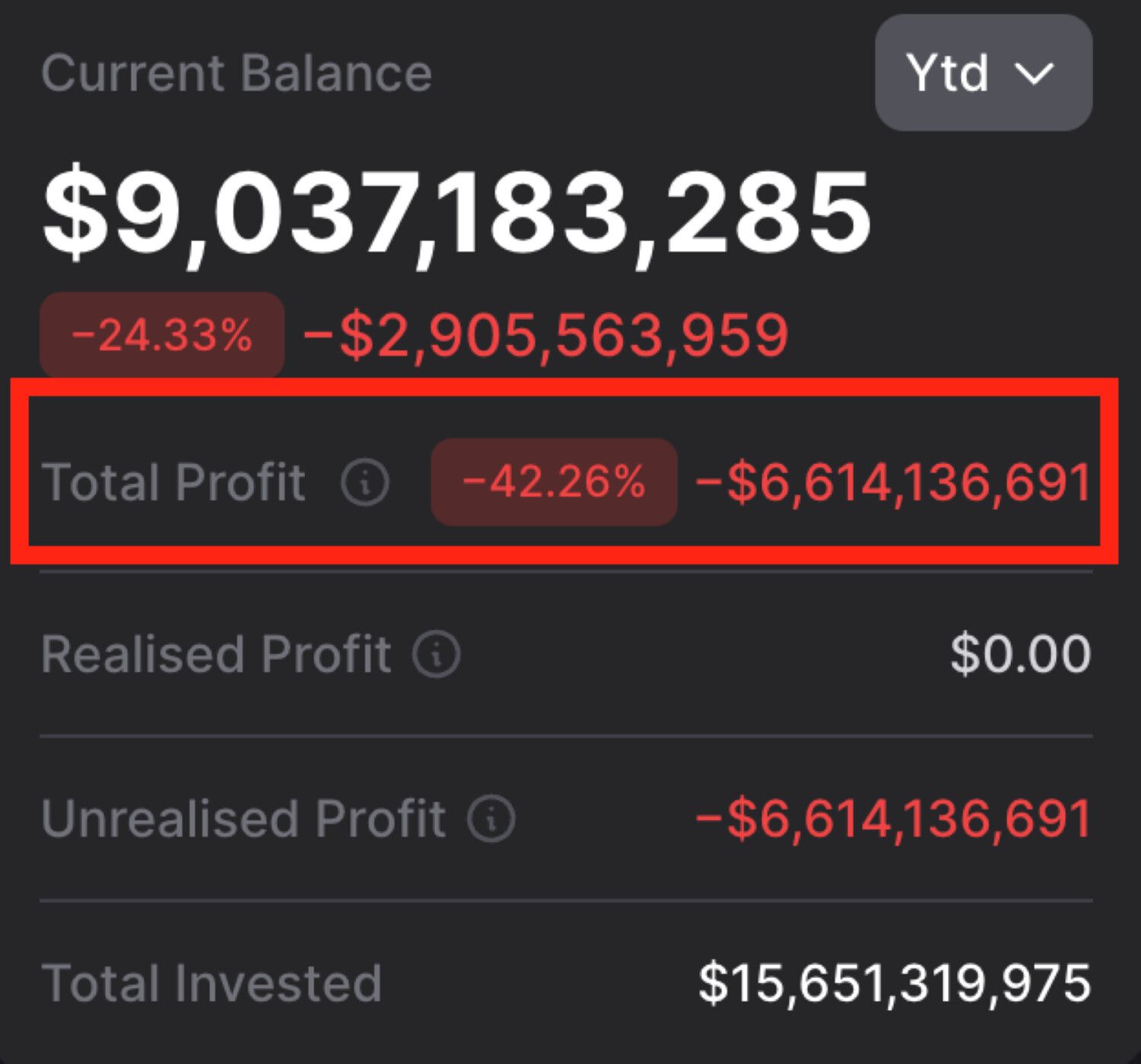

BitMine Immersion Technologies is facing mounting scrutiny after market estimates showed the company sitting on roughly $6.6 billion in unrealized losses tied to its Ethereum (ETH) holdings, a drawdown large enough to place it among the biggest balance-sheet hits ever recorded at a publicly traded crypto-linked firm.

BitMine Immersion Technologies is facing mounting scrutiny after market estimates showed the company sitting on roughly $6.6 billion in unrealized losses tied to its Ethereum holdings, a drawdown large enough to place it among the most severe balance-sheet hits ever recorded at a publicly traded crypto-linked firm.

Ethereum Exposure Reshapes The Balance Sheet

The scale of the loss reflects how central Ethereum has become to BitMine’s financial profile.

Company filings and disclosures show BitMine accumulated millions of ETH as part of a treasury strategy that extended well beyond traditional mining operations.

As Ethereum prices declined, the impact flowed directly through the balance sheet rather than through operating margins, altering how investors view the company’s risk profile.

Also Read: Epstein Archive Uncovers Unsettling Crypto Secrets About Ripple And Stellar

A Comparison Driven By Size Not Structure

Market attention intensified after the unrealized loss was compared to Archegos Capital’s 2021 collapse, with the figure nearing roughly two-thirds of that event’s total drawdown.

The comparison reflects magnitude rather than mechanics.

BitMine’s exposure was not built through margin leverage.

The vulnerability instead stems from concentration, with a single asset accounting for a large share of corporate value.

Why Unrealized Losses Still Matter

Although the position has not been sold, losses of this size can carry real consequences.

Mark-to-market declines can affect valuation, capital access, and strategic flexibility, as price swings can become the dominant financial story once asset exposure outweighs operating fundamentals.