Altcoins surged into the spotlight today with several names catching major investor attention. COMBO, FOMO, and SETAI saw strong community activity driven by early-stage buzz and staking campaigns, while IQ and GM gained momentum from product launches and fresh exchange listings.

Despite macro uncertainty, these tokens are managing to ride the speculative wave, feeding off the collective energy of both AI-driven innovation and community-led hype.

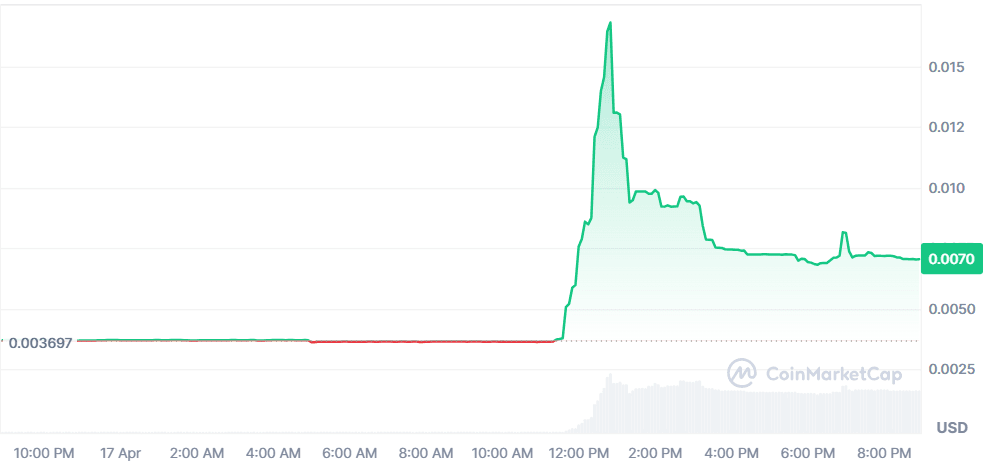

SETAI Agents (SETAI)

Price Change (24H): +90.28% Current Price: $0.007036

What happened today

SETAI saw a massive price surge driven by its ongoing Staking Challenge (Apr 16–23), which rewards the top 10 stakers with $1,000 worth of tokens. This campaign is linked to the upcoming SETAI_Future project reveal in May. The community buzzed with speculation as sudden buy-ins and staking activity were observed, possibly hinting at coordinated whale movement or insider anticipation.

Market Cap: $702.6K 24-Hour Trading Volume: $1.79M Circulating Supply: 100M SETAI

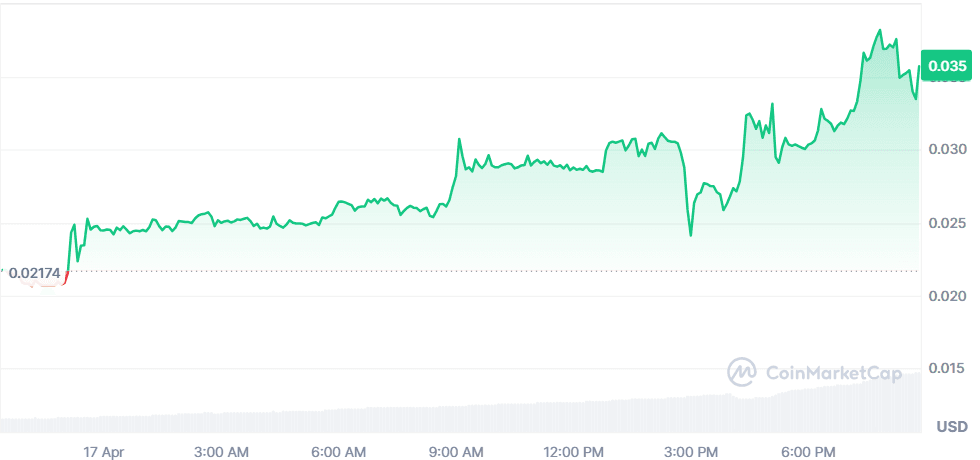

Gomble (GM)

Price Change (24H): +80.66% Current Price: $0.03575

What happened today

GM skyrocketed after Binance Alpha announced it would list the token for trading starting April 17. This announcement, coupled with airdrop incentives for prior Alpha users and recent CEX listings on Bitget and Coinone, created explosive upward momentum. The anticipation of increased liquidity and exposure has attracted heavy trading interest.

Market Cap: $9.51M 24-Hour Trading Volume: $5.41M Circulating Supply: 277M GM

IQ (IQ)

Price Change (24H): +53.58% Current Price: $0.005979

What happened today

IQ AI’s new update highlighting ultra-fast AI Agent deployment (within 60 seconds) through its Fraxtal-based platform created fresh investor interest. The push toward tokenized agents and seamless testing features reflect strong utility backing IQ's rally. Buzz from the developer and AI communities has fueled today's spike.

