This week, global markets responded to a flurry of macro and geopolitical developments, with the spotlight on potential U.S.–China trade talks and deepening strains within OPEC+.

Asian equities rallied on optimism around diplomacy and strong tech earnings, while U.S. indices found support in Microsoft and Meta’s results. In contrast, Europe struggled under the weight of Trump’s tariffs and weak corporate guidance, particularly in the automotive sector.

Investor sentiment was mixed. While appetite for growth sectors like AI and tech remained intact, caution crept in through significant U.S. equity fund outflows and further cracks in oil and manufacturing. Currency markets saw divergent trends, with strength in the ruble and select Asian currencies, while crypto edged higher as Bitcoin approached the $100K mark, reflecting a quiet but notable return of risk appetite.

Equities Roundup

Equity Markets React to Trade Tariffs and Tech Resilience

-

U.S. markets posted a mixed performance. While strong earnings from Microsoft and Meta lifted tech stocks (Nasdaq +1.52%), equity funds saw outflows of $15.56B, reflecting investor unease over Trump’s tariff-led uncertainty.

-

Europe faced headwinds: Automakers like Mercedes and Porsche slashed their guidance due to tariff risks. Volkswagen remained cautious, expecting returns at the lower end of forecasts.

-

Asia-Pacific surged, buoyed by optimism over potential U.S.–China trade talks. The Hang Seng Tech Index rallied 3.08%, and Japan’s Nikkei 225 rose 1.04%. Taiwan’s TAIEX jumped 2.07%, with strong gains from semiconductors and utilities.

-

India’s Nifty 50 closed the week up 0.21%, led by Adani-backed firms.

-

Australian equities climbed 1.13%, hitting a 2-month high ahead of elections, driven by banking and mining stocks.

Commodities Check

Oil Slips on Output Hike Rumors, Copper Gains on Trade Talk Hopes

-

Oil prices dropped to 4-year lows (~$60/barrel) after OPEC+ signaled further unwinding of voluntary output cuts (2.2M bpd), unless compliance improves from laggards like Kazakhstan.

-

Copper rallied 0.89% to $9,206/ton on news of potential China-U.S. trade talks, easing concerns over global demand.

-

Gold dropped to a 2-week low on 1st May settling at $3211. The price reduced amidst trade talk hopes and a holiday for top consumer China.

-

Iron ore futures rose 0.42% to $96.60, boosted by strong Chinese trade data and improved export conditions from Australia.

Currency & Forex Snapshot

Dollar Mixed as Ruble Soars and Latin American Currencies Diverge

-

The U.S. Dollar Index stayed broadly flat, but showed mixed behavior across regions.

-

In Europe, the Russian Ruble rose sharply (+0.91%) to 82.746/USD, while the Swedish Krona and Polish Zloty depreciated.

-

In the Americas, the Argentine Peso (ARS) and Costa Rican Colón (CRC) saw gains, while Mexican Peso and Chilean Peso slipped slightly.

-

Asian currencies were mostly steady; the INR closed at 84.499 with earlier sharp appreciation driven by foreign equity inflows and USD weakness.

-

South Korea’s Won, Taiwan Dollar, and Australian Dollar all gained as sentiment improved on potential U.S.–China trade resolution.

