Amid lingering Middle East tensions and cautious optimism ahead of the Fed’s rate decision, today’s market spotlight turned sharply toward high-volatility tokens. GOUT exploded on retail-driven hype despite overbought signals, while AICELL and KOGE saw modest rebounds backed by technical momentum.

Meanwhile, TEL benefited from stablecoin regulatory tailwinds as the GENIUS Act advanced, and OL struggled under post-airdrop selloffs. The mix of narratives, from memecoin mania to infrastructure-driven plays, reveals a fragmented but energized crypto landscape.

Gout (GOUT)

Price Change (24H): +71.57% Current Price: $0.00031

What happened today

GOUT soared on viral memecoin momentum, not fundamentals. A 236% surge in 24-hour trading volume to $2.4M signaled intense retail activity, supported by bullish MACD crossover and RSI above 80. Despite the overheated indicators, momentum persists. Whale concentration (top 10 hold 28.43%) remains a looming risk.

Market Cap: $21.13M 24-Hour Trading Volume: $2.4M Circulating Supply: 153.33B GOUT

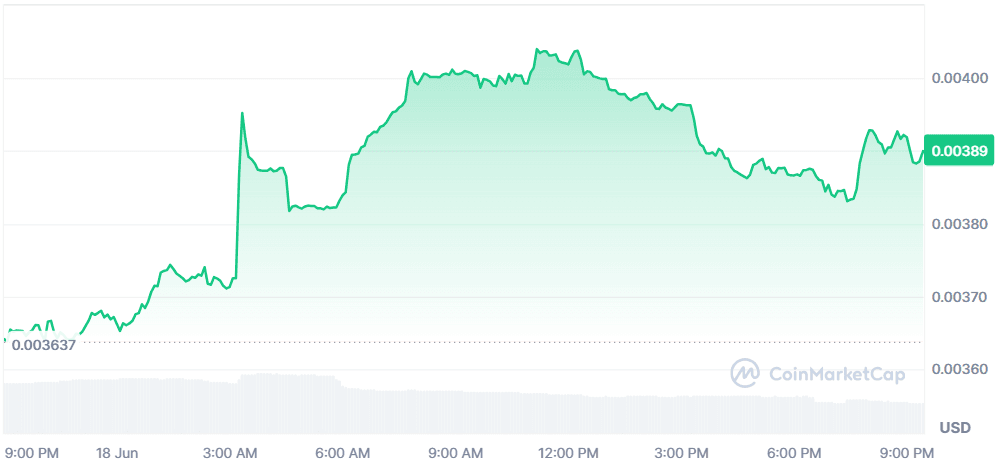

Telcoin (TEL)

Price Change (24H): +6.78% Current Price: $0.003899

What happened today

TEL’s price uptick coincides with heightened interest in stablecoin infrastructure after the Senate passed the GENIUS Act. Telcoin’s president emphasized the importance of interoperability and utility over hype, aligning with market expectations of stablecoins becoming financial infrastructure, not speculative assets.

Market Cap: $354.91M 24-Hour Trading Volume: $2.19M Circulating Supply: 91B TEL

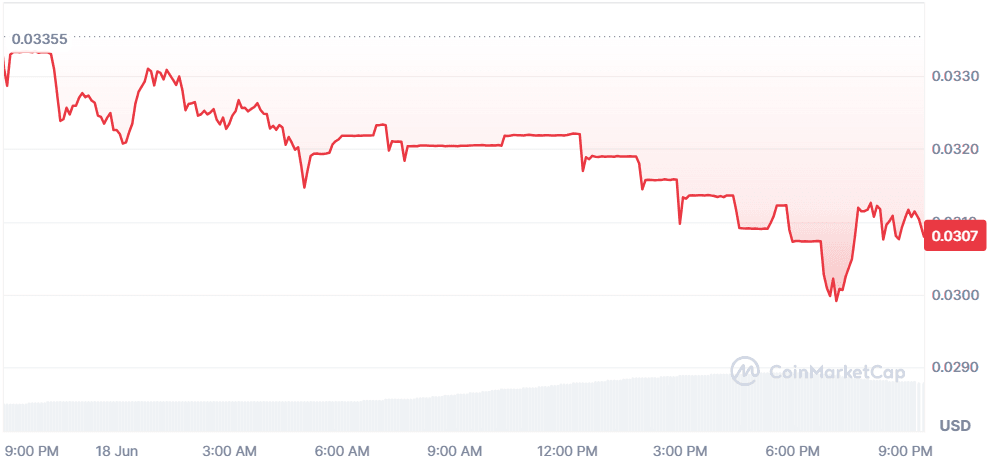

Open Loot (OL)

Price Change (24H): -7.20% Current Price: $0.03093

What happened today

OL fell sharply as a 16M token airdrop from Binance triggered predictable sell pressure. With over 70% of recipients likely dumping their tokens, volume surged 72.8% to $272.66M. RSI is nearing oversold, and price is struggling to hold the $0.030 support, undercut by broader altcoin weakness as BTC dominance rises.

