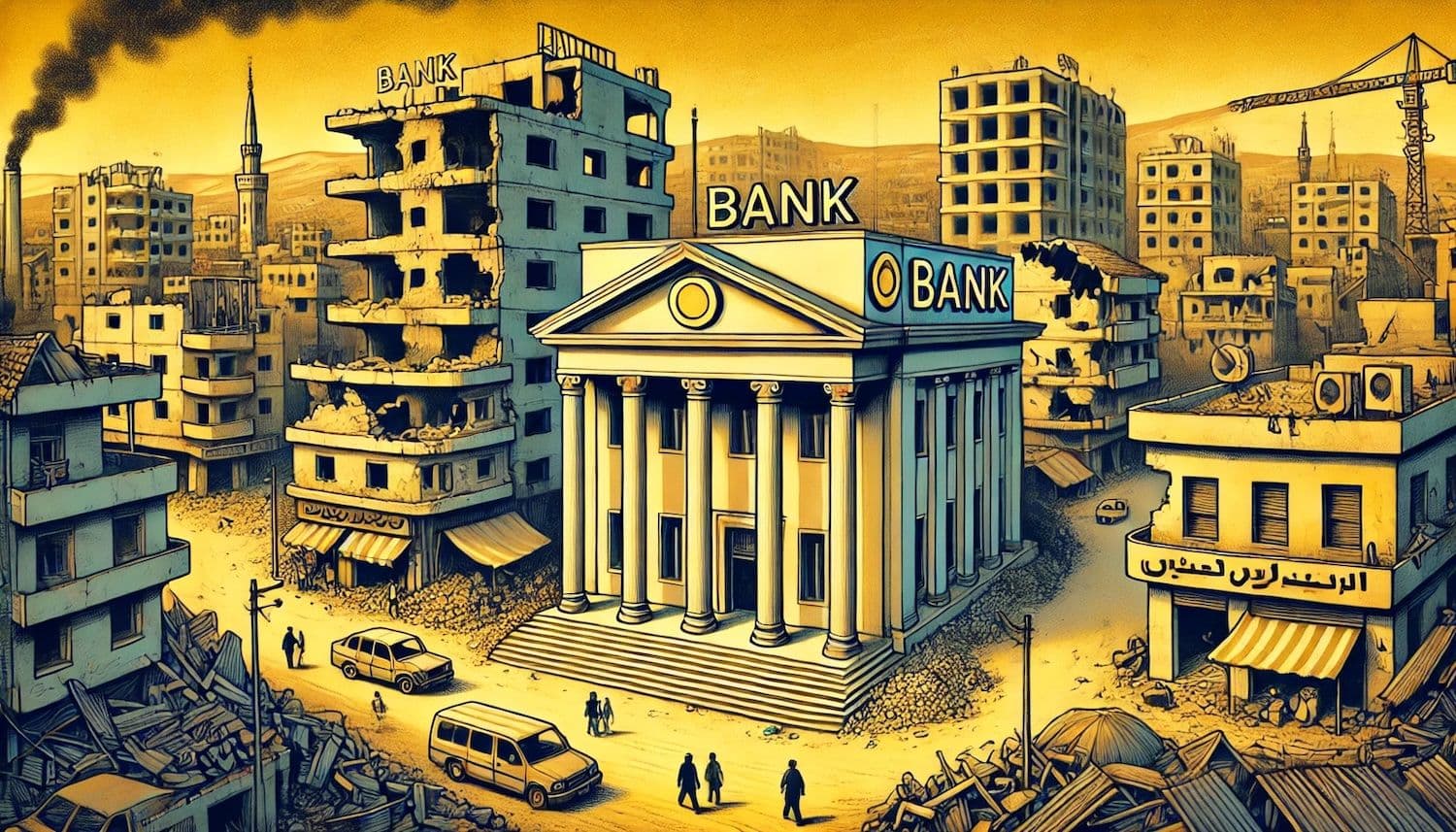

Syria's transitional government is exploring the adoption of Bitcoin as a key pillar for economic stabilization and attracting global investment. This initiative, in conjunction with the digitization of the Syrian pound, represents a significant strategy to rebuild the nation's battered financial landscape.

The Syrian Center for Economic Research (SCER) has crafted a detailed proposal advocating for cryptocurrency integration in the wake of the Assad regime's collapse.

Bitcoin is seen as a vital instrument for Syria’s economic revival. With decades of warfare and fiscal mismanagement having shrunk the economy by over 60% since 2010, according to the World Bank, confidence in traditional financial systems is severely eroded due to rampant inflation and the devaluation of the Syrian pound.

To tackle these pressing issues, the SCER recommends a comprehensive approach. Legalizing Bitcoin for trading, mining, and transactions is at the forefront. Furthermore, the digitization of the Syrian pound via blockchain technology is proposed, with stabilization achieved by linking it to assets such as gold, US dollars, and Bitcoin. The plan also suggests leveraging unutilized energy for Bitcoin mining, promoting environmental stewardship, and avoiding monopolistic practices.

Cryptocurrencies have already made their mark in Syria, although controversially. Groups like Hay’at Tahrir al-Sham (HTS) have allegedly utilized Bitcoin for financing. The SCER's proposal aims to legitimate and regulate digital currency usage but recognizes the potential risk of misuse by such factions. Nonetheless, they emphasize the central bank's role in overseeing this transformation within a secure and accountable framework.

The legalization of Bitcoin could yield several benefits for Syria. It could pave the way for international investment and collaborations akin to El Salvador, thereby delivering a pivotal economic stimulus. Remittance processes, crucial for millions of Syrians, could be streamlined, while citizens would gain enhanced security and privacy over their digital assets.

Bitcoin's decentralized design offers Syria a mechanism to circumvent international sanctions that have historically limited access to the global economy. This mirrors strategies by Russia, Iran, and North Korea, which have utilized crypto to alleviate sanctions' impacts.

Syria's interest in Bitcoin echoes a broader global trend of leveraging cryptocurrencies to enhance financial stability. Notably, Switzerland is deliberating incorporating Bitcoin into national reserves for financial innovation, as noted by BeInCrypto. Similarly, a Russian lawmaker has advocated for establishing a strategic Bitcoin reserve to bolster fiscal stability under sanctions. These international experiences might offer valuable insights for Syria as it develops its cryptocurrency framework.

In spite of its promise, the proposal faces formidable challenges. Blockchain’s transparency can reduce some risks by enabling transaction traceability, yet it also poses regulatory hurdles. Implementing robust oversight will be essential to ensure that cryptocurrency adoption supports legitimate economic endeavors, avoiding illicit activities. While bypassing traditional banks may provide short-term relief, it risks heightened international scrutiny and potential further isolation for Syria. Building the necessary digital infrastructure demands substantial investment and time. Additionally, Syria's economic recovery will likely involve geopolitical complexities, particularly with regional influences from Russia, Iran, and Turkey.

Despite uncertainties surrounding future roles, Russia and Iran are strong crypto economies that could play a part in Syria's reconstruction. Neighboring Lebanon and Turkey, having also shown a proclivity for crypto, could emerge as potential allies or competitors.

If executed effectively, the SCER's bold proposal has the potential to lift Syria from economic desolation. Successfully implemented, it could change the country's financial trajectory, fostering stability and growth opportunities.