XRP is maintaining its position above $2 despite reaching a five-month low in new address creation, signaling waning investor interest that could threaten the digital asset's price stability.

What to Know:

- New XRP addresses have fallen to a five-month low, indicating declining investor interest

- The cryptocurrency's RSI remains below the neutral 50.0 mark, suggesting continued bearish momentum

- Price currently hovers at $2.10, caught between $2.02 support and $2.16 resistance levels

Market Indicators Show Declining Demand

The digital asset XRP has managed to hold above the $2 threshold during recent days of consolidation, but technical indicators suggest trouble ahead.

After validating a four-month downtrend earlier in April, the cryptocurrency faces significant challenges in maintaining its current market position as investor enthusiasm continues to fade.

Data from blockchain analytics firm Glassnode reveals that new addresses associated with XRP have plummeted to their lowest point in five months. This metric, widely considered a barometer of fresh capital entering the ecosystem, points to a concerning trend for the cryptocurrency's prospects. The substantial decrease in new wallet creation typically signals that retail and institutional investors alike are directing their attention elsewhere in the digital asset space.

"The absence of new buyers could make it difficult for XRP to maintain its position above $2," noted market analysts tracking the situation. Without fresh capital flowing into the asset, price stability becomes increasingly difficult to maintain, particularly in the volatile cryptocurrency markets where momentum often drives short-term price action.

Technical analysis further reinforces this bearish outlook. The Relative Strength Index (RSI), a momentum indicator used to evaluate overbought or oversold conditions, remains stubbornly below the neutral 50.0 threshold. This positioning within the bearish zone suggests XRP lacks the upward momentum necessary to stage a significant recovery in the immediate future.

The broader cryptocurrency market sentiment continues to exert downward pressure on XRP's performance as well. Market-wide bearish conditions have created an unfavorable environment for recovery, compounding the asset's internal struggles.

Price Analysis and Potential Scenarios

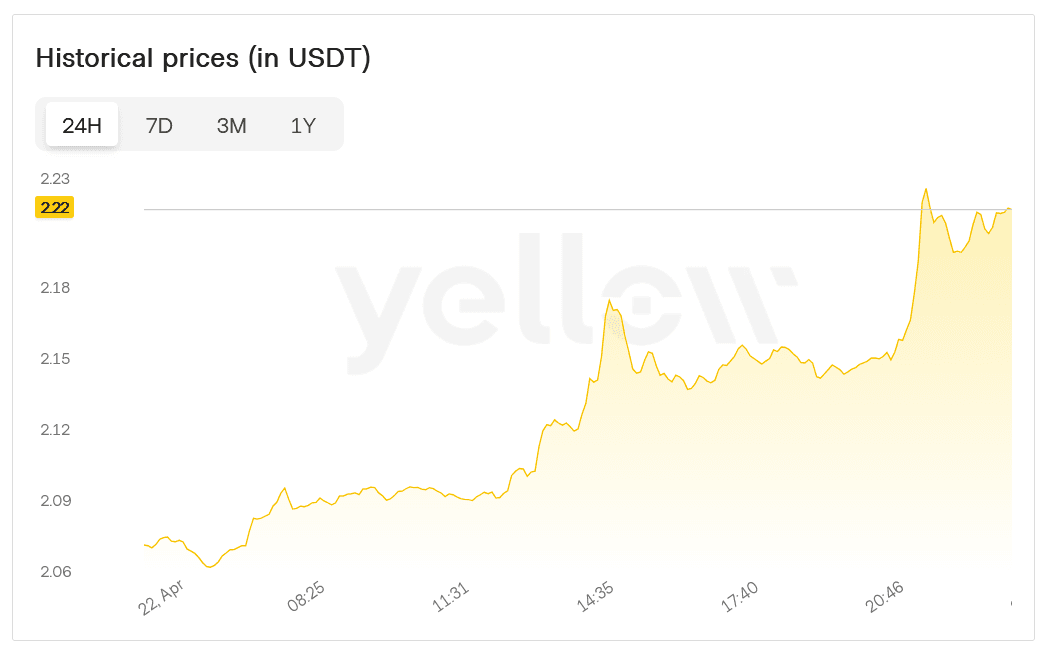

XRP currently trades at approximately $2.10, precariously positioned between established support at $2.02 and resistance at $2.16. The cryptocurrency has been trapped in a persistent downtrend since January, creating substantial overhead resistance that has repeatedly rejected upward price movements.

Technical traders are closely monitoring these key price levels for indications of XRP's next directional move. Should the cryptocurrency fail to maintain its tenuous hold above the $2.02 support level, analysts project a further decline to $1.94. A breach of this secondary support could accelerate selling pressure, potentially driving prices as low as $1.79 in a worst-case scenario.

"The current market conditions could prevent XRP from surpassing $2.16," explained cryptocurrency analysts familiar with XRP's price structure. The confluence of decreasing new users, bearish technical indicators, and unfavorable market conditions creates significant headwinds for any sustainable price appreciation.

However, not all potential outcomes are negative. If XRP successfully breaks through the $2.16 resistance level, it could trigger a relief rally toward $2.27. Such a move would likely require a substantial shift in market sentiment or fundamental developments specific to XRP that could reignite investor interest.

A sustained move above $2.27 could further propel the cryptocurrency toward the $2.40 level, which would effectively invalidate the current bearish outlook. This scenario would require renewed buying pressure and likely coincide with broader improvement in cryptocurrency market conditions.

Final Thoughts

The convergence of declining new addresses, bearish technical indicators, and unfavorable market conditions suggests XRP faces significant challenges ahead. Without fresh capital entering the ecosystem or a material change in market sentiment, the cryptocurrency may struggle to maintain its price above the psychologically important $2 threshold. Investors should closely monitor address growth metrics and key support levels for early indications of whether XRP can reverse its current downtrend.