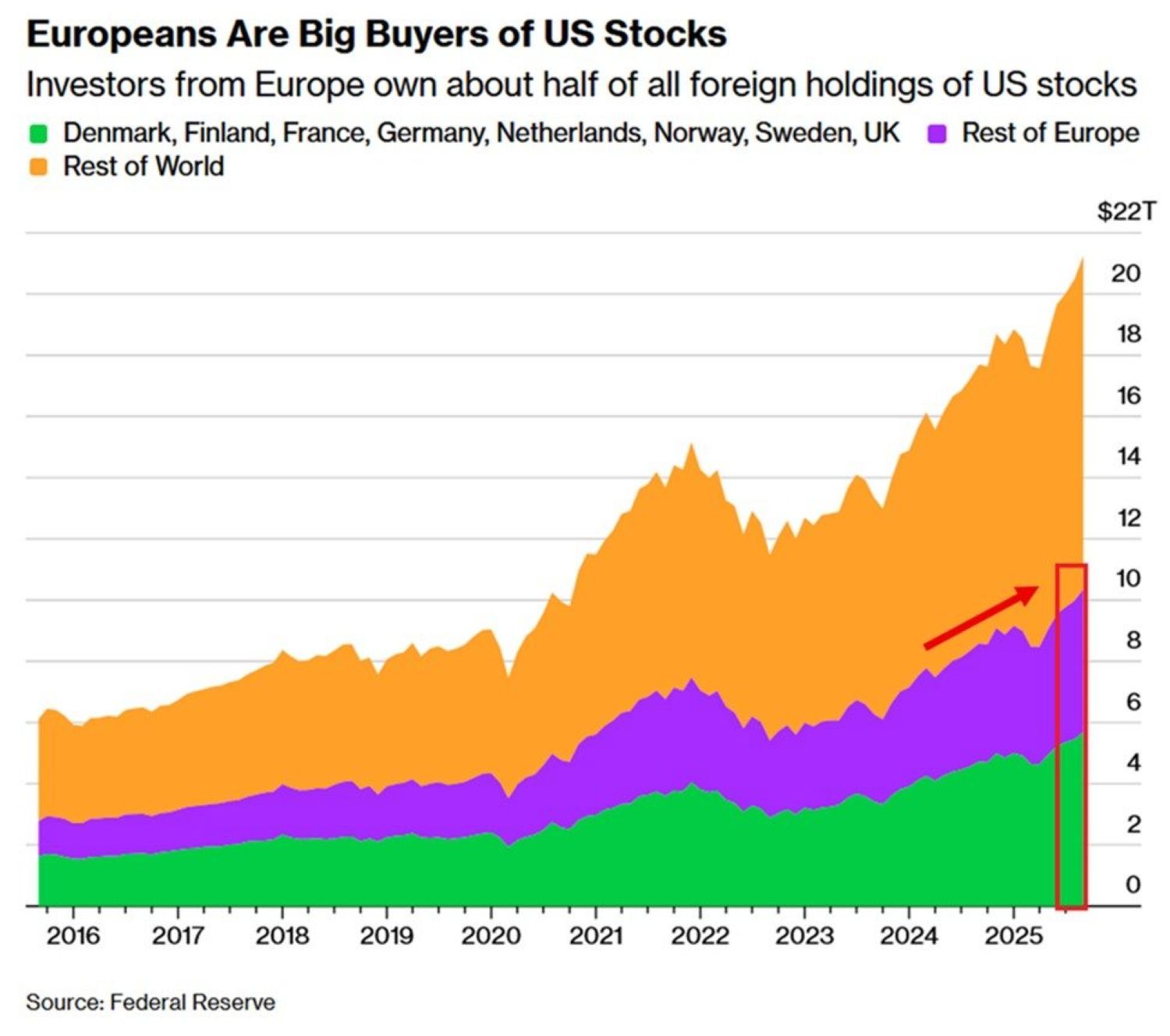

European investors have accumulated a record $10.4 trillion in U.S. equities, making Europe the single largest foreign owner of American stocks and accounting for nearly half of all foreign holdings, according to data.

The scale and speed of the shift highlight a structural reallocation of European capital toward U.S. markets at a time of rising geopolitical tension, trade frictions, and diverging economic trajectories between the two regions.

Concentration Of Ownership Reaches Unprecedented Levels

Data by the U.S. Federal Reserve shows European ownership of U.S. equities has surged by $4.9 trillion, or 91%, over the past three years.

Investors from Denmark, Finland, France, Germany, the Netherlands, Norway, Sweden, and the UK now collectively hold approximately $5.7 trillion in U.S. stocks, representing 55% of Europe’s total exposure to American equities.

By comparison, the rest of the world holds about $10.9 trillion in U.S. stocks, placing Europe’s share at roughly 49% of all foreign ownership.

Federal Reserve data illustrated in the chart above shows European holdings accelerating sharply since 2020, continuing to rise through periods of tighter monetary policy and escalating trade disputes.

The surge suggests that European investors are not merely reallocating tactically but increasingly relying on U.S. markets as the primary destination for equity capital.

Capital Flight From Europe, Not Just Confidence In The U.S.

While the inflows reflect confidence in U.S. corporate earnings and market depth, analysts note the trend also highlights persistent structural challenges within European capital markets.

Slower growth, fragmented equity markets, and limited domestic investment opportunities have pushed pension funds, insurers, and asset managers to seek returns abroad.

Also Read: Are We On The Cusp Of A Bear Market As Crypto Liquidity Drains And Metals Rally?

The timing is notable.

Europe’s exposure to U.S. equities has reached record levels despite ongoing trade tensions and political uncertainty, suggesting capital is prioritizing liquidity and scale over geographic diversification.

This dynamic increases Europe’s sensitivity to U.S.-specific risks, including fiscal policy shifts, regulatory changes, and election-driven volatility.

Rising Interdependence Carries Systemic Implications

The growing concentration of European wealth in U.S. equities creates a tighter financial linkage between the two economies.

Any sharp correction in U.S. markets would now transmit more directly into European household wealth, pension funding ratios, and institutional balance sheets.

At the same time, Europe’s rising dependence on U.S. capital markets may constrain its policy flexibility, as financial stability becomes increasingly tied to decisions made outside the region.

Rather than a simple story of bullish sentiment, the data points to a deeper structural reality, where European capital is increasingly underwriting U.S. equity markets at a moment when global economic and political fragmentation is intensifying.

That concentration leaves Europe more exposed than at any point in recent history to the direction of U.S. markets and the policies that shape them.

Read Next: From Hype To Liquidity: Data Shows Bitcoin Now Responds Only To Real Capital, Not Sentiment