Ethereum’s roadmap is making waves again, but this week it’s the extremes that are catching everyone’s attention. From WEMIX’s sudden delisting meltdown to COOKIE’s breakout fueled by Web3 updates, the market has been anything but quiet.

BEAM kept its GameFi buzz going with new reward cycles, while ETH maintained a calm and calculated rise amid protocol updates, ETF uncertainty, and major institutional buys. These are the names drawing the most chatter and volatility across crypto forums and trading desks alike.

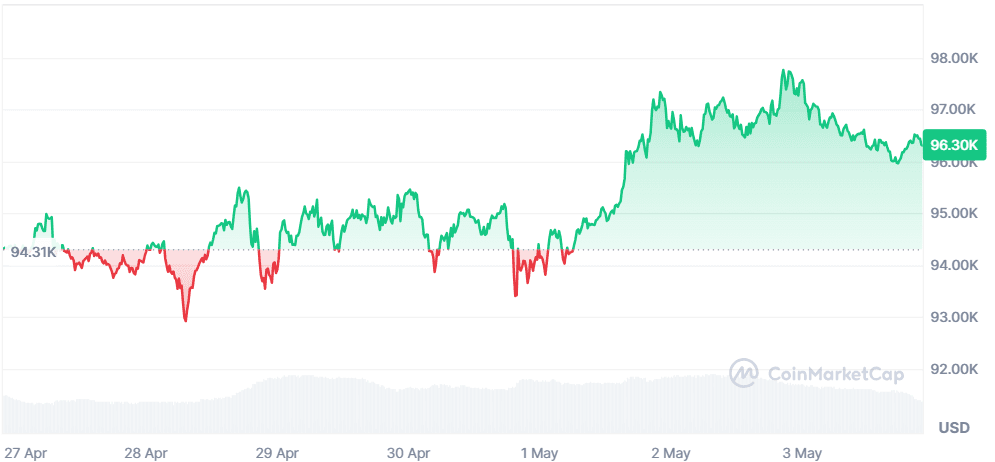

Bitcoin (BTC)

Price Change (7D): +2.06% Current Price: $96,303.64

News

Bitcoin continues to dominate headlines, rallying past $97,000 as institutional interest surges. BlackRock purchased 3,730 BTC worth $351.4M, while Strategy added over 15,000 BTC. Arizona has passed a bill to invest public funds in Bitcoin, potentially allocating up to $3.1 billion. On a federal level, Trump signed an order establishing a Strategic Bitcoin Reserve holding over 207,000 BTC. With ETFs drawing nearly $1 billion in inflows and Bitcoin surpassing Google’s market cap, the momentum around BTC as a strategic and institutional asset is growing rapidly.

Forecast

Bitcoin is trading just below its local high of $97,300, with strong support forming around $93,000. The RSI is nearing overbought territory (~72), suggesting short-term consolidation could occur. However, bullish momentum remains intact with ETF inflows and regulatory clarity acting as tailwinds. A breakout above $97.5K could trigger a run toward $100K, while failure to hold $93K could see retracement to $90K.

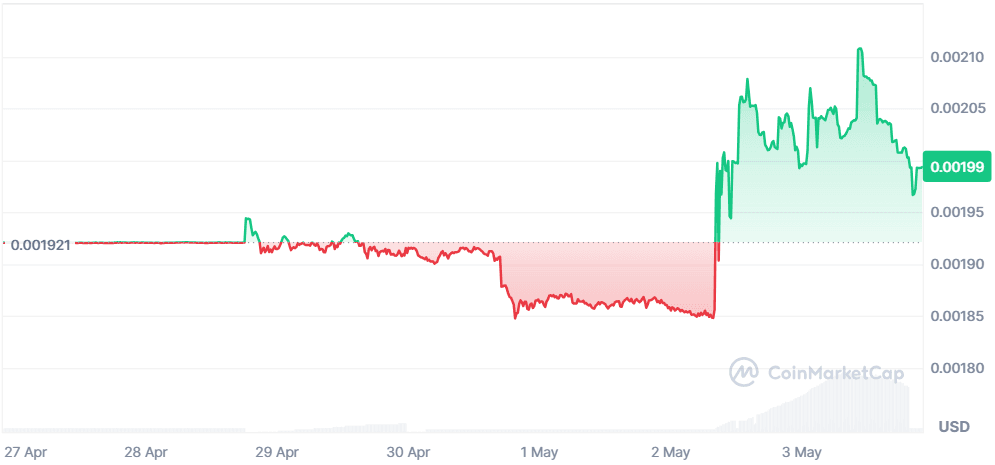

AskNoel (NOEL)

