Former Binance CEO Changpeng Zhao has proposed that Kyrgyzstan use Bitcoin and Binance Coin (BNB) as the foundation for its Strategic Cryptocurrency Reserve, advancing the Central Asian nation's ambitions to integrate blockchain technology into its economic framework.

What to Know:

- Changpeng Zhao recently joined Kyrgyzstan's National Crypto Committee at President Sadyr Japarov's invitation

- Binance signed a memorandum of understanding with Kyrgyzstan on April 3 for cryptocurrency payment systems

- The partnership includes educational initiatives through Binance Academy alongside payment infrastructure development

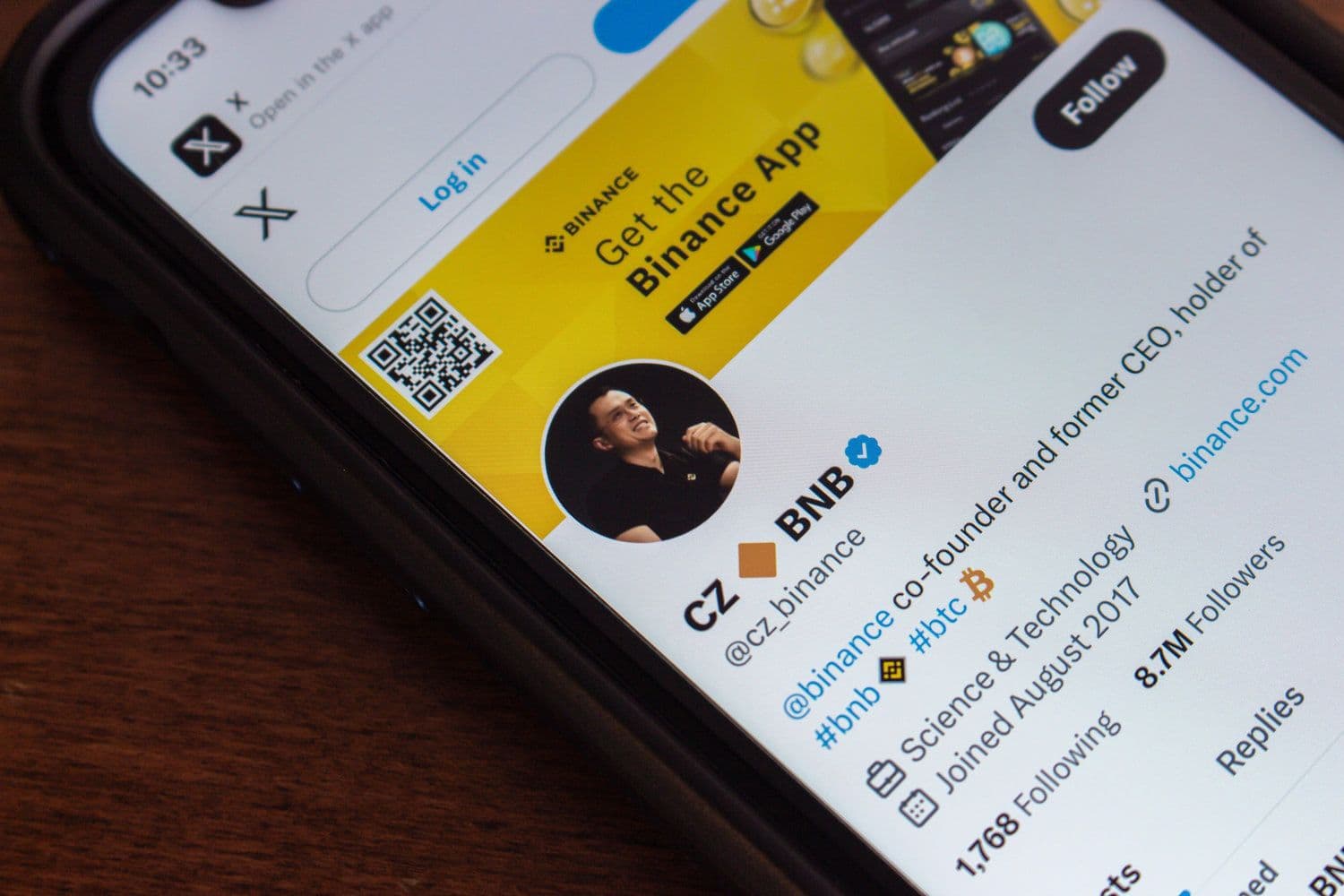

Zhao, widely known as "CZ" in cryptocurrency circles, revealed his proposal during a recent visit to the former Soviet republic. The recommendation comes just one month after he accepted an invitation from Kyrgyz President Sadyr Japarov to serve on the country's National Crypto Committee, a body established to guide the nation's cryptocurrency policies.

"Not against gold, but it's not a limited supply asset," Zhao wrote on social platform X on May 3, implicitly contrasting gold with Bitcoin's capped 21 million supply. The statement resonated with Bitcoin supporters among his followers, who emphasized the cryptocurrency's scarcity as a fundamental value proposition.

The partnership between Binance and Kyrgyzstan extends beyond reserve assets. According to documentation signed April 3, Binance will assist the country in implementing internal cryptocurrency payment systems while simultaneously launching educational programs about blockchain technology through its Binance Academy initiative.

Kyrgyzstan joins a growing number of nations exploring strategic cryptocurrency reserves. Several countries are reportedly considering similar reserves, following the model established by the United States, which already holds approximately 200,000 Bitcoins in government custody.

The Binance-Kyrgyzstan agreement represents one of the more comprehensive public-private cryptocurrency partnerships in Central Asia.

The memorandum of understanding establishes a framework for technological implementation alongside educational outreach, potentially positioning Kyrgyzstan as a regional leader in cryptocurrency adoption.

Zhao's cryptocurrency holdings reportedly consist exclusively of Bitcoin and BNB. He has previously stated on social media that he is "100% in crypto," explaining his inability to "buy dips" in Bitcoin as he is already fully invested in the cryptocurrency ecosystem.

The potential implementation of Bitcoin and BNB as reserve assets would mark a significant milestone for both cryptocurrencies, potentially establishing a precedent for other nations considering similar policies. While Bitcoin has attracted institutional and corporate attention as a treasury asset, its adoption as a national reserve remains relatively uncommon.

Market Context and Implications

Cryptocurrency markets have closely monitored developments in national adoption. At time of publication, Bitcoin trades slightly above $94,000, while Binance Coin changes hands at approximately $593.

The Kyrgyzstan initiative emerges amid growing interest in cryptocurrency reserves among governments worldwide. By potentially adopting both Bitcoin and BNB, Kyrgyzstan would distinguish its approach from countries that have focused exclusively on Bitcoin.

Zhao joined Kyrgyzstan's crypto committee on Sunday, formalizing his advisory role in the nation's cryptocurrency strategy. His position potentially offers significant influence over the country's emerging blockchain ecosystem and regulatory framework.

Closing Thoughts

Changpeng Zhao's proposal for Kyrgyzstan's Strategic Cryptocurrency Reserve represents an ambitious step toward national cryptocurrency adoption. The partnership between Binance and Kyrgyzstan establishes a comprehensive framework for payment systems and educational initiatives, potentially creating a model for cryptocurrency integration at the governmental level.