This week has been nothing short of a blood bath for both the crypto and stock markets. Red everywhere. Amid the chaos, only a handful of memecoins have managed to grab attention - and even fewer have posted gains. A large part of the market downturn can be traced back to renewed global uncertainty triggered by escalating tariff rhetoric from the U.S., adding pressure on already-fragile investor sentiment.

Most coins have either flatlined or plunged, with some retail interest shifting to smaller-cap assets in hopes of a quick rebound. Among the noise, MIU made the loudest entrance, skyrocketing despite the broader downturn, while bigger names like DOGE and TRUMP slid further into the red.

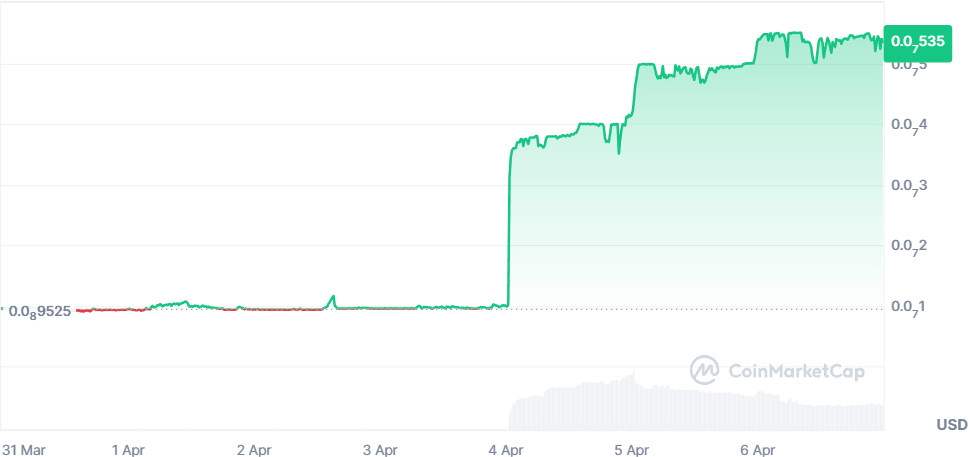

MIU (MIU)

Price Change (7D): +458.61% Current Price: $0.5353

News

MIU has experienced an explosive growth in its user base, crossing major milestones of 10K and 50K holders, and is now approaching the 100K mark. The community, dubbed the "MIU Army", is rallying with enthusiasm, suggesting strong social sentiment and community-driven momentum behind the project.

Forecast

MIU saw a parabolic rally from sub-$0.1 to over $0.5 in just a few days, indicating extremely high volatility. The Relative Strength Index (RSI) is likely in overbought territory (>80), signaling a potential short-term correction. However, if bullish momentum holds, next resistance lies near $0.75. A healthy pullback to $0.30 would offer a more stable reentry point.

Dogecoin (DOGE)

Price Change (7D): -8.11% Current Price: $0.1554

News

The Dogecoin Foundation has established a 10 million DOGE reserve to enhance transaction efficiency and support its ecosystem growth. Analyst Ali Martinez highlighted $0.16 as a pivotal level, projecting a potential rally to $0.57 if support holds, or a steep drop to $0.06 if it fails. Despite bearish movement this week, the DOGE community remains optimistic.

Forecast

DOGE is testing the $0.16 support. If this level holds, RSI currently around 40 suggests room for upward movement. A breakout above $0.18 could set the stage for a run toward $0.25. However, failure to hold support may lead to a downward spiral toward $0.12 and even $0.06. Caution advised unless strong reversal signals appear.

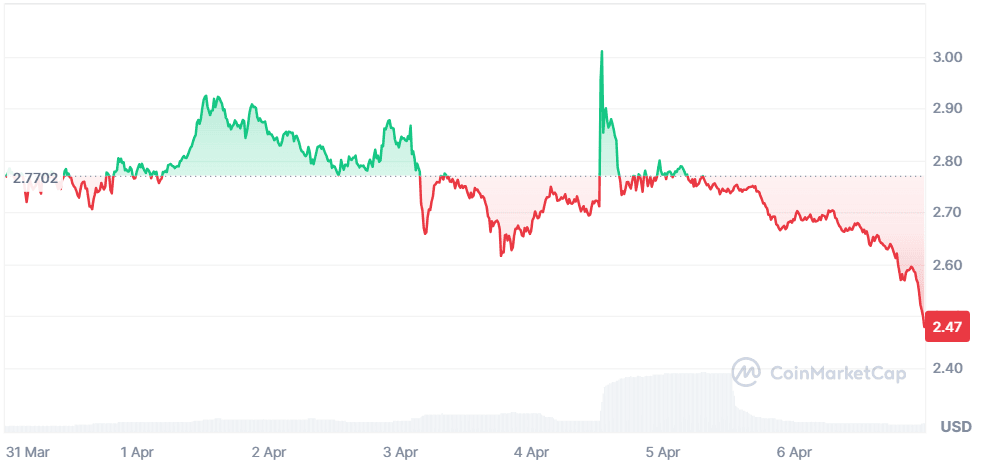

Filecoin (FIL)

Price Change (7D): -11.06% Current Price: $2.46

News

Filecoin has expanded its ecosystem with recent listings on Upbit and significant progress in decentralized compute. It now supports Ethereum contract redeployment and is working with DeepSeek AI, while already enabling 3 million transactions via 4,700 smart contracts. This positions FIL strongly in the decentralized storage and AI-integrated blockchain space.

Forecast

FIL has broken below key support at $2.70, testing lower levels. RSI sits near 35, approaching oversold territory. A rebound may occur near $2.30, with resistance at $2.70 and $2.95. Further downside could test $2.10. Long-term sentiment hinges on broader market recovery and adoption of its Web3 infrastructure.

OFFICIAL TRUMP (TRUMP)

Price Change (7D): -17.12% Current Price: $8.43

News

The TRUMP token has witnessed high volatility, possibly linked to broader political events and speculative trading. Despite a sharp 17% drop this week, daily trading volume surged by 74.33%, indicating increased investor attention. The circulating supply remains low relative to total supply, which may influence price swings in the short term.

Forecast

TRUMP fell from $10+ to $8.43 with strong bearish momentum. RSI is trending below 40, suggesting negative sentiment. If the token fails to reclaim $9, it could test support around $7.50. Upside resistance lies at $10.20. Given the speculative nature, traders should brace for sharp price action on both ends.

Closing Thoughts

This week's charts clearly reflect a risk-off sentiment. Even traditionally speculative sectors like memecoins couldn't escape the storm. What stood out, however, was the surge in community-driven, ultra-low-cap tokens like MIU, suggesting that traders are still hunting for volatility plays - but in newer arenas. Meanwhile, large-cap memecoins such as DOGE and TRUMP have shown they’re not immune to macroeconomic pressures, with price action closely mirroring market-wide fear.

DeFi and infrastructure tokens like Filecoin, which typically attract attention during tech-oriented rallies, also struggled - pointing to an overall lack of conviction from institutional and retail investors alike. The only real “action” is in emerging community coins, where new holders are piling in fast, hoping to ride early waves.

If this trend continues, we may see a short-term rotation toward newer, untested tokens while blue-chip memecoins and utility tokens take a back seat under macro pressure.