Market Cap: $127.05M 24-Hour Trading Volume: $184.7M Circulating Supply: 21.24B IQ

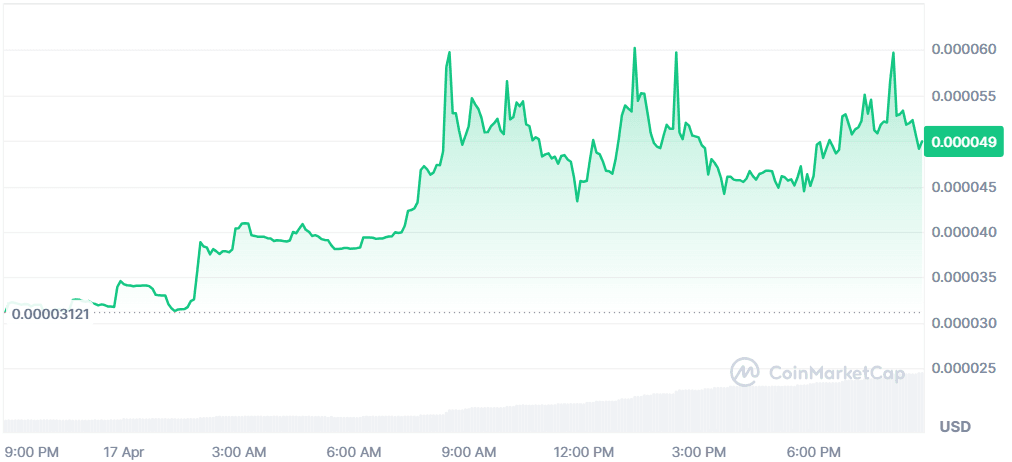

FOMO (fomo.fund) (FOMO)

Price Change (24H): +54.37% Current Price: $0.00004977

What happened today

FOMO’s rally appears to be fueled by rising social sentiment and small-cap investor attention. While there hasn’t been a major announcement, its price action shows classic FOMO-driven accumulation, suggesting possible community-led speculative runs or anticipation of news. The consistent upward trend points toward short-term hype rather than fundamentals.

Market Cap: $4.97M 24-Hour Trading Volume: $1.36M Circulating Supply: 99.98B FOMO

COMBO (COMBO)

Price Change (24H): +46.42% Current Price: $0.03080

What happened today

COMBO is riding a wave of momentum, reportedly up 500% from its earlier price. A massive $581K whale buy-in and $9.6M in volume suggest potential early-stage coordinated buys or speculative surges. External hype from BingX's new fantasy football-crypto promotion with Chelsea FC also hints at a broader push to integrate entertainment and DeFi.

Market Cap: $2.54M 24-Hour Trading Volume: $7.41M Circulating Supply: 82.46M COMBO

Global Market Snapshot

Markets are caught between hawkish U.S. policy and easing expectations in Europe. While Federal Reserve Chair Jerome Powell reaffirmed a firm stance on inflation, dismissing hopes of near-term rate cuts, the European Central Bank is widely expected to slash rates by 25 basis points today.

Meanwhile, Japan is voicing concern over the fallout from Trump's aggressive trade policies, and geopolitical tensions are flaring as the Kremlin moves to nationalize assets of an American-owned company.

Equity markets are mixed, bond yields are easing slightly, and traders are closely watching upcoming U.S. housing and jobless data. As central banks diverge in their strategies and the U.S.-China tariff narrative escalates, investor sentiment remains cautious — creating a volatile backdrop for both traditional and crypto markets.

Closing Thoughts

Investor sentiment in the crypto space is being buoyed by anticipation, not fundamentals. Whales are moving in stealthily, visible in sudden volume spikes (as with COMBO), while mass staking campaigns like SETAI’s are reshaping short-term narratives.

The presence of new listings (GM) and utility-focused launches (IQ) shows that traders are favoring tokens with either community-building mechanisms or direct product application—though it’s the speed and virality of those campaigns that seems to matter more than depth.

Meanwhile, on the global stage, monetary policy signals are diverging. While the Federal Reserve takes a hawkish stance, determined to hold rates amid inflation uncertainty tied to escalating tariff tensions, the European Central Bank is expected to ease rates, possibly pulling the euro into more volatility. This dichotomy is creating fertile ground for speculation across both traditional and crypto markets. Altcoin investors, it seems, are bracing for uncertainty by chasing short-term surges and ecosystem-specific events rather than waiting for broader macro stability.