In the wake of Bitcoin’s relative calm, altcoins are fighting for the spotlight - and today’s biggest moves came from unexpected corners.

From a meme coin rally led by Retard Finder Coin to a nostalgic resurgence of LimeWire, and a surprise comeback from AirSwap, the market has been buzzing. Meanwhile, solid performers like Alpha Quark Token and MiL.k showed that fundamentals still matter in a speculative sea. These five coins stole the show, driven by viral hype, ecosystem updates, and sharp rebounds.

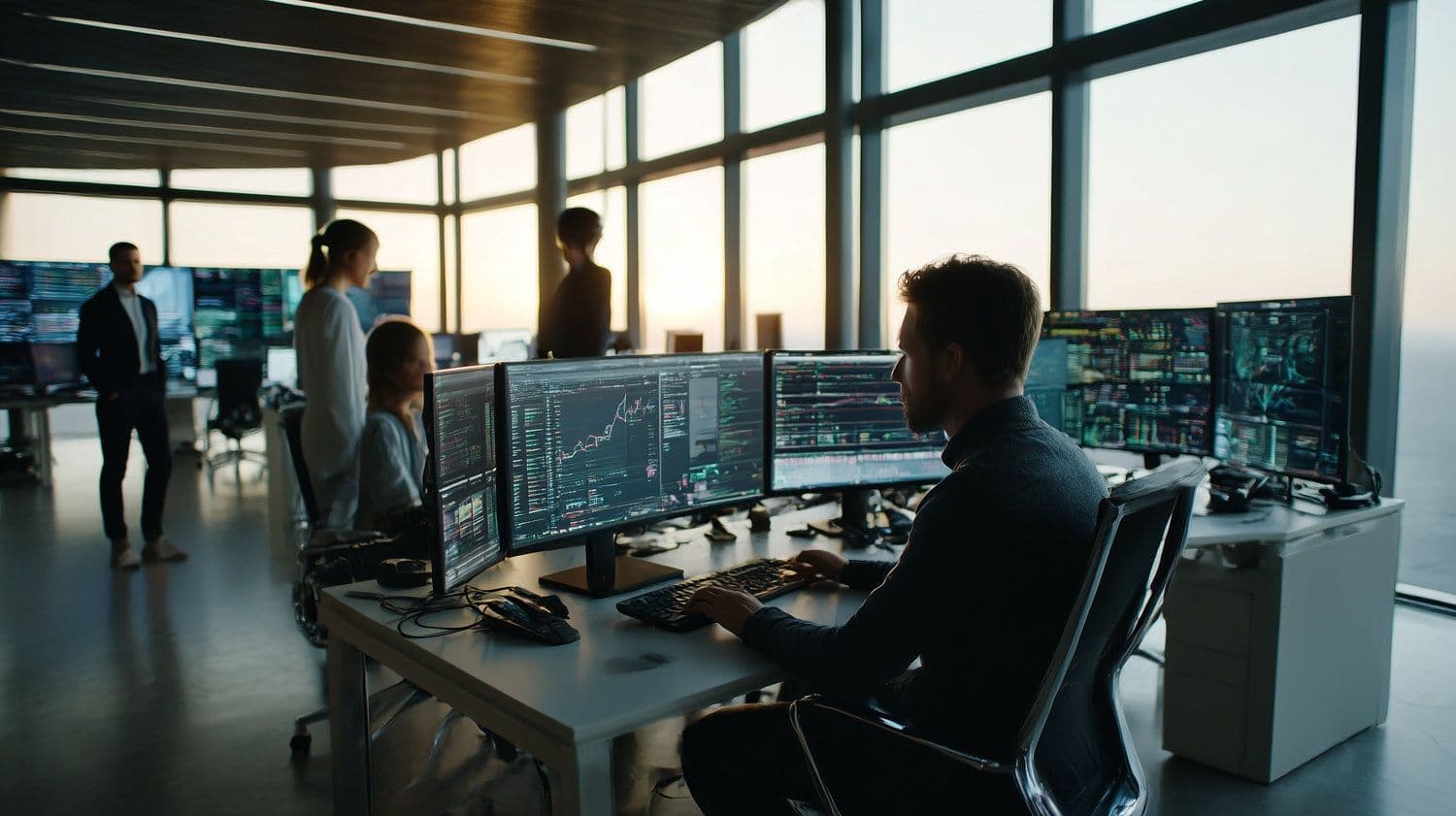

Retard Finder Coin (RFC)

Price Change (24H): +66.41% Current Price: $0.05039

What happened today

Retard Finder Coin surged over 66% in 24 hours, defying broader market conditions. Community engagement on X has skyrocketed, with hype from prominent influencers and even mentions of attention from Trump-followed accounts. Despite market uncertainty, RFC’s momentum shows no signs of slowing as it draws meme coin energy from the Solana ecosystem.

