Global markets spent the week weighing a resilient U.S. economy against pockets of softness elsewhere. Wall Street pushed to fresh highs on solid jobs data, but rising Treasury yields and a firmer dollar kept investors alert. In Europe, cooler inflation rekindled rate-cut hopes, while Asia’s major bourses were mixed as profit-taking set in and China’s recovery remained tentative. Commodities edged higher on supply jitters, and crypto held its ground, underscoring a risk mood that was optimistic but far from unanimous.

Across asset classes, the common thread was caution: traders cheered strength where they saw it yet stayed ready for surprises from central banks, energy markets, or geopolitics. Here’s how the week’s cross-currents shaped the broader landscape.

🟨 Equities Roundup

Equity Markets React to Upbeat U.S. Jobs Data

Record run in the U.S.

-

S&P 500 added 1.8 % for the holiday-shortened week, its third straight weekly gain and a fresh all-time high, while the Nasdaq Composite followed suit; the Dow gained 0.8 %.

-

Small-caps roared back, Russell 2000 jumped 3.4 %, as investors rotated out of megacap tech.

-

Sector winners: Materials (+3.7 %) and Information Tech (+2.6 %) led; Communication Services lagged (-0.24 %).

-

Nvidia’s market cap brushed $3.9 trn, inching within sight of Apple’s record.

Europe treads water.

- The STOXX Europe 600 slipped 0.46 % to 541 as middling PMI data and political wrangling in the U.K. capped risk appetite.

Asia mixed.

-

Japan’s Nikkei 225 fell roughly 1.7 % from Monday’s 40,487 peak to 39,811 as profit-taking set in near 40k resistance.

-

South Korea’s KOSPI outperformed on hopes of corporate-governance reform (up ~2 %), while India’s Nifty 50 inched 0.5 % lower to 25,429 as heavyweights cooled after record highs.

Notable corporate moves & deals

- No major IPOs priced, but M&A chatter lifted Siemens in Europe after the U.S. relaxed chip-software export curbs.

