A mix of regulation-fueled optimism, speculative frenzy, and low-cap momentum defined today’s crypto spotlight. Alchemy Pay (ACH) sparked attention after securing a key U.S. license, while Ghibli rode a meme-fueled rally following a viral Elon Musk-themed post.

Ardor (ARDR) shot up with no direct catalyst, hinting at whale action or market makers at play. Meanwhile, Alpha Quark Token (AQT) and Bubb (BUBB) benefitted from liquidity-driven activity and ecosystem visibility despite mixed fundamental news. The day clearly belonged to altcoins and memecoins, especially ones with strong narratives or fast-moving communities behind them.

Ardor (ARDR)

Price Change (24H): +52.43% Current Price: $0.08763

What happened today

Ardor exploded over 52% today, largely driven by a massive uptick in trading volume, which surged over 1200% in 24 hours to reach $201M. The coin’s market cap also rose sharply, now hovering around $87.49M. There is no single news catalyst identified, suggesting this spike may be a result of speculative trading momentum or community-driven buying patterns in the altcoin space.

Market Cap: $87.49M 24-Hour Trading Volume: $201.11M Circulating Supply: 998.46M ARDR

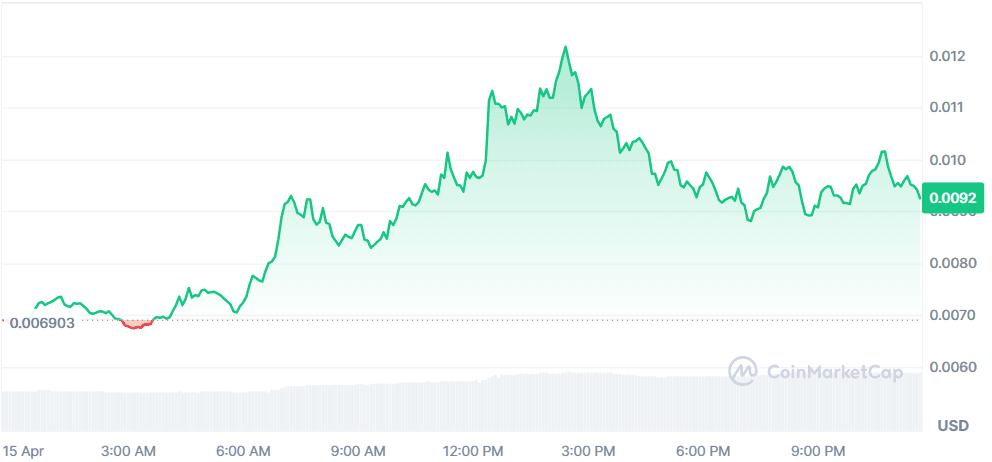

Ghiblification (Ghibli)

Price Change (24H): +33.72% Current Price: $0.009222

What happened today

Ghibli’s price was boosted following community hype fueled by a viral Elon Musk anime-style post and heavy traction on social platforms like Twitter and Telegram. The coin also witnessed significant activity on PumpSwap with nearly equal buy/sell volume and over 28K transactions in 24 hours, showcasing solid interest from traders.

Market Cap: $9.22M 24-Hour Trading Volume: $37.93M Circulating Supply: 999.9M GHIBLI

Bubb (BUBB)

Price Change (24H): +24.01% Current Price: $0.002769

What happened today

Bubb posted solid gains despite being disqualified from BNB Chain’s $100M Liquidity Incentive Program for not meeting criteria related to top holder concentration and user activity. However, it remains eligible for future batches. Its visibility through the program and listing mentions may have provided enough momentum to attract speculative interest.

Market Cap: $2.76M 24-Hour Trading Volume: $14.54M Circulating Supply: 1B BUBB

Alpha Quark Token (AQT)

Price Change (24H): +23.60% Current Price: $1.83

What happened today

AQT’s strong 24H performance appears to be tied to broader altcoin momentum and increased investor appetite for low-cap tokens with solid fundamentals. With a daily volume of $179M and a relatively low supply of 30M tokens, volatility works in its favor. There is no specific news, indicating this could be a technical or trader-led breakout.

Market Cap: $49.25M 24-Hour Trading Volume: $179.26M Circulating Supply: 26.8M AQT

Alchemy Pay (ACH)

Price Change (24H): +23.59% Current Price: $0.02851

What happened today

Alchemy Pay jumped after announcing it obtained a Money Transmitter License (MTL) in Arizona, marking its 9th license in the U.S. This expansion supports their long-term compliance strategy in the fiat-crypto payments space. Additionally, its new partnership with Ethena Labs offers seamless fiat-to-crypto ramps for ENA and USDe purchases using Visa/Mastercard.

Market Cap: $254.38M 24-Hour Trading Volume: $209.54M Circulating Supply: 8.92B ACH

Global Market Overview

U.S. markets showed restrained activity today as investors processed Q1 earnings and reacted to softening tariff tensions. The S&P 500 and Nasdaq dipped slightly, while the VIX dropped below 30, reflecting easing volatility. Financial stocks led some recovery momentum, while tech and healthcare remained mixed. Sentiment remains cautious as tariff-related policy swings and earnings revisions keep uncertainty high.

Closing Thoughts

Investor sentiment remains cautiously optimistic in both the crypto and global financial spaces. On Wall Street, volatility has eased post-tariff scare, with the VIX dipping below 30. While the Dow and S&P 500 saw minor pullbacks, strong earnings from major banks like Bank of America kept traders grounded. This signals a maturing attitude among investors: momentary policy shocks might still trigger swings, but they are no longer dictating trend direction entirely.

In crypto, memecoins and payment-related tokens dominated trader interest. Community-driven assets like Ghibli showed how social virality translates into volume, while ACH's licensing momentum reminded investors that compliance still pays in the long term. With volumes pouring into microcaps and speculative sectors, this cycle seems increasingly driven by hype, headlines, and short-term catalysts. The broader market feels like it’s holding its breath—relief rally on one side, cautious repositioning on the other.