A wave of institutional interest, blockchain infrastructure upgrades, and geopolitical headlines converged, pushing select altcoins sharply higher. XRP, ETH, XLM, MAGIC, and LA were the five most-watched coins today as both crypto and traditional markets navigated a volatile macro backdrop. XRP continues to benefit from growing clarity around its legal status, while Ethereum attracted fresh capital from corporate treasuries. Stellar’s on-chain upgrades, MAGIC’s exchange-fueled rally, and LA’s debut on Binance created fresh speculative buzz across multiple market segments.

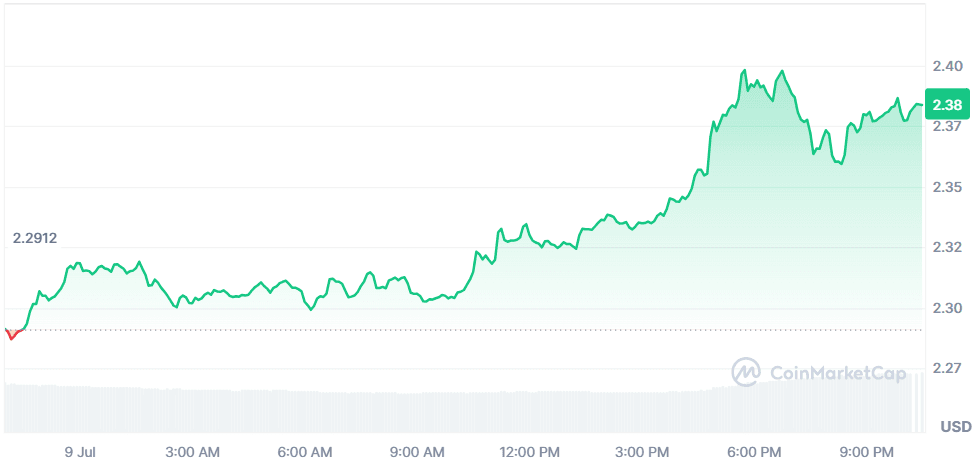

XRP (XRP)

Price Change (24H): +3.83% Current Price: $2.37

What happened today

XRP surged after a series of major developments signaled the closing chapter in its long-standing legal battle with the SEC. Ripple dropped its cross-appeal, and the SEC is expected to vote on dropping its appeal during a closed-door meeting on July 10. Ripple CEO Brad Garlinghouse testified before the Senate, advocating regulatory clarity and supporting the CLARITY Act. Meanwhile, Truth Social’s ETF filing named XRP among top assets, reigniting hopes for institutional adoption. XRP’s ecosystem also got a boost as BNY Mellon became the custodian for Ripple's stablecoin RLUSD, which crossed $500M in market cap within 7 months. With speculation mounting around a bank license and ETF inclusion, XRP is testing a breakout range toward $2.80–$3.40.

Market Cap: $140.54B 24-Hour Trading Volume: $4.22B Circulating Supply: 59.06B XRP

Ethereum (ETH)

Price Change (24H): +3.39% Current Price: $2,664.94

What happened today

ETH saw renewed strength as institutional accumulation intensified. Companies like SharpLink Gaming and BitDigital have acquired hundreds of millions worth of ETH, consuming up to 82% of new ETH issued post-Merge. Vitalik Buterin’s support for copyleft licensing sparked debate about open-source ethics, while EIP-4444 brought a revolutionary 500GB node storage reduction, improving accessibility for validators. ETH also gained momentum from its spot ETF flows and its deflationary mechanics post-Merge. The Pectra upgrade is expected to streamline the user experience, while Layer-2s like Arbitrum and Optimism continue scaling activity.

Market Cap: $321.7B 24-Hour Trading Volume: $20.83B Circulating Supply: 120.71M ETH

Stellar (XLM)

Price Change (24H): +13.21% Current Price: $0.2882

What happened today

Stellar rallied on the back of a major network upgrade rollout. The release of Stellar Core v23.0.0rc2 brings several improvements, including Soroban parallel execution and multiplexed account features. Analysts expect a breakout past $0.285 if momentum continues. Adding fuel to the surge, PayPal’s stablecoin PYUSD is reportedly launching on the Stellar network soon, promising to open fast, low-cost transfers across 170+ countries. Network activity hit a high with over 197 million operations in June, while stablecoin supply surpassed $667M, reflecting rising adoption.

