WAITLIST OPEN NOW

SIGN UP

Recent News on Cryptocurrency, Blockchain, and Finance | Yellow.com

Explore the latest Web3 and blockchain developments, cryptocurrencies news, market updates, technology, trading, mining, and trends.

Solana Adds 10M Daily Wallets As Price Tests $115 Support

Solana adds 10.2 million new wallet addresses daily as SOL price holds above $115 support amid first ETF outflows in two weeks.

Alexey BondarevJan 30, 2026

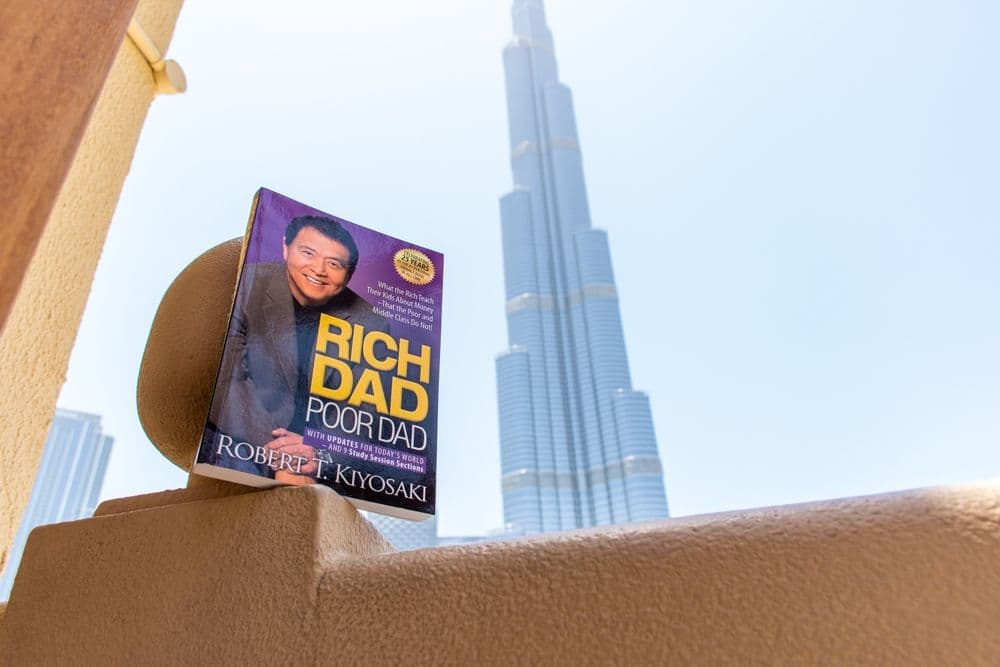

"Purchasing Power Of The US Dollar Keeps Going Down": Kiyosaki Stays Calm As Bitcoin Drops 33%

Rich Dad Poor Dad author Robert Kiyosaki says rising U.S. debt makes Bitcoin attractive despite 33% decline from peak.

Alexey BondarevJan 30, 2026

What Makes Sentient Soar 60% Defying Broader Crypto Market Weakness?

Sentient token climbed more than 60% against a declining crypto market, but heavy long leverage near $8 million raises liquidation risks.

Alexey BondarevJan 30, 2026

Can Bitcoin Hold $85K After 370K BTC Long-Term Holder Dump?

Long-term Bitcoin holders have offloaded more than 370,000 BTC this month, putting the $85,000 support level under pressure.

Alexey BondarevJan 30, 2026

"Money For AI Economy": Bitcoin Measures Energy Better Than Gold, CryptoQuant CEO Says

CryptoQuant's Ki Young Ju says Bitcoin measures energy value better than gold, positioning it for AI economy dominance.

Alexey BondarevJan 30, 2026

Optimism Greenlights 50% Revenue Shift For OP Token Buybacks

Optimism governance approves directing half of Superchain revenue toward monthly OP token buybacks starting February.

Alexey BondarevJan 30, 2026

Crypto Crime Hit Record $158B In 2025 As AI Scams Surge, TRM Labs Reports

Blockchain analytics firm TRM Labs reports illicit crypto flows hit $158 billion in 2025 as AI-powered scams proliferated.

Alexey BondarevJan 30, 2026

Why BTC And ETH Lag Despite Stock And Gold Rally: Analyst Blames Manipulation

Analyst Garret Bullish argues Bitcoin and Ethereum lag other risk assets due to market manipulation, not macro factors.

Alexey BondarevJan 30, 2026

Why Central Banks Are Stockpiling Gold Instead Of U.S. Debt For First Time Since 1996

Central bank gold holdings surpass US Treasury reserves as nations diversify away from dollar assets, signaling a major shift in global reserve strategy.

Murtuza MerchantJan 29, 2026

SEC, CFTC Launch Joint Crypto Initiative To Align U.S. Oversight And Bring Digital Asset Markets Onshore

The SEC and CFTC announced a joint initiative, Project Crypto, aimed at harmonizing U.S. oversight of digital asset markets as regulators move to bring crypto trading and derivatives onshore.

Murtuza MerchantJan 29, 2026