Solana's blockchain network experienced unprecedented activity levels in early 2025, driven by presidential meme coins that temporarily pushed transaction volumes, fees, and cryptocurrency prices to record highs before a dramatic decline. The chain processed 26 times more active addresses than Ethereum at its peak following the launch of Donald Trump's official TRUMP token on January 17 and Melania Trump's MELANIA coin two days later.

What to Know:

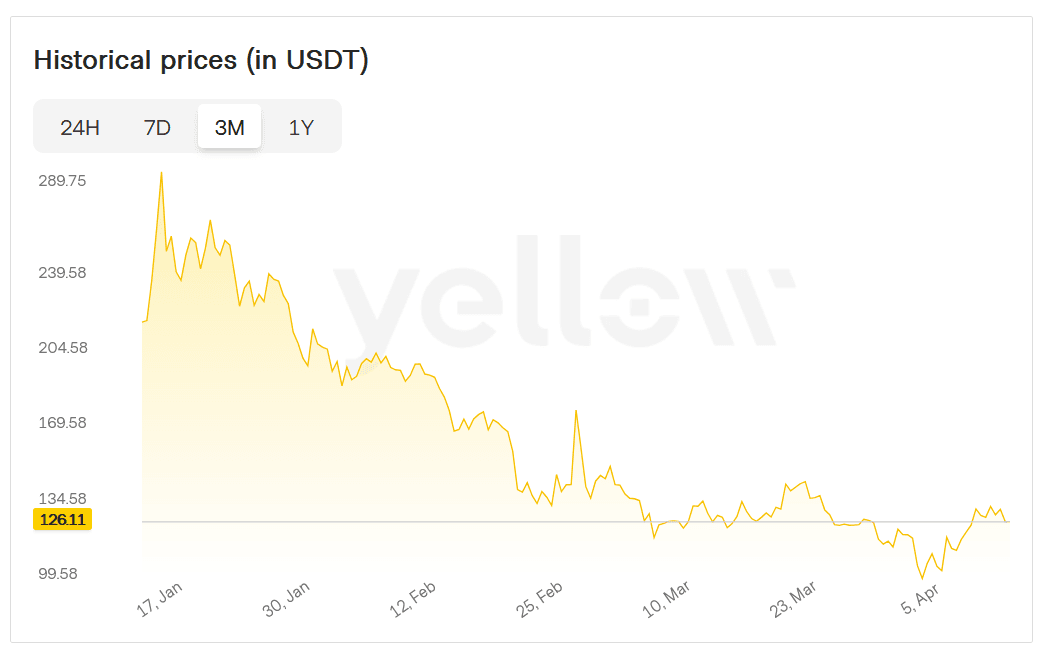

- Solana transaction fees reached an all-time high of $32.43 million on January 19, the same day SOL hit a record price of $293

- Daily active addresses surged to 832,000 per hour in January, compared to Ethereum's 31,000

- Despite the meme coin crash, Solana's DeFi total value locked has grown nearly 400% since January, suggesting potential for sustainable growth

Presidential Meme Coins Trigger Unprecedented Network Demand

When newly elected President Donald Trump launched his TRUMP meme coin on Solana's blockchain on January 17, 2025, it sparked a chain reaction that temporarily transformed the network's metrics.

Solana, known for its low-cost, high-speed transactions and developer-friendly infrastructure, quickly became the epicenter of a meme coin frenzy unseen since the 2021 bull market.

The initial surge intensified when Melania Trump introduced her MELANIA token on the same blockchain two days later.

MELANIA's trading volume exploded 396% within 24 hours of launch, skyrocketing from $1.33 billion to $6.6 billion. Developers rushed to create copycat tokens while traders scrambled to capitalize on volatile price movements.

Glassnode data shows Solana processed 832,000 active addresses per hour by January 24, dwarfing Ethereum's 31,000 during the same period. The network's transaction fees climbed to an unprecedented $32.43 million on January 19, coinciding with SOL reaching its all-time high price of $293.

"The speed and efficiency of Solana's infrastructure made it the natural choice for high-volume meme coin trading," noted blockchain analyst Jared Peterson, who monitored the activity surge. "We've never seen a single blockchain capture this magnitude of retail interest so quickly."

Rapid Decline Raises Questions About Sustainable Value

The meteoric rise proved unsustainable as market exhaustion set in shortly after price peaks were reached. Daily active addresses plummeted alongside declining interest in presidential meme coins, dragging down decentralized exchange (DEX) volume, SOL's price, and total value locked in decentralized finance protocols.

Solana's DEX volume illustrates this dramatic reversal. After hitting a record $36 billion on January 19, it collapsed to just $3.8 billion by January 31—a near 90% drop in less than two weeks. As of April 15, this figure had further declined to $1.5 billion, according to data from Artemis.

Network revenue suffered a similar fate. The daily revenue that soared to $16 million at the height of meme coin mania fell below $5 million by month's end.

Yesterday's network revenue from all transactions totaled less than $115,000, representing a 99.3% decrease from January's peak.

These dramatic swings have raised critical questions about Solana's value proposition. Some analysts wonder whether the network's fundamental worth is now inextricably linked to speculative, highly volatile meme assets rather than sustainable use cases.

The sharp decline in activity metrics has led some critics to characterize the episode as a temporary bubble rather than evidence of Solana's long-term viability. "What we witnessed was classic boom-and-bust cycle behavior," said cryptocurrency researcher Sarah Jenkins. "The question is whether any lasting value was created beneath the speculative layer."

Beyond Memes: Analysts See Foundation for Sustainable Growth

Despite the volatility, industry experts see potential for Solana beyond the meme coin phenomenon. Binance Research spokesperson Marina Zibareva told BeInCrypto that while these speculative assets contributed significantly to the network's early 2025 growth, Solana's performance is increasingly driven by broader ecosystem fundamentals.

"We've seen DeFi TVL grow nearly 4x in SOL terms since January, and stablecoin supply has increased over 6x – pointing to lasting interest in real utility," Zibareva explained. "Developer activity is also accelerating, with smart contract deployments rising almost 6x, suggesting strong long-term potential beyond the speculative wave."

Although Solana's technical characteristics make it an ideal platform for launching meme coins through services like Pump.fun, Jupiter, and Meteora, Zibareva envisions a future extending well beyond speculative tokens.

The infrastructure has proven itself capable of handling extreme demand spikes, potentially attracting developers focused on more substantial applications.

"Meme coins have brought attention and users, but the long-term trajectory likely points toward use cases like DeFi, DePIN, Gaming, and SocialFi," she added. "Solana's daily active addresses have increased nearly 6x year-to-date, and with its infrastructure battle-tested, we expect to see more developer activity focused on sustainable value creation."

Blockchain analysts note that despite the current downturn, Solana retains key advantages over competitors, including transaction costs that remain significantly lower than Ethereum's. The network has also demonstrated impressive resilience during periods of extreme congestion, maintaining operations despite unprecedented demand.

Infrastructure investments continue to flow into the Solana ecosystem, with venture capital firms committed to funding projects building applications beyond speculative trading. These developments suggest the possibility of a more diversified ecosystem emerging from the ashes of the meme coin frenzy.

Final Thoughts

The Solana network's journey through the presidential meme coin saga reveals both the potential and pitfalls of blockchain infrastructure in an era of viral digital assets. While the dramatic surge and subsequent crash in network metrics highlight the risks of building on speculative activity, underlying growth in development activity and financial metrics suggest a foundation for more sustainable expansion may be forming beneath the volatile surface.