The crypto market is buzzing with activity as multiple sectors see strong momentum. WhiteRock (WHITE) has exploded in value following major announcements that position it as a leader in tokenized securities, while Solv Protocol (SOLV) continues to ride the wave of demand for structured DeFi products.

Aave (AAVE) is making headlines with its expansion into the Sonic blockchain, strengthening its position in on-chain lending. Meanwhile, Peanut the Squirrel (PNUT) is gaining traction with traders eyeing its next breakout level, and Tron (TRX) faces scrutiny after reports of a multimillion-dollar exploit. With such diverse market movements, today’s trends reveal a lot about where investor interest is flowing.

WhiteRock (WHITE)

Price Change (24H): +71.26% Current Price: $0.001294

What happened today

WhiteRock has experienced a significant price surge following two major announcements. The project secured direct integration with securities exchanges such as NASDAQ and NYSE, making it the first tokenization platform to offer true T+0 settlement for listed securities. Additionally, WHITE was listed on KCEX and BingX, with spot trading starting on March 4 and March 5, respectively. The growing institutional adoption and increased market accessibility have fueled bullish momentum.

Market Cap: $841.49M 24-Hour Trading Volume: $43.9M Circulating Supply: 650B WHITE

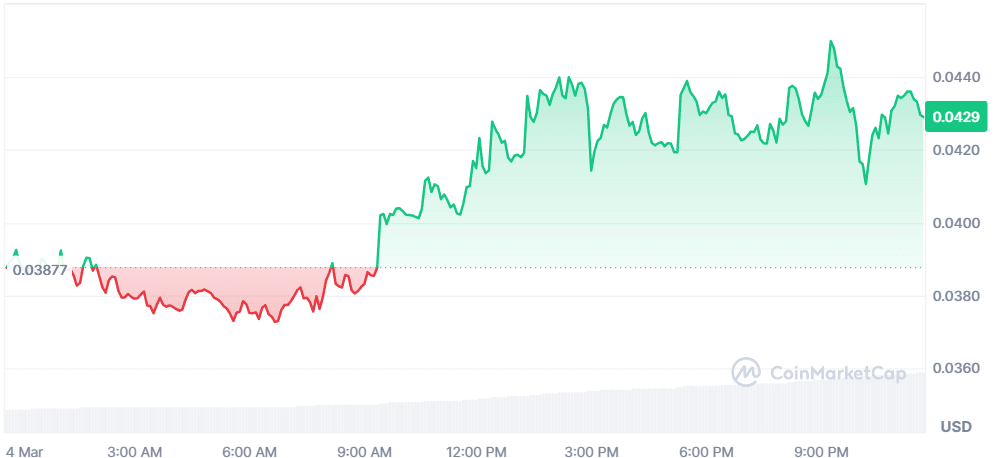

Solv Protocol (SOLV)

Price Change (24H): +10.85% Current Price: $0.04296

What happened today

Solv Protocol is gaining traction with the upcoming launch of SolvBTC.BNB Cap 2 on March 5, featuring 100 BTC available for users. This follows the success of Cap 1, which filled in less than 24 hours due to high demand for Binance Launchpools and HODLer rewards. The protocol has also expanded its offerings with new deposit options, enabling users to earn rewards in $CORN and other incentives. Additionally, Solv Protocol had a strong presence at ETHDenver, engaging with builders and investors, which has boosted market confidence.

Market Cap: $63.7M 24-Hour Trading Volume: $250.73M Circulating Supply: 1.48B SOLV

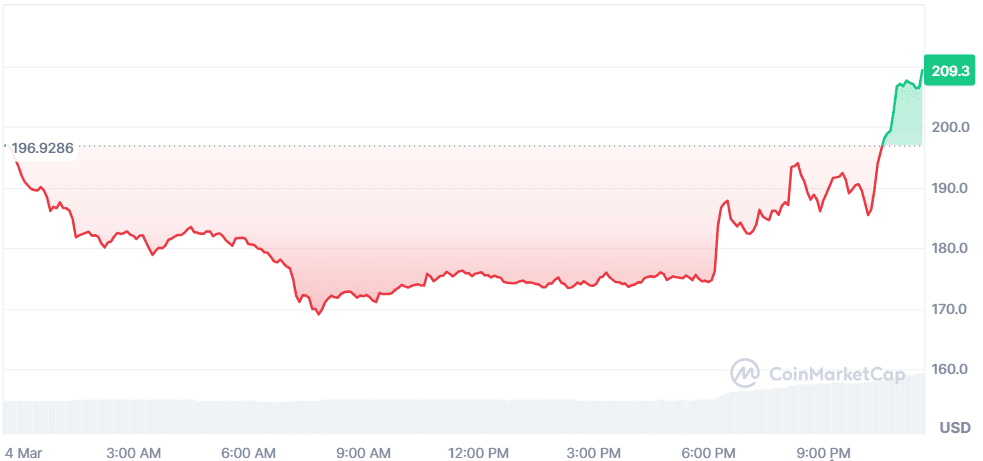

Aave (AAVE)

Price Change (24H): +6.35% Current Price: $209.37

What happened today

Aave has expanded its DeFi ecosystem with the official launch of AAVE v3 on the Sonic mainnet, previously known as Fantom. This deployment follows a governance proposal aimed at integrating Aave's lending markets with Sonic, supported by liquidity commitments including $15 million from the Sonic Foundation. The move strengthens Aave’s presence in the DeFi space by introducing borrowing and lending opportunities on the high-speed Sonic blockchain. Additionally, Trust Wallet has added support for Sonic’s $S token, further enhancing its ecosystem adoption.

