Global financial markets experienced a week marked by contrasting developments. On one hand, investor optimism was buoyed by a significant de-escalation in U.S.-China trade tensions, as both nations agreed to slash tariffs for a 90-day period. This move was perceived as a positive step towards stabilizing global trade relations. On the other hand, concerns resurfaced with Moody's downgrading the U.S. sovereign credit rating from AAA to AA1, citing rising government debt and widening budget deficits.

Investor sentiment remained cautiously optimistic. While the trade truce provided a temporary relief, the credit downgrade highlighted underlying fiscal challenges. Major economies like India saw their markets rally, with the Sensex rising by 500 points and the Nifty50 surpassing the 24,750 mark, driven by strong performances in the financial and IT sectors . Meanwhile, sectors such as technology and AI continued to attract investor interest, reflecting a broader focus on innovation-driven growth.

Equities Roundup

Equity Markets React to Tariff Truce and Tech Surge

-

The S&P 500 surged 5.3% for the week, closing at 5,958.38, while the Nasdaq Composite jumped 7.2%, and the Dow Jones gained 3.4%, turning positive for the year.

-

Big Tech led the rally as Nvidia rose ~16%, Meta 8%, Apple 6%, and Microsoft 3%.

-

The rebound was fueled by a 90-day tariff truce between the US and China boosting investor optimism.

-

The Roundhill Magnificent 7 ETF rallied nearly 10%, with the group contributing to 60% of the S&P's gains since early May.

-

Germany’s DAX hit a record high, reflecting Europe’s strong recovery amid easing global trade tensions.

-

eToro priced its long-awaited IPO at $52/share, raising nearly $310 million ahead of its Nasdaq debut — signaling a tentative return of risk appetite in public markets.

Commodities Check

Oil Climbs While Gold Finds Support

-

Gold fell 4%, its worst weekly performance since November, as risk appetite returned to equities and the dollar strengthened.

-

Copper markets were highly volatile due to anticipated US tariffs. A wave of physical copper flooded into US warehouses, pushing CME inventories to an eight-year high.

-

The arbitrage premium between US and LME copper narrowed sharply, collapsing from $1,600 to $600 per ton, as traders sought to lock in gains before tariffs.

Currency & Forex Snapshot

Dollar Strengthens as Trade Anxiety Looms

-

The US Dollar Index rose 0.8%, notching its best week since February.

-

Currency movement was driven by hawkish expectations on tariffs and a re-evaluation of global trade dynamics.

-

The dollar’s rise was partly offset by weakening demand for US Treasuries, especially from China, which reduced its holdings from $784.3B to $765.4B.

Bond Yields & Interest Rates

Yields Rise on Moody’s Downgrade and Fiscal Stress

-

US 10-year Treasury yields climbed to 4.48%, following Moody’s downgrade of US sovereign credit from AAA to AA1. The downgrade cited rising debt and interest burdens, echoing long-standing fiscal concerns.

-

The iShares 20+ Year Treasury Bond ETF dropped ~1%, while US equity ETFs also saw minor declines in after-hours trading.

-

Fed futures shifted rate cut expectations to July instead of June, with only two cuts priced in for the year — down from three last week.

Crypto & Alternative Assets

Coinbase Rallies, Galaxy Digital Goes Nasdaq

-

Coinbase rebounded over 9%, recovering Thursday’s losses, after analysts dismissed SEC probe concerns as immaterial.

-

Galaxy Digital began trading on the Nasdaq at $23.50, transitioning from the Toronto Stock Exchange via direct listing, boosting sentiment in institutional crypto adoption.

-

EToro's IPO also spotlighted the blending of retail trading and crypto narratives, with crypto revenue tripling for the platform last year.

