Binance held its ground in derivatives all through 2025, even with regulators intensifying oversight across major markets.

Meanwhile, Hyperliquid (HYPE) emerged as the top on-chain perps platform, the most rapid volume ramp among niche players. The key question: can that momentum translate to meaningful market share against the CEX leader this year?

The Players: CEX Giant Vs. On-Chain Derivatives Engine

Binance enters 2026 as the crypto trading standard, market position remains unchallenged.

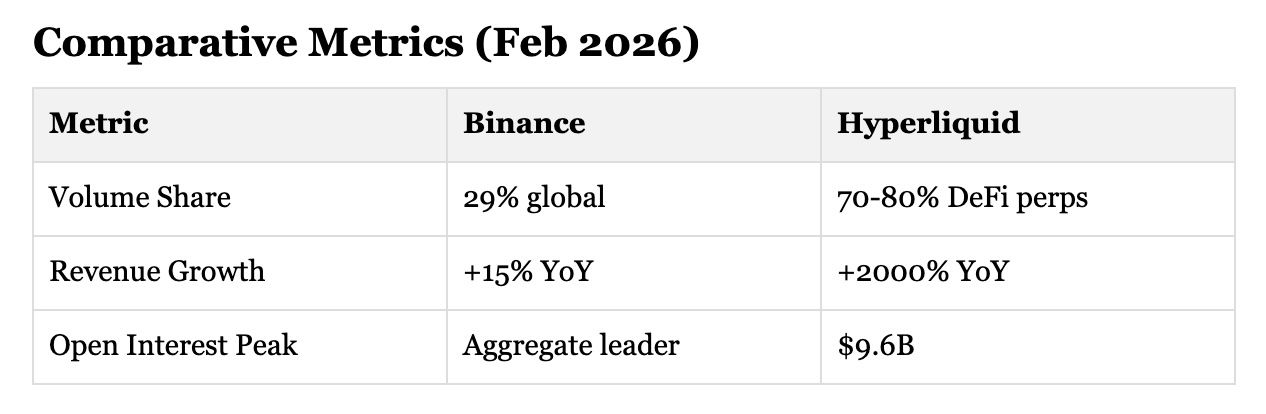

Last year, they grabbed about 29% of global derivs volume, clocking $25 trillion despite the U.S. and EU cracking down.

Spot averaged $10-12B daily over 600+ pairs, futures and options pulled 75% of the action, and stuff like Launchpool, Simple Earn, plus BNB staking chipped in ~40% of revenue.

Here's the lock-in: their APIs have thousands of prop desks, market makers, and local brokers committed—switching costs remain substantial. Subsidiaries with licenses reroute non-U.S. flows around blocks, but growth's cooled to mid-single digits thanks to compliance headaches.

Standout edges

- Unmatched execution speed and uptime for high-frequency flow.

- Deep liquidity across 600+ pairs, minimizing slippage.

- Institutional-grade APIs with low-latency endpoints.

Hyperliquid Surge

Hyperliquid owned the on-chain perps game in 2025, weekly volumes jumped from $13B to $47B highs, generating $833M in fees from maker-taker spreads. OI settled around $9.6B over 100+ markets at 50x leverage, with keeper nodes achieving sub-100ms fills that stack up to mid-tier CEXs.

It's L1 non-custodial, no central risk, but oracles are the potential vulnerability. 60% of trades are programmatic, caps keep retail at bay, favoring big players.

Core differentiators:

- Emissions-to-fees transition for sustainable liquidity.

- Governance via native HYPE coin, accessible through exchange options.

- Specialization in perpetuals-only infrastructure.

This focus positions Hyperliquid as dedicated derivatives engine rather than a broad trading hub.

Growth Trajectories: Volumes, Revenue, Market Penetration

Binance Momentum

Binance scaled derivatives volume to $25 trillion through 2025, capturing roughly 29% of the global market despite regulatory headwinds in the U.S. and EU. Daily spot flows held steady at $10-12 billion across 600+ pairs, while perpetuals and options fueled 75% of activity. Revenue diversification through Launchpool, Simple Earn and BNB Chain staking added about 40% to fee income.

