This week, global financial markets traded with a deceptive calm, concealing deep undercurrents of policy anxiety, trade realignments, and geopolitical tension.

While U.S. equities clawed back recent losses and Germany’s DAX touched record highs, much of this stability stemmed from cautious optimism around de-escalation in the trade war, not from organic strength. In Asia, Japanese stocks extended their winning streak, buoyed by a weakening yen and hopes of dovish central bank policy, while Indian markets slipped amid rising cross-border tensions.

Investor sentiment hovered in a zone of fragile confidence bolstered by selective earnings surprises and active diplomatic channels, but weighed down by the looming U.S. debt ceiling standoff, rising inflation risks, and softening global demand. Trade tariffs, once seen as temporary leverage, are now appearing structural—altering supply chains and corporate strategies. As the market digests these shifts, signs of sectoral rotation are emerging, offering subtle clues about where conviction is starting to build again.

Equities Roundup

Markets Stabilize Amid Trade Optimism and Inflation Watch

Global equity markets steadied this week, masking underlying volatility. The S&P 500 ended the week nearly flat, clawing back from earlier losses triggered by tariff concerns, while Germany’s DAX touched a record high, lifted by export optimism and easing inflation. Japan’s Nikkei rose for the fourth straight week, aided by a weakening yen and hopes that the Bank of Japan will maintain dovish policy.

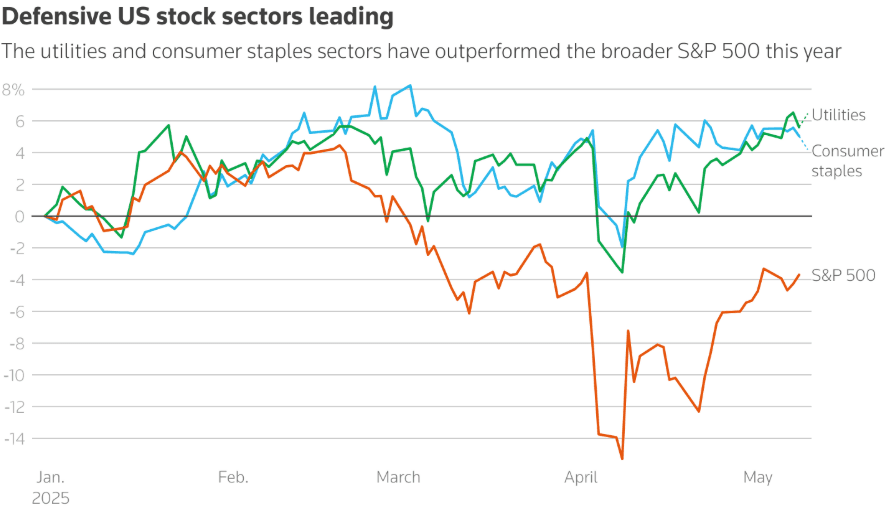

Sector rotation was visible. Defensive plays like consumer staples (+5%) and utilities (+5.6%) led the early part of 2025. But in a potential sentiment shift, investors started dipping into tech, industrials, and consumer discretionary stocks, signaling cautious optimism. This move coincides with expectations of resilient U.S. consumer spending ahead of CPI and retail sales data next week.

Trade developments continued to influence sentiment. Trump’s UK deal, despite locking in a 10% baseline tariff, sparked optimism that a tariff détente could be near. Talks with China over the weekend added to this hope, with both sides signaling willingness to soften stances.

Commerzbank’s record profit (highest since 2011) and Aramco’s earnings beat (despite a 5% YoY dip) added regional resilience in Europe and the Middle East, offsetting weaker forecasts elsewhere.

