50 could occur, with $18.80 being a key level to watch. A breakdown below this range could lead to further downside, targeting $17.50 as the next major support level. As staking participation increases and more supply is locked, any dips may present buying opportunities for long-term holders.

Usual (USUAL)

Price Change (7D): -0.93% Current Price: $0.3169

News

Usual partnered with Chainlink to integrate price feeds and proof of reserve mechanisms for USDO and USDO++. This strengthens its position as a transparent and reliable stablecoin issuer. Nearly 50% of its circulating supply is staked in USUALx, and another 11% has been captured by early redemption, reducing sell pressure. Recent exchange listings, including Kraken, have increased liquidity. Despite market-wide corrections, Usual continues to build strategic partnerships and expand its adoption.

Forecast

USUAL remains in a corrective phase after failing to sustain its rally above $0.35. To regain momentum, the price needs to reclaim the $0.33 level, where stronger demand is expected. If successful, the next resistance level at $0.38 could be tested, followed by $0.42 if volume increases. A sustained uptrend could eventually bring USUAL back to the $0.45-$0.48 range. However, if the price fails to hold above $0.30, the next critical support is at $0.27, which previously served as a reversal point. The 50-day moving average is hovering near $0.29, making it a crucial area to watch for potential buying interest. Given the high staking percentage, reduced circulating supply could limit downside pressure, but weak market sentiment could still push USUAL lower before recovery attempts.

JasmyCoin (JASMY)

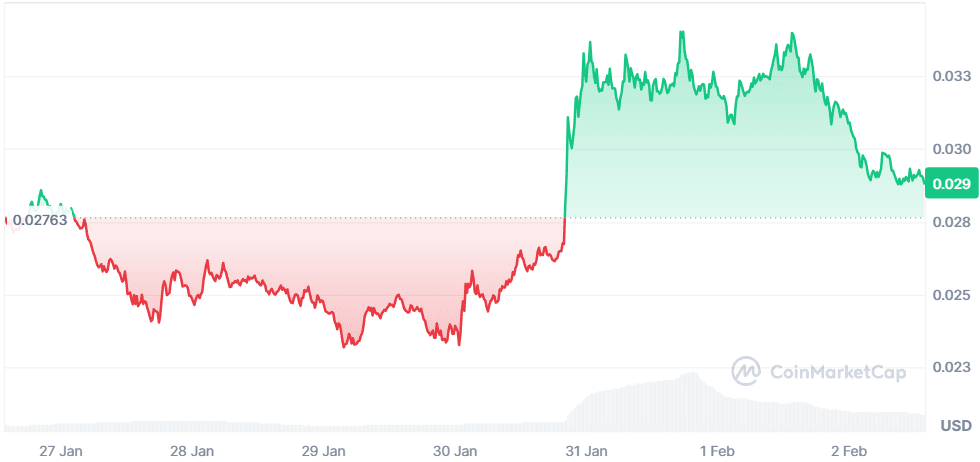

Price Change (7D): +4.13% Current Price: $0.02881

News

JasmyCoin has been in focus following its breakout from a falling wedge pattern. The price initially surged past $0.030 but has since retested this breakout level. Whale holdings remain high at 49.64%, suggesting strong investor interest. JASMY’s performance remains closely tied to Ethereum, which is also testing its own breakout levels. If Ethereum sustains its uptrend, JASMY could see further upside as well.

Forecast

JASMY has held above its critical support at $0.028, indicating some resilience despite recent market weakness. The next resistance stands at $0.032, and a breakout above this level could open the way to $0.036, where a previous rejection occurred. If market sentiment remains strong, the next target of $0.041 comes into play, which aligns with a key Fibonacci retracement level. However, if JASMY fails to sustain above $0.028, a pullback toward $0.025 is likely, followed by $0.022 in a more extended decline. The RSI is nearing neutral levels, suggesting room for upward movement, but trading volume needs to increase for a sustainable breakout. If Ethereum rebounds, JASMY could follow, given their correlated price action in recent trading sessions.

Closing Thoughts

Crypto adoption is clearly accelerating, particularly in payment solutions and cross-chain interoperability. Alchemy Pay's strong performance highlights growing regulatory acceptance of crypto payments, while Usual’s integration with Chainlink reflects increasing demand for transparency in stablecoins.

Security remains a dominant sector, with GoPlus Security reinforcing its position as a Web3 infrastructure leader. DeFi participation remains steady, as seen with DEXE’s strong staking numbers, but price action remains mixed. Cross-chain interoperability is another major theme, with Wormhole and XYO making strides. Overall, the market is favoring utility-driven projects over speculation, signaling a maturing ecosystem where adoption and security play leading roles.