Growth stabilized at mid-single digits annually, anchored by institutional API integrations. Licensed subsidiaries preserved non-U.S. dominance amid compliance costs.

Hyperliquid Acceleration

Hyperliquid posted explosive growth, lifting weekly perpetuals volumes from $13 billion in late 2024 to $47 billion peaks by year-end.

Open interest climbed toward $9.6 billion across 100+ markets, with protocol revenue hitting $833 million via maker-taker fees, shifting from HYPE emissions to self-sustaining operations.

Programmatic traders drove 60% of flow, prioritizing infrastructure over retail access. Rapid L1 scaling mirrors white-label blockchain solutions that streamline custom derivatives platforms for businesses seeking on-chain efficiency.

Hyperliquid demonstrates strong momentum for on-chain perps viability—reflected in performance metrics—but Binance's all-around reach keeps them ahead.

Product and execution: trader decision factors

Binance Edge

Binance offers proven reliability: millions of orders/sec across 600+ pairs, sub-10ms latencies, 99.99% uptime. Tiered maker-taker fees reward high volume; deep liquidity cuts slippage on majors. APIs handle prop desks seamlessly.

Key decision factors:

- Depth that holds in market volatility.

- Cross-margin spanning spot/perps.

- Reg-compliant local access.

Hyperliquid Appeal

Hyperliquid delivers on-chain perps with 50x leverage on 100+ markets, sub-100ms fills via L1 keeper nodes. Makers earn -0.02%, takers pay 0.05%; transparent books match CEX depth without central failure points.

Primary attractions:

- Gasless execution, true self-custody.

- Liquidations independently verifiable.

Binance wins on breadth and scale; Hyperliquid on transparent perps purity.

