In a market still adjusting to macroeconomic tension, today’s crypto leaderboard lit up with some explosive movers. XCN’s Binance Futures listing sent its volume soaring, while ORCA stole headlines with a bold governance proposal promising $10M in buybacks and a 25% supply burn.

Meme favorite BUTTCOIN continued its viral streak, and LOOM remained active despite erratic spikes, showing the resilience of speculative assets. Meanwhile, SynFutures (F) gained attention for its dominance on the Blast network, rounding out a day that clearly favored utility-backed altcoins and community-driven narratives.

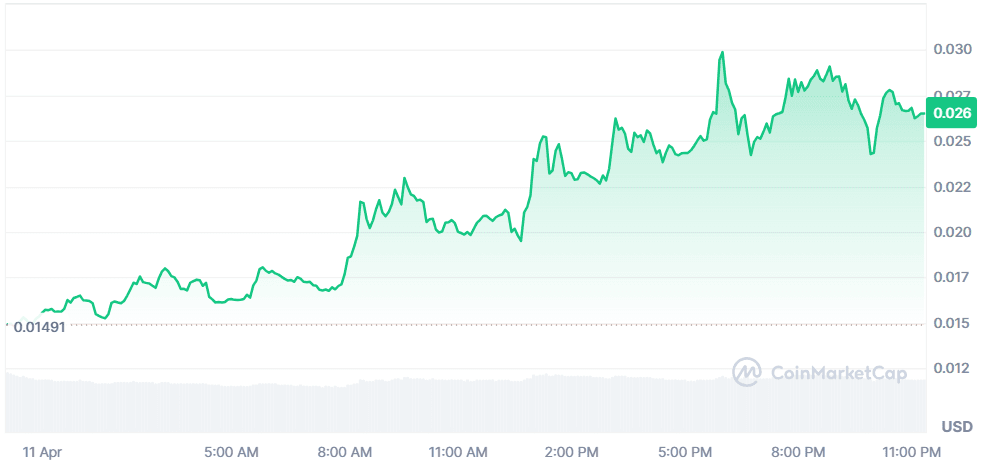

The Next Bitcoin (BUTTCOIN)

Price Change (24H): +78.66% Current Price: $0.02650

What happened today

BUTTCOIN saw a massive 78% surge in price today, likely driven by increased retail interest and social hype due to its meme-like branding. While the volume dropped slightly (-8.20%), the sharp price spike indicates strong momentum trading and speculative activity dominating the charts.

Market Cap: $26.47M 24-Hour Trading Volume: $13.86M Circulating Supply: 999.15M BUTTCOIN

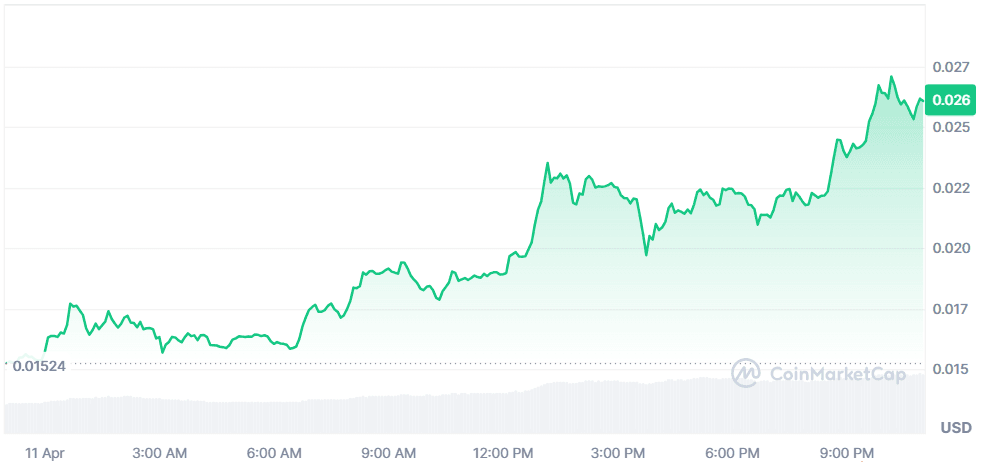

Loom Network (LOOM)

Price Change (24H): +75.98% Current Price: $0.03250

What happened today

LOOM experienced a notable price spike today, climbing over 75% as volume increased by more than 45%. The sharp and sudden movements on the chart suggest high-frequency trading or bot-driven spikes. Traders are also reacting to Loom Network's recent migration to a new token address, a technical change that often draws investor attention.

Market Cap: $40.4M 24-Hour Trading Volume: $17.15M Circulating Supply: 1.24B LOOM

Onyxcoin (XCN)

Price Change (24H): +70.16% Current Price: $0.02613

What happened today

XCN surged following its listing on Binance Futures on April 11, 2025, at 21:00. This high-profile listing significantly boosted visibility and sparked trader interest, reflected in its massive 93.72% jump in 24-hour volume.