Price Change (7D): +3.79% Current Price: $0.001993

News

AskNoel, a crypto search engine inspired by a child’s questions, has gone viral on social media. Designed to simplify crypto learning for all ages, the platform ranked #1 on CoinMarketCap's trending list. The charm of the story behind its creation, centered on a 5-year-old's curiosity has drawn significant attention. Backed by a mission to demystify blockchain for the average user, AskNoel is seeing increased visibility across platforms like X and Telegram.

Forecast

NOEL has broken above its 7-day range, bouncing from $0.00185 to $0.00202 before retracing. RSI is neutral at around 54, indicating room for further upside. A sustained move above $0.00205 could open the door to $0.0023. If selling pressure resumes, look for support around $0.00190. Momentum remains steady, with potential for news-driven spikes in price.

Virtuals Protocol (VIRTUAL)

Price Change (7D): +67.07% Current Price: $1.78

News

Virtuals Protocol has surged thanks to multiple bullish catalysts. A major update to the Genesis Launchpad now allows token auto-lock and vesting, enhancing transparency and trust. Listings on Binance.US and other exchanges, along with participation at Token2049 Dubai, have further amplified hype. The Genesis system's “Virgen Points” incentivize ecosystem activity over capital, drawing in loyal users and fueling presale success stories like BIOS (60x) and HOLLY (18x).

Forecast

VIRTUAL has rallied nearly 300% since mid-April, breaking out of a long-term descending channel. RSI sits high at 86.26, signaling overbought conditions, and a short-term cooldown toward $1.40–$1.50 is likely. The 50-day SMA at $0.71 is far below current levels, reinforcing the strength of the move. If price holds above $1.60, the next leg could test $2.00–$2.10.

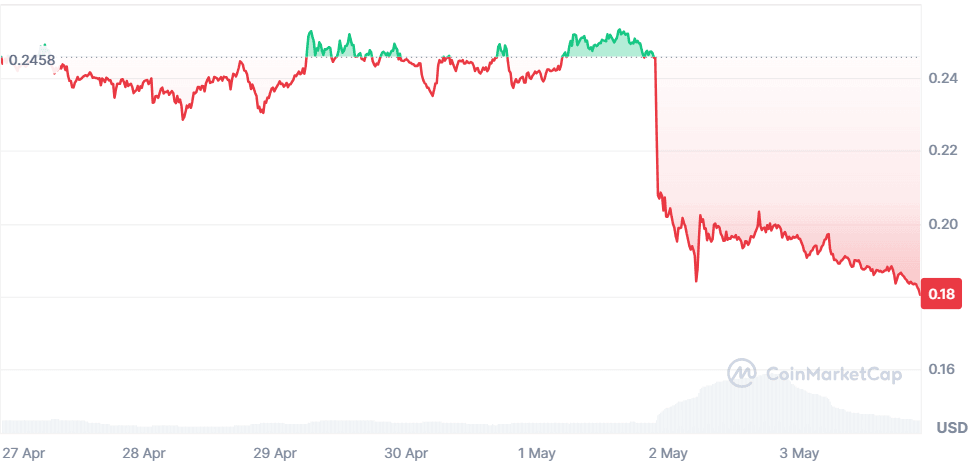

Movement (MOVE)

Price Change (7D): -26.03% Current Price: $0.1804

News

Movement Labs is in turmoil after a leaked report exposed a market-making deal that led to a $38 million token dump. Co-founder Rushi Manche was suspended, and the incident has prompted an independent investigation. Coinbase is delisting MOVE, while Binance banned associated market maker Web3Port. Although Movement Labs insists treasury funds remain safe, confidence has plummeted. The scandal has brought increased scrutiny on crypto market makers and their impact on tokenomics.

Forecast

MOVE is in a steep downtrend, falling from $0.24 to $0.18 in a week. RSI is extremely oversold near 23, suggesting a short-term bounce could occur, possibly back to $0.20. However, the trend remains bearish. Continued bad press could drag the token toward its December low of $0.15. Recovery depends heavily on governance restructuring and restored exchange support.