Commodities Check

Oil Holds Despite Long-Term Gloom; Gold Pulls Back on Trade Talks

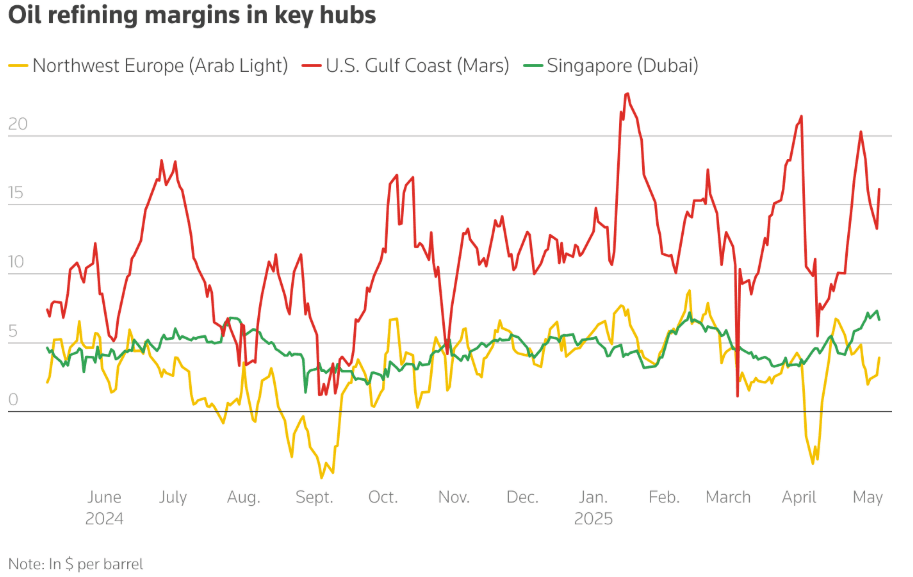

Oil refining margins remained historically high, contradicting bearish outlooks. U.S., European, and Singapore margins all rose YoY, buoyed by strong gasoline demand ahead of summer. Yet, oil futures slipped into contango indicating market expectations of oversupply in H2 2025 due to higher OPEC+ output and weakening global growth.

Despite falling oil prices (Brent forecast revised to $60–62/barrel by Morgan Stanley and Goldman Sachs), refiners are rushing to stockpile amid low diesel and gasoline inventories in the U.S. and Europe.

Meanwhile, gold dipped 0.8%, falling from highs as the U.S.-UK trade deal and upcoming U.S.-China negotiations improved risk appetite. However, ETF inflows, especially from China, suggest underlying demand remains intact amid geopolitical stress.

Currency & Forex Snapshot

Dollar Stable as China Weakens Yuan to Counter Tariffs

The U.S. dollar index held steady, but pressure remains as the Fed walks a tightrope between inflation and unemployment. In Asia, China weakened the yuan to its softest level since late April, signaling a strategic response to the 145% U.S. tariffs. Meanwhile, the yen weakened further, helping boost Japanese equities. The euro and pound gained on optimism around trade clarity and stronger-than-expected German performance. The Indian rupee declined, in part due to geopolitical concerns with Pakistan and foreign capital outflows.

