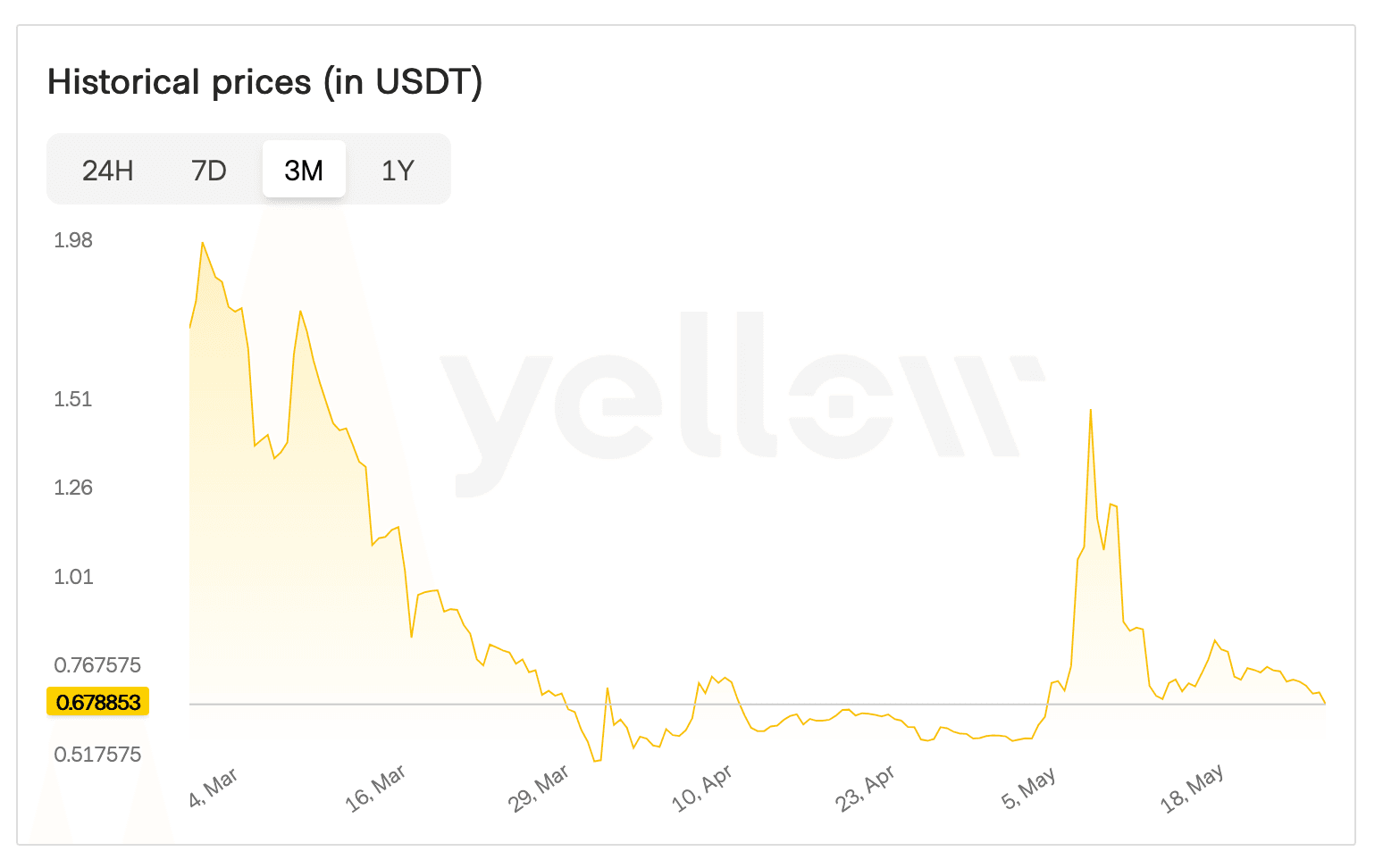

Pi Network cryptocurrency has fallen to $0.67 after losing critical support at the $0.71 level within the past 24 hours, with technical analysis suggesting the digital asset may face continued downward pressure in coming trading sessions.