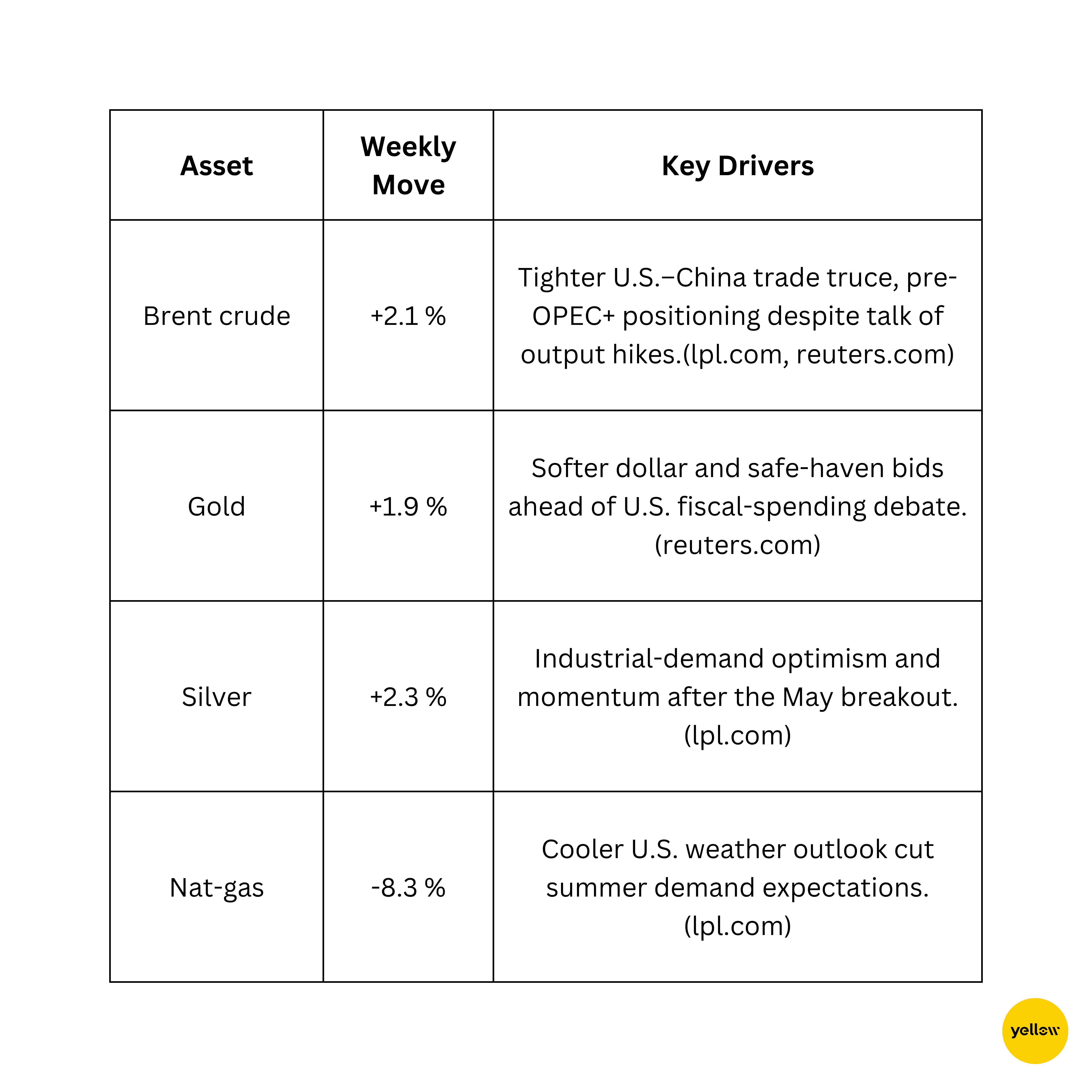

🟩 Commodities Check

Oil Climbs While Gold Finds Support

Technical traders eye $68–70/bbl resistance for Brent and $3,360/oz resistance for gold after the latest bounce.

🟦 Currency & Forex Snapshot

Dollar Firm, Yen Soft as Payrolls Surprise

-

DXY climbed 0.4% to 97.13, its second weekly advance, after June payrolls beat forecasts.

-

EUR/USD dipped toward 1.03 as German data confirmed inflation back at the ECB’s 2% target, keeping rate-cut hopes alive.

-

GBP/USD held near 1.25 despite U.K. political noise; USD/JPY pushed up to 154.4 as higher U.S. yields widened rate differentials.

-

INR was steady around 83.30 per dollar; oil’s modest rise offset foreign-inflow support.