Bond Yields & Interest Rates

Treasury Risk Premiums Rise Amid Debt Ceiling Jitters

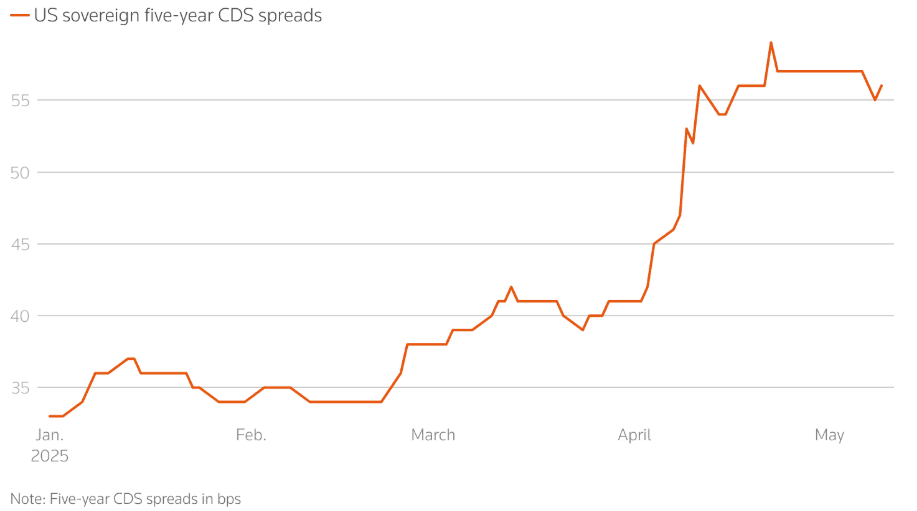

The U.S. 10-year yield eased to 4.36%, down 20 bps from April highs, reflecting investor caution despite a pause in tariff escalation. Still, credit default swaps (CDS) on U.S. government debt spiked, reflecting fears around debt ceiling talks and overall fiscal direction.

Market hedging against sovereign default risk reached post-2023 highs. Active CDS contracts rose from $2.9B in Jan to $3.9B in May, driven by Trump's fiscal policies and deficit concerns.

Central banks took divergent paths: the Bank of England cut rates, the BoJ paused tightening, and the Fed held steady but acknowledged rising risks. Inflation-watch remains crucial as CPI and retail sales data loom.

Crypto & Alternative Assets

Bitcoin Breaks $100K Again, but Regulatory Overhang Grows

Bitcoin surged nearly 10%, crossing $100K amid renewed retail interest and broad market optimism. Altcoins saw mixed performance, with volatility returning to mid-caps.

But legislative gridlock in the U.S. is threatening crypto momentum. The GENIUS Act (for stablecoin regulation) failed due to President Trump’s personal crypto conflicts, most notably $TRUMP and $MELANIA meme coins and his family’s stake in World Liberty Financial. Crypto industry insiders warn that regulatory delays and “pay-to-play” scandals could deter global investors and hurt U.S. leadership in digital assets.

Global Events & Macro Trends

Tariff Tensions, Debt Concerns, and Peace Talks Shape Macro Picture

-

The global economic narrative is increasingly shaped by tariffs. Major firms like Pandora, Puma, and Hugo Boss warned of price hikes and altered supply chains. Meanwhile, freight traffic from China to the U.S. plunged, reflecting a real-time slowdown in global trade.

-

Amid fears of stagflation, analysts pointed to a sharp disconnect between hard and soft economic data. April CPI and retail sales next week are now critical.

-

U.S.-China talks in Geneva and Trump’s Middle East visit (focusing on oil, semiconductors, and nuclear cooperation) could have broader implications for commodity flows and geopolitical alignments.

-

Putin’s unexpected offer for peace talks with Ukraine in Istanbul on May 15 has opened a new front in geopolitical risk. But skepticism remains high, especially from European leaders who issued fresh ultimatums.

-

China’s April export beat (+8.1%) shows resilience despite tariffs, but imports remain weak, showing fragility in domestic demand. The government’s stepped-up stimulus efforts—including a weaker yuan and rate cuts—are clear signs of internal stress.

Closing Thoughts: Signs of Stress, Not Strength

Markets may look stable on the surface, but the weight of policy risk is starting to distort their rhythm. Defensive outperformance early in the year gave way this week to a cautious shift into risk-on sectors like tech and industrials—not out of confidence, but because there's nowhere else left to hide. The tightening in U.S. high-yield spreads and a record run in German equities mask growing unease around the U.S. fiscal picture, structural tariffs, and trade fragmentation.

Investors aren't betting on growth, they're bracing for impact. With freight volumes collapsing, credit insurance spiking, and trade partners reshuffling supply chains, the bigger risk is no longer shock, it’s slow erosion. Next week’s CPI and retail sales will test how much fragility is already priced in. The broader worry? Markets are adjusting to dysfunction as the new baseline.