Market Cap: $867.98M 24-Hour Trading Volume: $674.27M Circulating Supply: 33.2B XCN

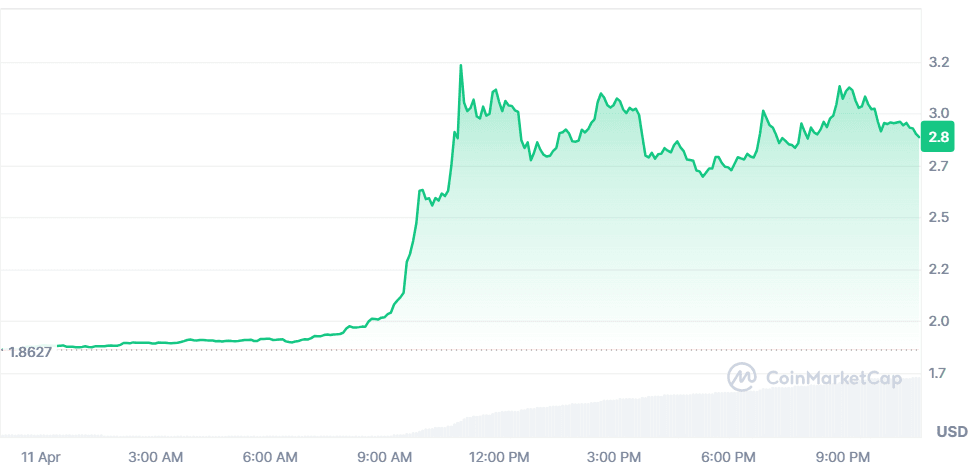

Orca (ORCA)

Price Change (24H): +55.84% Current Price: $2.90

What happened today

ORCA rallied strongly after the Orca Governance Council submitted a major proposal involving staking rewards, $10M buybacks, a 25% token supply burn, and over two years of dev funding. This was coupled with the launch of Liquidity Terminal Phase 2, which enhances LP management, significantly increasing trading activity on the platform.

Market Cap: $162.05M 24-Hour Trading Volume: $585.87M Circulating Supply: 55.77M ORCA

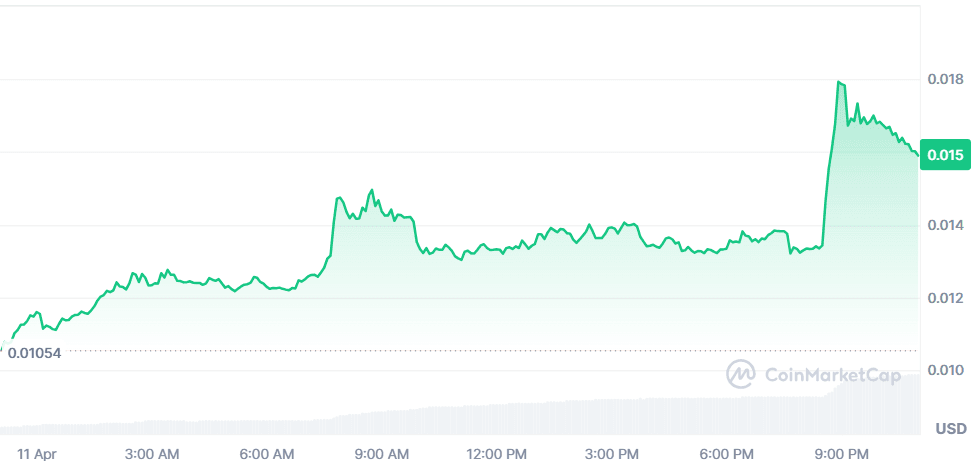

SynFutures (F)

Price Change (24H): +49.54% Current Price: $0.01611

//What happened today**

F token soared nearly 50% after SynFutures published a high-engagement recap of their Blast network performance. Highlights included over $180B in trading volume, rapid onboarding of permissionless pairs, and consistent engagement from a degen-native community—positioning SynFutures as the #1 perp DEX on Blast.

Market Cap: $26.12M 24-Hour Trading Volume: $43.04M Circulating Supply: 1.62B F

Global Market Snapshot

Investor sentiment remains tense as the global trade war continues to dominate headlines. U.S. Treasury yields surged, marking their biggest weekly rise in over two decades, while the dollar weakened sharply—dropping to decade lows against the Swiss franc. Meanwhile, gold soared past $3,200 an ounce, setting a new record. U.S. stocks climbed over 1% following strong bank earnings, but concerns about recession linger amid China’s retaliatory tariffs and deteriorating consumer sentiment. The financial world watches closely as volatility, fueled by geopolitical uncertainty, continues to ripple across both traditional and digital asset markets.

Closing Thoughts

The global financial scene today played a crucial backdrop to crypto’s momentum. U.S. bond yields surged at a historic pace, the dollar fell to multi-year lows against the Swiss franc, and gold breached $3,200 to hit another all-time high. Investors remain visibly shaken by the ongoing trade war, recession whispers, and unexpected consumer sentiment dips. Meanwhile, U.S. equities edged up thanks to strong banking earnings, suggesting cautious optimism in traditional markets.

Within the crypto sphere, investor sentiment skewed risk-on, but with a preference for coins with tangible activity - be it listings, tokenomics reform, or cross-chain utility. Governance tokens and protocol-native assets like ORCA and F saw more participation than memecoins or Layer 1s, pointing to a sector rotation in favor of ecosystem growth and protocol revenue. The market remains hyper-responsive to both platform innovation and macro triggers - suggesting that traders are actively hunting momentum in this uncertain yet opportunistic environment.