After a volatile week of mixed economic signals and institutional plays, the crypto market delivered a wave of momentum across niche sectors. NXPC stole the spotlight with its explosive debut, turning legacy IP MapleStory into a Web3 phenomenon.

Bitcoin hovered above $103K as institutional demand and sovereign adoption kept supply constrained. Meanwhile, Aethir extended its breakout rally, though signs of correction loom. Civic and MARBLEX joined the rally with double-digit surges as altcoin rotation intensified. The market buzzed with participation from both speculative gaming tokens and infrastructure projects with real use cases.

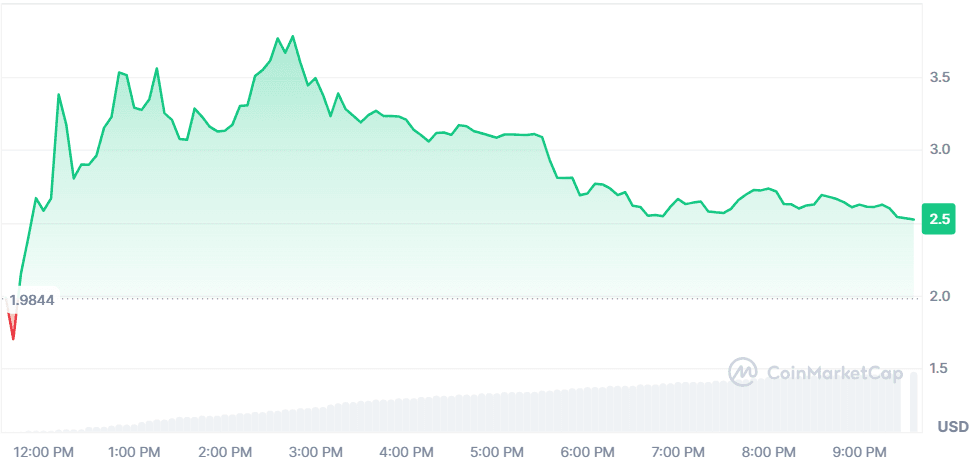

NEXPACE (NXPC)

Price Change (24H): +69.48% Current Price: $2.52

What happened today

NXPC soared after the official launch of MapleStory N, the blockchain version of the iconic MMORPG, under the MapleStory Universe (MSU). The NXPC token debuted on seven major exchanges including Binance and KuCoin. Built on Avalanche via AvaCloud, this launch enables real-world asset ownership, NFT economies, and a player-driven marketplace. The game integrates a fusion-fission model to maintain token value and curb inflation. Backed by gaming giant Nexon, this marks one of the most impactful Web3 gaming launches in recent years.

Market Cap: $425.99M 24-Hour Trading Volume: $1.76B Circulating Supply: 169.04M NXPC

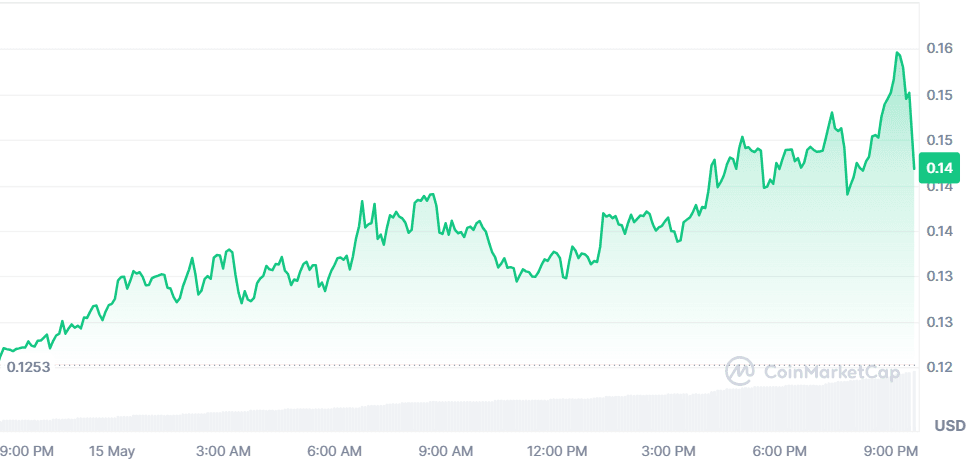

Aethir (ATH)