Global Events & Macro Trends

US Consumer Sentiment Hits New Low as Inflation Worries Climb

-

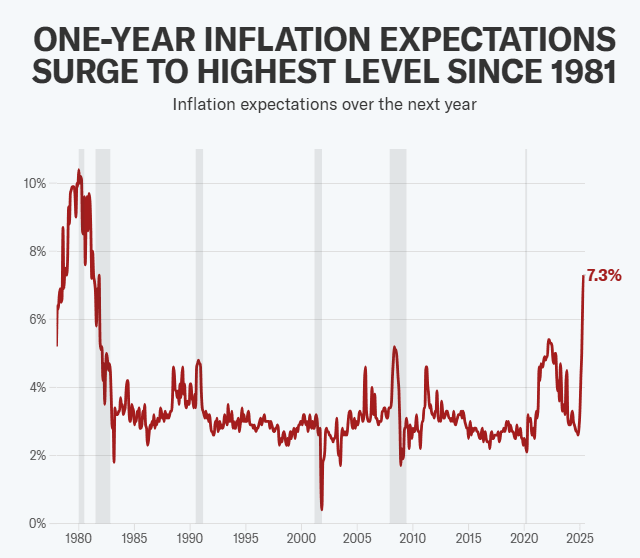

The University of Michigan's consumer sentiment index dropped to 50.8, the second-lowest reading ever, with one-year inflation expectations rising to 7.3%, the highest since 1981. Tariffs were spontaneously mentioned by nearly 75% of survey respondents, indicating significant anxiety over trade policy.

-

Import prices rose 0.1% in April, while capital goods prices jumped 0.6%, signaling early-stage inflationary pressures.

-

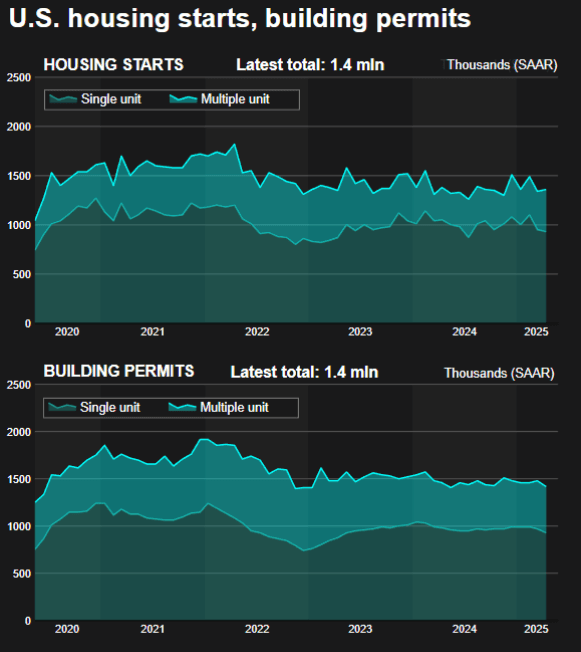

Single-family housing starts fell to a nine-month low, and builder sentiment dropped as tariff-driven material costs hit profit margins.

-

The U.S. and China agreed to a 90-day reduction in tariffs, with the U.S. lowering tariffs on Chinese imports from 145% to 30%, and China reducing duties on U.S. imports from 125% to 10%. This temporary easing aimed to alleviate trade tensions that had previously disrupted $600 billion in bilateral trade.

-

European Central Bank (ECB) member Pierre Wunsch indicated that the ECB might need to lower interest rates below 2% in response to economic uncertainties and trade tensions, marking a shift from his previously hawkish stance.

-

U.S. Treasury Secretary Scott Bessent attended the G7 finance leaders' meeting in Canada, emphasizing the need to address global trade imbalances and promote private sector-led growth.

-

Following political unrest and the arrest of Istanbul's mayor, the Turkish lira depreciated sharply, and the stock market experienced significant declines, raising concerns about the country's economic stability.

Closing Thoughts

The juxtaposition of positive trade developments and concerns over fiscal stability underscores the complex landscape investors navigate. While the U.S.-China tariff pause offers a window of opportunity for global trade, the U.S. credit downgrade serves as a reminder of the structural fiscal issues that could impact long-term economic health. Sectors like technology and AI have demonstrated resilience, benefiting from both investor enthusiasm and tangible advancements. Conversely, sectors sensitive to interest rates and fiscal policy may face headwinds if concerns over government debt lead to higher borrowing costs. The real interest rates in the U.S. approaching decade highs could further tighten financial conditions, potentially dampening consumer and business activity .

Looking ahead, the markets are poised at a critical juncture. The temporary nature of the trade truce means that any regression could reignite volatility. Simultaneously, the implications of the U.S. credit downgrade could manifest in various ways, from increased borrowing costs to shifts in investor confidence. Investors should remain vigilant, balancing short-term opportunities with an awareness of the underlying risks that could shape market dynamics in the coming weeks.