As global markets shuddered under renewed tariff threats from Trump, crypto traders turned to high-volume tokens and ecosystem milestones for direction. Solana (SOL) led the narrative with institutional partnerships and a bullish technical setup, while PEPE and MOODENG thrived on social momentum and exchange listings. SOON made waves through Jump Crypto’s wallet activity and major exchange listings, hinting at coordinated liquidity efforts. FET, buoyed by the AI hype cycle and robust fundamentals, showed signs of potential overextension. From memecoins to market infrastructure plays, today’s top coins reveal where risk appetite is heating up amid broader uncertainty.

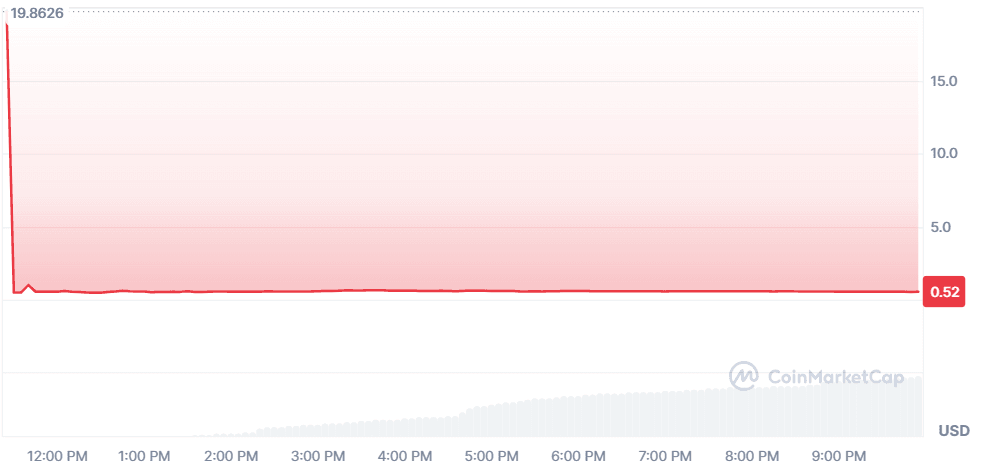

SOON (SOON)

Price Change (24H): +0.00% Current Price: $0.5209

What happened today

SOON debuted on multiple major exchanges today, including Upbit, Bithumb, and Binance Futures, marking a significant expansion in trading availability. The real buzz, however, surrounds Jump Crypto, whose wallet received 2 million SOON tokens and transferred 301 SOON to Gate.io, signaling potential market-making activities. This has led to increased speculation and trading activity, with analysts highlighting a 9% uptick in on-chain transactions and volume spikes on Gate.io. SOON is closely correlated with Solana, meaning SOL’s momentum could drive further interest. Technicals show an RSI of 58, suggesting room for upward movement.

Market Cap: $0 24-Hour Trading Volume: $122.48M Circulating Supply: 0 SOON

Solana (SOL)

Price Change (24H): +1.70% Current Price: $182.00

What happened today

SolanaAs global markets shuddered under renewed tariff threats from Trump, crypto traders turned to high-volume tokens and ecosystem milestones for direction. Solana (SOL) led the narrative with institutional partnerships and a bullish technical setup, while PEPE and MOODENG thrived on social momentum and exchange listings. SOON made waves through Jump Crypto’s wallet activity and major exchange listings, hinting at coordinated liquidity efforts. FET, buoyed by the AI hype cycle and robust fundamentals, showed signs of potential overextension. From memecoins to market infrastructure plays, today’s top coins reveal where risk appetite is heating up amid broader uncertainty. surged on bullish sentiment following its integration with R3’s Corda, a platform used by HSBC and others to tokenize over $10B in assets. This opens public blockchain access to institutional settlements. The Alpenglow upgrade also drove momentum, improving validator performance with Votor and Rotor. Technicals point to a breakout above trendline resistance, with potential to hit $194 and possibly $210. Kraken’s new tokenized stock product, xStocksFi, built on Solana, adds to institutional interest.

Market Cap: $94.67B 24-Hour Trading Volume: $7.09B Circulating Supply: 520.16M SOL

Moo Deng (MOODENG)

Price Change (24H): +14.86% Current Price: $0.2799

What happened today

MOODENG exploded after being listed on Robinhood, climbing over 750% in May alone. The price is pressing against the $0.30 resistance zone, a potential launchpad to new all-time highs. Technical indicators flash caution with RSI and MACD divergences, but wave counts suggest MOODENG is in the middle of a parabolic third wave. A breakout from current consolidation could ignite the next leg upward.