Market Cap: $8.94B 24-Hour Trading Volume: $655.3M Circulating Supply: 31.01B XLM

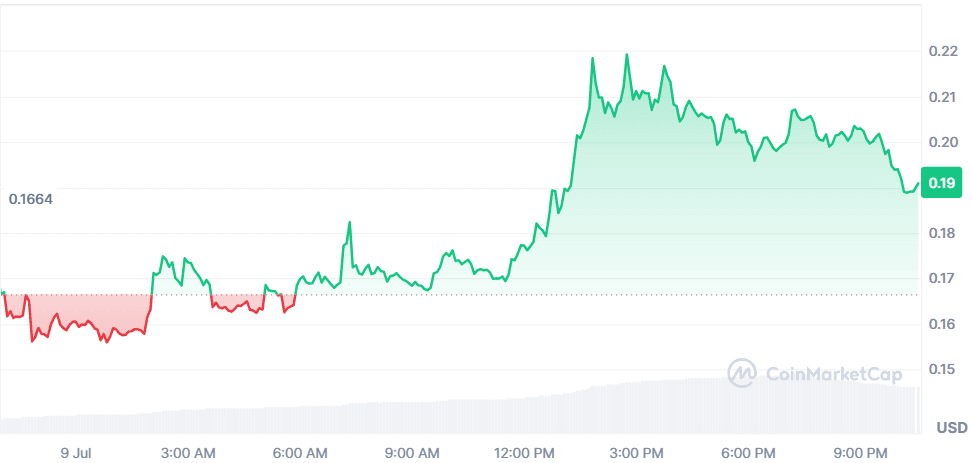

Treasure (MAGIC)

Price Change (24H): +18.71% Current Price: $0.1911

What happened today

MAGIC broke out above key resistance after its listing on Niza.io and Gate.io, which sparked a 2,300% surge in volume earlier this month. A bullish technical setup, including a positive MACD crossover, RSI of 77.63, and price action above the 200-day EMA, fueled momentum. On-chain data shows whales have withdrawn MAGIC from exchanges, reducing circulating supply and intensifying buy pressure. The market responded strongly, suggesting renewed confidence in Treasure's metaverse and gaming ecosystem.

Market Cap: $58.86M 24-Hour Trading Volume: $527.04M Circulating Supply: 307.92M MAGIC

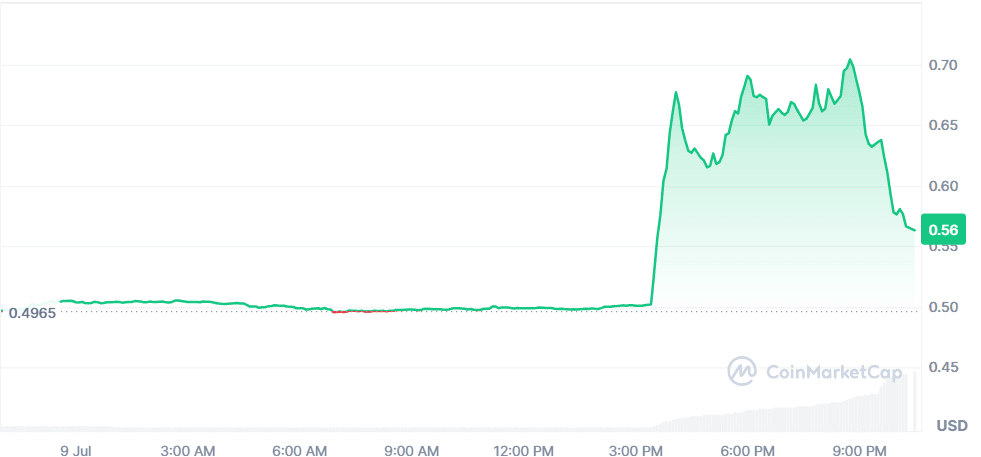

Lagrange (LA)

Price Change (24H): +7.1% Current Price: $0.5332

What happened today

Lagrange surged following its listing on Binance, where it was introduced as the platform’s 26th HODLer Airdrop project. Binance will support LA/USDC, LA/USDT, and other major trading pairs, driving significant visibility and liquidity. LA’s core offering includes a ZK Prover Network and SQL-based ZK Coprocessor, which power proof generation and on-chain data analysis for DeFi. The Binance listing—combined with airdrop rewards and marketing campaigns—sparked over 34% daily gains at one point and positioned LA as a promising infrastructure play in the zk-rollup space.

