This week, global financial markets moved in response to a potent mix of central-bank patience, cooling macro data and a late-week geopolitical jolt. Wall Street began digesting a Fed that left policy unchanged yet still signals two cuts in 2025, while Beijing’s latest figures showed factory output slowing even as consumers opened their wallets.

In Europe, inflation slipped neatly back inside the ECB’s 2% target, and the Bank of England’s steady-as-she-goes stance kept gilt yields in check. Investor sentiment turned distinctly volatile after Washington confirmed precision air-strikes on Iran’s main nuclear facilities, an escalation that sent crude futures sharply higher and had traders scrambling for safe havens.

While US equities eked out fractional gains, Europe slipped and Asia was mixed, underscoring a cautious global tone. Energy names rode the oil spike, defensive plays outperformed growth in the S&P 500, and bond markets rallied on a classic risk-off bid. Currency moves were muted overall, though the yen briefly tested 146 per dollar as rate-differential trades resurfaced. Here’s how the action unfolded across the board.

Equities Roundup

Equity Markets React to Oil Jitters & Central-Bank Cues

-

US: The S&P 500 slipped 0.2% to 5,967.84 for its second losing week, while the Dow eked out a 0.1% gain and the Nasdaq added 0.2 %, helped by defensive real-estate names and a late-week bid for megacap tech despite Middle-East-fuelled volatility.

-

Europe: The FTSE 100 snapped a six-week winning streak, finishing the week down 0.86 % at 8,774.65 as weak UK retail-sales data and profit-taking in house-builders weighed on sentiment.

-

Asia: Japan’s Nikkei 225 inched up 0.2% on the week to 38,403, supported mid-week by chip-stock strength before profit-taking set in.

-

India: Riding a 1.3% Friday surge, the Nifty 50 closed the week 1.5 % higher at a fresh record 25,112 on renewed foreign inflows into banks and industrials.

-

Sector pulse: AI-themed growth ETFs such as ARK Innovation jumped 8.9%, while energy lagged as oil gave back some mid-week spikes.

-

Corporate movers: Accenture (-7 %, guidance cut) and Tesla (-1%, robotaxi launch chatter) were notable US laggards; UK builder Berkeley Group tumbled 8% on weaker profits.

Commodities Check

Oil Climbs While Gold Finds Support

-

Crude oil (WTI): Settled Friday at $74.93/bbl, up ~2.7 % on the week after Israel-Iran headlines briefly pushed Brent above $77; resistance sits near $77, with support around $71.

-

Gold: Spot gold slipped 0.6 % to $1,936/oz but held the $1,930 support band as safe-haven bids offset a softer dollar.

-

Silver & metals: Silver tracked gold lower (-1.1% to $23.10/oz), while copper hovered near $4.38/lb amid mixed China data and a modest dollar pull-back.