Token economics and value accrual: HYPE vs BNB

BNB Ecosystem Anchor

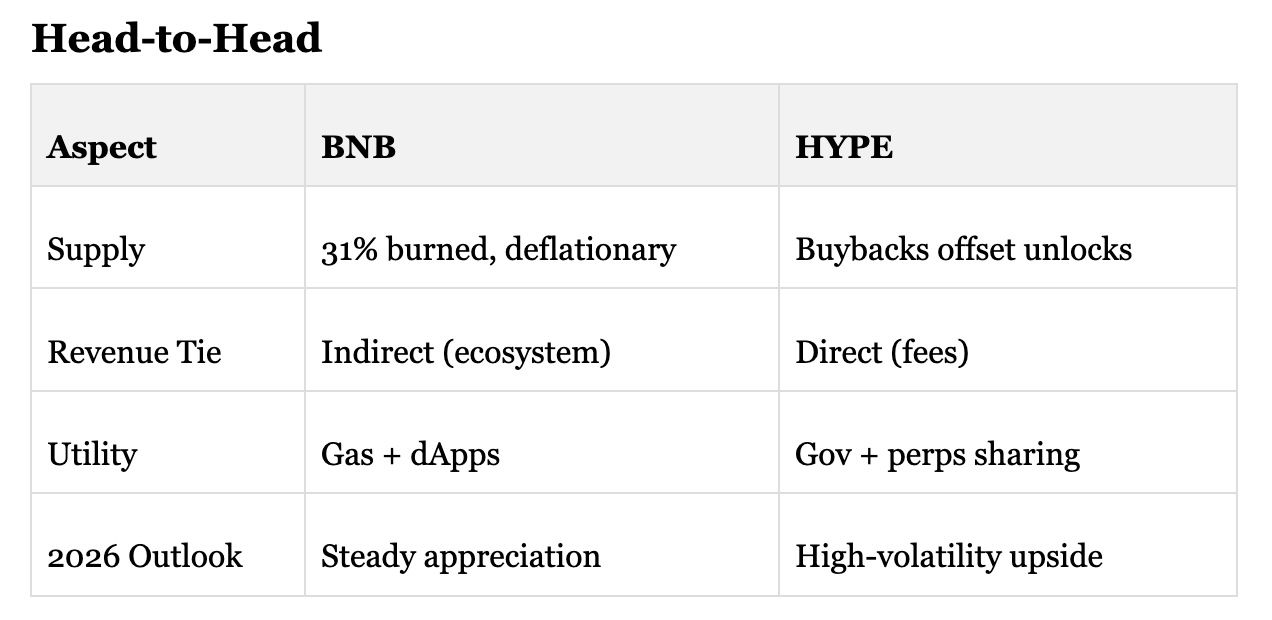

BNB powers BNB Chain as gas token across 5,000+ dApps, $11B TVL and 58M monthly users. Dual burns — quarterly and real-time gas fees — reduced supply 31% since 2023 to 136M circulating, targeting 100M by 2027-2028. Monthly revenue topped $76M in late 2025.

Value accrual via:

- Trading/staking fee burns.

- Launchpool rewards and governance.

- Chain growth dividends.

HYPE Protocol Capture

HYPE enables Hyperliquid governance, fee-sharing and L1 emissions. $833M LTM revenue supports buybacks against unlocks; 70% DeFi perps dominance drives demand. At 238M circulating ($7.2B cap), it trades ~$30 with $14.7B FDV.

Mechanisms include:

- Staker rebases from perp fees.

- $1.3B buyback treasury.

- Liquidity governance control.

BNB leverages broad utility for stability; HYPE captures perps fees for focused growth.

Infrastructure and B2B relevance: rails for brokers and fintech

Binance Backbone

Binance arms thousands of brokers and fintechs with white-label APIs, prime brokerage and custody. These channel 20%+ of volume via aggregated spot/futures flow, low-latency endpoints and risk engines for institutional primes. Custom UIs, sub-accounts and fiat ramps enable branded crypto services; compliance tools support regulated global access.

Hyperliquid Rails

Hyperliquid supplies order book APIs and keeper nodes for on-chain perps, drawing DeFi protocols and fintechs building derivatives layers. Non-custodial execution avoids CEX risk, with SDKs integrating 50x leverage and gasless L1 settlement.

B2B edge: CEX-rivaling depth plus fee-sharing for white-label desks.

Binance owns hybrid rails; Hyperliquid claims the transparent on-chain lane.