Bond Yields & Interest Rates

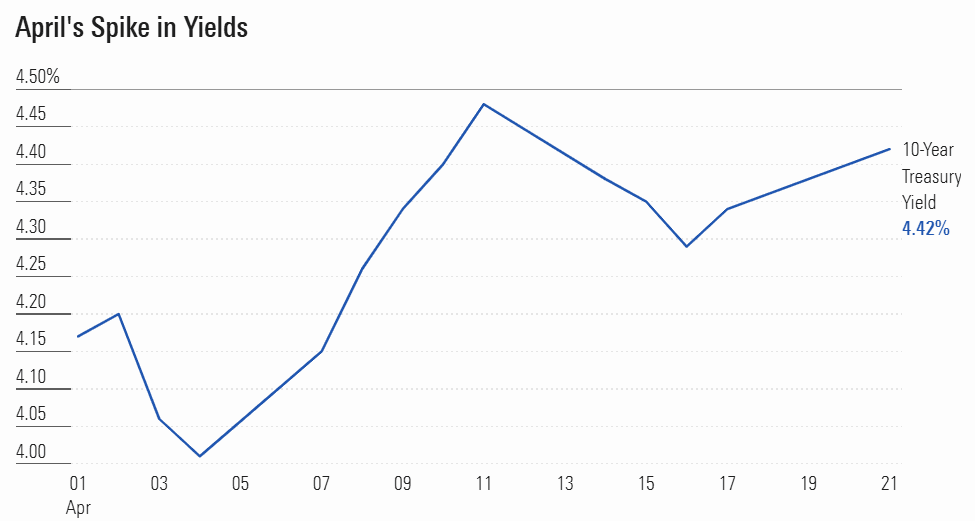

Yields Creep Higher Amid Hawkish Fed Cues

-

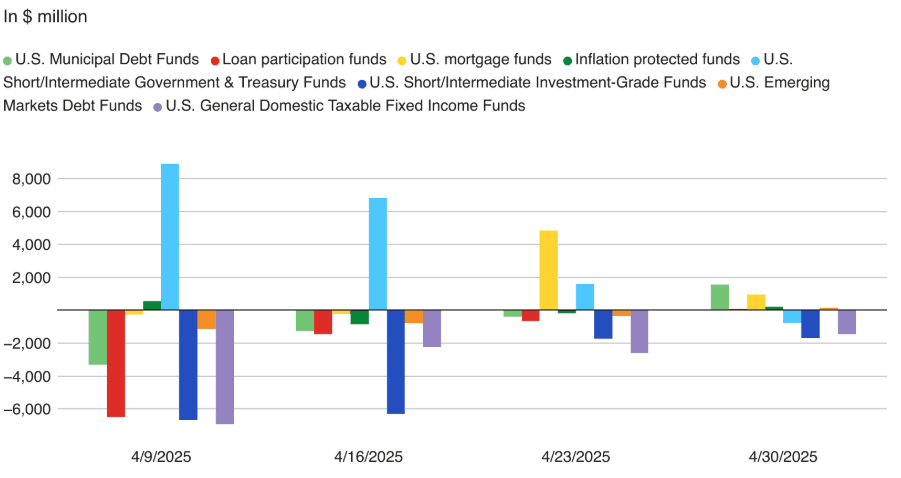

The U.S. 10-year Treasury yield rose to 4.48% even though GDP slipped slightly by 0.3% and bond funds saw minor inflows ($230M).

-

Japan's JGB yields dropped (10Y down 5.4bps to 1.259%) after the BoJ held rates steady and revised down its growth forecast.

-

The US Treasury introduced a new 3.98% Series I bond rate for the next six months, indicating continued efforts to provide inflation-linked protection to retail savers.

-

Municipal and mortgage funds in the U.S. received $1.57B and $961M respectively, showing a shift toward stable income assets.

Crypto & Alternative Assets

Bitcoin Eyes $100K as UK, India Mull Regulatory Steps

-

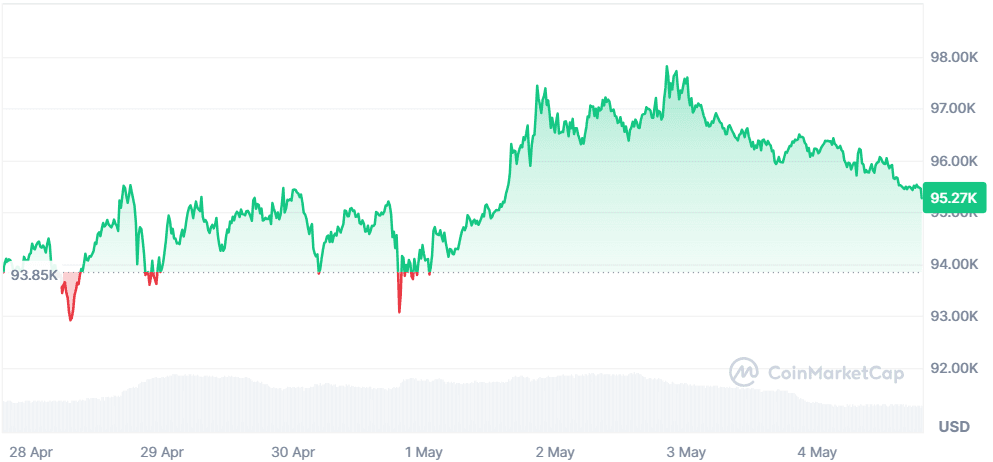

Bitcoin (BTC) rebounded 0.34% to $96,805.58, heading toward the $100K mark amid improved sentiment and ETF hopes.

-

The UK unveiled draft crypto regulations, aiming to curb credit card purchases and tighten lending/staking practices while promoting U.S. collaboration.

