In a market driven by listings, partnerships, and sectoral momentum, today's top-performing coins highlight the growing interest in Web3, AI, and payment infrastructure. SIREN made waves following multiple exchange listings, while Banana For Scale capitalized on community-driven incentives.

Alchemy Pay surged with strong institutional partnerships, OORT continued to push decentralized AI solutions, and Lista DAO expanded its DeFi footprint. The trends suggest shifting investor focus across different blockchain applications, with some sectors seeing greater engagement than others.

Siren (SIREN)

Price Change (24H): +51.12% Current Price: $0.09156

What happened today

SIREN saw a significant price increase after being listed on multiple exchanges, including KuCoin, Bitget, and BingX. The new listings improved accessibility and liquidity, attracting a surge in trading activity. Additionally, Bitget and BingX launched promotional events such as trading competitions and airdrops, further fueling investor interest.

Market Cap: $67.8M 24-Hour Trading Volume: $36.57M Circulating Supply: 740.49M SIREN

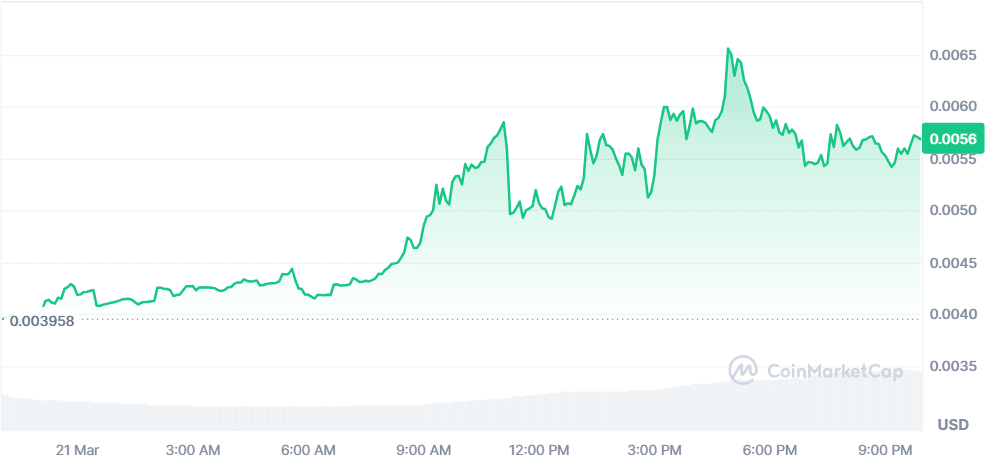

Banana For Scale (BANANAS31)

Price Change (24H): +43.56% Current Price: $0.005678

What happened today

BANANAS31 gained traction following the launch of an airdrop event rewarding users who purchase and hold the token, as well as those participating in voting on Binance. The token was also listed on Bitrue Spot, increasing its exposure to traders. Additionally, its Diamond Hand Rewards program incentivized long-term holding by offering extra token rewards to top holders, contributing to the rising market enthusiasm.

Market Cap: $56.78M 24-Hour Trading Volume: $35.38M Circulating Supply: 10B BANANAS31

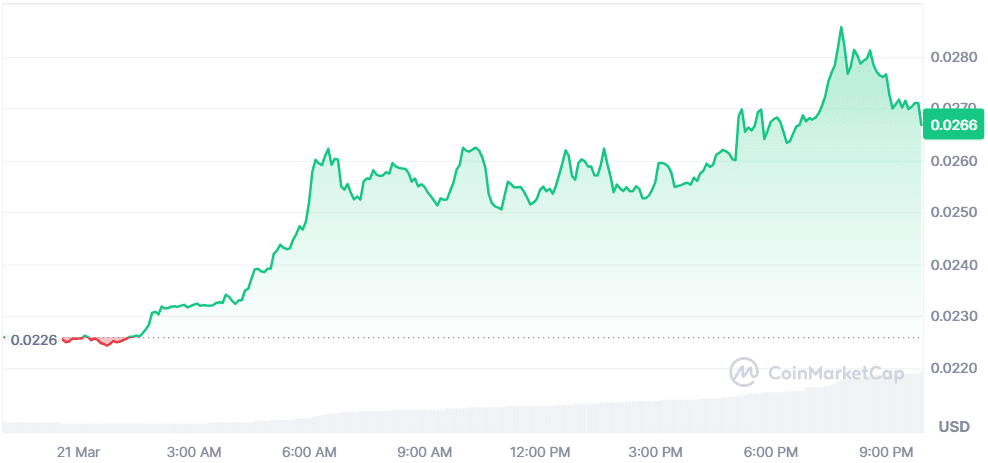

Alchemy Pay (ACH)

Price Change (24H): +17.83% Current Price: $0.02665

What happened today

Alchemy Pay's price surged following its announcement of participation in the upcoming Hong Kong Web3 Festival 2025, where it will showcase its latest crypto payment solutions. The company also celebrated surpassing 1,000 partnerships, with key collaborations including Tether, BNB Chain, Coinbase Wallet, and Uniswap. This growing ecosystem strengthened investor confidence, helping ACH climb to #162 in market cap rankings.