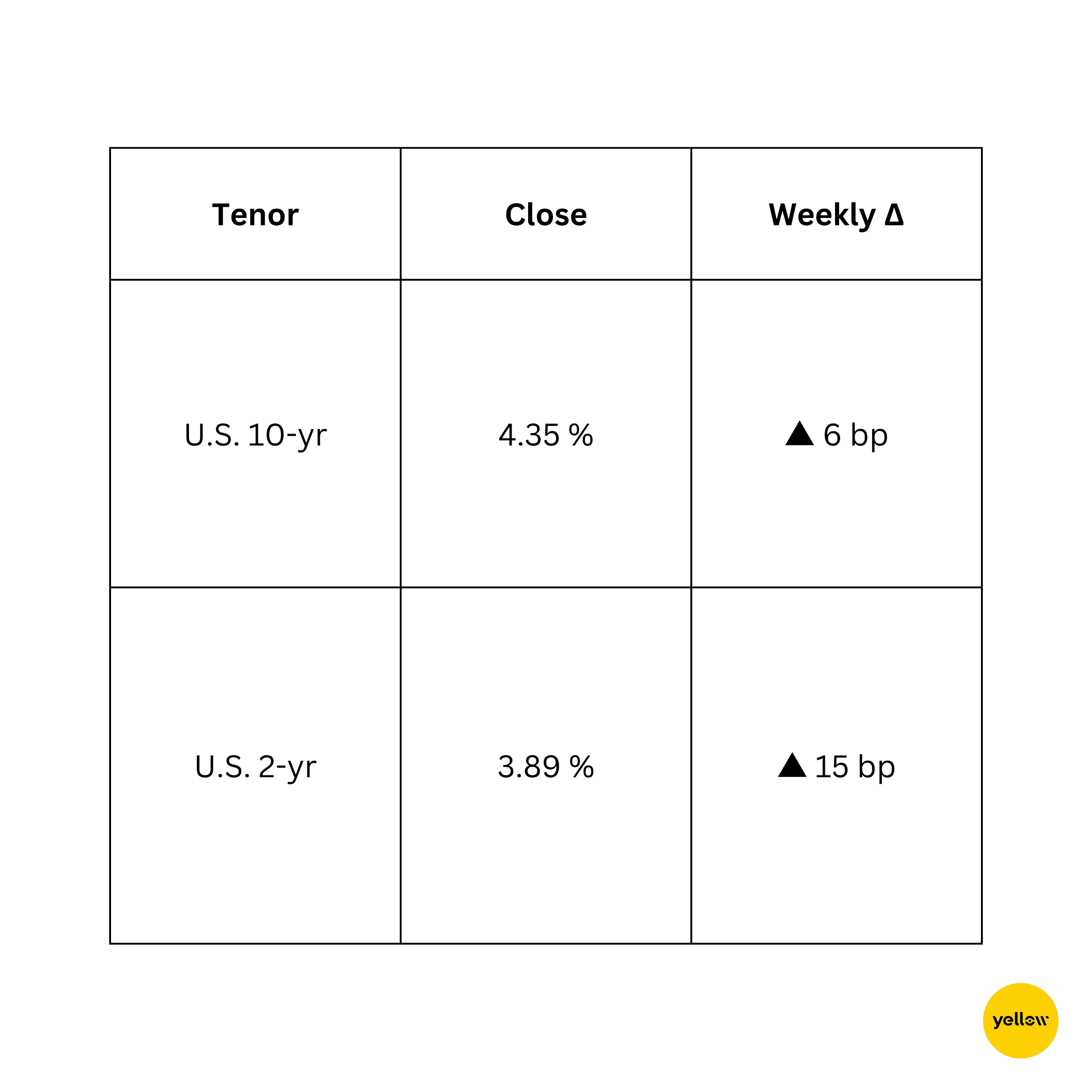

🟥 Bond Yields & Interest Rates

Yields Rise on Hawkish Fed Language

Stronger jobs data cooled expectations for a September Fed cut, lifting front-end yields, while supply concerns tied to Washington’s new tax-and-spend bill kept the long end under pressure. ECB officials struck a dovish tone after inflation slipped to target, capping Bund yields; meanwhile, Indian 10-yr yields eased 3 bp to 7.05 % on steady RBI open-market purchases.

🟪 Crypto & Alternative Assets

Bitcoin Holds Firm; Traders Fade the Pop

-

BTC traded a tight $105k–$109k range, ending the week near $107k, up about 1 %. Market-makers quickly “filled” a CME gap at $105k before spot bids resurfaced.

-

Despite the grind higher, perpetual-futures data show shorts piling in as the long/short ratio slid below 1 while price poked above $110k mid-week.

-

ETH hovered near $2,400, lagging Bitcoin as ETF inflows slowed.

-

No major hacks, but the SEC opened consultations on stable-coin disclosures, keeping DeFi names choppy.

Sentiment remains split: macro bulls point to ETF inflows and a friendlier U.S. regulatory backdrop, while technicians warn of waning momentum.

