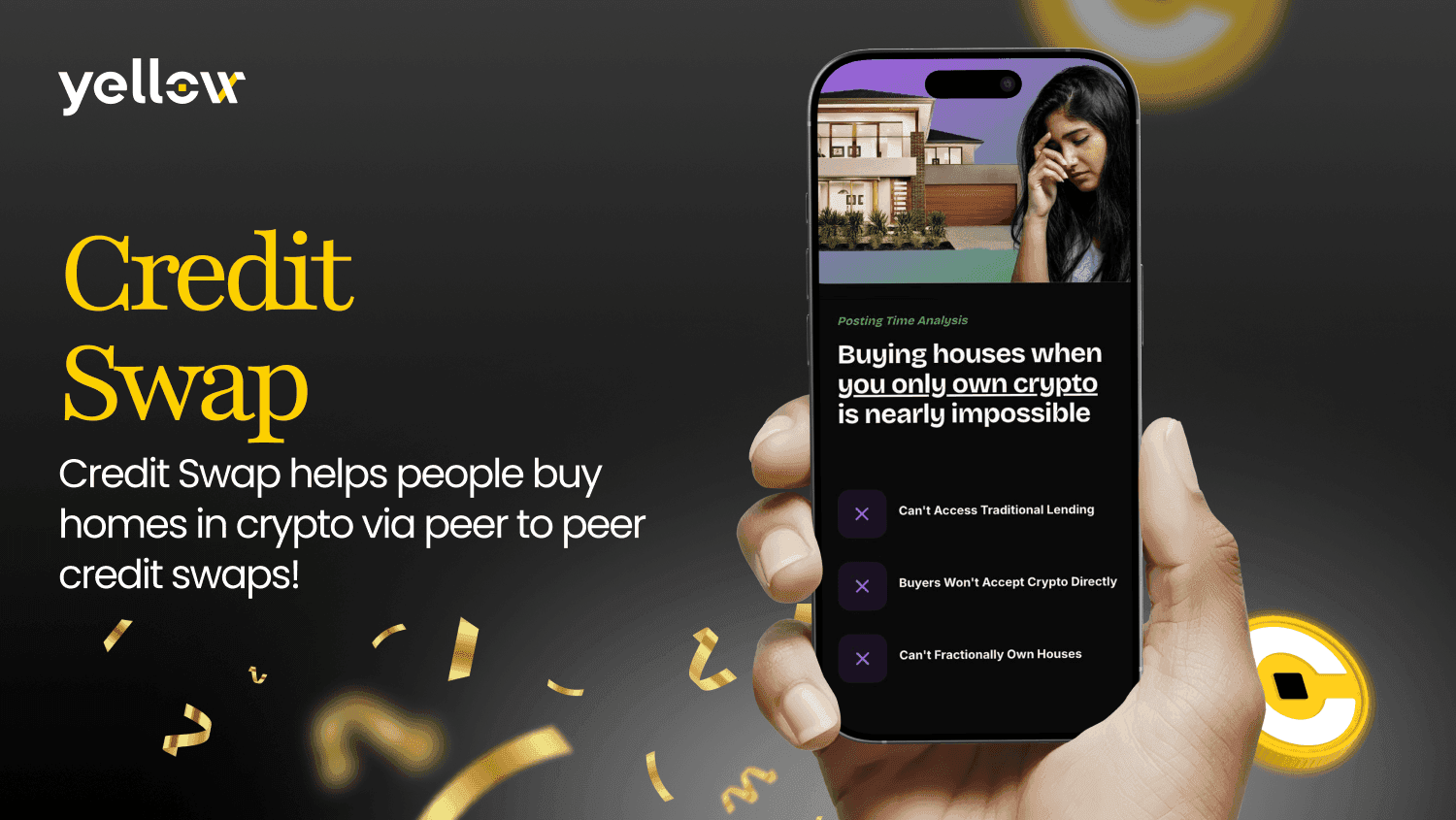

A new peer-to-peer platform called Credit Swap has launched to help cryptocurrency holders purchase real estate by connecting them with proxy buyers who can secure traditional bank loans on their behalf. The system, built on the Yellow SDK, addresses a growing market need as many crypto asset holders struggle to qualify for conventional mortgages because banks typically disregard digital assets as collateral.

What to Know:

- Asset holders with cryptocurrency post requests for specific properties, seeking proxy buyers with good credit to secure loans

- Proxy buyers take out traditional loans to purchase properties, then enter credit swap contracts with asset holders who repay over time

- The platform uses a trust structure that allows multiple investors to pool funds and maintains anonymity for legal transactions

The platform operates through a structured process where asset holders identify desired properties and post credit swap requests. Proxy buyers with established credit lines review these requests and select properties to purchase using traditional bank loans.

Once a property is acquired, the platform facilitates a credit swap contract between the parties.

Under these arrangements, proxy buyers essentially provide private loans to asset holders at rates slightly above their bank loan costs. Asset holders repay these loans over defined periods, receiving full property rights upon completion. The system allows crypto holders to access real estate markets at competitive rates while proxy buyers earn markup fees for their credit facilitation services.

The platform incorporates several blockchain technologies to ensure security and verification. Yellow state channels handle the auction bidding system where proxy buyers submit proposals and asset holders negotiate terms.

The vLayer system verifies loan completion through web proofs and bank login verification with services like Revolut.

Flow blockchain manages the application logic and final credit swap settlements through smart contracts. The platform's trust structure serves as the legal signatory for transactions, enabling two key features: multiple asset holders can pool resources for single property purchases, and participants can complete transactions without revealing personal identities.

The technical infrastructure includes a React-based frontend built with Vite, TypeScript, and Tailwind CSS for user interface design.

Closing Thoughts

Credit Swap represents an emerging solution for cryptocurrency holders seeking real estate investment opportunities despite traditional banking limitations. The platform's is built on the Yellow SDK and its trust-based structure and blockchain verification systems aim to create secure, anonymous property transactions while expanding access to real estate markets for digital asset holders.

Alt text for picture: New platform connects crypto holders with proxy buyers for real estate purchases