Today’s surge showcased a powerful blend of narrative-driven hype, utility-based growth, and exchange-backed momentum.

From memecoins riding on strong community sentiment to infrastructure tokens like PARTICLE NETWORK spiking on sheer volume, today’s action reflects a market craving novelty, access, and perceived value. Gaming ecosystems (GM), social-fi layers (SHELL), and exchange-fueled memecoins (BOOP) all rode strong tailwinds, hinting at a market where storytelling and real-world integrations are moving hand-in-hand.

Particle Network (PARTI)

Price Change (24H): +48.44% Current Price: $0.2978

What happened today

PARTI surged nearly 50% as trading volume spiked to $217.68M — a massive +485.73% jump. The rally appears to be driven by increased attention toward Web3 infrastructure solutions, with Particle Network positioned as a key player. Its sharp price movement, paired with high volume-to-market-cap ratio (311.92%), signals renewed investor interest and speculative inflow.

Market Cap: $69.39M 24-Hour Trading Volume: $217.68M Circulating Supply: 233M PARTI

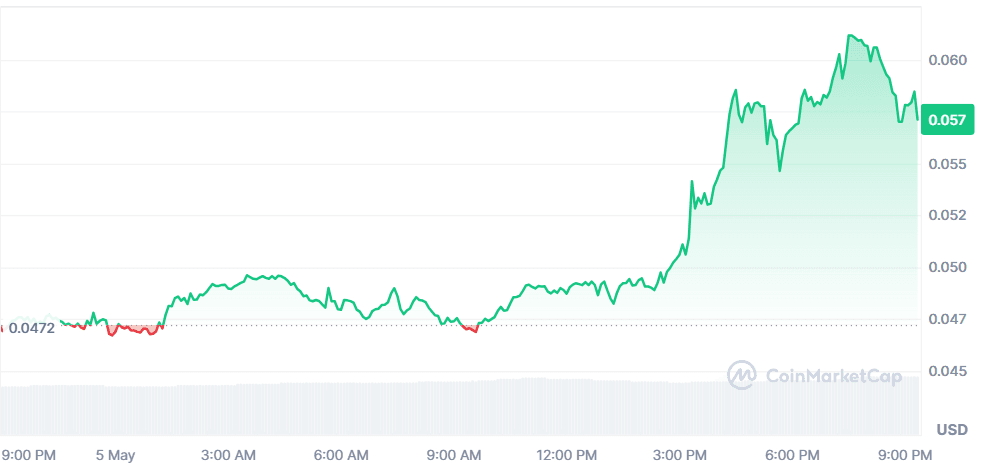

Gomble (GM)

Price Change (24H): +19.89% Current Price: $0.05714

What happened today

GM gained traction after Gomble Games teased its expanding hyper-casual Web3 gaming ecosystem. With over 3.5 million users already onboarded and a push toward seamless blockchain integration via ARB and BNB Chain, investor enthusiasm around its PoSQ-based reward system and upcoming releases helped drive GM’s price and visibility.

Market Cap: $15.65M 24-Hour Trading Volume: $10.56M Circulating Supply: 273.93M GM

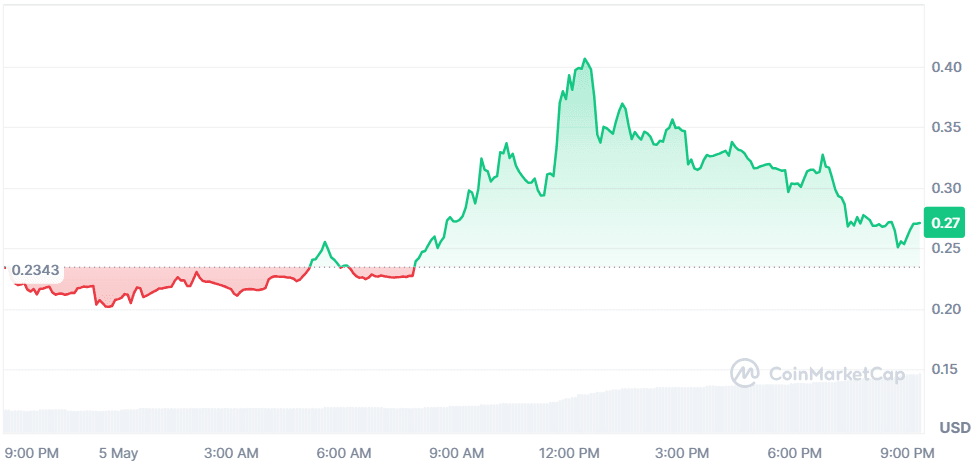

Boop (BOOP)

Price Change (24H): +23.16% Current Price: $0.2712

What happened today

BOOP soared after announcements of its listing on Gate.io and Binance Alpha’s airdrop campaign. Eligible users received 291 BOOP each, spurring activity and retail interest. Earlier spikes saw prices briefly touch $0.5388 before stabilizing. High-profile exchange listings and airdrops are cementing BOOP’s momentum in memecoin circles.