Market Cap: $48.45M 24-Hour Trading Volume: $29.84M Circulating Supply: 961.55M RFC

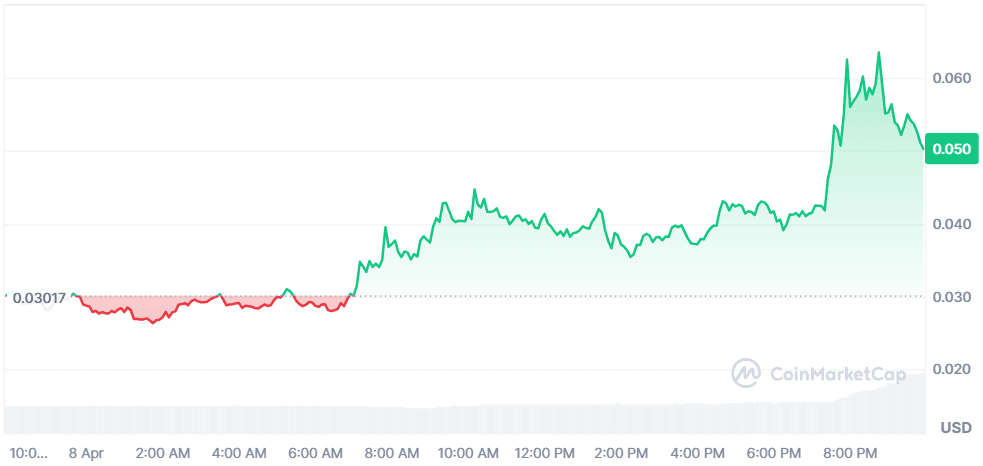

Alpha Quark Token (AQT)

Price Change (24H): +18.12% Current Price: $1.21

What happened today

Alpha Quark Token posted strong intraday gains, climbing over 18%. Volume exploded to $126M+, suggesting accumulation by larger players. The coin’s steady uptrend and increased interest point to renewed institutional or ecosystem activity. Traders are closely watching for a potential breakout continuation.

Market Cap: $32.47M 24-Hour Trading Volume: $126.67M Circulating Supply: 26.8M AQT

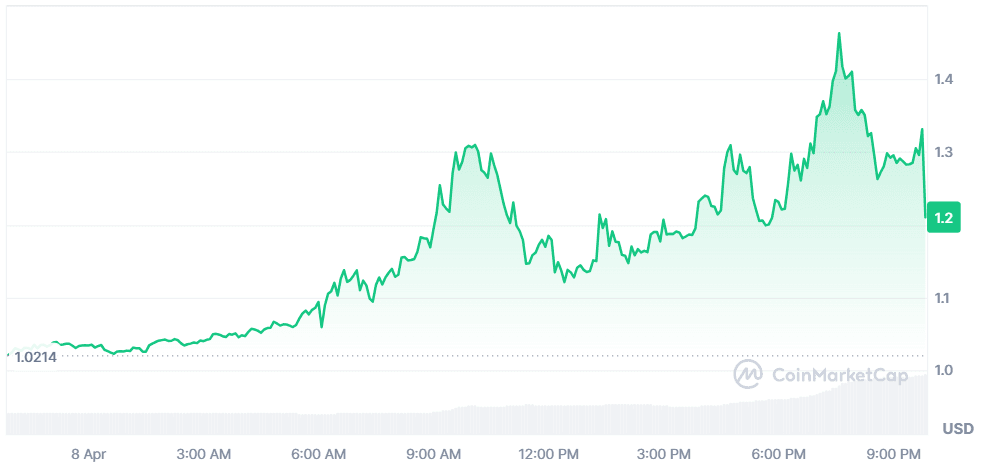

MiL.k (MLK)

Price Change (24H): +16.66% Current Price: $0.1629

What happened today

MiL.k jumped over 16% today amid renewed activity. The coin saw strong buying pressure around midday, causing a sharp price rally. With over $56M in 24H trading volume and a circulating supply below 450M, MLK could be gearing up for further upside if bullish sentiment continues.

Market Cap: $72.95M 24-Hour Trading Volume: $56.41M Circulating Supply: 447.76M MLK