2026 outlook: scenarios and takeaways

Binance Stability

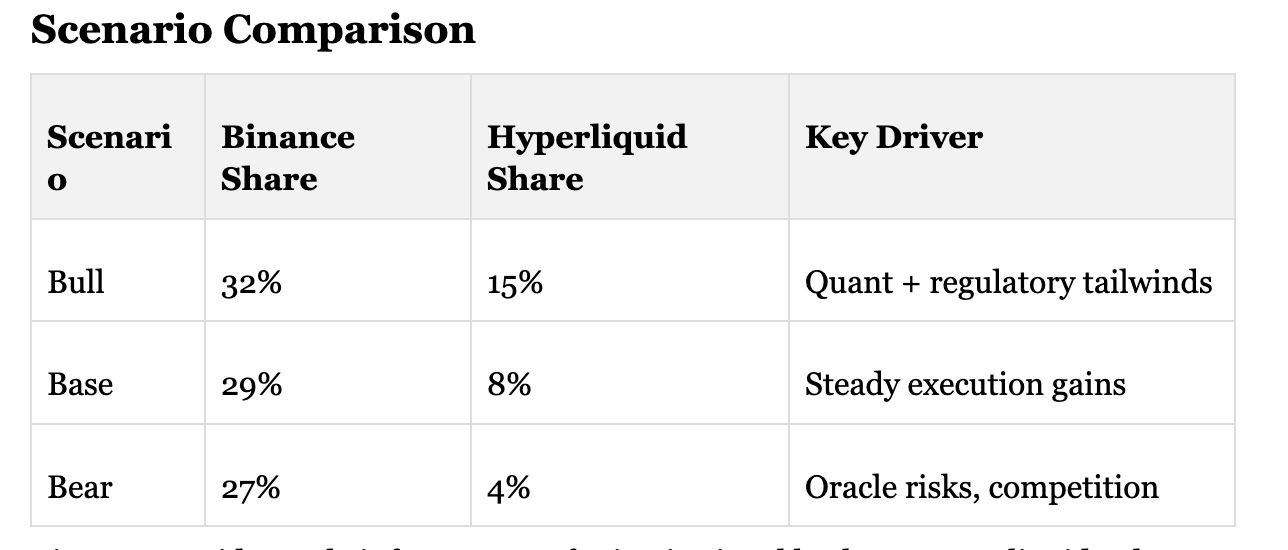

Binance enters 2026 with 29% derivatives dominance and diversified revenue, projecting mid-teens growth via institutional APIs and geographic pivots. Spot volumes could rise 15-20% with regulatory wins; BNB Chain scaling lifts non-fee income toward 45%. U.S./EU constraints persist, but licensed entities ensure resilience.

Hyperliquid Upside

Hyperliquid aims for 10%+ global perps share, leveraging $833M revenue for L1 upgrades and liquidity. HYPE buybacks may double open interest to $20B if DeFi adoption surges.

Binance provides scale infrastructure for institutional brokers; Hyperliquid enhances on-chain perpetuals execution capabilities. Hybrid CEX-DeFi liquidity strategies demonstrate superior performance, with HYPE offering higher-beta exposure relative to BNB's consistent returns.

Final Thoughts

Binance retains dominance in derivatives with 29% global market share, robust infrastructure, and established B2B integrations securing institutional flows. Hyperliquid demonstrates significant on-chain potential through $833 million LTM revenue, over 70% DeFi perpetuals dominance, and direct fee accrual to HYPE. The landscape favors integrated approaches combining centralized scale with decentralized execution.

Projections indicate Hyperliquid achieving 8-10% global perpetuals penetration if L1 reliability persists, supporting HYPE appreciation, while BNB benefits from ecosystem expansion. Institutional strategies emphasizing hybrid liquidity will prevail; monitor Q1 volumes for confirmation.

FAQ

What gives Binance its edge in 2026?

Binance commands 29% of global derivatives with $25 trillion in 2025 volume, offering unmatched liquidity across 600+ pairs and sub-10ms execution for institutions. About 40% of revenue flows from Launchpool and BNB staking, while licensed subsidiaries navigate U.S./EU regulations effectively.

How has Hyperliquid grown so fast?

Hyperliquid surged from $13 billion to $47 billion weekly perps volumes, reaching $833 million LTM revenue and $9.6 billion open interest on its L1 chain. Sub-100ms fills, 50x leverage and 60% programmatic trading secured 70-80% DeFi perps dominance through a shift to sustainable fees.

BNB or HYPE — which token to watch?

BNB drives BNB Chain utility with 31% supply reduction via burns since 2023, delivering steady ecosystem growth. HYPE captures Hyperliquid perps fees directly through rebases and buybacks, providing higher volatility and upside tied to protocol expansion.

Can Hyperliquid challenge Binance overall?

Hyperliquid eyes 8-15% global perps share in 2026 via L1 upgrades but focuses solely on on-chain perps without spot or options breadth. It attracts quants and self-custody traders; Binance retains leadership through scale and B2B infrastructure.

What's the B2B angle for brokers?

Binance delivers white-label APIs handling over 20% of volume, complete with custom UIs and compliance tools for regulated fintechs. Hyperliquid provides on-chain SDKs for gasless perps execution and fee-sharing, suiting DeFi-oriented brokers avoiding CEX risks.

2026 outlook summary?

Binance expects mid-teens growth with proven resilience; Hyperliquid targets $2 billion revenue and doubled open interest. Brokers benefit most from hybrid setups combining CEX scale with DeFi transparency for optimal execution.

Disclaimer

This analysis reflects market conditions as of February 2026 and draws on publicly available data. Crypto derivatives trading carries substantial risk of loss; past performance does not predict future results. Token values like BNB and HYPE remain highly volatile. No investment advice is provided — consult qualified professionals before trading. Platforms mentioned operate in regulatory gray zones across jurisdictions.