DeFi tokens are commanding attention again, with AAVE leading the charge after a major protocol expansion and WalletConnect (WCT) catching up on the back of fresh utility updates. Meanwhile, MASK benefits from growing Web3 social integration buzz, while Polyhedra (ZKJ) stays flat despite strong exchange presence. MERL, however, faces a sharp pullback following its token unlock and airdrop-driven sell-off. These five coins are each driven by a different narrative, capture today’s mix of innovation hype, profit-taking, and long-term ecosystem plays.

Aave (AAVE)

**Price Change (24H): +14.91% Current Price: $260.57

What happened today

Aave soared over 21.5% in the past 24 hours, driven by the launch of Aave v3 on the Aptos blockchain. This move signals Aave’s strategic expansion into newer Layer 1 ecosystems, drawing massive investor attention. Whale accumulation, declining exchange supply, and revived DeFi TVL further contributed to a 95% surge over the past 30 days. Technical indicators suggest AAVE could test $400 next, following a bullish breakout and increasing investor confidence in DeFi protocols.

Market Cap: $3.93B 24-Hour Trading Volume: $831.75M Circulating Supply: 15.11M AAVE

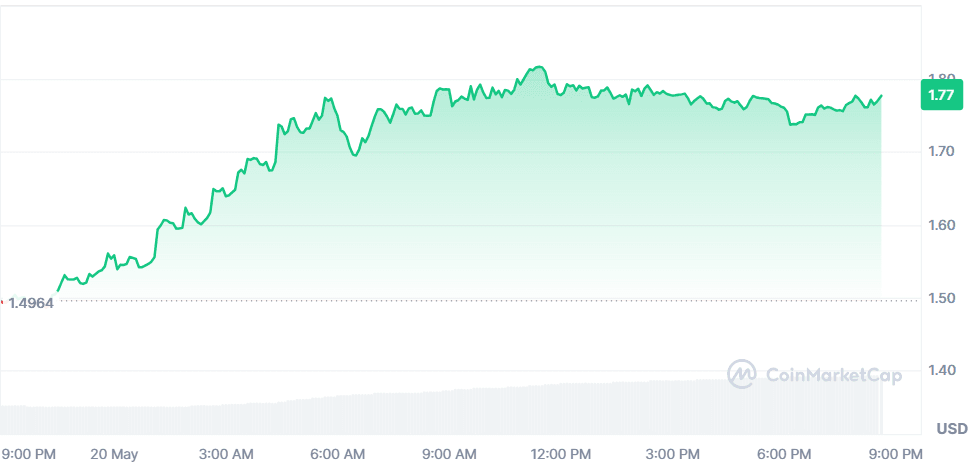

Mask Network (MASK)

Price Change (24H): +19.27% Current Price: $1.78

What happened today

MASK surged following renewed interest from Firefly, a social layer built on the Mask Network that integrates Web2 and Web3 social media feeds. This cross-platform capability has attracted tech-savvy users. Earlier, a $5M MASK token purchase by DWF Labs further boosted sentiment. The token has reappeared on trending lists multiple times in May, suggesting growing traction among retail investors.

Market Cap: $178.12M 24-Hour Trading Volume: $204.31M Circulating Supply: 100M MASK

WalletConnect Token (WCT)

Price Change (24H): +17.29% Current Price: $0.6302

What happened today

WCT gained nearly 18% following its recent Townhall event where the team revealed new feature rollouts, enhanced interoperability, and upcoming integrations. This sparked a rise in trading volume and interest. Analysts suggest the token’s RSI and MACD indicators show bullish momentum, hinting at further upside. Correlation with DeFi tokens like AAVE and broader tech market optimism is also contributing to WCT’s price action.

Market Cap: $117.36M 24-Hour Trading Volume: $216.23M Circulating Supply: 186.2M WCT

Polyhedra Network (ZKJ)

Price Change (24H): +0.08% Current Price: $2.05

What happened today

ZKJ saw flat price movement as the market absorbed its recent token unlock of $32.15M (5.29% of supply). Despite this, ZKJ maintained stability, bolstered by positive visibility after being featured in a BNB Chain panel and highlighted on Binance Alpha. Developer commentary and slow-release unlocks may help maintain community trust and price resilience.

Market Cap: $602.81M 24-Hour Trading Volume: $3.41B Circulating Supply: 292.86M ZKJ

Merlin Chain (MERL)

Price Change (24H): -13.41% Current Price: $0.09207

What happened today

MERL declined over 13% despite being featured on Binance Alpha. A token unlock worth $4.15M and upcoming airdrop events may have led to increased sell pressure. While the upcoming trading competition on Binance Wallet (Keyless) could provide positive momentum, current market reactions show short-term dilution concerns overshadowing long-term incentives.

Market Cap: $66.75M 24-Hour Trading Volume: $40.83M Circulating Supply: 725M MERL

Global Market Snapshot

Global equities paused after a strong multi-week rebound. The S&P 500 slipped 0.3%, Nasdaq fell 0.4%, and Dow edged down by 62 points. Tech underperformed with Nvidia, Meta, and Apple leading the pullback. Despite this, European stocks like Germany’s DAX and Spain’s IBEX hit multi-year highs after a landmark post-Brexit UK-EU economic agreement boosted investor sentiment. Healthcare stocks like Moderna (+8.8%) and Pfizer (+1.9%) rallied after updated FDA booster guidelines, while Tesla gained slightly on Musk’s leadership commitment. Meanwhile, UBS and HSBC noted a shift toward European equities amid U.S. volatility and tariff-related policy ambiguity. Investors remain cautiously optimistic, riding the rebound but wary of unclear macro signals, what UBS calls a market in “healing mode.”

Closing Thoughts

Investor sentiment in crypto is increasingly being shaped by real developments, protocol upgrades, token utility, and institutional interest. AAVE’s surge suggests whales are positioning for sustained DeFi activity, while WCT and MASK reflect rising appetite for ecosystem plays beyond L1s.

Even though ZKJ remained stable, its presence on Binance Alpha signals long-term growth potential. MERL’s drop, on the other hand, reminds us of the impact token unlocks and incentive programs can have on short-term price action, especially in retail-heavy coins.

In the global context, the equity market is showing signs of fatigue after weeks of rebound. With the S&P 500 dipping and tech underperforming, risk sentiment is shifting. However, the rally in European equities and renewed interest in DeFi protocols indicate a possible sectoral rotation, out of big tech and into assets with growth narratives. For crypto, this creates an opportunity zone. Traders appear to be recalibrating their risk exposure in favor of projects showing real-world traction, especially within the DeFi and Web3 integration spheres.