This week, global financial markets moved in response to a mix of resilient US economic data, shifting central bank tones, and simmering geopolitical tensions. While US equities surged to new highs on the back of stronger-than-expected job numbers and easing trade concerns, European markets took a more cautious tone following the ECB’s rate cut and policy pause.

Meanwhile, Asian markets reflected a patchwork of trends, with Japanese equities benefiting from yen weakness, and China and India showing tentative industrial demand recovery.

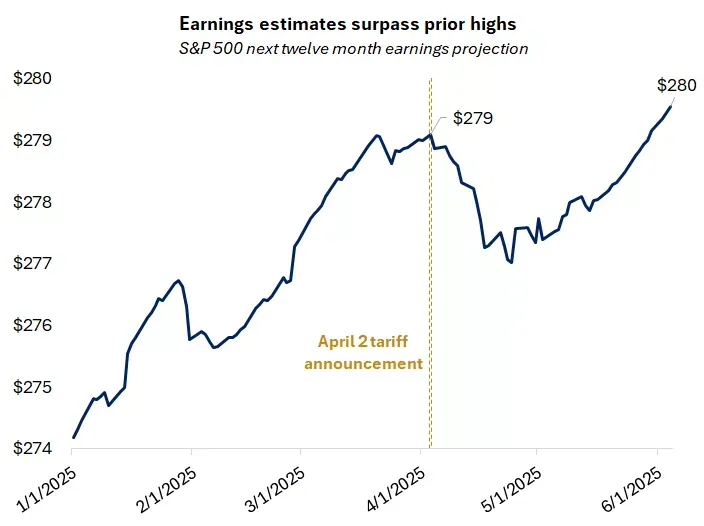

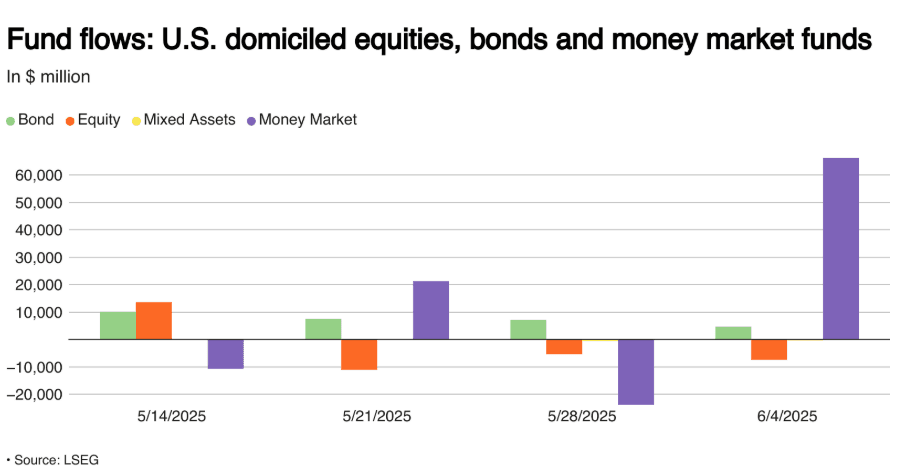

Investor sentiment remained cautiously optimistic, buoyed by strong corporate earnings and resilient labor markets, yet undercut by massive inflows into US money market funds signaling that not all investors are fully buying into the risk-on rally. As summer begins, markets seem eager to climb, but with one eye on the growing risks around trade, policy uncertainty, and stretched valuations.

Equities Roundup

Equity Markets React to Strong Jobs Data and Easing Trade Fears

- US: S&P 500 surged +1.03% to cross the 6,000 mark for the first time since February, powered by solid May job data and cooling trade tensions. The Dow (+1.2%) and Nasdaq (+2.2%) also extended their gains.

-

Europe: Euro STOXX 50 advanced +0.36%, supported by a dovish ECB tone and easing inflation in the eurozone.