Price Change (24H): +18.01% Current Price: $0.05592

What happened today

ATHAfter a volatile week of mixed economic signals and institutional plays, the crypto market delivered a wave of momentum across niche sectors. NXPC stole the spotlight with its explosive debut, turning legacy IP MapleStory into a Web3 phenomenon. Bitcoin hovered above $103K as institutional demand and sovereign adoption kept supply constrained. Meanwhile, Aethir extended its breakout rally, though signs of correction loom. Civic and MARBLEX joined the rally with double-digit surges as altcoin rotation intensified. The market buzzed with participation from both speculative gaming tokens and infrastructure projects with real use cases. surged as it completed wave (iii) of a bullish Elliott Wave impulse following a breakout from long-term corrective patterns. Aethir also announced a Checker Node Buyback Program set to launch on May 22, allowing NFT holders to exit while helping stabilize node supply. While overbought conditions hint at a near-term correction, technicals suggest a pullback toward $0.042 could offer a new base before targeting the $0.065 resistance level.

Market Cap: $508.03M 24-Hour Trading Volume: $180.74M Circulating Supply: 9.08B ATH

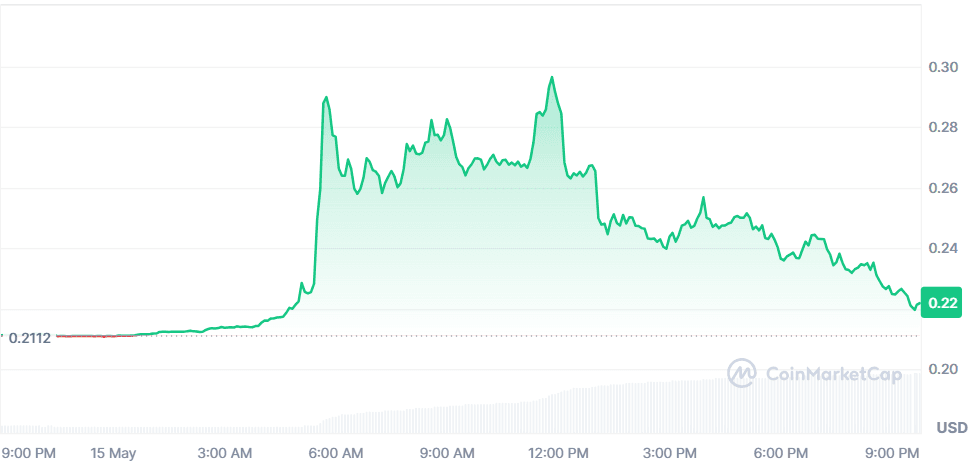

Civic (CVC)

Price Change (24H): +14.87% Current Price: $0.1467

What happened today

CVC gained traction, potentially due to growing interest in decentralized identity solutions and token revival sentiment. With full circulating supply unlocked and a relatively low market cap, Civic is benefiting from broader crypto sector momentum and renewed investor attention. No major ecosystem updates today, but price action aligns with rising liquidity inflows into altcoins with legacy narratives.

Market Cap: $146.78M 24-Hour Trading Volume: $185.95M Circulating Supply: 1B CVC

MARBLEX (MBX)

Price Change (24H): +4.93% Current Price: $0.2218

What happened today

MBX showed modest gains following steady upward price action from its recent multi-week rally. As a gaming-focused chain, the token is likely riding sentiment from NXPC's Web3 game debut. The high volume surge (+639%) indicates fresh interest or whale activity, despite no specific project news.