-

UK is also considering a new restriction to be imposed on buyers to stop them from using credit cards or getting loans from e-money agencies to buy cryptocurrencies.

-

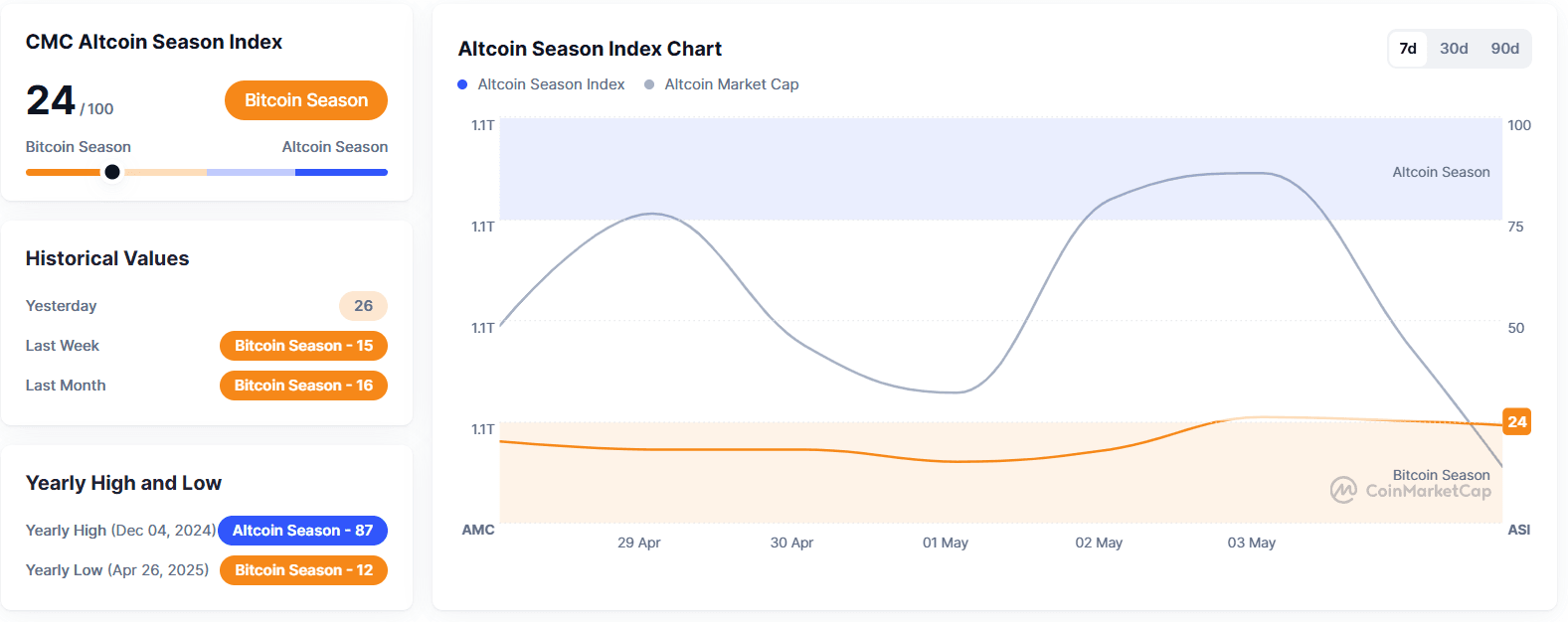

Altcoins remained volatile, with investors closely tracking regulatory shifts and ETF activity.

Global Events & Macro Trends

OPEC Tensions, Auto Industry in Flux, and U.S. Trade Chaos

-

{OPEC+](https://www.reuters.com/business/energy/opec-further-speed-up-oil-output-hikes-three-sources-say-2025-05-04/) tensions escalated over quota non-compliance, as Saudi Arabia warned of unwinding all 2.2M bpd voluntary cuts by October unless Iraq and Kazakhstan cooperate.