Market Cap: $18.61M 24-Hour Trading Volume: $272.66M Circulating Supply: 601.64M OL

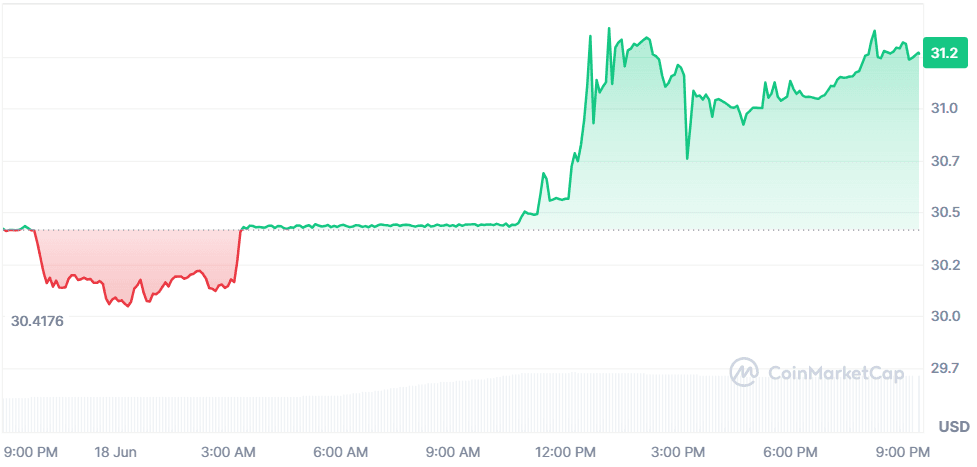

48 Club Token (KOGE)

Price Change (24H): +2.69% Current Price: $31.24

What happened today

KOGE bounced after a 50% weekly crash. With RSI at 16.25 (severely oversold), the token saw short-term accumulation, helped by Binance removing Alpha Points incentives that previously fueled arbitrage selling. Still, turnover remains abnormally high and liquidity risks persist.

Market Cap: $105.85M 24-Hour Trading Volume: $364.96M Circulating Supply: 3.38M KOGE

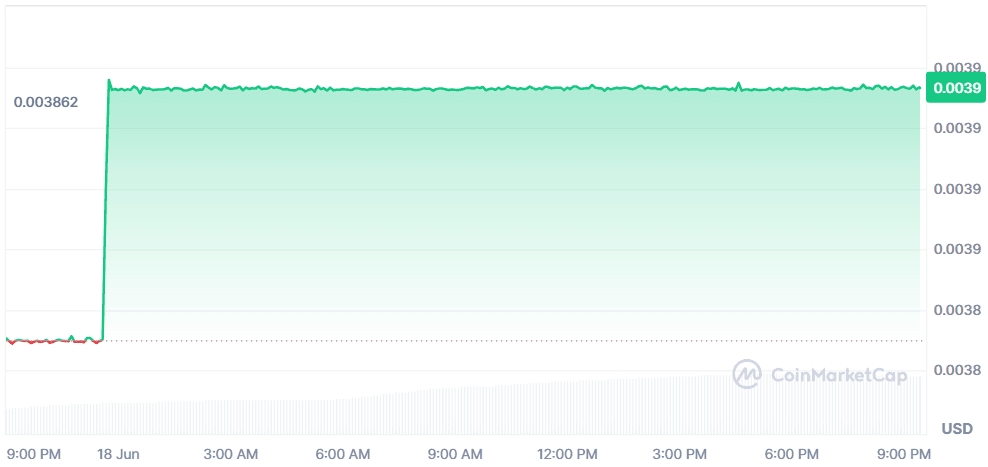

AICell (AICELL)

Price Change (24H): +2.71% Current Price: $0.003966

What happened today

AICell continued its bullish run (+75% weekly) amid strong technical indicators (RSI 72.58, MACD positive). Despite mixed macro sentiment, it gained from Binance Smart Chain traction and DAO treasury growth. High concentration (top 10 hold 54%) and a 104% turnover rate suggest volatile trading ahead.

Market Cap: $3.96M 24-Hour Trading Volume: $409.1K Circulating Supply: 1B AICELL (self-reported)

Global Market Snapshot

Markets are holding steady despite rising geopolitical tension, as Iran threatened the U.S. with “irreparable damage” if it enters the ongoing Israel-Iran conflict. Crude oil prices dipped over 1% after President Trump revealed that Tehran had reached out to negotiate, softening the tone of earlier threats.

While the situation remains volatile with Iranian nuclear sites hit and regional fears growing investors rotated into safe-haven assets like silver, which surged to its highest level since 2012.

Meanwhile, global equities edged higher ahead of the Federal Reserve’s rate decision. The Dow rose 140 points and the Nasdaq gained 0.5%, with markets widely expecting a rate hold but awaiting clarity from Chair Powell’s post-meeting commentary. In Europe, stocks closed lower amid Middle East anxieties and multiple central bank decisions due Thursday. Sweden’s Riksbank preemptively cut rates by 25 bps to 2%. The broader mood remains cautiously optimistic but headline-driven, as markets continue to fade geopolitical risk while watching for any hawkish shift from the Fed.

Closing Thoughts

Investor sentiment appears split between chasing speculative upside and preparing for broader macro risk. The surge in low-cap, high-turnover coins like GOUT and AICELL signals a revival in microcap risk appetite, often seen during periods of Bitcoin stagnation. However, the market remains highly reactive, moves are driven more by narratives than fundamentals, with whale concentration and short-term arbitrage playing a bigger role than long-term conviction.

Globally, equities have shown resilience despite geopolitical overhang, as traders wait for signals from the Fed and signs of potential de-escalation in the Israel-Iran conflict. This cautious optimism is echoed in the crypto sector’s rotation stablecoin infrastructure plays like TEL are gaining traction while meme-fueled rallies capture retail flow. The split attention between utility and hype mirrors a broader market still unsure whether to lean into safety or chase alpha in volatile pockets.