Market Cap: $271.37M (self-reported) 24-Hour Trading Volume: $47.83M Circulating Supply: 999.99M BOOP

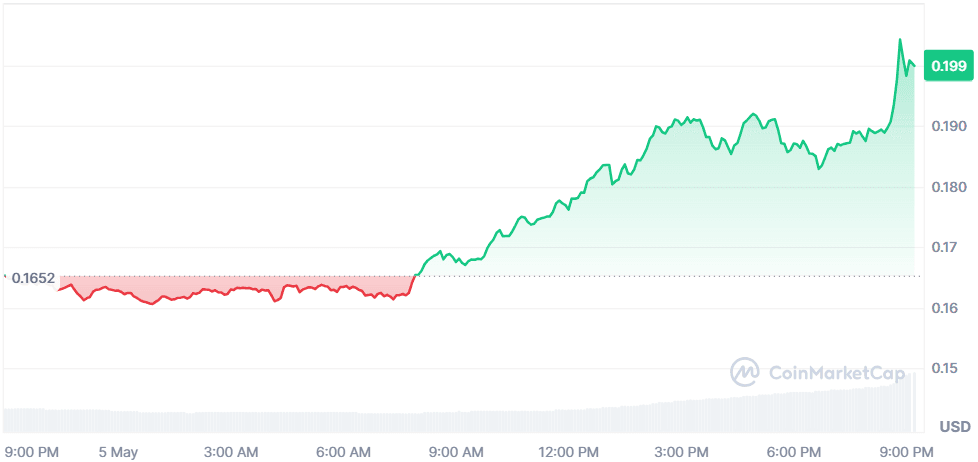

MyShell (SHELL)

Price Change (24H): +19.24% Current Price: $0.1954

What happened today

SHELL’s price action reflects growing excitement around its AI-powered voice infrastructure in Web3. With trading volume up 147%, and a 93.91% volume-to-market-cap ratio, momentum suggests organic accumulation possibly ahead of a product update or marketing campaign.

Market Cap: $54.67M 24-Hour Trading Volume: $54.19M Circulating Supply: 279.66M SHELL

Just a Chill Guy (CHILLGUY)

Price Change (24H): +19.66% Current Price: $0.05206

What happened today

CHILLGUY continues its memecoin rise with over 132K holders actively trading on Raydium. With $2.2M in daily volume and nearly balanced buy-sell ratio, its steady climb is attributed to strong community backing, meme virality, and speculative momentum common to Solana memecoins.

Market Cap: $52.06M 24-Hour Trading Volume: $22.06M Circulating Supply: 999.95M CHILLGUY

Global Market Snapshot

Markets opened with geopolitical and fiscal shifts in focus. Germany's incoming Chancellor Friedrich Merz confirmed a coalition agreement promising major reforms and a €500B investment fund, while U.S. stocks fell ahead of the Fed's rate decision.

In crypto, Trump’s crypto-centric fundraising dinners and memecoin endorsements boosted interest, while China’s export redirection strategy sparked deflation fears. Amid these dynamics, traders are navigating an environment where policy signals, trade tensions, and crypto adoption by political figures are shaping volatility.

Closing Thoughts

Investor sentiment is currently swinging between cautious optimism and opportunistic aggression. The strongest inflows are targeting high-engagement sectors—particularly memecoins and gaming. CHILLGUY and BOOP saw impressive traction due to social momentum and airdrops, while GM tapped into the utility narrative with its user-centric gaming ecosystem.

Meanwhile, PARTICLE NETWORK’s sharp spike, driven by trading volume and a Web3 infrastructure theme, hints that market participants are also eyeing tech-driven assets with future upside.

In the broader macro landscape, political shifts in Europe and crypto-aligned fundraising in the U.S. are shaping investor psychology. With Germany’s €500B stimulus promise and Trump’s memecoin-backed campaign events reinforcing crypto’s political utility, speculative interest is gaining ground even amidst global deflation fears and uncertain rate policy. As volatility continues to rise, the market appears to be favoring tokens with strong narratives, community-led demand, and proximity to real-world developments.