Morgan Stanley has taken a further step into digital assets, filing to launch investment products tied to both Bitcoin (BTC) and Solana (SOL), signaling that the Wall Street bank is moving beyond exploratory exposure and toward direct participation in the rapidly expanding cryptocurrency fund market.

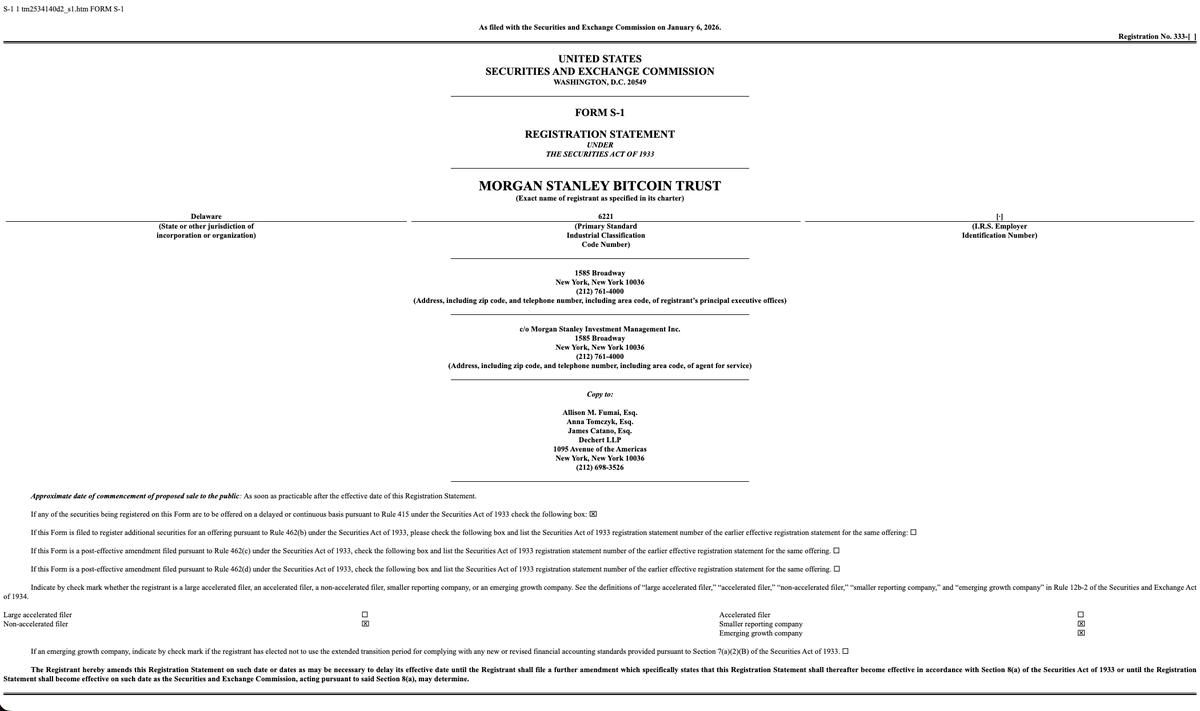

Regulatory filings submitted Tuesday show that the firm has applied to create a Bitcoin Trust and a Solana Trust, each designed to hold the underlying cryptocurrency on behalf of investors.

The proposed products would be sponsored by Morgan Stanley Investment Management, according to the documents.

The Solana vehicle would include a staking component, allowing a portion of the holdings to earn rewards by supporting the blockchain’s network operations, a structure that reflects growing institutional interest in yield-generating crypto strategies beyond simple price exposure.

The move marks Morgan Stanley’s most direct entry yet into crypto-focused exchange-traded products, coming roughly two years after U.S.-listed crypto ETFs surged into the mainstream following regulatory approvals in early 2024.

Traditional Finance Accelerates Crypto Push

Morgan Stanley’s filings arrive as legacy financial institutions continue to expand their digital-asset capabilities.

Firms such as Goldman Sachs, JPMorgan Chase, and Citigroup have all increased institutional crypto activity, rolling out trading desks and testing blockchain-based custody, settlement, and tokenization services.

According to Bloomberg data, more than one hundred fifty billion dollars is now invested across roughly one hundred thirty crypto-linked funds in the United States.

The bulk of those assets are concentrated in Bitcoin-focused products, many of which launched in January 2024 and quickly drew substantial inflows.

Market participants say issuers with built-in advisory platforms face mounting pressure to offer crypto exposure as client demand becomes harder to ignore.

Todd Sohn, a senior ETF strategist at Strategas Securities, said the expansion reflects a broader acceptance of crypto within traditional portfolios, likening it to recent decisions by firms such as Vanguard and Bank of America to permit limited crypto allocations.

He noted that entirely new asset classes rarely enter the ETF ecosystem, making the pace of institutional adoption particularly notable.

Bitcoin Leads, While Altcoin Funds Face Headwinds

Bitcoin remains the dominant force in the crypto fund market.

More than ten Bitcoin-only investment products are already listed in the U.S., alongside a smaller number of Solana-linked offerings tied to the sixth-largest digital asset by market capitalization.

While flagship Bitcoin funds, including BlackRock’s IBIT, have attracted billions of dollars, demand for more specialized products tied to smaller or less established tokens has been uneven.

Many niche crypto funds have struggled to generate meaningful inflows despite broader market enthusiasm.

Morgan Stanley itself remains a relatively small player in the ETF business.

Data from Bloomberg Intelligence shows the firm does not rank among the top ten ETF issuers by assets, trailing newer entrants such as Neos Investments, which launched in 2022.

The bank’s existing ETF lineup has historically focused on traditional equity and fixed-income strategies.

A Broader Crypto Strategy Takes Shape

Despite its modest ETF footprint, Morgan Stanley has been steadily laying the groundwork for a larger role in digital assets.

Morgan Stanley had in September last year partnered with a crypto infrastructure provider to enable E*Trade customers to trade major tokens beginning in 2026.

The bank has also explored launching a dedicated crypto asset-allocation strategy and evaluating wider applications of tokenization across financial products.

Read Next: Did The DOJ Just Violate Trump's Bitcoin Reserve Order? $6M Sale Raises Questions