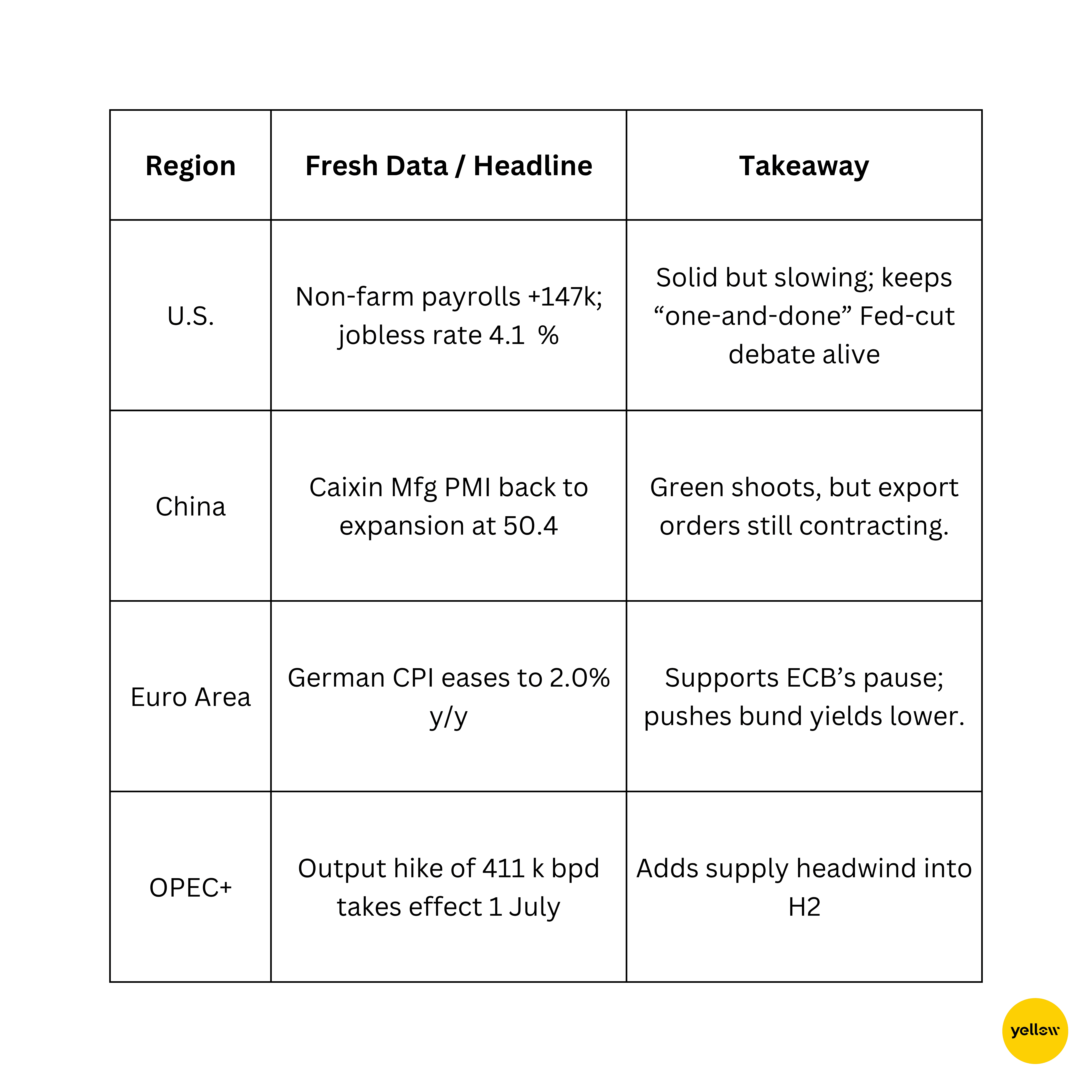

🔶 Global Events & Macro Trends Mixed Data Paint a Patchwork Global Picture

The first week of Q3 opened with a bang for U.S. risk assets, but beneath the fireworks the tone is more nuanced: falling euro-area inflation and soft-patch Chinese PMIs hint at uneven global growth, even as oil rides geopolitical cross-currents. Rising U.S. yields and a firmer dollar re-price interest-rate bets, and crypto markets trade cautiously after an early-summer rally.

A Reflection on the Week

Taken together, the tape still leans bullish, but the leadership is narrowing. Big-tech momentum and a bounce in resource names masked fatigue in rate-sensitive sectors and select Asian equities. That divide suggests investors are happy to chase quality growth and commodity plays while shying away from anything that needs lower yields to thrive.

Next week’s U.S. CPI and a handful of central-bank meetings will test that stance. A benign inflation print could extend the rally; a hot one might amplify the dollar’s advance and deepen the rotation out of high-duration assets. Either way, keeping some dry powder, and an eye on oil and currency moves, looks prudent.

My read? The near-term path favours selective risk-taking: stick with cash-rich firms in tech and energy, but be ready to pivot if policy signals turn harsher. In short, the market is still climbing, yet the footholds are getting narrower.