This week, global markets found themselves tugged in two very different directions. A softer-than-expected U.S. CPI print (headline up just 0.1 % month-on-month, 2.4 % year-on-year) fed hopes that the Federal Reserve could finally start easing before the summer is out.

Yet almost on cue, Israel’s retaliatory strikes on Iranian assets reignited Middle-East risk, forcing traders to re-price crude-supply fears and stoking talk of a potential Strait-of-Hormuz choke-point.

Against that push-and-pull backdrop, U.S. benchmarks hovered within 2 % of record highs, European indices slipped as energy costs gnawed at margins, and Asia traded mixed as China’s export miss kept metal bulls in check. The dollar index slid to a three-year low near 97.8 before clawing back some ground, leaving investors simultaneously hunting havens in gold and Treasuries and chasing risk in tech and DeFi tokens.

Equities Roundup

Equity Markets React to Cooling CPI & Middle-East Shock

-

United States: The S&P 500 slipped 1.1 % on Friday after Israel’s strike on Iran but finished the week almost unchanged, still sitting <3 % below its February record high.

-

Europe: Energy names (Shell +1.9 %, BP +2.6 %) cushioned the STOXX 600, yet the index fell 0.9 % on Friday and logged a weekly loss as travel & leisure and autos slumped on higher oil and flight diversions.

-

UK: The FTSE 100 notched a record close at 8 884.92 on Thursday thanks to energy strength, before handing back gains to end the week fractionally lower.

-

Asia-Pac: A chip-led bounce kept Japan’s Nikkei 225 on course for a second weekly advance, while India’s Nifty 50 and Sensex fell 1.1 % / 1.3 % as higher crude hurt refiners and airline stocks tumbled after the Air India crash.

-

Sector stand-outs: Energy and defence outperformed globally; airlines, autos and Indian OMCs were the notable laggards.

Commodities Check

Oil Spikes While Gold Finds Refuge

Currency & Forex Snapshot

Dollar Pops, Yen Still Closes Up for the Week

-

DXY jumped 0.5 % Friday to 98.2, snapping a two-day slide, but is still headed for a second straight weekly fall on softer U.S. data.

-

JPY faced Knee-jerk sell-off to ¥143.9 per USD on Friday reversed an earlier weekly gain of almost 1 % as safe-haven flows waxed and waned.

-

EUR/GBP, both slipped 0.4–0.5 % as investors rotated into the greenback.

-

INR edged lower, pressured by the oil spike and broad dollar strength.

Central-bank colour: Markets await the Fed (19 June) for fresh rate-path clues and watch the BoJ’s bond-buying tweak as the yen tests authorities’ pain threshold.

Bond Yields & Interest Rates

Treasuries Whipsaw on Geo-Risk, Fed in Focus

-

US 10-year sank to a one-month low of 4.31% on safe-haven buying, after spiking to 4.42 % intraday; the weekly change is a modest -3 bp.

-

Curve chatter: Strategists still expect the Fed to hold at 4.25 - 4.50% next week but see futures pricing two cuts by year-end.

-

Europe: Bunds firmed after German May CPI confirmed a cool 2.1%, while peripherals tightened on ECB reinvestment talk.

Crypto & Alternative Assets

DeFi Tokens Out-Race Majors as Institutions Keep Buying

-

Bitcoin (BTC) +3.2 % w/w, $105.3 K close. Long-term holders locked in $1.47 billion/day of profit last week, yet exchange balances sit at five-year lows, signalling supply tightness.

-

Ethereum (ETH) +2.7 %, $2 520. U.S. spot-ETH ETFs soaked up $240 million on 12 June topping BTC inflows for the day and cementing ETH’s “digital bond” narrative.

-

Aave (AAVE) +8.9 %, $276. Popped 22 % intraday on 10 June after SEC Chair Paul Atkins floated an “innovation exemption” for DeFi platforms.

-

Uniswap (UNI) +12.7 %, $7.25. Daily active addresses jumped 31% w/w as traders rotated out of memecoins into DEX blue chips on the same DeFi optimism.

-

Crypto-fund AuM hit a record $167 billion in May on $7.05 billion of net inflows versus a $5.9 billion outflow from global equity funds—hinting that institutions are treating digital assets as a hedge against equity-rate volatility.

Global Events & Macro Trends

Data & Geopolitics Tug at Growth Narratives

-

U.S. May CPI: Headline +0.1 % m/m (2.4 % y/y) and core +0.1 %, softest since January. Shelter rose 0.3 %, energy fell 1 %. Treasuries rallied, pulling the 10-yr yield down 7 bp to 4.31 % and lifting September-cut odds to ~60 %.