-

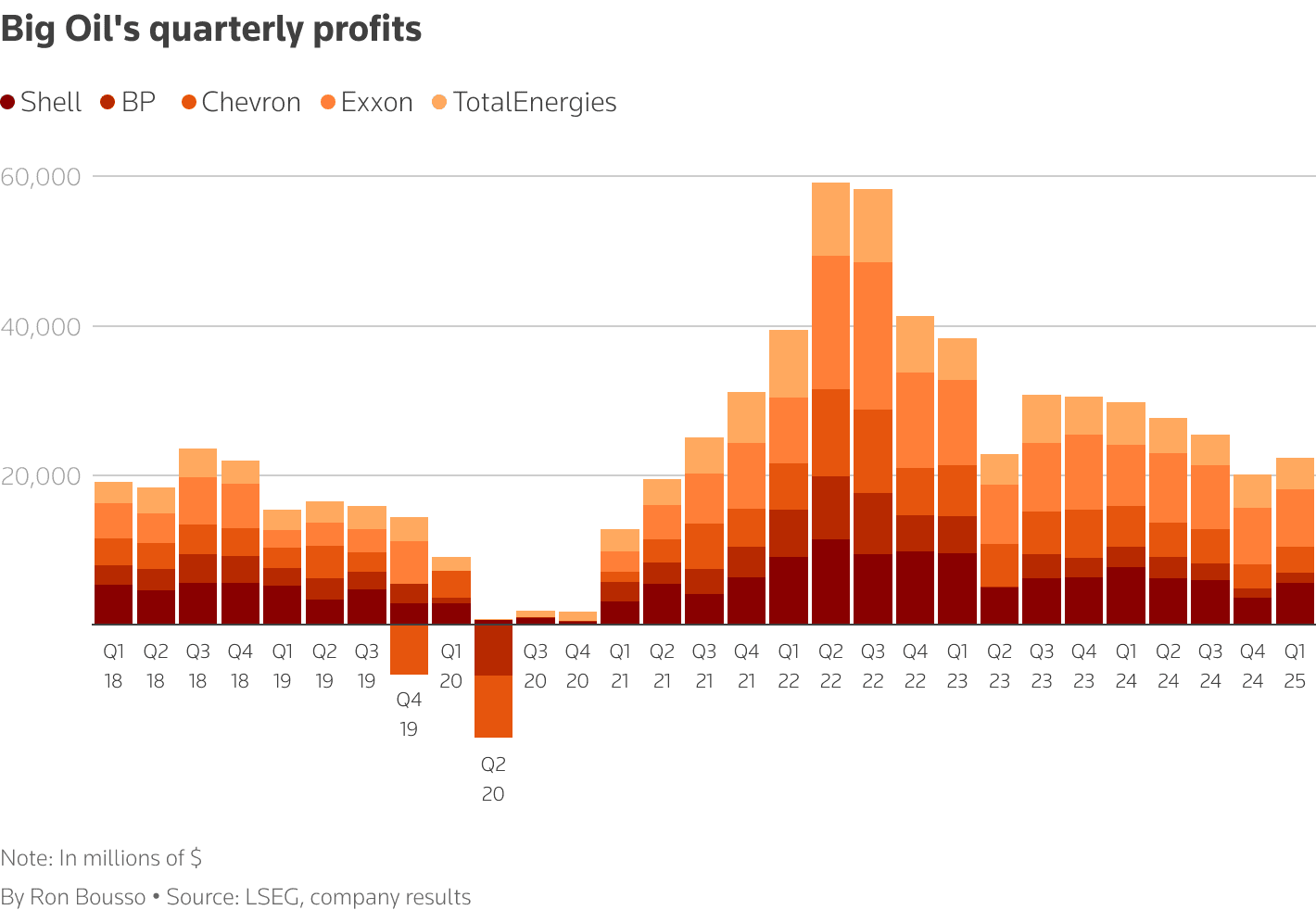

Big Oil continues business-as-usual despite growing macro risks; Exxon, Shell, and TotalEnergies increased debt to maintain dividends.

-

Auto majors like Mercedes, Volvo, and Stellantis slashed financial guidance due to Trump’s tariffs and a collapsing supply chain.

-

Ukraine-U.S. minerals deal offers symbolic support but little immediate impact, as 40% of Ukraine’s mineral assets remain under Russian control.

-

Asia-Pacific economic activity showed resilience; China evaluating U.S. trade talks lifted sentiment, while Australia posted a surprise trade surplus of AUD 6.9B.

Closing Thoughts

Global markets appear to be walking a tightrope — supported by tech strength and trade optimism on one side, but weighed down by structural weaknesses in oil, autos, and global trade flows on the other. The surge in Asian markets and the rebound in copper suggest that investors are selectively leaning into growth narratives, even as defensive moves like bond inflows and gold support continue.

Looking ahead, the market’s direction may hinge on OPEC+ output clarity, further signs of trade thawing between China and the U.S., and upcoming inflation data. If the optimism holds, we could see risk assets push higher — but if macro cracks widen, especially in energy and manufacturing, expect volatility to return. In this landscape, active positioning across asset classes remains key.