Market Cap: $46.23M 24-Hour Trading Volume: $20.42M Circulating Supply: 208.42M MBX

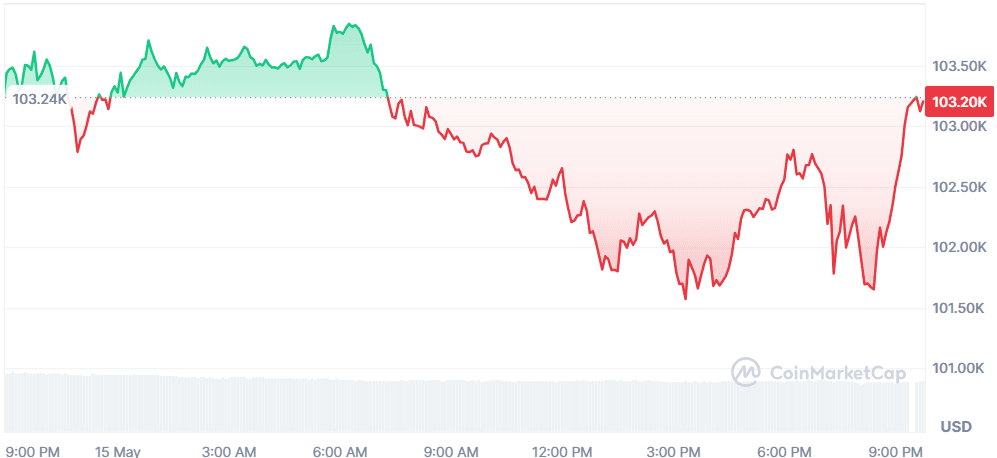

Bitcoin (BTC)

Price Change (24H): -0.09% Current Price: $103,262.86

What happened today

BTC remains in consolidation near $103K after briefly touching $105K following Tether’s massive $459M Bitcoin buy and launch of its institutional treasury company Twenty One. The supply shock narrative continues, with Coinbase logging 9,739 BTC outflows (over $1B) this week, signaling institutional accumulation. Political support for Bitcoin ETFs in South Korea, Ukraine's strategic reserve plans, and BlackRock’s own BTC purchases are adding further momentum. Technical resistance lies ahead, but institutional demand is tightening exchange supply.

Market Cap: $2.05T 24-Hour Trading Volume: $44.89B Circulating Supply: 19.86M BTC

Global Market Snapshot

U.S. equities extended their rally into the fourth day, with the Dow gaining 140 points and the S&P 500 rising 0.3%, buoyed by easing U.S.-China tariffs and strong tech earnings. Nvidia, Tesla, and Meta led the charge, while retail stocks posted their best week since 2023, fueled by Foot Locker’s 98% surge post-acquisition deal with Dick’s Sporting Goods.

Producer prices unexpectedly fell by 0.5% in April, signaling disinflation in services, while retail sales edged higher. However, concerns linger. Jamie Dimon warned that a U.S. recession isn’t off the table, and bond markets remain skeptical despite equity gains, reflecting caution around inflation and fiscal populism.

Oil prices fell over 3% as hopes of an Iran nuclear deal emerged, while Walmart posted better-than-expected earnings. Market sentiment has shifted to cautious optimism, the summer rally may depend on whether the breadth of gains can sustain beyond megacaps.

Closing Thoughts

Investor sentiment today leaned heavily into optimism—though not without caution. The strongest signals came from the gaming and infrastructure side of crypto, with NXPC and ATH reflecting rising appetite for Web3-native ecosystems with tangible utility. These coins aren’t just pumping on narrative anymore—they’re launching on major exchanges, rolling out real products, and drawing volume across multiple platforms. Simultaneously, Bitcoin’s rally is being sustained by supply dynamics, not just speculation. Massive institutional buys from Tether and BlackRock, plus sovereign interest from Ukraine, are anchoring BTC’s value narrative even as short-term price action cools off.

On the global side, risk-on appetite is returning slowly but surely. Retail stocks surged, major indices like the S&P 500 held gains, and disinflation signals from the U.S. PPI report gave equities more breathing room. Still, the bond market remains unconvinced, with yields resisting the equity euphoria. In crypto, that tension is mirrored in the split between long-term bullish structures and overbought RSI levels on altcoins. For now, institutional accumulation and breakout narratives are leading, but a healthy correction could shake out weaker hands before a potential summer rally gains full steam.