Market Cap: $102.92M 24-Hour Trading Volume: $158.03M Circulating Supply: 193M LA

Global Market Snapshot

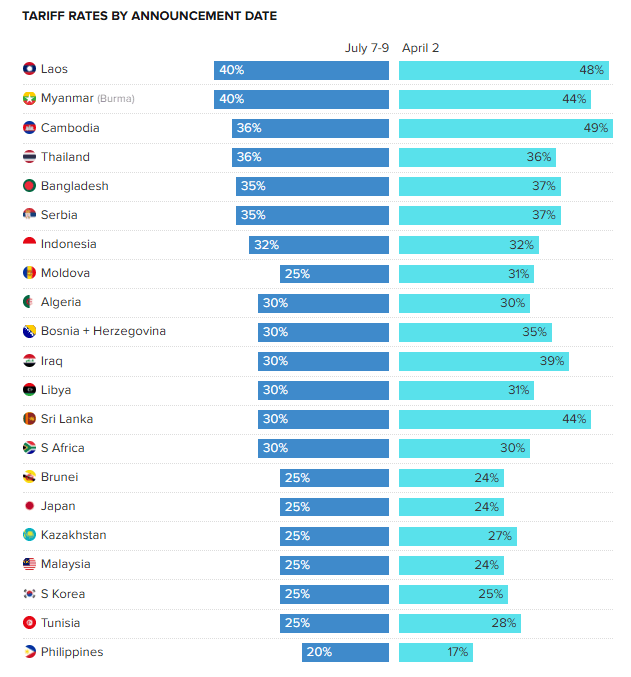

Global markets absorbed another round of tariff escalation from President Trump, who issued fresh letters dictating steep import duties, 20% to 40%, on goods from seven more countries, bringing the total to 21.

Meanwhile, copper prices surged to record levels in the U.S. after Trump confirmed a 50% tariff on copper imports, driving the domestic premium over global benchmarks up 138% in a single day. Analysts warn this sharp divergence could ripple across manufacturing, infrastructure, and consumer goods, with substitution toward aluminum already being considered. The copper shock, along with rising input costs, casts new shadows over U.S. industrial resilience, especially as supply-side inflation risks mount.

Despite the trade tension, Wall Street appeared unfazed. The S&P 500 rebounded, tech led the way, and Nvidia soared past a $4 trillion valuation, becoming the first company to do so. The Nasdaq hit new intraday highs, powered by chipmakers and AI optimism. Investors seemed to bet that Trump’s tariff threats leave room for negotiation, particularly after the deadline extension to August 1. While tariffs threaten economic pain, market strategists believe a deal-making window is open. At the same time, Fed minutes and macro data remain closely watched, as rate-cut expectations continue to build despite strong equity momentum.

Closing Thoughts

Investor sentiment remains bifurcated across the financial landscape. In traditional markets, the S&P 500 rebounded despite escalating tariff tensions, led by Nvidia’s record-breaking $4 trillion valuation and a broad tech rally. Markets seem to be pricing in the possibility that Trump’s aggressive tariff push including a 50% copper import levy will either soften through negotiation or at least be absorbed by resilient corporate earnings. But under the surface, rising input costs and commodity pressure are stirring concerns about demand destruction and inflation echoing through manufacturing-heavy sectors.

In contrast, crypto markets are responding more positively to structural developments. Institutional accumulation is lifting confidence in large-cap assets like ETH and XRP, while infrastructure upgrades (Stellar), new listings (LA), and supply shocks (MAGIC) are catalyzing micro-cap momentum plays. The action is largely centered around utility and credibility, projects with regulatory headroom, real-world integration, or ecosystem upgrades are leading the charge. That alignment with traditional investment themes like scarcity, compliance, infrastructure suggests crypto is moving deeper into mainstream relevance, even as the broader global economy braces for what comes next.