-

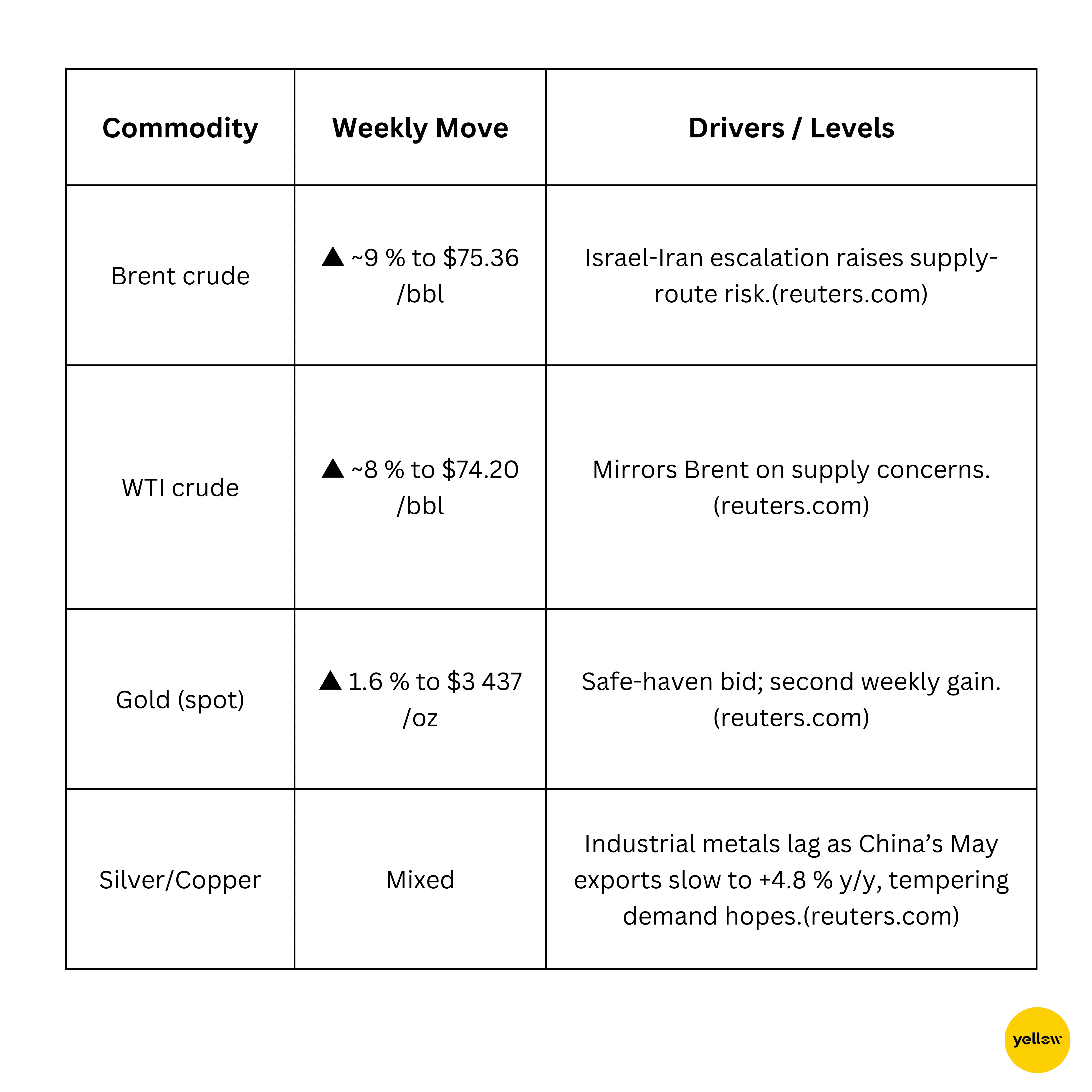

Israel–Iran air-strikes: Israeli hits on Iranian missile sites, retaliatory drones over Tel-Aviv. Brent crude spiked 12.5 % on the week to $74.23, its biggest jump since 2022; S&P-500 E-minis fell 1.7 % pre-open; gold added 1.6 %. Roughly 20 % of global oil transits the now-vulnerable Strait of Hormuz.

-

China May trade: Exports +4.8 % y/y (miss), imports -3.4 %. Soybean purchases soared 129 % m/m, but crude and copper imports each slipped ~3 %. Copper futures ended the week -2 %; AUD/USD slid 0.7 %.

-

German HICP: Inflation confirmed at 2.1% y/y (down from 2.2 %). Bund yields eased 5 bp to 2.35 %; EUR/USD softened 0.5 % as markets priced the ECB on hold until autumn.

Closing Thoughts

Cooling U.S. inflation suggests the long-promised transition from “higher for longer” to “lower, but cautiously” may finally be under way, yet the parallel spike in oil is a stark reminder that headline prices can re-accelerate quickly if geopolitics blocks a fifth of global crude flows. Energy and defence stocks soaked up the bid, while rate-sensitive tech and utilities proved surprisingly resilient underscoring just how much faith the market still places in an eventual policy pivot.

At the same time, weakness in European cyclicals and emerging-market currencies hints at cracks below the surface. The DXY’s tumble signalled eroding U.S. yield support, but it also handed hard-asset bulls fresh ammunition: gold hit a two-week high; Bitcoin added more than 3%, and spot-ETH ETFs logged their nineteenth straight day of net inflows before a small Friday reversal.

Looking ahead, next Wednesday’s Fed dot-plot and any word on strategic reserves from OPEC+ will decide whether the rally broadens or retreats. My contrarian take: if Brent holds above $80 while core CPI stays south of 3%, we could see a rare “good-inflation, good-growth” window, short-lived, but powerful enough to push global equities into fresh highs before summer liquidity thins out. For investors, that means staying nimble: keep a toe in energy, maintain hedges in Treasuries and gold, and don’t ignore the quiet accumulation happening in quality DeFi names.