Market Cap: $277.14M 24-Hour Trading Volume: $749.32M Circulating Supply: 989.97M MOODENG

Artificial Superintelligence Alliance (FET)

Price Change (24H): +5.45% Current Price: $0.9173

What happened today

FET surged 15% as bullish sentiment around AI tokens continues. The coin broke above its 50-day moving average and trades near resistance at $0.98. RSI at 72 signals potential overbought territory, prompting traders to consider profit-taking. With the recent Fetch.ai, SingularityNet, and Ocean Protocol alliance, FET’s long-term target of $2 remains in play, supported by high volume and ecosystem growth.

Market Cap: $2.19B 24-Hour Trading Volume: $489.29M Circulating Supply: 2.39B FET

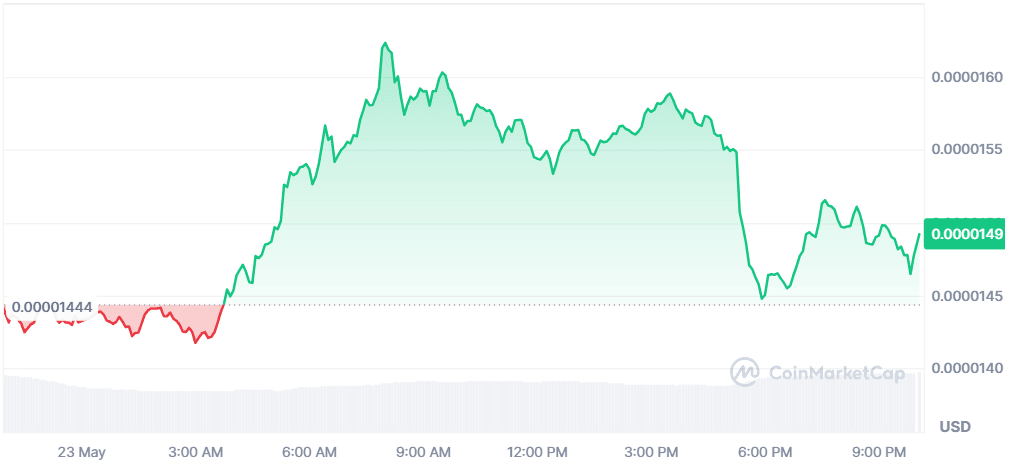

Pepe (PEPE)

Price Change (24H): +4.11% Current Price: $0.00001492

What happened today

PEPE remains in focus with bullish technicals and strong whale activity. A recent 1.5 trillion PEPE token withdrawal from Binance suggests major holders are reducing exchange selling pressure, reinforcing bullish sentiment. Global market listings, including Binance.US and Binance Japan, further increase reach. With RSI nearing overbought levels, short-term traders are eyeing profit zones while long-term holders remain cautious due to PEPE’s memecoin nature.

Market Cap: $6.27B 24-Hour Trading Volume: $2.82B Circulating Supply: 420.68T PEPE

Global Market Snapshot

Markets turned sharply lower on May 23 as President Donald Trump reignited trade tensions by recommending a 50% tariff on European Union imports starting June 1, and threatening Apple with a 25% tariff unless iPhones are made in the U.S. The Dow dropped 318 points, with Apple shares down over 2%, and European markets falling 2%.

While the White House tried to downplay the announcement, citing it as leverage in upcoming talks, investors took it seriously. The S&P 500, Dow, and Nasdaq all closed over 2% lower for the week. Recession fears resurfaced as bond yields fell, indicating risk-off sentiment. Meanwhile, nuclear stocks gained on reports that Trump will support the sector via executive orders, offering a bright spot in an otherwise red day.

This geopolitical jolt could trigger volatility in both equities and crypto as investors rebalance portfolios in light of escalating tariff threats and looming stagflation concerns.

Closing Thoughts

Investor sentiment remains bifurcated across markets. In equities, rising recession fears and volatility from Trump's proposed EU tariffs triggered risk-off behavior, especially in blue-chip tech stocks like Apple. Yet, crypto appears to be absorbing that volatility in a classic divergence. The strongest price action today came from coins with either institutional infrastructure narratives (SOL, FET) or explosive community traction (PEPE, MOODENG). This split underscores a rotation toward high-momentum assets that feel "detached" from macroeconomic noise, even if temporarily.

That said, the underlying drivers differ. Institutional plays like SOL and FET are seeing steady volume and strong technical structures, suggesting broader capital is flowing into themes with scalability and long-term use cases. On the other hand, SOON and PEPE reflect retail speculation at its peak with whales positioning themselves early and liquidity deepening rapidly. The market is still very much in search of narrative leadership, and today's winners show that both smart money and degens are active, just not in the same rooms.