Pundi X (PUNDIX)

Price Change (7D): +75.39% Current Price: $0.5261

News

PUNDIX is gaining major traction with new perpetual contract listings on Binance, Bybit, MEXC, and BingX, all offering up to 75x leverage. These listings have expanded exposure and enabled derivative traders to speculate heavily on price action. The token is also gaining popularity as a payments solution, with active mentions across social channels and support from Pundi X Labs. High leverage access and trading volume surges are driving renewed interest.

Forecast

PUNDIX has surged from $0.30 to $0.62 before retracing to $0.52. RSI is cooling off from an overbought 80+ level, now near 68, suggesting momentum remains but with caution. If the token holds above $0.50, another leg toward $0.65 is possible. Breakdown below $0.48 may trigger pullbacks to $0.42. Derivatives activity will likely dictate the next move.

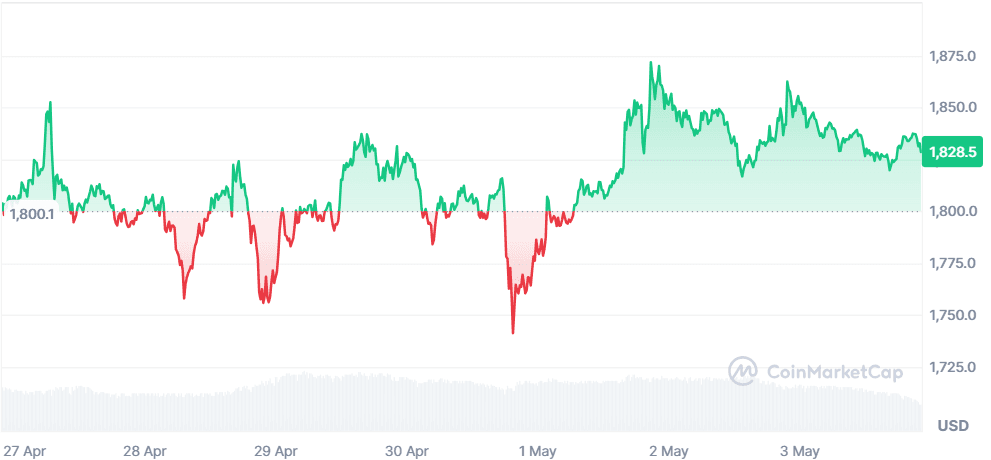

Ethereum (ETH)

Price Change (7D): +1.41% Current Price: $1,828.32

News

Ethereum developers are doubling down on decentralization and simplicity. The recently launched Ethereum R1 is a token-free Layer-2 rollup emphasizing community funding and credible neutrality, countering the VC-heavy governance trends in other L2s. Simultaneously, new ERC standards (ERC-7828 & ERC-7930) are being proposed to fix cross-chain UX inconsistencies, while Vitalik Buterin is pushing for a major protocol simplification to align Ethereum closer to Bitcoin’s minimalistic design. On the regulatory front, the SEC has delayed its decision on ETH ETF staking, but Fidelity's $6.43M ETH purchase has sparked renewed institutional optimism. Meanwhile, EIP-7938 proposes a 100x capacity boost on Layer 1, which could strengthen Ethereum’s infrastructure amid mounting scalability demands.

Forecast

Ethereum is consolidating near $1,830 after a week of market stabilization. Institutional confidence remains strong, highlighted by Fidelity’s acquisition and intensified dev activity. With bullish fundamentals like the R1 rollup and EIP-7938, plus long-term prospects from Vitalik’s L1 overhaul plan, ETH could reclaim the $2,000 mark in the medium term. However, SEC's ETF indecision might add temporary volatility. RSI is neutral, and the price is holding above key support levels, signaling strength if momentum continues.

