Institutional and retail investors are navigating a dynamic market, with certain sectors showing significant movement. Tokenization is making waves as Ondo rolls out a framework to bring stocks, bonds, and ETFs on-chain, a move that could transform financial markets.

Meanwhile, MELANIA is facing an intense tug-of-war between whales and retail traders, with aggressive price manipulations shaping its volatility. On the gaming front, Engines of Fury is seeing heightened interest as it gears up for launch later this month, proving that blockchain gaming remains a compelling narrative.

Similarly, Vine is riding on its legacy of digital creativity, reinforcing its commitment to long-term stability with a locked dev wallet. Amp is gaining traction in the payments sector, with whale activity suggesting growing confidence in its use as collateral for transactions.

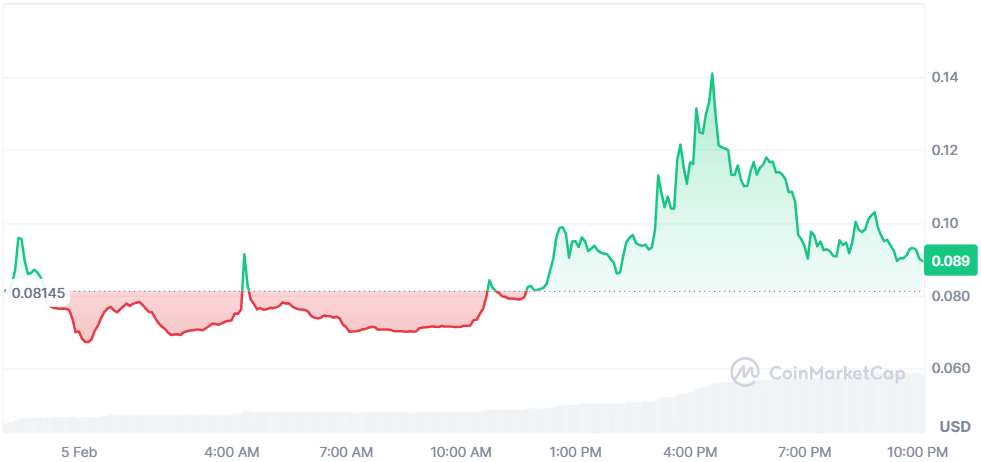

Engines of Fury (FURY)

Price Change (24H): +17.86% Current Price: $0.08944

What happened today

Engines of Fury is gaining traction due to its upcoming launch on February 25th. The game, a post-apocalyptic top-down extraction shooter, integrates NFTs and a deflationary token system. The project is built by industry veterans from Blizzard, Activision, Ubisoft, and Unity and is backed by major investors, including Animoca Brands, Metavest Capital, and Double Peek Group. The recent hype is due to its announcement of its launch on the reputable Epic Games. There was also a livestream hosted by BNB Chain promoting Engines of Fury's upcoming launch.

Market Cap: $2.28M 24-Hour Trading Volume: $8.76M (+462.35%) Circulating Supply: 25.53M FURY

Vine Coin (VINE)

Price Change (24H): +19.27% Current Price: $0.1493

What happened today

Vine Coin continues to gain attention due to its commitment to long-term stability. The dev wallet holding 5% of the total 1B VINE supply is locked until April 20, 2025. This initiative signals confidence in the project, which aims to revive the legacy of Vine as a blockchain-powered video content platform supporting American-based creators.

Market Cap: $149.25M 24-Hour Trading Volume: $286.17M Circulating Supply: 999.99M VINE

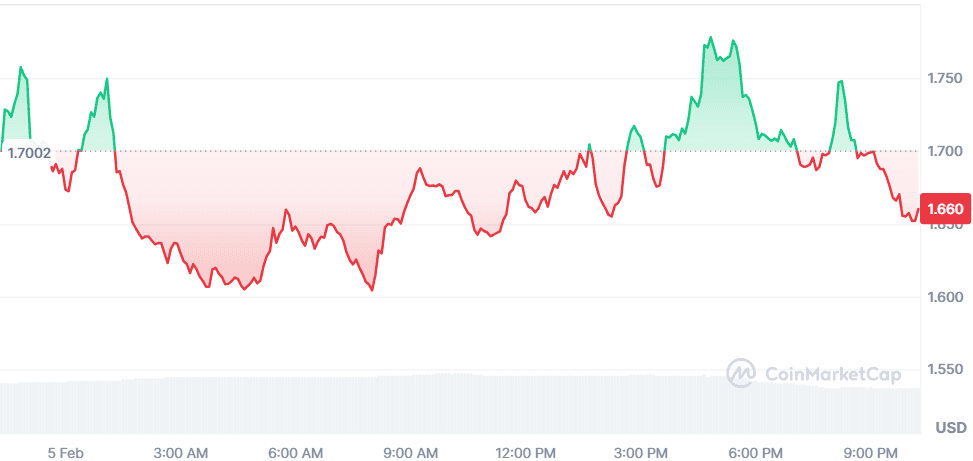

Official Melania Meme (MELANIA)