-

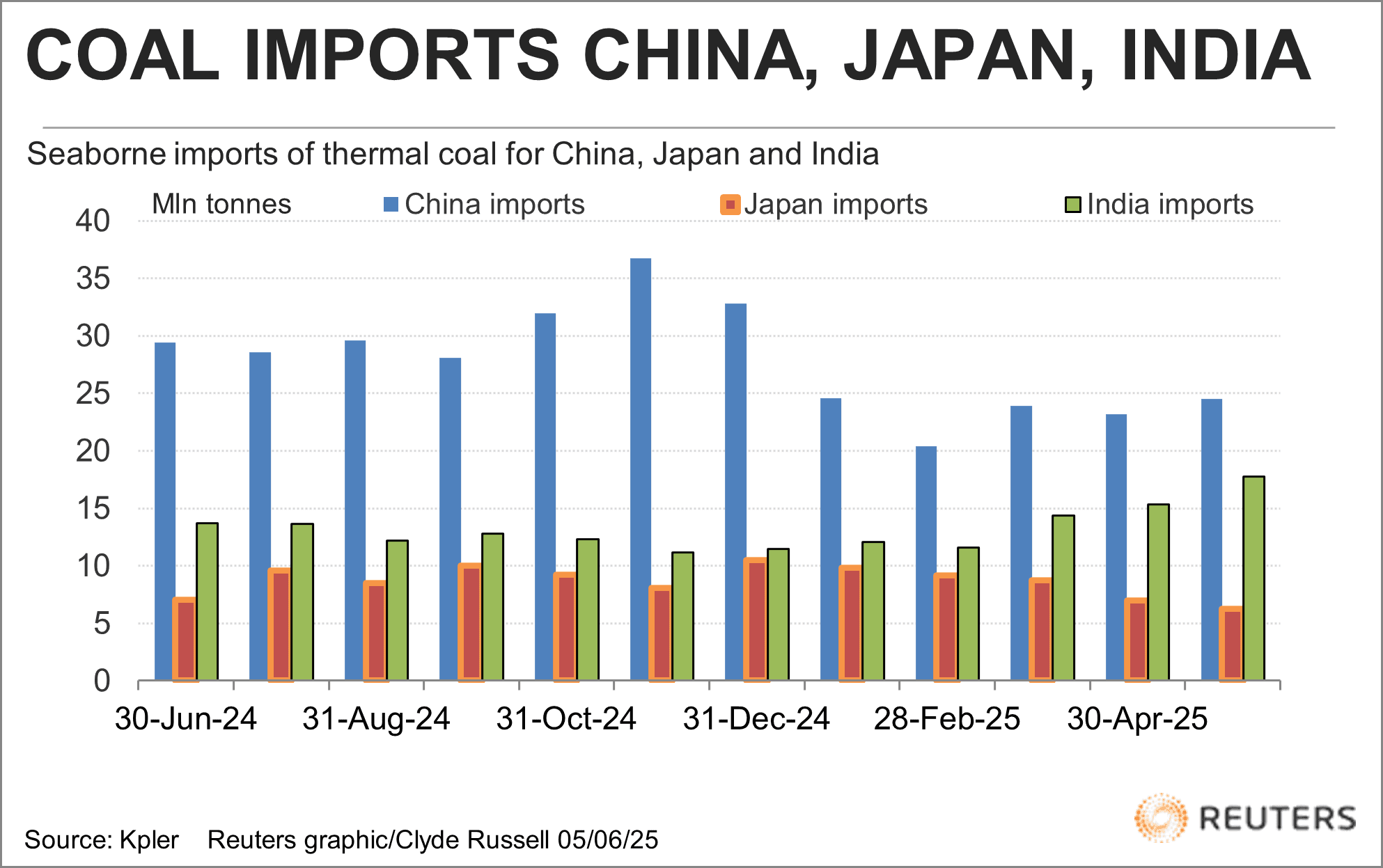

Asia: Nikkei 225 climbed +0.50%, underpinned by resilient corporate earnings and a weakening yen. China and India showed growing demand for coal, hinting at stabilizing industrial activity.

-

Sectors: Tech and consumer discretionary led US gains (+20% and +8% YoY EPS), supported by AI-driven optimism (NVIDIA reclaimed the most valuable company title). Financials saw fund outflows as caution rose.

-

Flows: US money market funds saw $66B in inflows, largest since Dec 2024, while equities experienced $7.4B in outflows.

Weekly flows into US equity, bond and money market funds in $ million

Weekly flows into US equity, bond and money market funds in $ million

- IPOs/Earnings: Solid Q1 earnings (+12.5% YoY S&P 500) with a high forward EPS estimate supported equity strength.

Commodities Check

Oil Climbs While Gold Eases on Stronger Dollar

-

Brent Crude: Rose +0.27% to $66.65 amid Middle East tensions and summer demand outlook.

-

Gold: Fell -0.44% to $3,308.20 as USD firmed and equities rose.

