Toncoin’s payment pivot, Mask’s technical breakout, and MXC’s mining revival stole the spotlight today in a market brimming with selective optimism. As traditional finance cools ahead of Nvidia’s earnings and Fed minutes, crypto traders appeared to chase high-volatility narratives.

CETUS clawed back trust after a major recovery vote, while BUILDon posted modest gains on fresh exchange listings and partnerships. From AI-powered tokens to protocol-level reversals, today's top movers reflect an appetite for high-conviction plays across both centralized and decentralized narratives.

Toncoin (TON)

Price Change (24H): +13.02% Current Price: $3.39

What happened today

Toncoin surged over 13% amid a flurry of positive developments. Telegram’s recent $1.5B bond raise drew institutional players like BlackRock and Citadel which sparked speculation around an IPO, lifting sentiment across its ecosystem. Meanwhile, a major payment push led by ex-Visa crypto lead Nikola Plecas signals TON’s intent to become a true payment infrastructure layer. Adding to the excitement, a new partnership between Telegram and Elon Musk’s xAI will integrate AI-powered "Grok" into Telegram, monetizing activity and potentially increasing Toncoin's utility. Technical traders are also eyeing a breakout, with resistance targeted at $4.55.

Market Cap: $8.47B 24-Hour Trading Volume: $855.64M Circulating Supply: 2.49B TON

Mask Network (MASK)

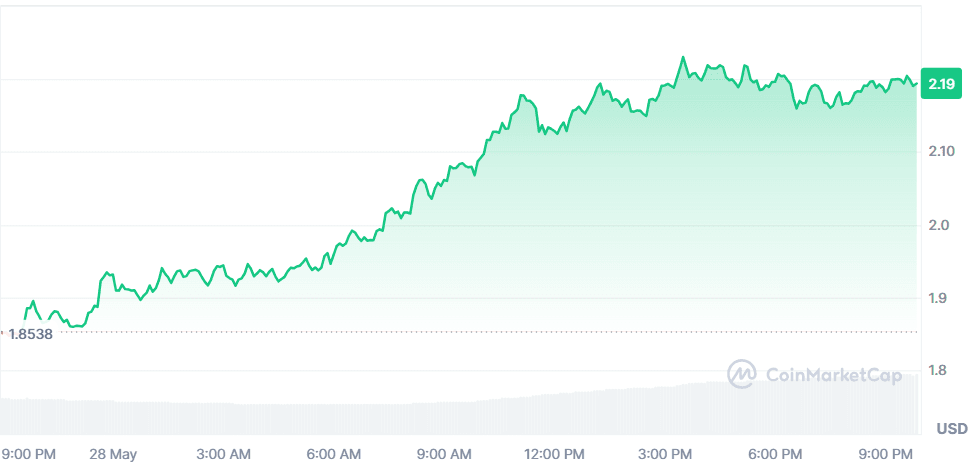

Price Change (24H): +16.92% Current Price: $2.19

What happened today

MASK surged nearly 17% today, breaking out from a multi-week ascending triangle pattern on the daily chart—a classic bullish continuation setup. The price pushed through a key resistance at $2.10, with volume rising significantly to confirm the breakout. Technical indicators are supporting this upward momentum: the RSI (Relative Strength Index) has entered bullish territory above 60, suggesting sustained buying pressure, while the MACD line has crossed above the signal line, indicating a fresh bullish reversal. Bollinger Bands show a widening formation, with the price hugging the upper band—commonly interpreted as a strong breakout in progress rather than overbought noise.

Market Cap: $219.93M 24-Hour Trading Volume: $290.46M Circulating Supply: 100M MASK

Cetus Protocol (CETUS)

Price Change (24H): +16.88% Current Price: $0.1595

What happened today

Cetus Protocol recovered sharply following news that the SUI community voted to unlock $162M worth of frozen assets stolen in a recent hack. The funds will be redirected via a multisig wallet co-managed by the Sui Foundation and OtterSec, with plans to fully reimburse affected users. The rapid recovery action and strong validator support restored some trader confidence. CETUS’s price reflects both relief and optimism, although debates around decentralization persist after validators intervened to blacklist hacker wallets.

Market Cap: $115.74M ** 24-Hour Trading Volume:** $224.67M Circulating Supply: 725.22M CETUS

BUILDon (B)

Price Change (24H): +5.90% Current Price: $0.3943

What happened today

BUILDon gained momentum after Aster DEX announced $B as the first perpetual trading pair with up to 25x leverage, accompanied by a $5,000 giveaway. Another catalyst was BUILDon’s new partnership with Lista DAO to expand use cases for USD1 within the BNB Chain ecosystem. These developments have added short-term excitement and reflect efforts to boost real-world application and community activity around the BUILDon ecosystem.

Market Cap: $394.34M 24-Hour Trading Volume: $331.59M Circulating Supply: 1B B

Moonchain (MXC)

Price Change (24H): +217.33% Current Price: $0.002272

What happened today

Moonchain rocketed over 217% after a social media post declared “$MXC MINING IS BACK!”, reviving interest in the network’s core utility proposition. This rally follows months of inactivity and a massive price crash from its 2022 highs. MXC recently completed a migration to a Layer-3 zkEVM network to enhance scalability and utility. The relaunch of mining appears to be the spark the community needed to start building momentum again, although sustainability remains to be seen.

Market Cap: $6.7M 24-Hour Trading Volume: $8.85M Circulating Supply: 2.94B MXC

Global Market Snapshot

Global markets traded cautiously on Wednesday as investors awaited Nvidia’s earnings and the Federal Reserve’s meeting minutes. The S&P 500 dipped 0.3%, the Dow lost 147 points, and the Nasdaq edged down 0.1%. Nvidia, expected to post 66% revenue growth, faces mounting pressure after a $5.5 billion inventory write-down tied to U.S. export restrictions to China. Meanwhile, rising bond yields, particularly the 30-year yield crossing the 5% mark, added to investor unease, alongside mixed earnings reports and continued macroeconomic headwinds.

Sentiment was further weighed down by record-low business confidence in China among European firms. According to the EU Chamber of Commerce’s latest survey, 73% of respondents said doing business in China became harder in the past year, with only 12% optimistic about future profitability. Despite ongoing supply chain dependence, companies are reevaluating expansion plans due to regulatory hurdles and geopolitical tension. In commodities, oil gained after OPEC+ reaffirmed existing output cuts, with Brent climbing 1.5% to $65.06 and WTI rising 1.76% to $61.96, supported by expectations of rising summer demand.

Closing Thoughts

Investor sentiment across global markets remains cautious. Wall Street hesitated as bond yields crept above 5% and China-related uncertainties weighed heavily on European business outlooks. Tech stocks showed cracks, while energy markets found support from OPEC+ output coordination. Meanwhile, crypto traders leaned into risk-on behavior—favoring smaller caps and ecosystem-specific tokens with high narrative velocity.

The day’s crypto activity highlights a clear preference for projects linked to utility and momentum: Toncoin surged on real-world payment ambitions and Mask benefited from a textbook breakout setup. CETUS’ rebound shows the market's willingness to reward transparency and community responsiveness, while MXC’s explosive move underscores the continued power of miner-based narratives when paired with strong social sentiment. While traditional finance waits on macro signals, crypto continues to sprint ahead on story-driven speculation.