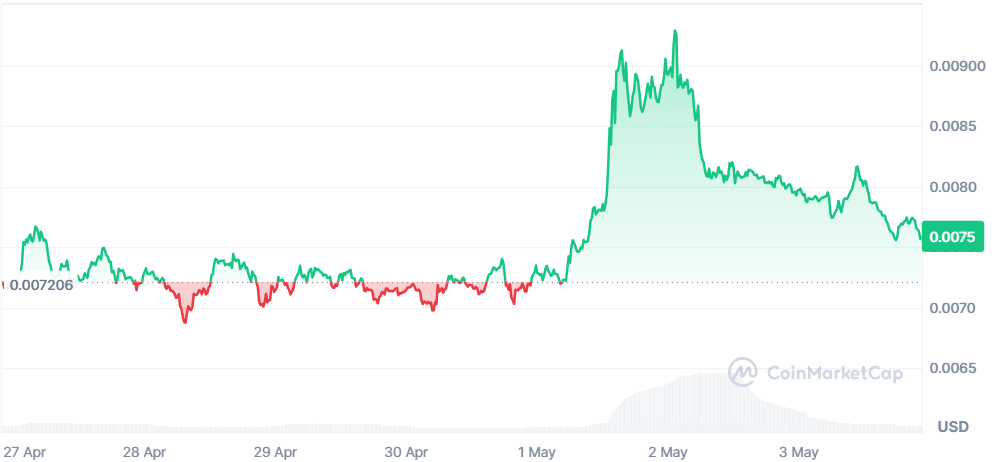

Beam (BEAM)

Price Change (7D): +5.59% Current Price: $0.007581

News

Beam launched its Season 2 validator reward program, reinforcing its growing Web3 gaming presence. The token surged over 30% in two weeks, driven by staking incentives and a strong April finish. Despite recent pullbacks, BEAM is forming a bullish Elliott Wave structure above a key trendline. With a $238M treasury and increasing ecosystem expansion, BEAM is aiming for its 2024 high of $0.039. It’s also part of broader Ethereum discussions, with Vitalik’s beam-chain simplification potentially benefiting associated infrastructures.

Forecast

BEAM is showing signs of continuation after breaking resistance at $0.0075. As long as validator incentives remain attractive and the ecosystem stays active, BEAM could push toward $0.009–$0.01 in the short term. Momentum indicators remain moderately bullish, though watch for potential corrections due to volatility in reward-driven pumps. Fundamentally, BEAM remains a leading GameFi contender.

Cookie DAO (COOKIE)

Price Change (7D): +16.14% Current Price: $0.1614

News

Cookie DAO surged more than 50% over the past week, driven by updates to its Web3 platform and UI improvements. The token is powering a decentralized data ecosystem tailored for AI agents, with added use cases in DAO governance and multiairdrop farming via Cookie3. A recent social media update hinted at a new marketing knowledge hub and case study repository, pushing investor engagement.

Forecast

COOKIE is riding strong bullish momentum, recently peaking above $0.20 before a mild retracement. With increased platform engagement and continued development, the token could retest $0.18–$0.20 resistance levels. However, its low profile score (62%) suggests caution on long-term sustainability unless product traction grows. Short-term traders may target swings around the $0.15–$0.18 range.

WEMIX (WEMIX)

Price Change (7D): -46.67% Current Price: $0.3720

News

WEMIX crashed nearly 60% after five major South Korean exchanges including Upbit and Bithumb announced plans to delist the token due to security and transparency concerns. The move followed a $6M exploit and delayed disclosure, triggering sharp criticism and regulatory scrutiny. CEO Shane Kim has since responded by announcing legal action against the exchanges, while emphasizing WEMIX’s long-term commitment to its gaming ecosystem and buyback plans.

Forecast

WEMIX is in crisis mode, trading near $0.37 after plummeting from $0.72. Investor confidence is shaken, and liquidity has dried up across Korean markets. While legal action and planned buybacks may offer slight relief, the token faces downward pressure until clarity emerges. Expect volatile swings between $0.30–$0.40, with minimal upside unless the delisting fallout is resolved.

Closing Thoughts

This week paints a split-screen view of the crypto market. On one side, Ethereum’s development-focused updates (R1, ERC standards, EIP-7938) show continued builder conviction in foundational infrastructure, indicating strong institutional and technical attention. Meanwhile, GameFi and AI-linked ecosystems like BEAM and COOKIE are driving momentum on the retail and innovation fronts, proving users are still hungry for utility-driven tokens with community incentives.

The WEMIX crisis, however, serves as a stark reminder of how fragile trust can be—especially in markets with strict regulatory scrutiny. The token’s collapse highlights the heightened sensitivity around transparency and compliance in Asia. In contrast, sectors like DeFi infrastructure and AI data are gaining interest for their long-term narratives. Overall, it's a week marked by divergence: fundamentals continue to strengthen at the top, while speculative bets either soar or fall hard.