Market Cap: $3.15B 24-Hour Trading Volume: $610.05M Circulating Supply: 15.08M AAVE

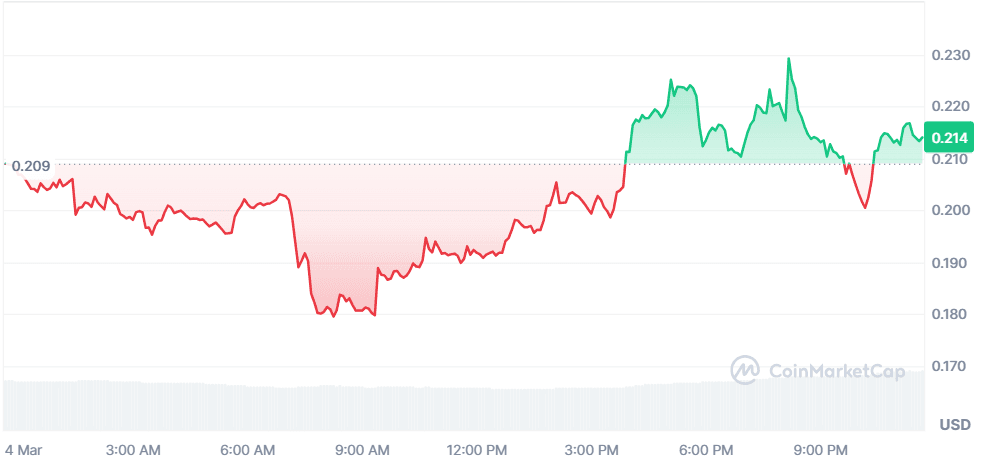

Peanut the Squirrel (PNUT)

Price Change (24H): +2.05% Current Price: $0.2131

What happened today

PNUT has seen steady gains, trading near its 24-hour high of $0.2319, reflecting strong bullish sentiment. The price movement suggests a potential breakout, with key resistance at $0.2319 and support at $0.1858. Increased trading volume and a positive MACD trend indicate that market interest in PNUT is growing. If the bullish momentum continues, PNUT could surpass its resistance level, potentially setting new highs.

Market Cap: $213.14M 24-Hour Trading Volume: $515.23M Circulating Supply: 999.85M PNUT

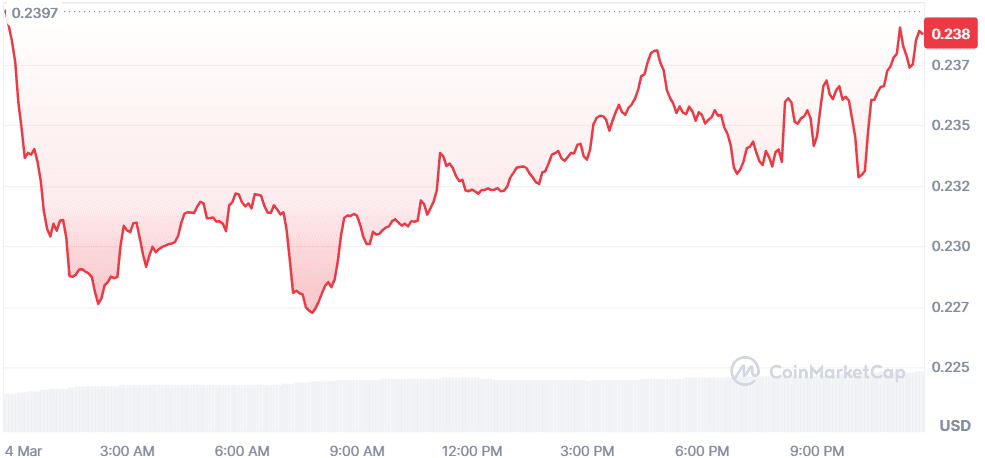

Tron (TRX)

Price Change (24H): -0.41% Current Price: $0.2387

What happened today

Tron faced a setback after reports emerged of a $3.1M exploit affecting an unknown TRX wallet. Blockchain investigator ZachXBT linked this incident to the 2023 Fantom Foundation hack, raising concerns about potential vulnerabilities. The attacker quickly transferred stolen funds to Ethereum and laundered them via Tornado Cash. While TRX remains stable, the breach underscores the need for enhanced security measures within the Tron ecosystem.

Market Cap: $20.54B 24-Hour Trading Volume: $1.14B Circulating Supply: 86.05B TRX

Closing Thoughts

The tokenization sector is seeing increased interest, as evidenced by WhiteRock’s explosive rally. The integration of real-world assets (RWA) with traditional securities exchanges like NASDAQ and NYSE is a game-changer, and investors are clearly taking notice. Similarly, Solv Protocol’s structured financial products and staking incentives continue to attract strong demand. This suggests that DeFi and tokenization solutions that offer real-world financial utility are gaining traction, especially as institutions explore blockchain integration.

The DeFi sector is another area with significant movement, especially with Aave’s expansion into Sonic. Its deployment marks yet another step in the evolution of on-chain lending, and the ecosystem’s incentive program is likely to attract liquidity providers. However, not all market trends are bullish—Tron’s price stagnation amid security concerns highlights lingering risks in the space. Meanwhile, PNUT’s strong trading volume suggests retail traders are still actively speculating on mid-cap tokens. Overall, the day’s trends reveal a market where institutional adoption and real-world integration are driving positive sentiment, but security vulnerabilities and speculative volatility remain key risk factors.

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial or legal advice. Always conduct your own research or consult a professional when dealing with cryptocurrency assets.