The team behind the Solana-based TRUMP meme coin transferred 3.527 million TRUMP tokens, valued at approximately $32.8 million, to Binance on June 21. This latest transfer adds to a growing series of exchange-bound movements, totaling over $150 million since April, and has raised significant concerns among investors about transparency, market manipulation, and political entanglement.

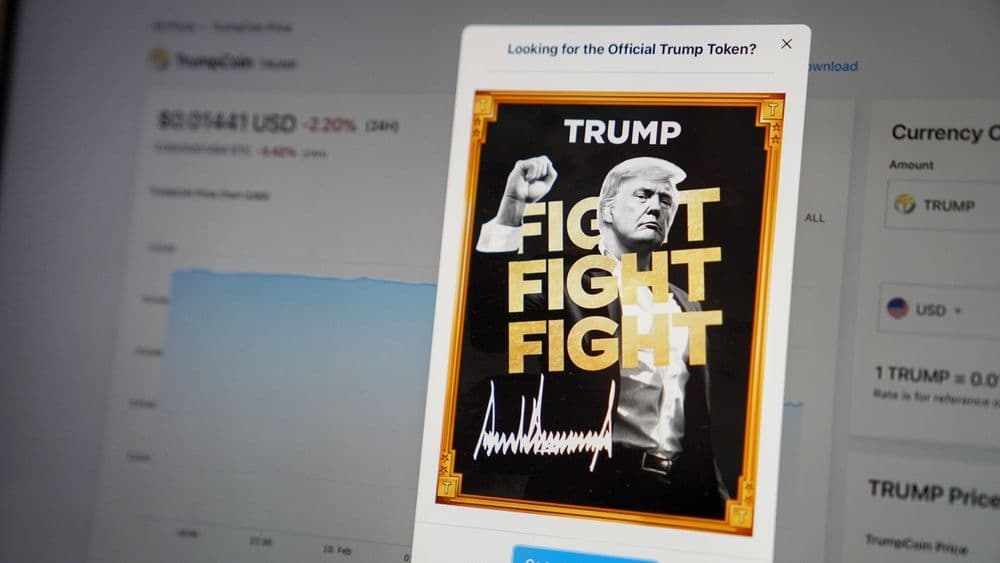

Despite initial hype around the TRUMP token - widely speculated to be aligned with U.S. President Donald Trump’s growing interest in crypto - its price has plummeted by over 90% from its January high of $75, falling to $8.68 at press time.

According to blockchain analytics platform Lookonchain, the TRUMP coin team has made repeated large-volume transfers to centralized exchanges such as Binance, OKX, and Bybit. Since late April, more than 12.5 million tokens have been sent to exchanges, suggesting a coordinated strategy to liquidate or manage large holdings under the guise of "liquidity provisioning."

These transactions have stirred unease across the crypto community. Market watchers argue that such high-frequency deposits from team-associated wallets can undermine trust, particularly in the absence of clear, on-chain disclosures about token economics and distribution plans.

"Repeated, opaque movements to CEXs tend to reflect either an intention to sell or a lack of transparency," said analyst Jon Wu from DeFi Watch. "It damages community trust, especially in a market already skeptical of meme-based projects with political overtones."

Price Impact: 90% Collapse From All-Time High

The cumulative effect of these transfers has been brutal on the TRUMP token's price performance. The coin, which gained initial traction due to its meme status and perceived political relevance, has shed over 90% of its value since peaking in January 2025.

TRUMP currently trades near $8.68, down 6% in the past 24 hours alone, according to BeInCrypto data. The asset's rapid decline mirrors similar boom-and-bust patterns seen in other politically themed tokens, where hype outpaces fundamental utility.

Analysts warn that continued sell pressure, combined with investor fatigue and growing political controversy, could push the token into a prolonged bear cycle.

Official Response: Liquidity or Exit Strategy?

In earlier statements, the project’s representatives defended the token transfers, claiming they were executed from a liquidity provisioning wallet established during the TRUMP coin’s launch phase. They argued that maintaining exchange-side liquidity was necessary to ensure "smooth market conditions" amid rising user activity.

However, the vague framing and lack of granular transparency have left investors unconvinced.

"Liquidity provisioning is a legitimate function, but the scale and timing of these transfers - paired with the lack of updates on tokenomics, governance, or roadmap - make it hard to distinguish operational strategy from exit behavior," said crypto commentator Jack Nellis.

The situation has prompted calls for independent auditing or at least more detailed disclosures from the team behind the token, which still remains pseudonymous despite its proximity to a high-profile political figure.

TRUMP Token at the Center of U.S. Policy Debate

Further complicating the TRUMP coin narrative is its entanglement in ongoing political debates in the U.S. While the token’s originators claim no official affiliation with Donald Trump, the former president’s vocal support for Bitcoin and crypto more broadly has fueled perceptions that the token enjoys tacit approval.

The situation escalated when U.S. Representative Brad Sherman publicly accused TikTok's parent company of allegedly planning a $300 million campaign to buy TRUMP tokens in a bid to influence American policy. TikTok categorically denied the accusation, calling it "misleading and irresponsible."

“This baseless claim doesn’t even accurately reflect the congressional letter Sherman co-signed last month,” a TikTok spokesperson stated.

Despite denials, the political spotlight has intensified scrutiny of the TRUMP coin, with regulators and advocacy groups questioning whether such politically branded assets blur ethical lines between campaign finance, token promotion, and speculative investment.

Regulatory Climate

The latest token movements have also sparked debate about the need for better oversight and regulation in politically adjacent crypto projects. Critics argue that meme tokens with political branding can mislead retail investors, especially when backed by high-profile figures or organizations that later disavow them.

Given the U.S. Securities and Exchange Commission’s increasing crackdown on misleading crypto promotions, TRUMP token could eventually come under investigation - particularly if investors file complaints about misleading marketing or unfulfilled project promises.

Meanwhile, platforms such as Binance and OKX, which have facilitated the listing and trading of TRUMP, may face secondary scrutiny over their role in promoting tokens with unclear affiliations and governance.

Final thougths

With the TRUMP token now down more than 90% from its peak and no clear roadmap or utility outlined, investor confidence is eroding rapidly. The frequency and scale of token transfers to centralized exchanges suggest either heavy sell-offs or attempts to create short-term liquidity for team members or insiders.

Unless the project delivers concrete updates - such as a defined governance structure, usage model, or confirmed affiliation - it’s unlikely to recover significant investor interest. The token’s remaining appeal may now rest solely in speculative trading and its tenuous link to Trump-era branding.

In the broader meme coin landscape, TRUMP’s trajectory offers a cautionary tale: political relevance can create explosive short-term gains but is rarely enough to sustain long-term value without transparent management and product development.

The $32.8 million TRUMP token transfer to Binance highlights a pattern that has alarmed both investors and analysts. With over $150 million in exchange-bound transactions since April and a 90% price collapse, the TRUMP token’s future looks increasingly uncertain.

As the team remains largely anonymous and resistant to deeper transparency, questions about their intentions and the token’s legitimacy persist. Combined with the added weight of political controversy and regulatory interest, the project stands at a critical crossroads.