Price Change (24H): -1.94% Current Price: $1.66

What happened today

Melania Meme has been experiencing high volatility due to presumed manipulative trading activity. Bearish pressure has dominated the Asian trading hours, leading to negative funding rates, while European and American sessions have seen bullish price manipulations, resulting in price spikes. Notably, after a major sell-off on February 3rd, the price was reversed through market manipulation presumably, bringing MELANIA back to its market average. Additionally, liquidations from recent pumps and dumps have totaled around $200K, indicating speculative trading behavior.

Market Cap: $801.9M 24-Hour Trading Volume: $160.82M Circulating Supply: 483.31M MELANIA

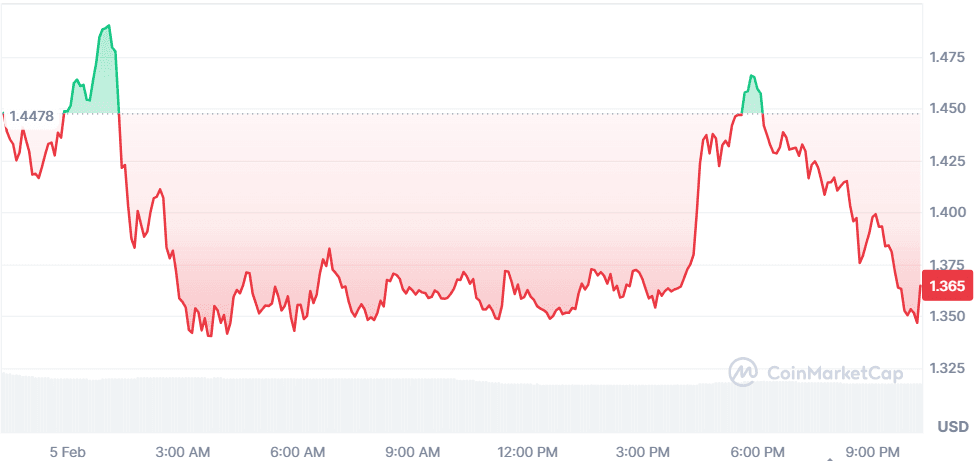

Ondo (ONDO)

Price Change (24H): -5.71% Current Price: $1.36

What happened today

Ondo Finance has announced a major expansion of its Ondo Global Markets (Ondo GM) platform, introducing a new framework to bring stocks, bonds, and ETFs on-chain. This update enables investors outside the U.S. to gain on-chain exposure to publicly traded securities, with each token backed 1:1 by its underlying asset, making them freely transferable outside U.S. jurisdiction. Additionally, the platform will support third-party financial application development through API and SDK integrations, helping to expand the ecosystem of tokenized securities. Ondo GM is shifting toward a model similar to stablecoins, improving liquidity and accessibility while ensuring instant minting and redemption, 24/7 global access, and on-chain financial services such as securities lending.

Market Cap: $4.31B 24-Hour Trading Volume: $663.18M Circulating Supply: 3.15B ONDO

Amp (AMP)

Price Change (24H): +11.15% Current Price: $0.006211

What happened today

Amp continues to gain traction as a collateral-as-a-service token, providing secure and instant transactions. Developed by Flexa, Amp addresses network inefficiencies such as slow transaction confirmations and price volatility. The project utilizes collateral partitions and smart contract managers to secure transactions across multiple asset classes, offering verifiable collateralization directly on the Ethereum blockchain. Additionally, Amp's whale holdings show that 67.88% of the token supply is controlled by large investors, suggesting strong institutional interest, while 32.12% is held by smaller investors, indicating growing retail adoption. With its structured collateral model, Amp aims to revolutionize digital payments by increasing transaction security and reducing volatility risks.

Market Cap: $523.2M 24-Hour Trading Volume: $127.38M Circulating Supply: 84.23B AMP

Closing Thoughts

The market today reflects a divide between high-risk speculation and fundamental innovation. Tokenization is gaining traction, drawing institutional interest as blockchain expands beyond crypto-native assets into traditional finance. Meanwhile, speculative trading remains dominant in volatile assets, with liquidity-driven price swings shaping market sentiment.

Sectors like gaming and payments are seeing steady engagement, though investor confidence appears more narrative-driven than fundamentally strong. The growing presence of whales in infrastructure projects suggests renewed interest in long-term, utility-based tokens.

As capital shifts between speculation and real-world applications, tokenized assets, payments, and gaming could shape the next market cycle while short-term traders continue chasing volatility.