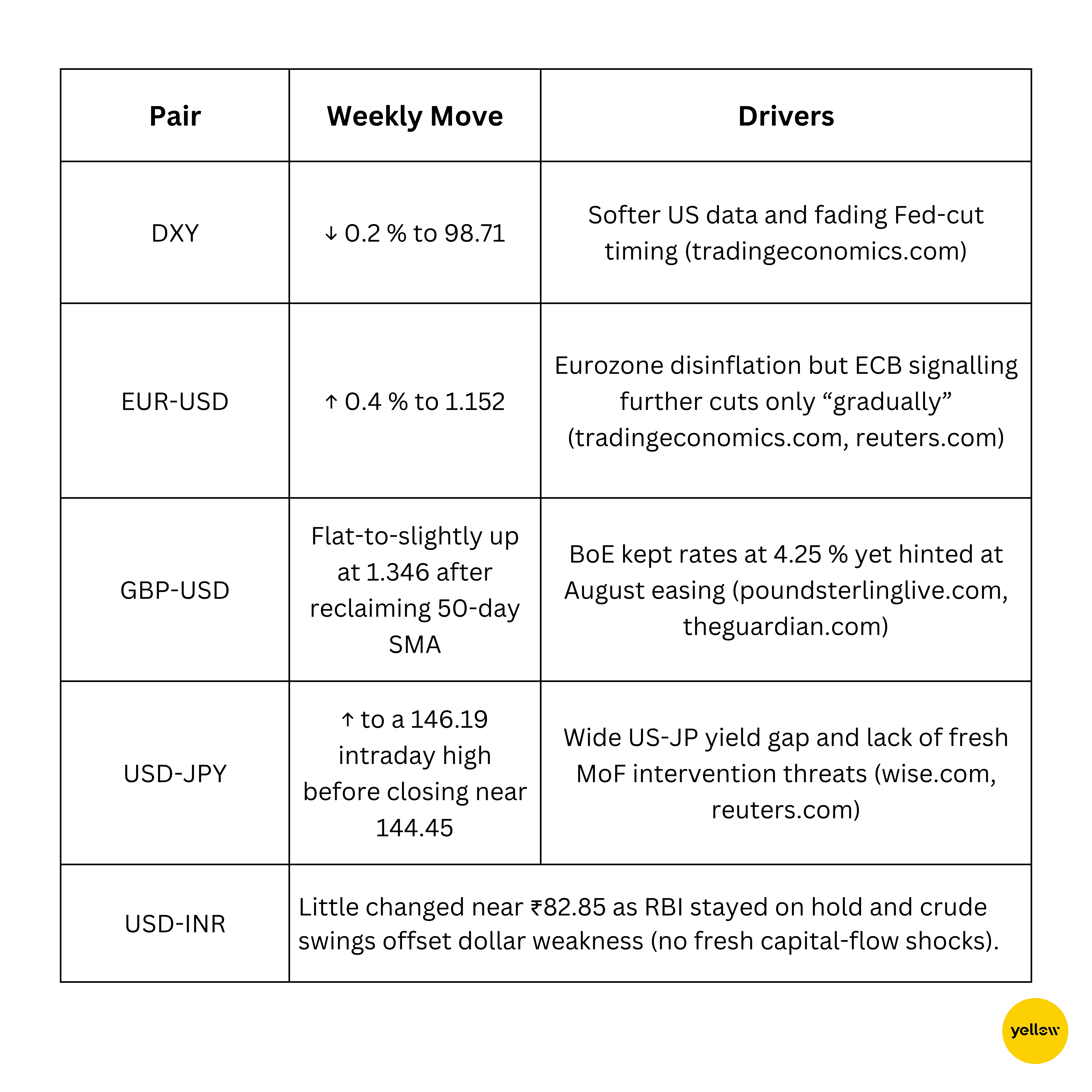

Currency & Forex Snapshot

Dollar Eases; Yen Tests 146 on Policy Divergence

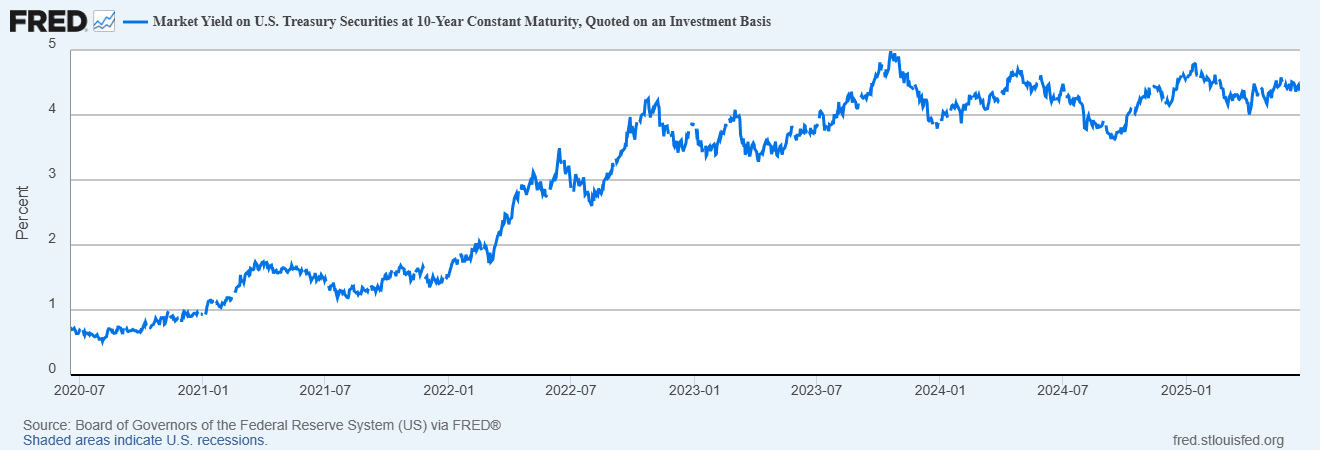

Bond Yields & Interest Rates

Yields Dip as Fed Patience Meets BoE Pause

- US 10-year: Fell 8 bp from 4.46% (Mon) to 4.38 % (Wed/Fri close) as jobless claims ticked higher and Fed speakers reiterated “data-dependency”.