What to Know:

- Pi Network broke below the crucial $0.71 support level, now trading at $0.67 with immediate support at $0.61

- The Chaikin Money Flow indicator shows growing investor outflows, signaling increased selling pressure over buying interest

- Technical squeeze momentum patterns indicate potential for sharp price movement, likely to the downside given current bearish conditions

Technical Indicators Signal Growing Investor Exodus

The Chaikin Money Flow indicator has moved below the zero line for Pi Network, revealing a shift toward selling pressure that exceeds buying volume. This technical measure tracks the flow of money in and out of the cryptocurrency. When CMF readings fall below zero, it typically indicates that institutional and retail investors are reducing their positions.

Market analysts view this pattern as evidence of weakening investor confidence in Pi Network's short-term prospects. The indicator suggests that selling volume has gained momentum over recent trading periods. If this trend continues, it could signal broader skepticism about the cryptocurrency's ability to maintain current price levels.

The growing dominance of outflows reflects what appears to be systematic profit-taking or loss-cutting behavior among Pi Network holders. This technical development often precedes extended periods of price weakness.

Squeeze Momentum Builds Toward Potential Breakout

Pi Network currently exhibits characteristics of an active squeeze pattern, according to the squeeze momentum technical indicator. Black dots appearing on price charts typically signal periods of compressed volatility. These compression phases often precede significant price movements once the squeeze releases.

The current technical setup shows bearish momentum building within this squeeze pattern. Historical analysis suggests that when squeeze patterns develop alongside negative momentum indicators, the subsequent price movement tends to favor the downside. Blue dots on the indicator would signal the beginning of the volatility release phase.

Technical traders monitor these patterns because they often provide advance warning of sharp price moves. The combination of squeeze conditions and bearish momentum creates what analysts consider a high-probability setup for downward price action.

Price Action Tests Critical Support Levels

Pi Network's breach of the $0.71 support level represents a significant technical development for the cryptocurrency. This price point had served as a floor for the digital asset during previous trading sessions. The failure of this support suggests that selling pressure has intensified beyond what buyers were willing to absorb at that level.

The next meaningful support level sits at $0.61, representing approximately a 9% decline from current trading levels. Should Pi Network fail to find buying interest at this price point, technical analysis points to a potential drop toward $0.57. Such a move would extend the current downtrend and create additional pressure on investor sentiment.

Market participants will likely monitor trading volume at these key levels to gauge the strength of any potential support. Higher volume at support levels typically indicates stronger buying interest.

Recovery Scenarios Remain Possible

Despite the bearish technical outlook, Pi Network retains pathways for potential recovery if market conditions shift. A successful reclaim of the $0.71 level as support would represent a significant technical reversal. This development would suggest that selling pressure has diminished and buying interest has returned.

A more substantial recovery scenario would require Pi Network to advance above $0.78. This price target sits approximately 16% above current levels. A move to this level would likely invalidate the current bearish technical thesis and could attract momentum-based buying from technical traders.

However, such a recovery would require a notable shift in market sentiment and increased buying volume. The cryptocurrency would need to overcome the technical headwinds currently reflected in momentum indicators.

Market Context and Investor Sentiment

The broader cryptocurrency market environment continues to influence individual asset performance, including Pi Network. Risk sentiment among digital asset investors has shown signs of caution in recent trading sessions. This backdrop creates challenges for cryptocurrencies attempting to maintain upward momentum or recover from technical breakdowns.

Pi Network's price action occurs within this context of heightened market scrutiny. Investors appear increasingly selective about cryptocurrency investments, focusing on assets with strong fundamental support or clear technical setups.

The current technical picture for Pi Network suggests that market participants have adopted a more cautious stance toward the asset. This shift in sentiment could persist until technical indicators show signs of improvement or fundamental developments provide new catalysts for investor interest.

Closing Thoughts

Pi Network's technical breakdown below $0.71 support, combined with bearish momentum indicators, suggests the cryptocurrency faces near-term challenges that could drive prices toward the $0.61 or $0.57 levels. While recovery scenarios remain possible above $0.78, current market conditions favor continued downward pressure for the digital asset.