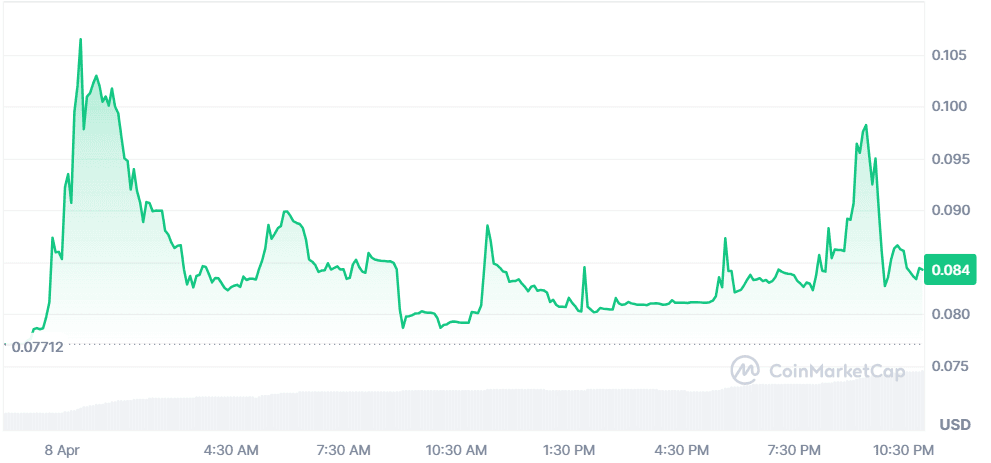

LimeWire (LMWR)

Price Change (24H): +9.27% Current Price: $0.08428

What happened today

LimeWire DeFi pools are expanding rapidly with over 16 million LMWR locked, fueling speculation and pushing the price up nearly 10%. The brand has been steadily climbing the charts seemingly outside the bubble of global market crashes, as expected from the OG brand.

Market Cap: $27.49M 24-Hour Trading Volume: $15.97M Circulating Supply: 326.24M LMWR

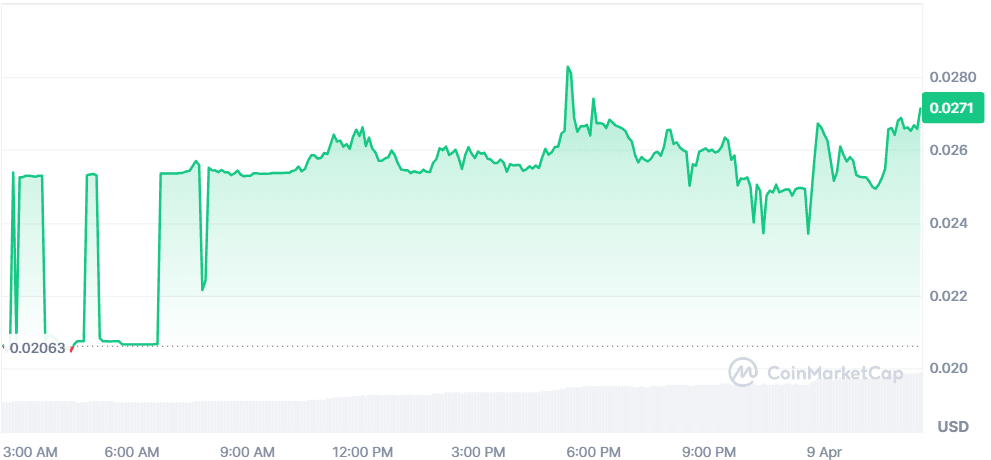

AirSwap (AST)

Price Change (24H): +30.15% Current Price: $0.02684

What happened today

AirSwap rebounded strongly after FUD surrounding its Binance delisting was clarified. A community member confirmed the project will be re-listed with a USDC pair. On-chain activity remains solid, with $194.5M in YTD volume and steady staking. Long-term supporters continue to hold, citing AirSwap’s OG status since 2018.

Market Cap: $4.68M 24-Hour Trading Volume: $4.44M Circulating Supply: 174.47M AST

#Global Financial Snapshot

Markets in Flux as U.S.–China Trade War Escalates

U.S. stock markets turned red after Washington announced 104% duties on Chinese imports, triggering fears of a global recession. Meanwhile, the euro gained following reports of a possible German coalition government, and oil prices dipped on recession concerns. Despite the turmoil, Asian markets bounced back sharply - Tokyo up 6%, Shanghai 1.6% - and optimism lingers with upcoming earnings reports from major banks.

Closing Thoughts

Investor sentiment is swinging toward high-volatility assets, particularly meme coins and comeback tokens. Retard Finder Coin's massive surge despite a weak broader market highlights the enduring power of community-driven momentum and social media hype. Similarly, Limewire is riding the wave of DeFi excitement with locked token pools, while AirSwap is benefiting from renewed faith post-Binance delisting drama. There’s a clear appetite for high-risk, high-reward plays—especially those tied to nostalgia or social narrative.

However, the traditional global markets are sounding a more cautious tone. With escalating U.S.–China trade tensions, falling oil prices, and jittery equity indices, crypto seems to be moving independently once again.

Altcoins with active ecosystems and strong community engagement are pulling in participation, showing that traders are temporarily stepping away from macro fears and focusing on faster, speculative gains. The day’s leaders suggest the meme and DeFi segments are currently drawing the most action, while legacy projects are seeing quiet accumulation or recovery.