-

UK Gilts: 10-year gilt yields slipped 5bp to 3.78% after the BoE’s 6-3 hold vote kept the door open for summer cuts.

-

Eurozone: Bund yields held around 2.24%, with ECB officials such as Centeno and de Guindos talking up room for more easing later in 2025.

-

Policy highlights: Switzerland and Norway each trimmed rates 25 bp, underscoring the 'global tilt toward incremental easing even as the Fed waits.

Crypto & Alternative Assets

Bitcoin Holds the $100k Handle as Alt Volatility Returns

-

Bitcoin (BTC): Started the week above $106k and finished around $99k (~ -3%), but still well above its 50-day MA; retail sentiment dropped to a two-month low.

-

Ethereum (ETH): Even though was R=range-bound near $2,530, compressing into a tight coil ahead of the 21 June options expiry, has fallen to $2,181 alongside Bitcoin with the announcement of America attacking Iran.

-

Altcoins: Solana (SOL) and Hyperliquid (HYPE) spiked 5-7 % on Monday, while DeFi token AERO surrendered early gains.

-

Regulation/Events: No major hacks; EU MiCA licensing consultations wrapped up, US spot-ETH ETF rumours returned after an SEC meeting leak (unconfirmed), and XRP is in talks with SEC to finally wrap up its legal case.

Global Events & Macro Trends

China Trade Cools, Eurozone Prices Ease, US Labour Softens

-

May industrial production in China grew 5.8% year-on-year, its slowest clip in three months, while retail sales unexpectedly jumped 6.4 %, illustrating an uneven domestic recovery.

-

Euro-area inflation was confirmed at 1.9% in May, slipping back inside the ECB’s target range for the first time in two years and bolstering expectations of a cautious but steady rate-cut path.

-

US initial jobless claims dipped to 245,000 yet remain higher than in the first quarter, pointing to a labour market that is cooling rather than collapsing ahead of this week’s flash PMIs.

-

UK retail sales fell 2.7 % month-on-month in May, the sharpest drop since 2023, highlighting weakening consumer momentum and giving the Bank of England further cover to discuss summer rate cuts.

-

The United States has bombed three of Iran’s key nuclear facilities, an action that immediately pushed oil prices higher, spurred a flight to safe-haven assets, and heightened fears of wider regional escalation and supply-chain disruption.

-

Ongoing Israel-Iran hostilities, now compounded by Washington’s direct involvement, continue to embed a risk premium in energy markets and inject fresh volatility across global equities and emerging-market currencies.

Closing Thoughts

Looking at the broader picture, markets appear to be tip-toeing along a narrow ledge: softening but not collapsing macro prints are anchoring the case for gradual easing, yet the sudden flare-up in the Middle East reminds investors that exogenous shocks can overturn even the clearest data-driven narratives. Cyclicals such as autos and travel lagged, while oil majors and gold miners drew fresh bids on the geopolitical risk premium. The tech complex proved resilient, hinting that AI-linked capital expenditure remains a counter-cyclical shelter.

Heading into next week, all eyes will be on flash PMIs, a raft of US housing data and, crucially, Iran’s response to the strikes. A material disruption to Strait-of-Hormuz traffic would amplify the current oil rally and could force central banks to juggle growth worries against an energy-driven inflation bump. Conversely, any signs of diplomatic de-escalation may see risk assets claw back lost ground, especially with quarter-end rebalancing flows in play.

A bold prediction: if Brent settles above $85 bbl for more than a week, expect at least one major central bank outside the Fed to pause or rethink its easing path before July is out. For nimble investors, the opportunity may lie in barbell positioning, holding quality defensives on one side and selective energy or commodity plays on the other, while keeping dry powder for a potential summer volatility spike.