-

Copper: Slipped -0.55% to $875.40 due to concerns over slower Chinese industrial demand.

-

Soybeans: Marginal gain (+0.07%) supported by shifting dynamics in global corn trade, with Brazil’s bumper crop potentially pressuring US exports.

-

Coal: Asia thermal coal imports rebounded (China + India), but prices remain near 4-year lows. Australian 5,500 kcal/kg coal dropped to $66.84/ton.

Seaborne thermal coal imports by China, Japan, India

Seaborne thermal coal imports by China, Japan, India

Currency & Forex Snapshot

Dollar Holds Firm Amid Mixed Global Signals

-

USD Index: Stable, supported by solid US jobs data and inflows into money markets.

-

EUR/USD: Slightly down -0.04% at 1.1391 after ECB cut rates but signaled pause.

-

GBP/USD: Down -0.03% at 1.3521 amid political noise and cautious BoE outlook.

-

JPY/USD: Weakening trend continues (-0.01%), now 0.0069, benefiting Japanese equities.

-

CNY/USD: Slight move (-0.01%), reflecting ongoing trade friction and soft domestic data.

-

Flows: Caution drove capital to USD-denominated assets; $66B inflows into US money market funds.

Bond Yields & Interest Rates

Yields Rise on Fed Caution and Resilient US Economy

- US 10Y: Yield surged +0.111 to 4.506%, with market reducing bets on near-term Fed cuts.

-

DE 10Y: Edged up +0.018 to 2.582% post-ECB rate cut and neutral guidance.

-

UK 10Y: Held steady at 4.653%, awaiting more clarity on BoE policy path.

-

JP 10Y: Small uptick (+0.004) to 1.458%, tracking global bond market moves.

-

Fed Outlook: June hold expected, September cut more likely as inflation data and tariff impacts evolve.

-

ECB: Nagel confirmed neutral stance, further easing paused for now.

Crypto & Alternative Assets

Bitcoin Stabilizes, Altcoins See Mixed Flows Amid Regulatory Noise

-

BTC: Held ~$106,000, eyeing key $104,400 support on weekly close. Possible short squeeze risk with ~$15B in shorts at risk on 10% BTC move.

-

ETH & Alts: Volatility remains high; Michael Saylor hinted at fresh BTC buys post $1B stock raise.

-

Regulation: Coinbase data breach reignited debate on KYC efficacy. Calls for ZK-based identity systems gaining traction.

-

Market Tone: Cautious optimism in BTC; altcoins struggling with mixed sentiment and regulatory overhang.

Global Events & Macro Trends

US Jobs Data Eases Slowdown Fears; Trade and Geopolitics Stay Front & Center

-

US Jobs: +139K jobs in May, unemployment stable at 4.2%. Wage growth outpacing inflation. Fed likely to stay patient.

-

Global Equities: +20% off April lows; S&P 500 up +2% YTD, global markets resilient but increasingly vulnerable to policy shocks.

-

Macro Flows: Money moving to safer assets (money market funds) even as equities rise.

-

US Politics: LA National Guard deployment, trade negotiations with China, and fiscal bill debates dominate headlines.

-

Germany-US Relations: Merz’s visit calms trade and NATO tensions; signals potential transatlantic cooperation.

-

Commodities: Brazilian corn harvest may pressure US export prospects; coal demand in Asia rising modestly as prices remain subdued.

-

Aviation: Industry poised for profitability rebound in 2025 despite macro headwinds with lower fuel costs and strong demand cited by IATA.

Closing Thoughts

Looking at the broader picture, markets appear to be in a fragile uptrend, with robust earnings and resilient US labor data anchoring sentiment. While tech, consumer discretionary, and AI-linked sectors continue to fuel market strength, defensive flows into money markets and bond market caution reveal an undercurrent of risk aversion. Commodity markets painted a more subdued picture, with gold easing, industrial metals under pressure, and energy prices seeing only modest gains—highlighting persistent concerns about global demand.

Heading into next week, all eyes will be on the May CPI report and ongoing trade negotiations, both of which could sharply sway market tone. While the rally has strong momentum, rising geopolitical frictions (as seen in LA protests and US-China tariff talks), political uncertainties in the US and Europe, and emerging signs of policy fatigue in central banks may inject renewed volatility. For now, the narrative remains bullish but the divergence between risk-on equity action and defensive capital flows suggests this summer rally will be tested sooner rather than later.