Market Cap: $235.36M 24-Hour Trading Volume: $200.33M Circulating Supply: 8.82B ACH

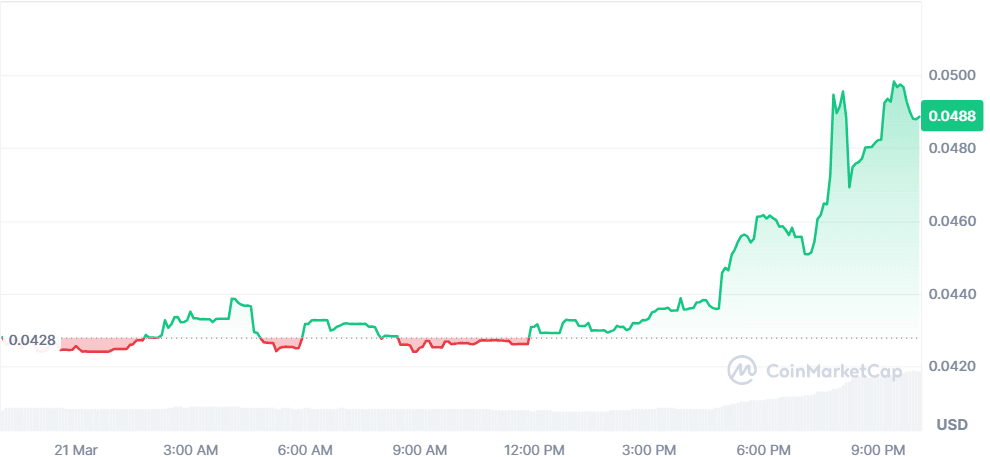

OORT (OORT)

Price Change (24H): +14.65% Current Price: $0.04885

What happened today

OORT made headlines by becoming the first cross-border Web3 data provider for China’s AI industry, partnering with Shenzhen Intellifusion Technologies. This collaboration, facilitated by Shenzhen Data Exchange, will support AI model training using OORT’s industrial-grade decentralized data solutions. Additionally, OORT secured $10 million in funding from major investors such as Taisu Venture, Sanction Capital, and Red Beard Venture, alongside grants from Google and Microsoft, further solidifying its position in the AI and Web3 space.

Market Cap: $18.41M 24-Hour Trading Volume: $2.08M Circulating Supply: 376.91M OORT

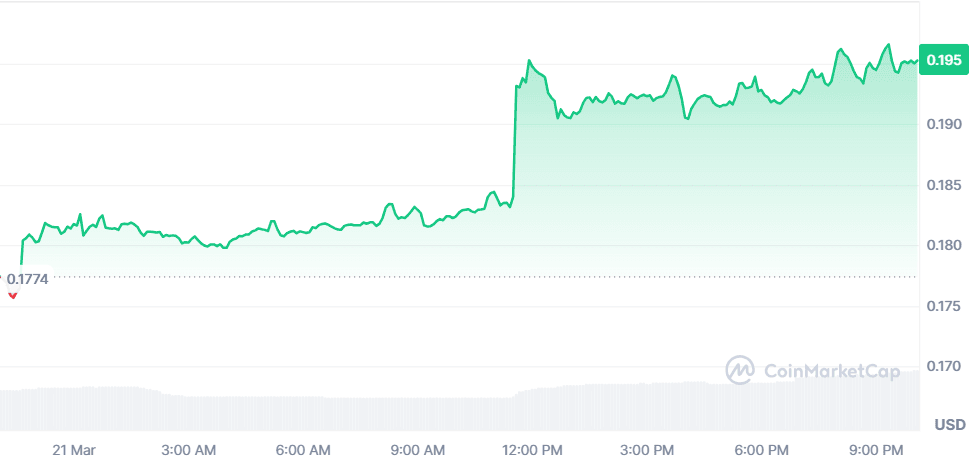

Lista DAO (LISTA)

Price Change (24H): +11.06% Current Price: $0.1964

What happened today

Lista DAO saw positive momentum after announcing a partnership with CIAN Protocol to optimize BNBFi yield strategies, enhancing its ecosystem. Additionally, Aave is set to onboard lisUSD onto Aave V3 Core Pool, a move that is expected to boost the stablecoin’s utility, exposure, and demand. Voting for this integration begins on March 22, 2025, potentially bringing further growth opportunities for LISTA.

Market Cap: $37.61M 24-Hour Trading Volume: $17.56M Circulating Supply: 191.49M LISTA

Closing thoughts

A closer look at today's trending coins shows a strong tilt toward Web3 infrastructure and AI-driven solutions, with Alchemy Pay and OORT leading in adoption-focused news. ACH’s institutional partnerships and OORT’s role in AI data solutions suggest increased confidence in blockchain utility beyond speculation. Meanwhile, SIREN and BANANAS31 reflect the power of exchange listings and community incentives, as their price surges were largely fueled by increased accessibility and active participation in airdrop and listing events.

Investor sentiment appears to be favoring practical use cases over pure hype, as projects with strong ecosystems and partnerships are seeing more sustainable gains. The DeFi sector also remains relevant, with Lista DAO’s stablecoin expansion through Aave demonstrating the continued demand for yield optimization. However, meme and community-driven tokens are still finding traction, as seen with BANANAS31’s reward structure, which attracted speculative interest. With the market moving in multiple directions, the coming days will show whether these trends continue or shift with broader market sentiment.